Smith County Notice of Non-Payment Form

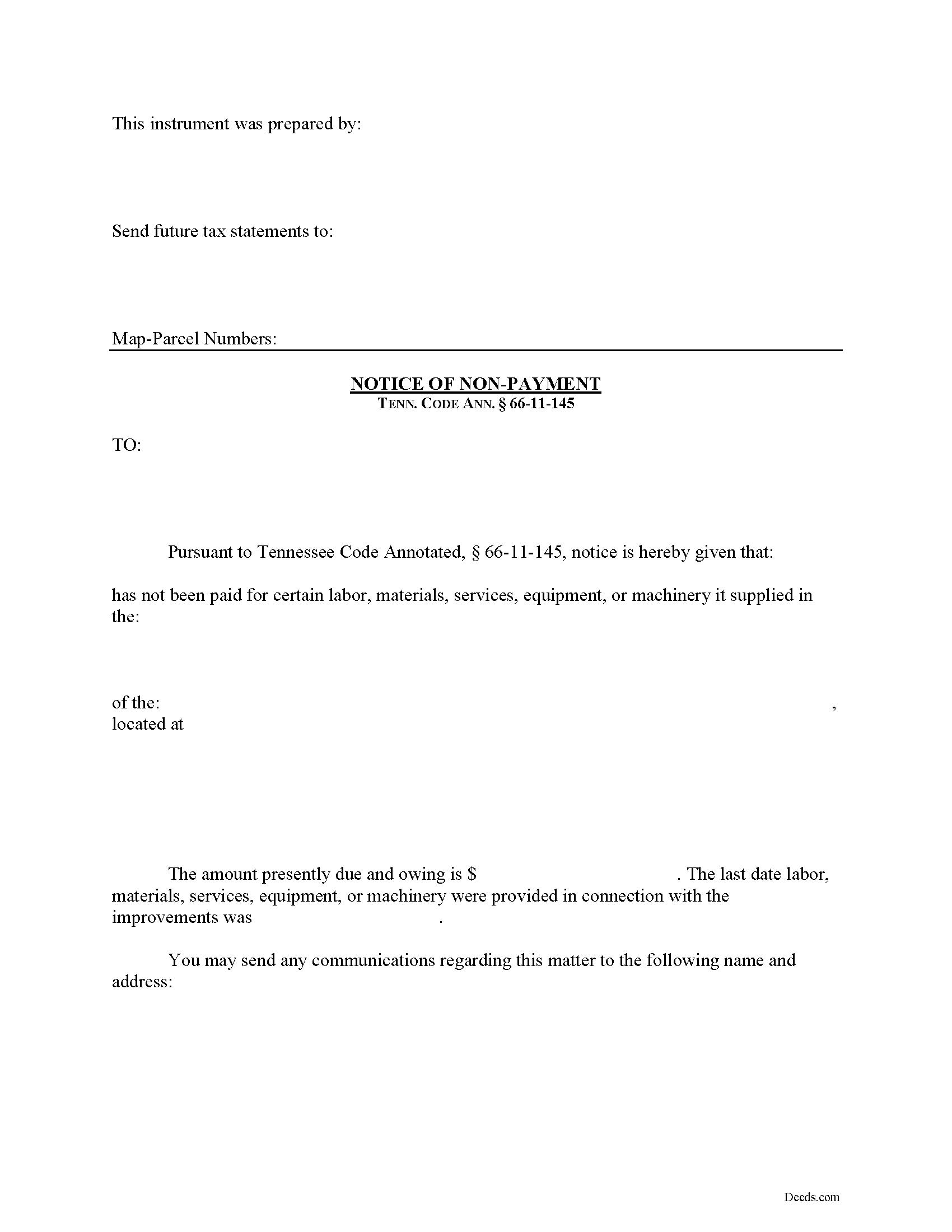

Smith County Notice of Non-Payment Form

Fill in the blank Notice of Non-Payment form formatted to comply with all Tennessee recording and content requirements.

