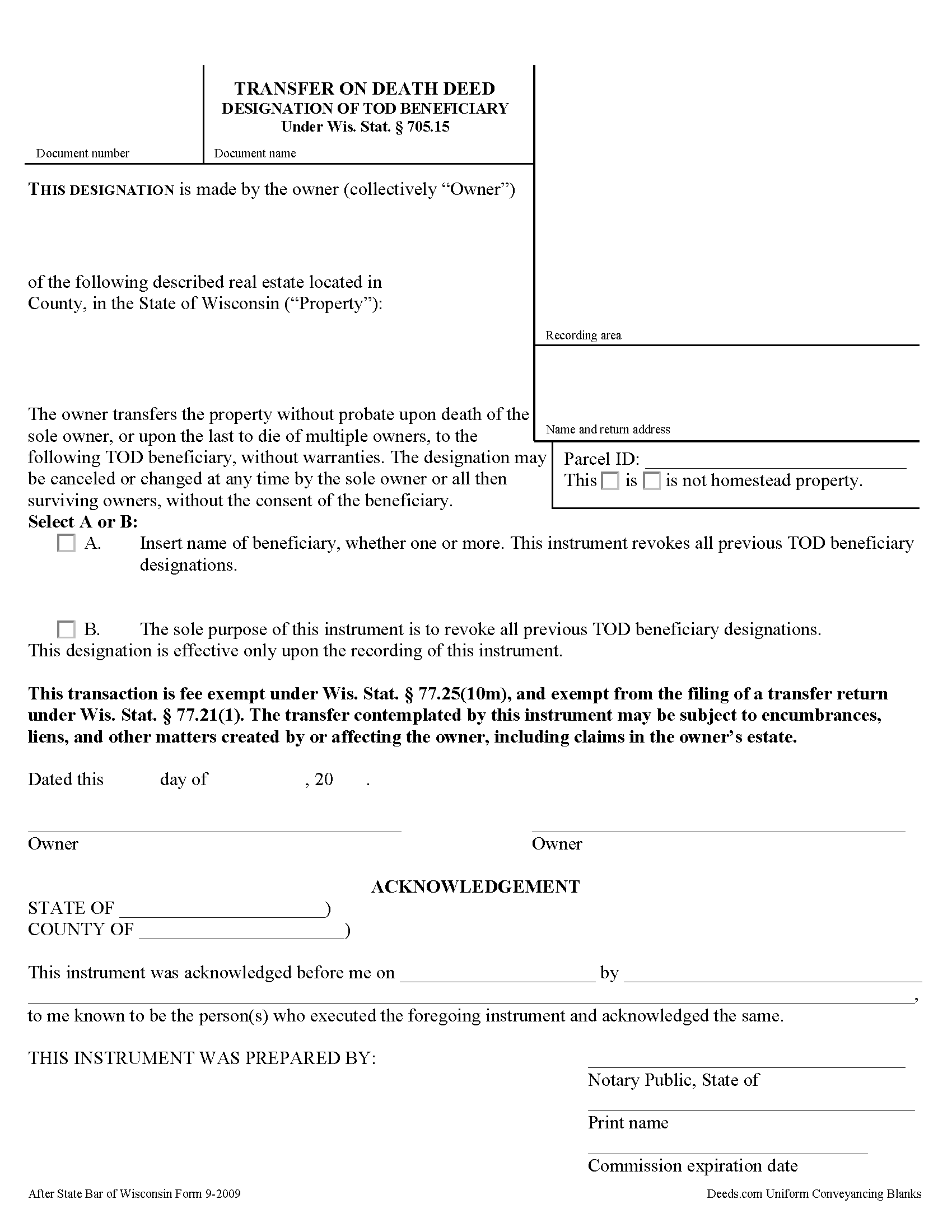

Vernon County Transfer on Death Deed Form

Vernon County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

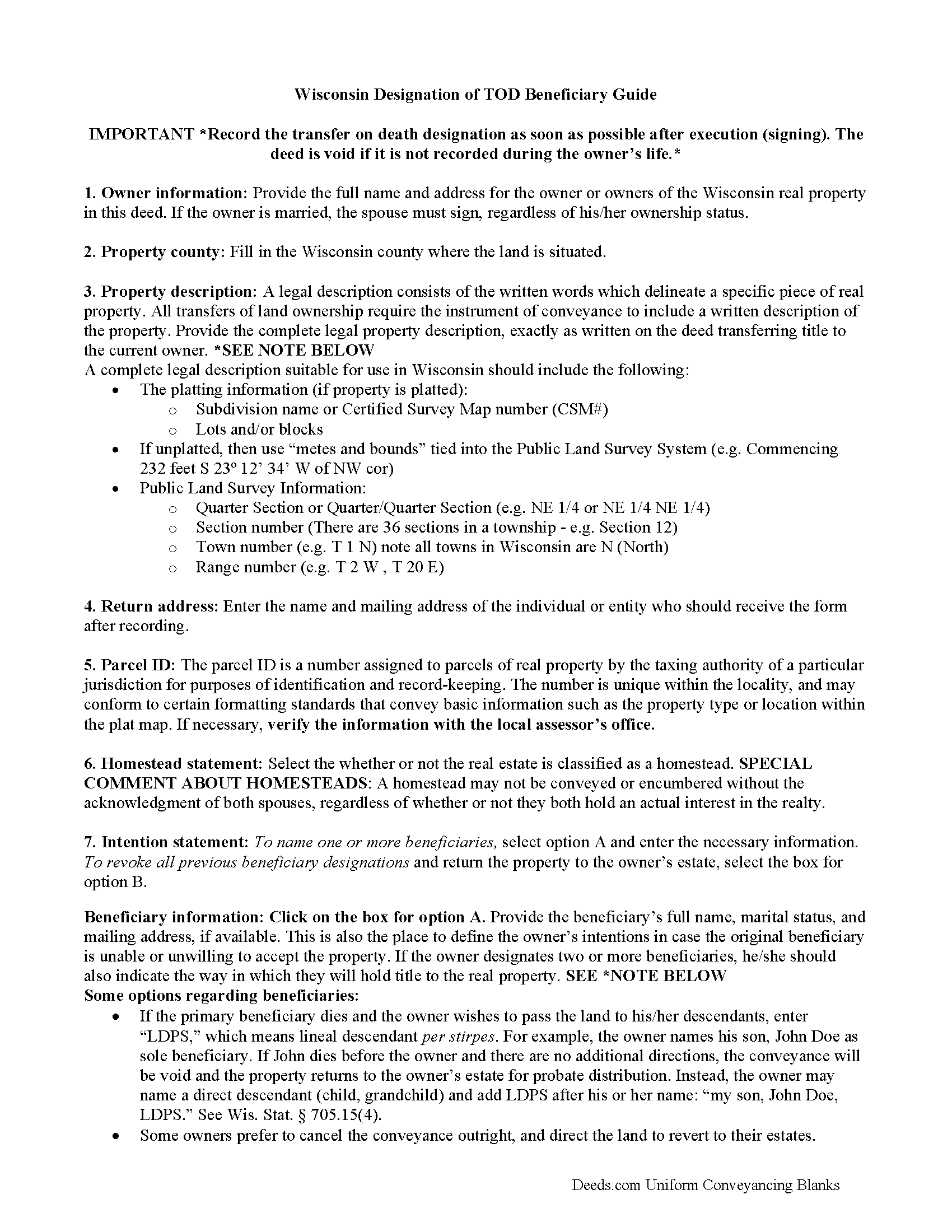

Vernon County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

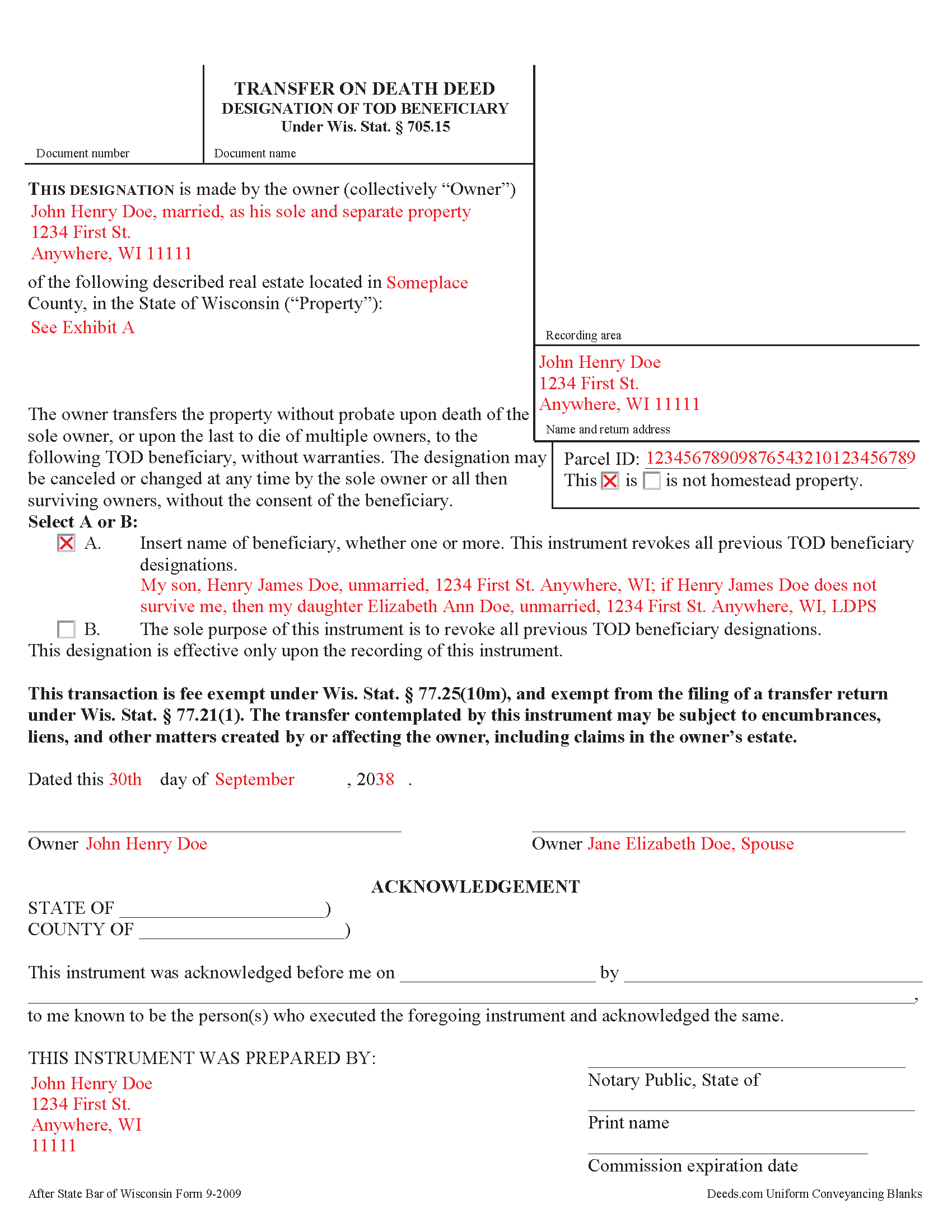

Vernon County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Vernon County documents included at no extra charge:

Where to Record Your Documents

Vernon County Register of Deeds

Viroqua, Wisconsin 54665

Hours: Mon-Fri 8:30 to 4:30

Phone: (608) 637-5371

Recording Tips for Vernon County:

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Vernon County

Properties in any of these areas use Vernon County forms:

- Chaseburg

- Coon Valley

- De Soto

- Genoa

- Hillsboro

- La Farge

- Ontario

- Readstown

- Stoddard

- Viroqua

- Westby

Hours, fees, requirements, and more for Vernon County

How do I get my forms?

Forms are available for immediate download after payment. The Vernon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Vernon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Vernon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Vernon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Vernon County?

Recording fees in Vernon County vary. Contact the recorder's office at (608) 637-5371 for current fees.

Questions answered? Let's get started!

