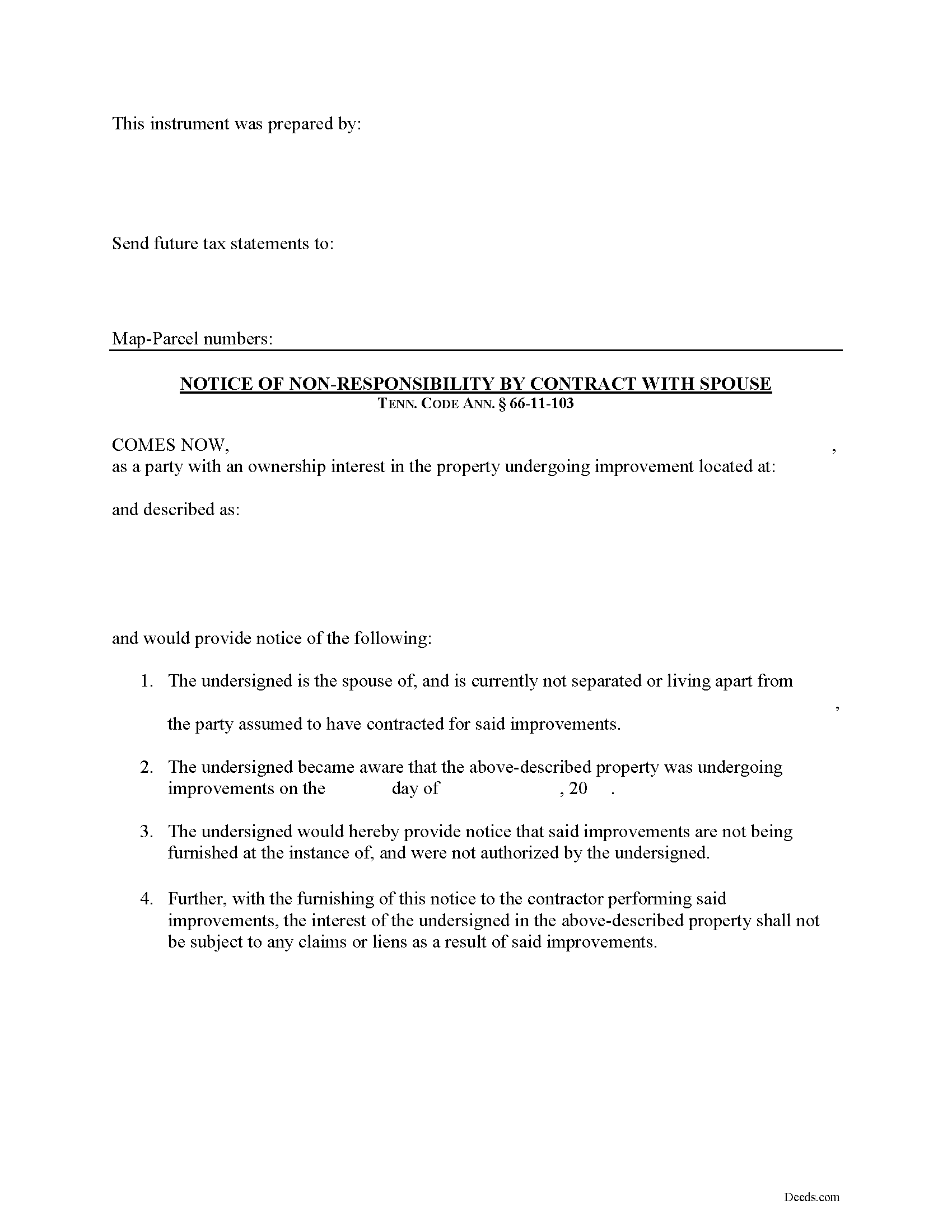

Smith County Notice of Spousal Non-Responsibility Form

Smith County Notice of Spousal Non-Responsibility Form

Fill in the blank Notice of Spousal Non-Responsibility form formatted to comply with all Tennessee recording and content requirements.