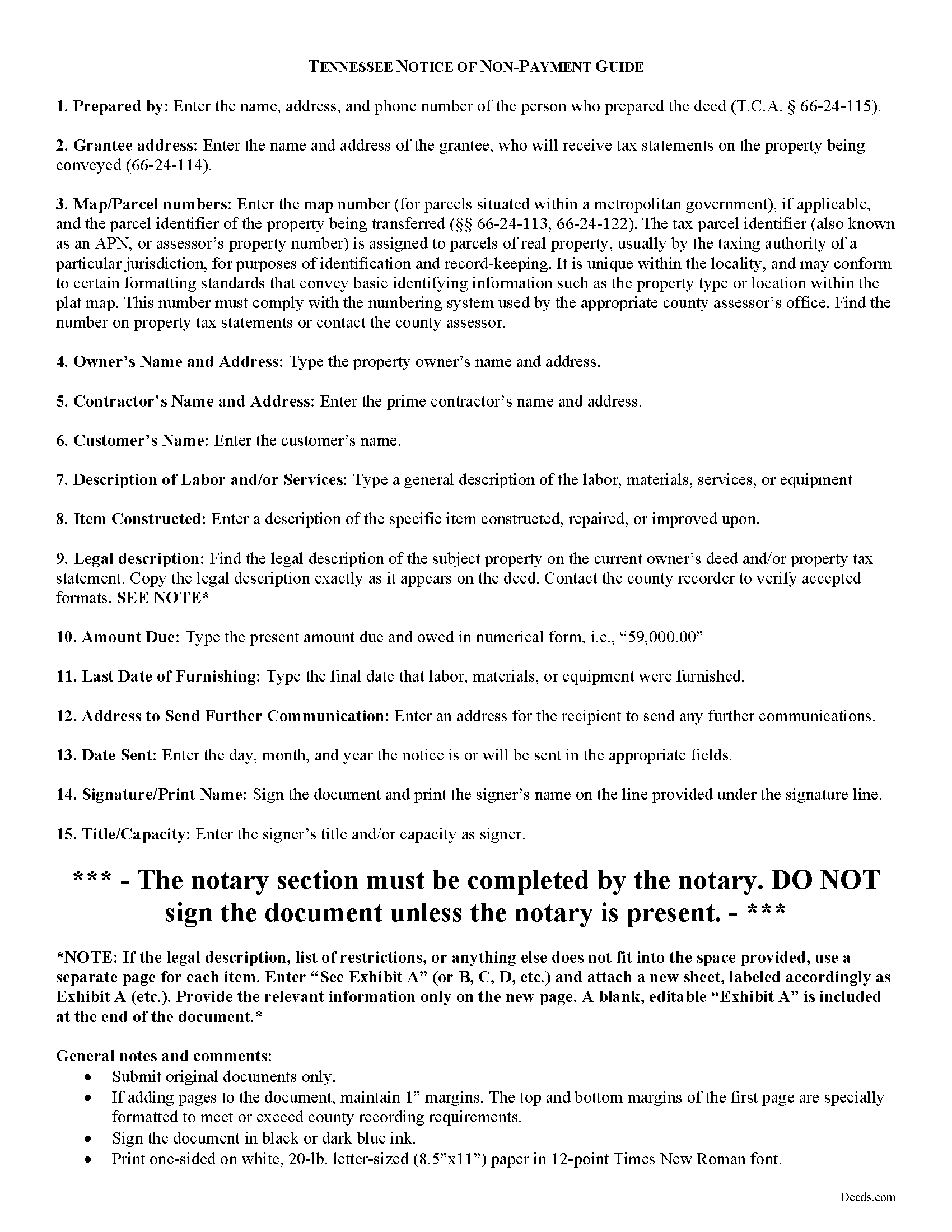

Smith County Notice of Non-Payment Guide

Line by line guide explaining every blank on the form.

