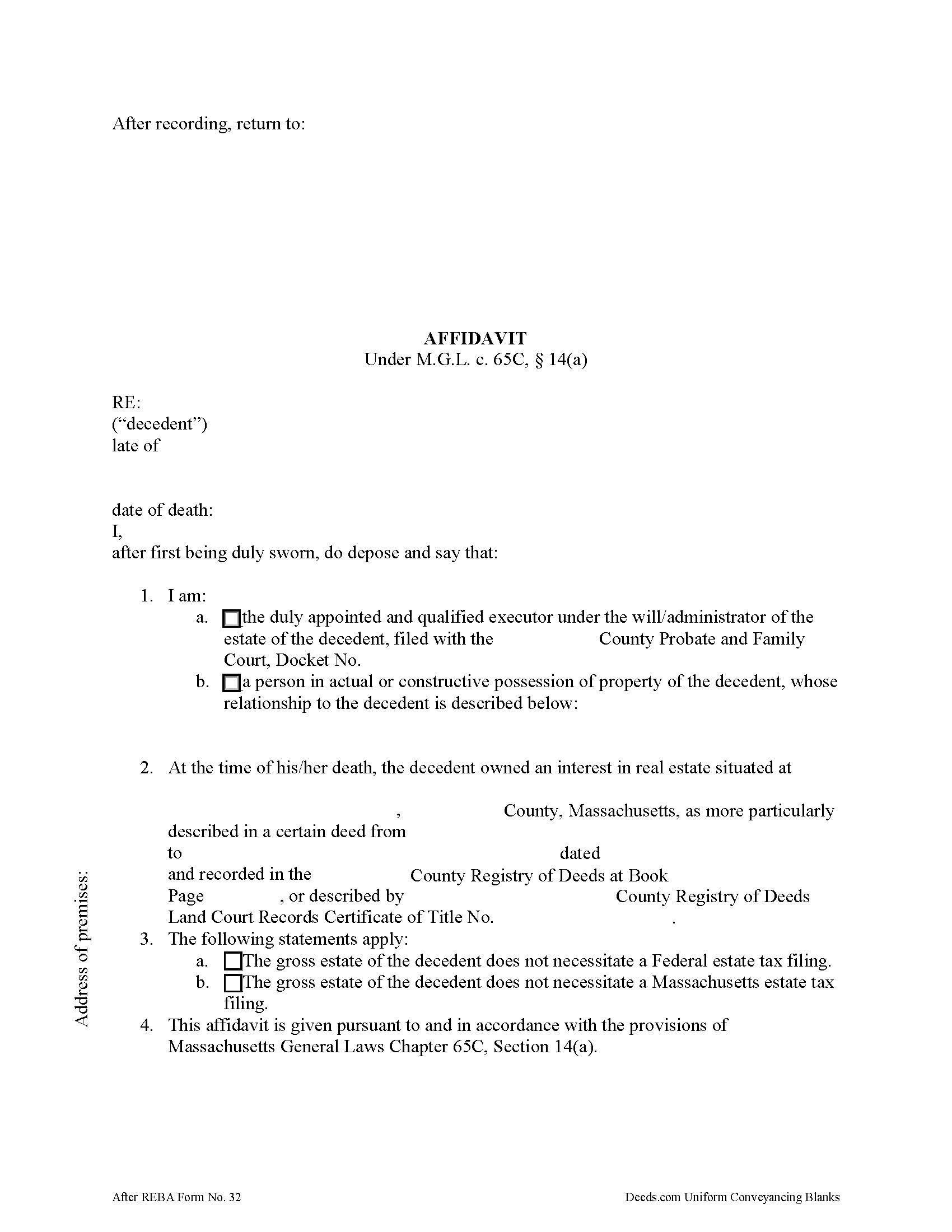

Bristol County Estate Tax Affidavit Form

Bristol County Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

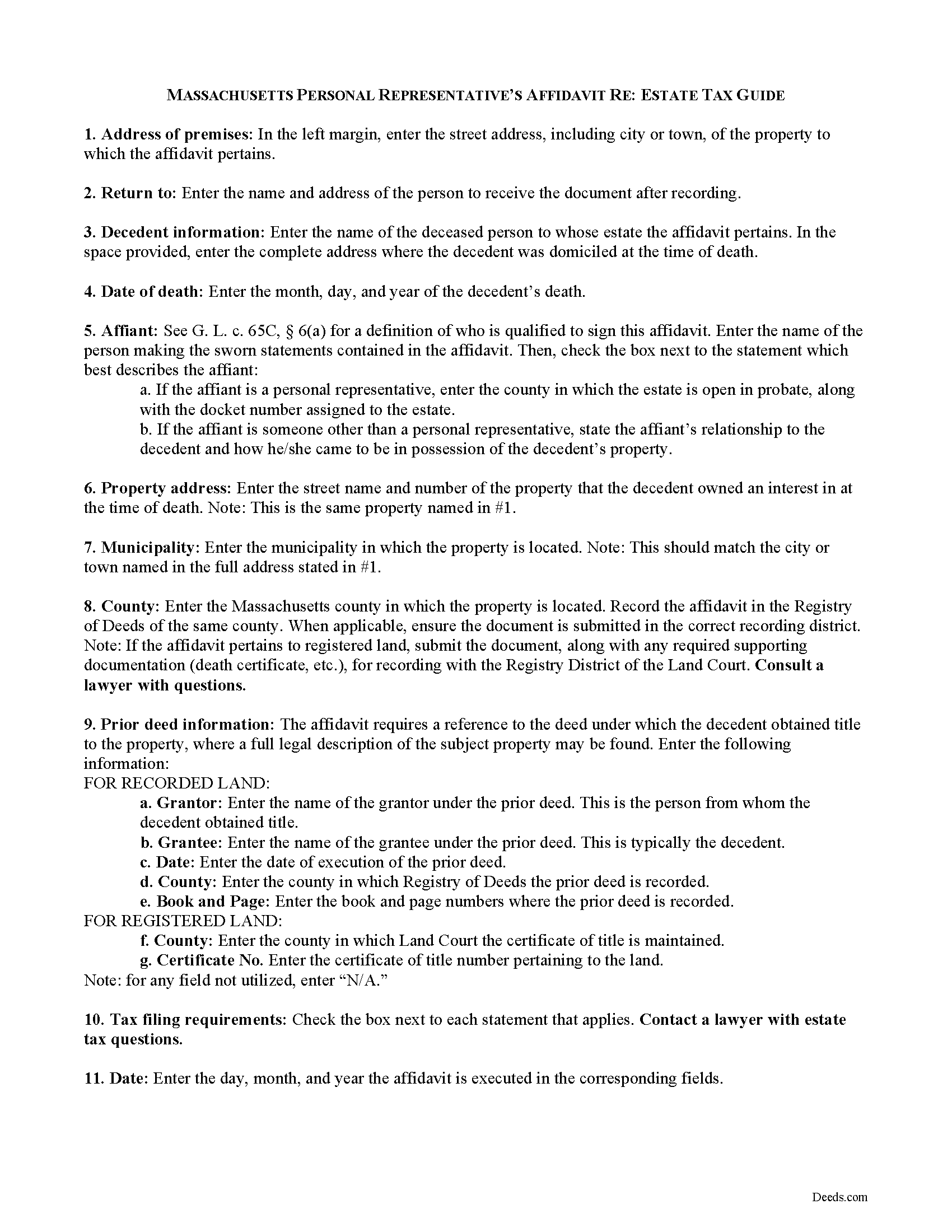

Bristol County Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

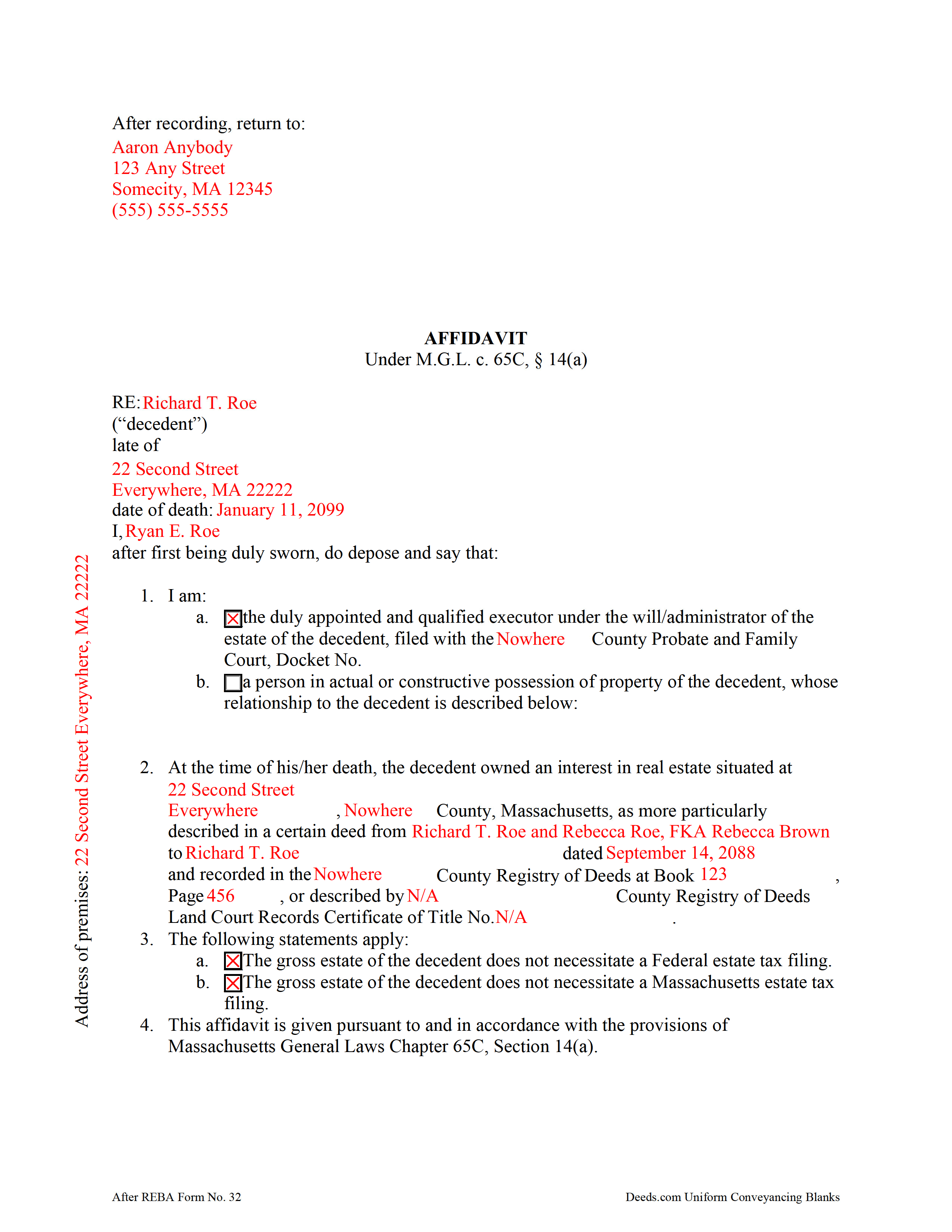

Bristol County Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Bristol County documents included at no extra charge:

Where to Record Your Documents

Bristol County Registry of Deeds, Fall River District

Fall River, Massachusetts 02722

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 673-2910

Bristol County Registry of Deeds, Northern District

Taunton, Massachusetts 02780

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 822-0502

Northern District - Attleboro location (no registered land)

Attleboro, Massachusetts 02703

Hours: 9:00 to 4:00 Mon-Fri / Recording until 3:30

Phone: (508) 455-6100

Bristol County Registry of Deeds, Southern District

New Bedford, Massachusetts 02740

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 993-2603

Recording Tips for Bristol County:

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Bristol County

Properties in any of these areas use Bristol County forms:

- Acushnet

- Assonet

- Attleboro

- Attleboro Falls

- Berkley

- Chartley

- Dartmouth

- Dighton

- East Freetown

- East Mansfield

- East Taunton

- Easton

- Fairhaven

- Fall River

- Mansfield

- New Bedford

- North Attleboro

- North Dartmouth