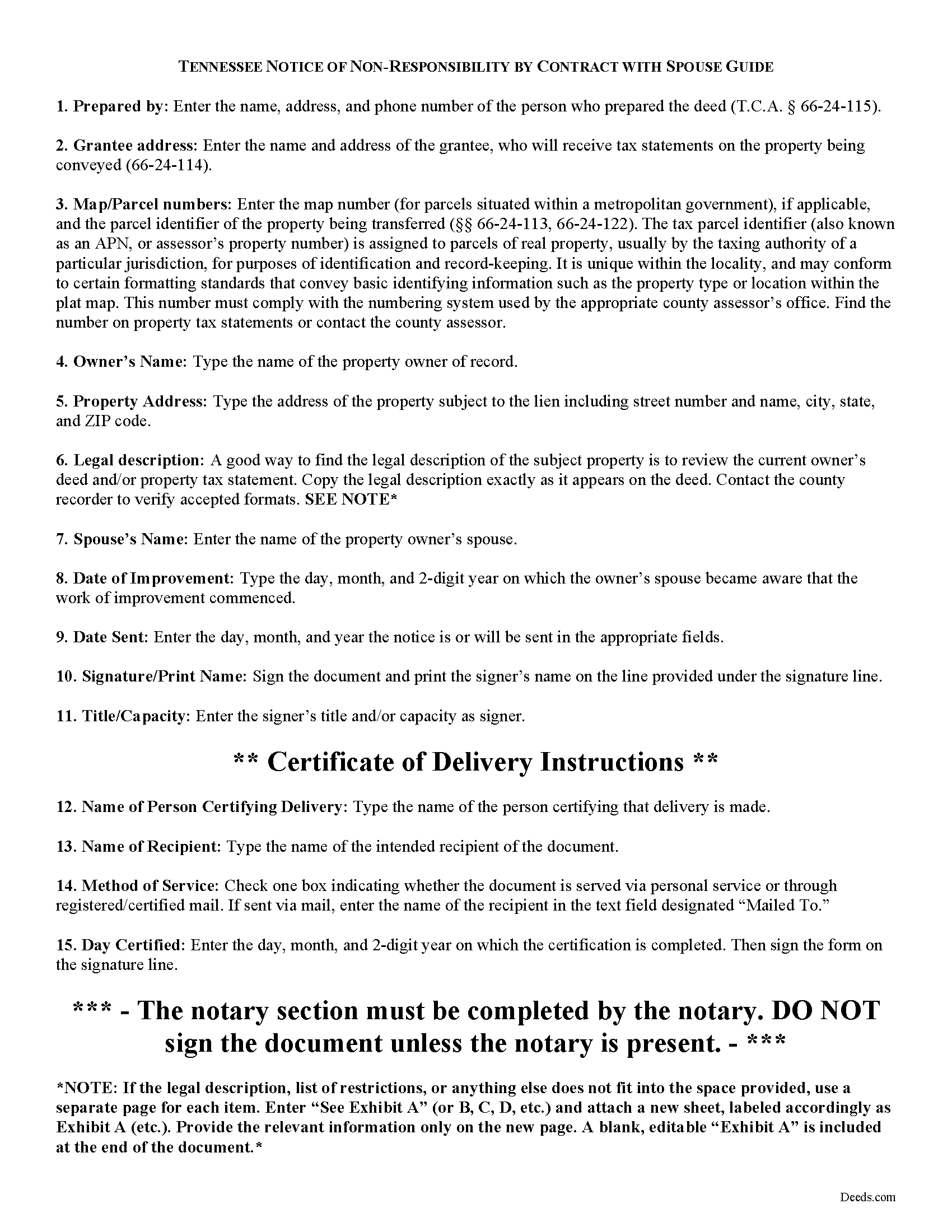

Smith County Notice of Non-Responsibility Guide

Line by line guide explaining every blank on the form.