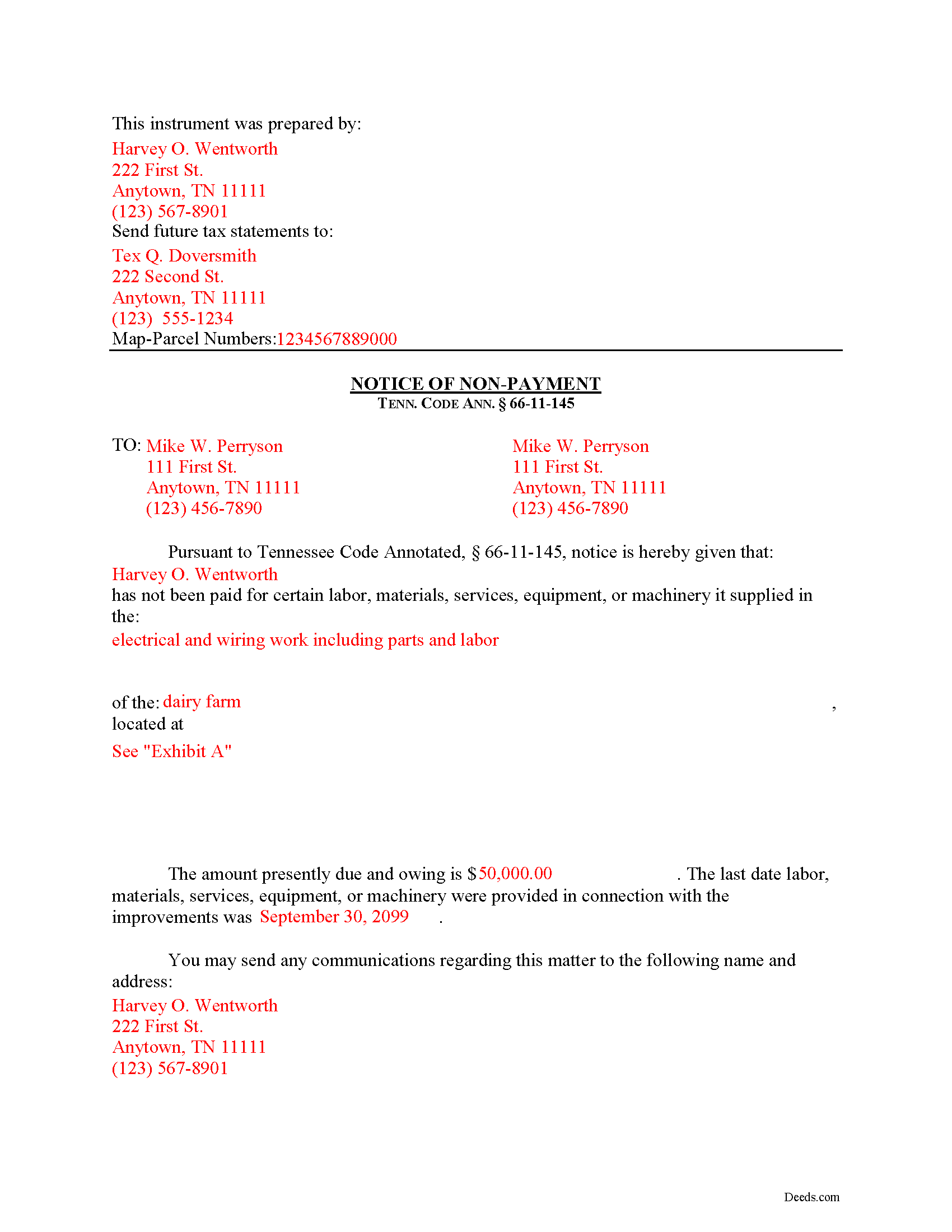

Smith County Completed Example of the Notice of Non-Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Carthage, Tennessee 37030

Hours: 8:00 to 4:00 M-F

Phone: (615) 735-1760

Recording Tips for Smith County:

- Bring your driver's license or state-issued photo ID

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Brush Creek

- Carthage

- Chestnut Mound

- Dixon Springs

- Elmwood

- Gordonsville

- Hickman

- Lancaster

- Pleasant Shade

- Riddleton

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (615) 735-1760 for current fees.

Questions answered? Let's get started!

Remote Contractor Claims in Tennessee

Remote contractors who have not contracted directly with the owner, must send a special type of notice when they are not paid at time. In Tennessee, that notice is called the "Notice of Non-Payment."

