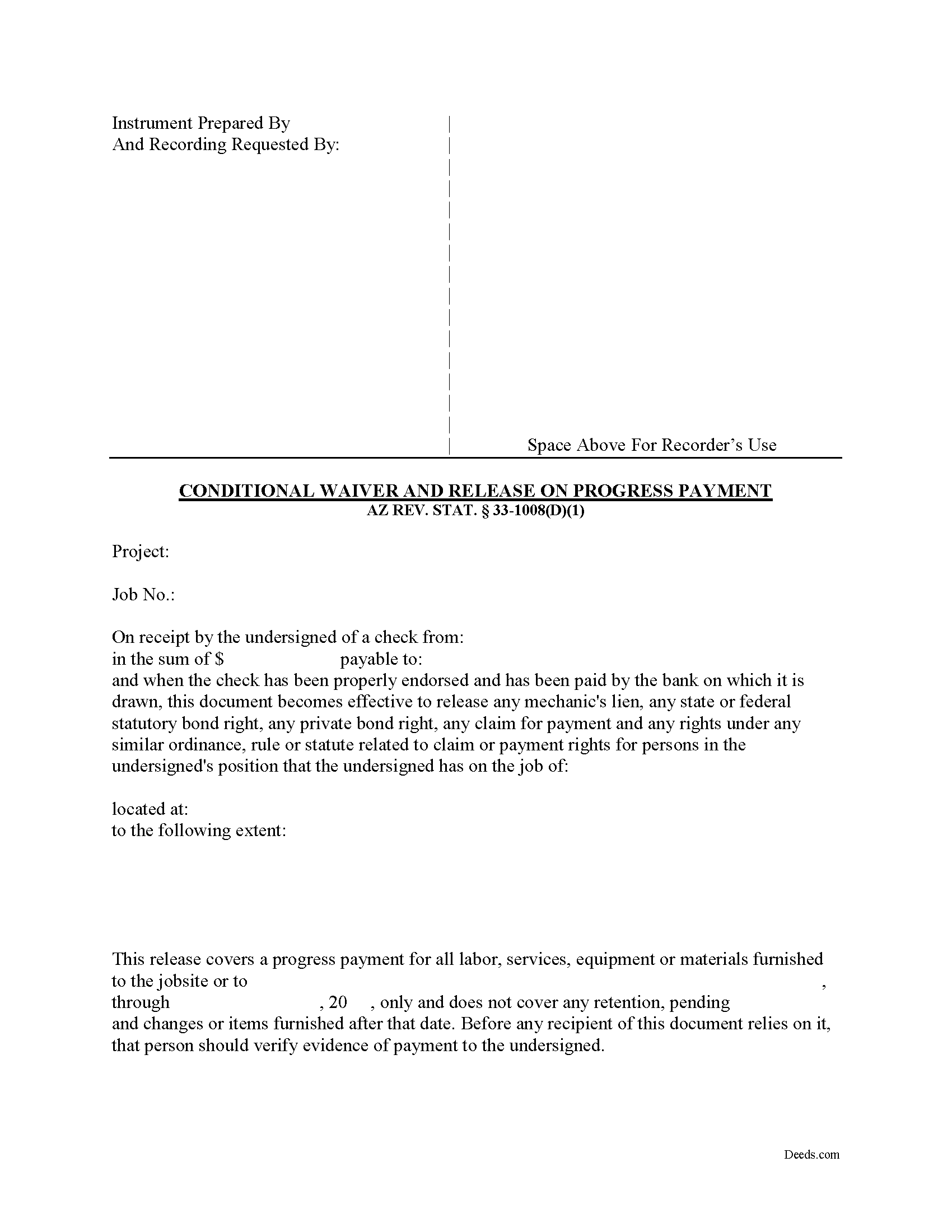

Cochise County Conditional Lien Waiver on Progress Payment Form

Cochise County Conditional Lien Waiver on Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