Under Wisconsin Statutes section 705.15, owners of real property in Wisconsin may designate one or more people to gain ownership of their property outside of the probate process. The transfer on death deed form contains the designation and must be recorded, DURING THE OWNER'S NATURAL LIFE, for validity.

By executing and recording a transfer on death beneficiary designation, the owner retains absolute control over the real estate, and may sell, mortgage, or use the property in any legal manner, and change or revoke the beneficiary designation without penalty or obligation to inform the beneficiary.

Because the transfer does not occur until after the owner's death, there is no transfer tax due when recording the deed under 77.21(1) and 77.25(10m). While the change in ownership happens as a function of law when the owner dies, when the beneficiary claims the land, he or she must record form TOD-110 to make the transfer official and enter the updated information into the public records.

Wisconsin's transfer on death deeds are useful estate planning tools. Even so, carefully consider the potential impact of a non-probate transfer of property on taxes, as well as eligibility for local, state, and federal benefits. Each case is unique, so contact an attorney with questions or for complex situations.

(Wisconsin TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Vernon County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Vernon County.

Our Promise

The documents you receive here will meet, or exceed, the Vernon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Vernon County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Vicki A.

October 29th, 2023

Very fast and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Martha V.

August 30th, 2020

Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Mary S.

March 25th, 2022

Really, really great. Instructions are so helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald C.

October 2nd, 2019

Easy to navigate and very concise

Thank you!

Stefan L.

May 5th, 2022

Great templates and very efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony T.

August 6th, 2019

Would be better if you could save the forms to word for easier use on your computer.

Thank you!

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Michael M.

June 19th, 2019

Deeds.com had what I needed at the time that I needed it. Thank you very much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

PATRICK C.

September 29th, 2021

Fast, honest company Worth every penny! DO IT YOURSELF SAVE THOUSANDS

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

nannette b.

October 27th, 2019

got what I needed quick and easy thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles K.

December 23rd, 2021

So far it has been a good experience. I am working on getting a beneficiary deed.

Thank you for your feedback. We really appreciate it. Have a great day!