Every remote contractor with respect to an improvement, except one-to-four-family residential units, shall serve, within ninety (90) days of the last day of each month within which work, material, or labor was provided, or machinery furnished and for which the remote contractor intends to claim a lien, a notice of nonpayment to the owner and prime contractor in contractual privity with the remote contractor if its account is, in fact, unpaid. Tenn. Prop. Code 66-11-145(a). Serve the notice via registered or certified US Mail, or any other service with official delivery confirmation.

The notice shall contain the following: (1) The name of the remote contractor and the address to which the owner and the prime contractor in contractual relation with the remote contractor may send communications to the remote contractor; (2) A general description of the work, labor, materials, services, equipment, or machinery provided; (3) The amount owed as of the date of the notice; (4) A statement of the last date the claimant performed work and/or provided labor or materials, services, equipment, or machinery in connection with the improvements; and (5) A description sufficient to identify the real property against which a lien may be claimed. Id.

If a remote contractor fails to provide the notice of nonpayment in compliance with the law, he or she may lose the right to claim a lien (except with regard to a certain amount or percentage of the contract amount retained to guarantee performance of the remote contractor). Tenn. Prop. Code 66-11-145(b). Even though the notice of nonpayment is a required step in the lien process, be aware that it is NOT the same notice required to fulfill a notice of an impending lien, which must be drafted and sent separately. Tenn. Prop. Code 66-11-145(c).

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Notice of Non-Payment meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Notice of Non-Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Tammie S.

February 8th, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

john t.

November 1st, 2019

it worked well and printed out well.

Thank you!

Robert B.

June 22nd, 2021

This suited my purposes just fine. Instructions were clear and easy to follow. But,I would like to have had the ability to delete the many extra spaces on the final document ... for readability purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David J.

November 12th, 2019

Excellent documents, downloaded quick, completed and printed with no problems. Thank you

Thank you!

Debra B.

October 1st, 2022

Easy to process and file with the courthouse.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

December 24th, 2018

I found this site a must. It provided all the forms I needed to file a Quit Claim Deed. I filed what use to be called a Quick Claim Deed 30 years ago. You only had to file the one form. Today it is called a Quit Claim Deed. The pack provided forms that I had no idea had to be filed with the Quit Claim Deed. I would not have known this otherwise if the option hadn't presented itself. Thank you!

Thanks for taking the time to leave your feedback Debra, we really appreciate it.

christopher c.

May 22nd, 2025

Everything was professionally, handled and the process was simple and easy. I appreciated the responsiveness and recommendations from the reviewer of my package and look forward to getting my other submissions done. Wish I knew about this process sooner, thanks

Thanks, Christopher! We're glad the process was smooth and our team could help. Looking forward to assisting with your future submissions!

BRIAN M.

May 1st, 2020

Excellent Service, Fast and efficient. Thank You!

Thank you!

steven l.

July 29th, 2020

As a first time user and not having knowledge of how your site worked it was awkward to upload a file and not know what to do next. I found out there is nothing to do next but that after some time looking for a submit button or some kind of confirmation that I was doing the right thing. Ended up being very easy, just wasted time trying to figure out what to do when there was nothing left to do.

Thank you!

Anthony C.

January 9th, 2021

Good information for solving my issue...

Thank you!

Connie G.

October 15th, 2019

This product makes it so much easier to understand and file forms that you might have to pay an attorney to do. All Counties have their own way of submitting forms and with Deeds you have the correct format.

Thank you for your feedback. We really appreciate it. Have a great day!

Charlotte B.

August 2nd, 2021

I was very impressed with this service. It's a very important tool to be able to get the documents filed properly. I was not able to understand how to fill in the blanks on line.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa H.

April 18th, 2021

My recent experience with Deeds.com has been outstanding. I especially appreciated the sample filled-out deed but even more the explanation of the questions. i recommend to download both. It was very easy and fast. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cherif T.

June 17th, 2019

I wish every state offered such an easy and economical download of these forms. You were reasonable in price, I received one of every form you offered along with instructions, and it made my day so easy. Why pay a lawyer a fortune for these simple (almost) everyday forms when you can do it all for less than $20. Thank you for being reasonable, well organized, and available for common use! Cherif T.

Thank you!

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.