- North Dighton

- North Easton

- Norton

- Raynham

- Raynham Center

- Rehoboth

- Seekonk

- Somerset

- South Dartmouth

- South Easton

- Swansea

- Taunton

- Westport

- Westport Point

Hours, fees, requirements, and more for Bristol County

How do I get my forms?

Forms are available for immediate download after payment. The Bristol County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bristol County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bristol County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bristol County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bristol County?

Recording fees in Bristol County vary. Contact the recorder's office at (508) 673-2910 for current fees.

Questions answered? Let's get started!

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Important: Your property must be located in Bristol County to use these forms. Documents should be recorded at the office below.

This Estate Tax Affidavit meets all recording requirements specific to Bristol County.

Our Promise

The documents you receive here will meet, or exceed, the Bristol County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bristol County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Shaaron Z.

August 29th, 2019

So far, this is working well. However, I don't see a form to change name due to marriage.

Thank you!

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

Cathaleen P.

April 26th, 2021

Excellent service and very easy to process. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Ann W.

July 13th, 2020

GREAT forms, easy to use and most importantly... compliant. Worth it and then some!

Thank you!

Quanah N.

July 30th, 2022

Instruction easy to follow

Thank you!

Rachel C.

January 18th, 2021

This service is a game-changer. I work all over and being able to e-record so easily has been so effective for my business.

Thank you for your feedback. We really appreciate it. Have a great day!

Dianna K.

August 14th, 2019

Excellent customer service - couldnt have been any more helpful, with a smile I could hear through the phone!

Thank you!

Anita W.

June 18th, 2020

Love this site. It has been truly helpful and easy to navigate.

Thank you Anita, glad we could help.

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki L.

July 4th, 2020

Quick results with accurate information and thorough information.

Thank you!

Mary K.

September 28th, 2019

Awesome site. Looking for a way to save hiring an attorney. Family doesn't have the money for that so this site is much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

JORGE S.

August 22nd, 2019

Excelent! I cannot believe I found this company. Thanks!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Nora T.

March 10th, 2023

The forms are easy to fill in but too restricted for editing.

Thank you!

Pamela M.

May 13th, 2021

Saved a great deal of time and hassle. THANKS

Thank you!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!