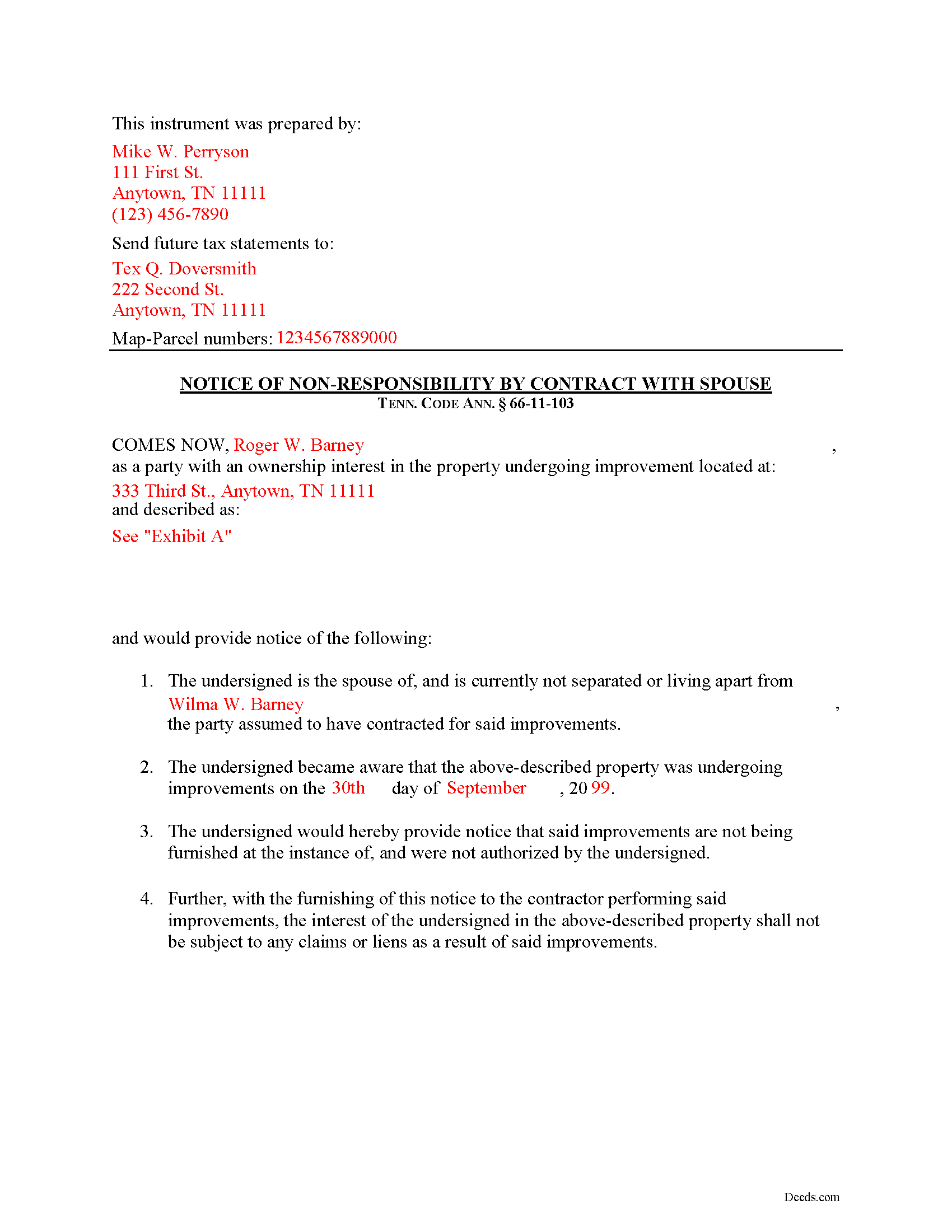

Smith County Completed Example of the Notice of Non-Responsibility Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Carthage, Tennessee 37030

Hours: 8:00 to 4:00 M-F

Phone: (615) 735-1760

Recording Tips for Smith County:

- Ask if they accept credit cards - many offices are cash/check only

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Brush Creek

- Carthage

- Chestnut Mound

- Dixon Springs

- Elmwood

- Gordonsville

- Hickman

- Lancaster

- Pleasant Shade

- Riddleton

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (615) 735-1760 for current fees.

Questions answered? Let's get started!

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Non-Responsibility or for any other issues regarding mechanic's liens.

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Notice of Spousal Non-Responsibility meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Notice of Spousal Non-Responsibility form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

Robert A.

August 5th, 2020

A well constructed site, easy to navigate and a pleasure to use. I'd give it a 10 on 10

Thank you for your feedback. We really appreciate it. Have a great day!

Louise S.

May 15th, 2022

The form was easy to download and complete however you should be able to convert to a word document.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia G.

January 19th, 2021

Oh my goodness! Y'all are an answer to prayers! You provided all the forms necessary in one convenient packet, and at a VERY reasonable price! I can't thank y'all enough for helping my family & myself with what could've been a difficult and expensive situation! God bless you for your time and talent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chad R.

January 31st, 2020

a refreshing web based legal form site Thanks I will recommend to friend

Thank you!

Joyce B.

April 29th, 2021

Thanks, the documents were easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Mallah B.

October 7th, 2021

I think this company offers a great service that is non-discriminatory and allows me to save time going downtown and hassle dealing with different personalities.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret C.

February 9th, 2021

I recieved my document in a reasonable amount of time. I thought being a member i would be able to look up more than 1 document but it keeps asking me for more money. I requested help, asking if I need to pay for each document but have not yet been answered. I appreciate the fact I got 1 document I needed quickly.

Thank you!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

Carl T.

October 1st, 2020

Awesome! Quick service and well worth the very minimal fee for the convenience of being able to quickly record my mothers will without having to leave the house. Also, our court is currently closed due to Covid. So happy to have found Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shirley T.

April 14th, 2021

Quit Claim deed for North Carolina did not include all of the information I needed (two separate notary sections), but I was able to re-create another notary section in Word, and then insert it in the appropriate place after printing both documents. Otherwise, the document worked as described.

Thank you for your feedback. We really appreciate it. Have a great day!

Charlotte K.

August 31st, 2022

Really a simple, quick, professional experience!

Thank you!

Timothy P.

February 2nd, 2019

Straightforward, easy to navigate, saves time and gas = a real value for the price!

Thank you for your feedback. We really appreciate it. Have a great day!