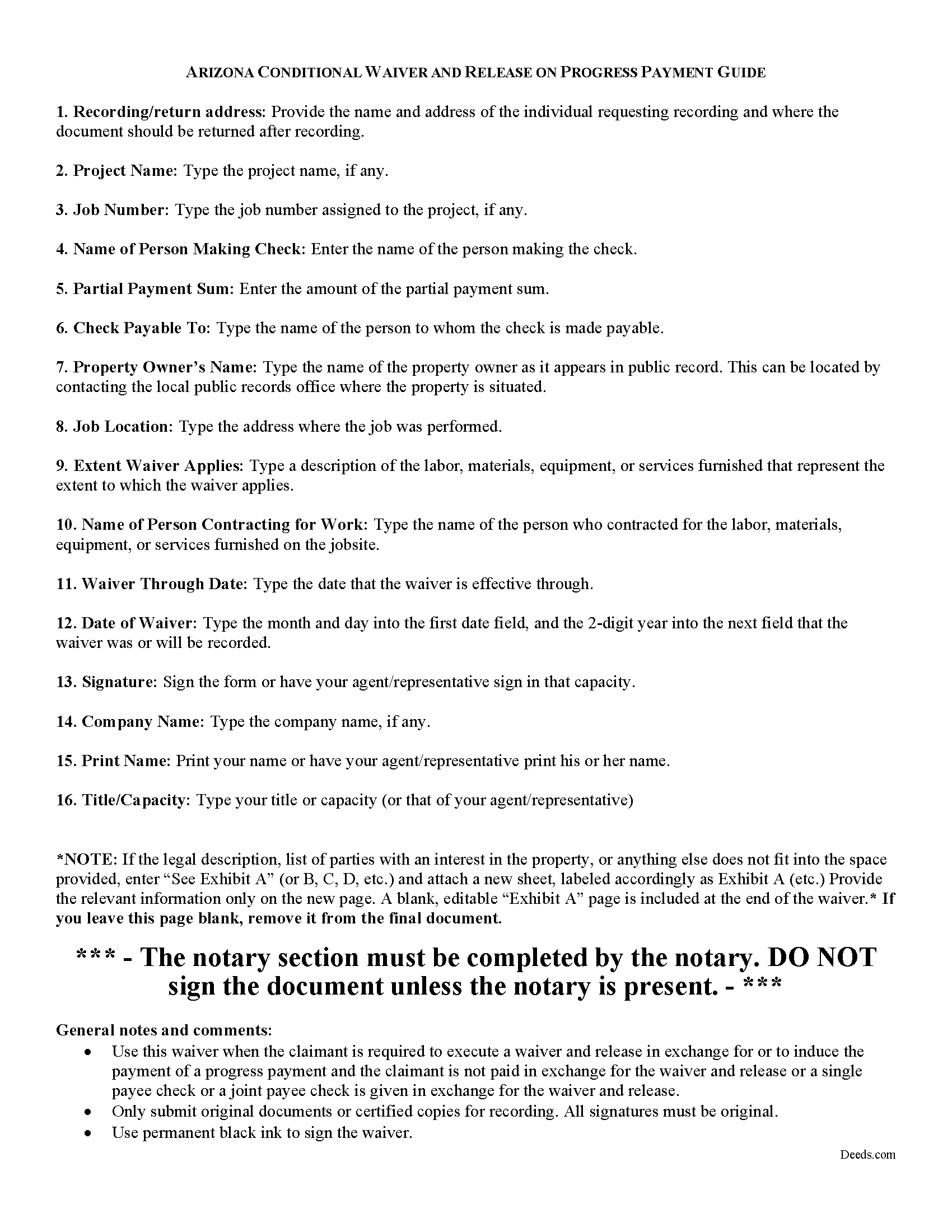

Cochise County Conditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

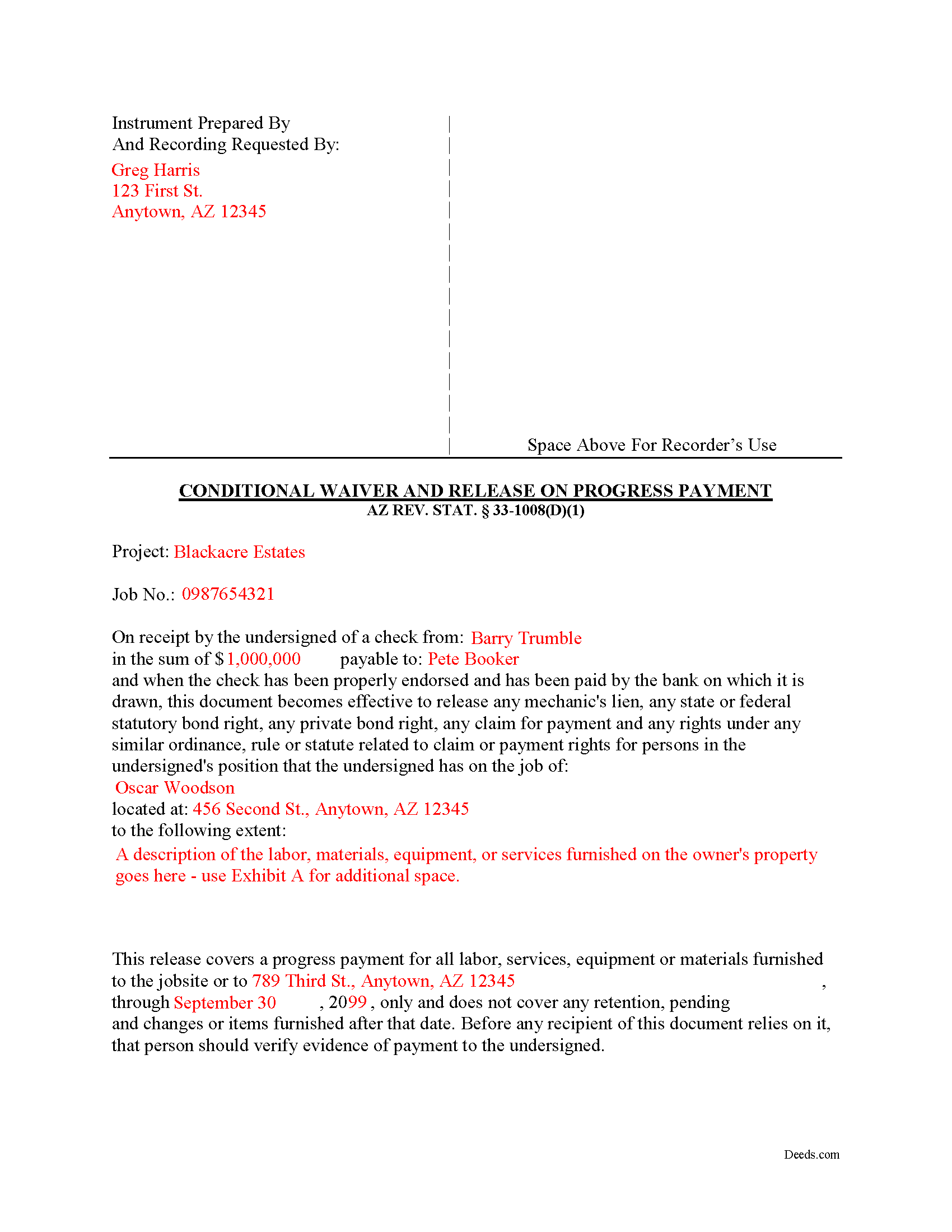

Cochise County Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Cochise County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Bisbee, Arizona 85603

Hours: 8:00am - 5:00pm Monday - Friday

Phone: 520-432-8350

Recording Tips for Cochise County:

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Cochise County

Properties in any of these areas use Cochise County forms:

- Benson

- Bisbee

- Bowie

- Cochise

- Douglas

- Dragoon

- Elfrida

- Fort Huachuca

- Hereford

- Huachuca City

- Mc Neal

- Naco

- Pearce

- Pirtleville

- Pomerene

- Saint David

- San Simon

- Sierra Vista

- Tombstone

- Willcox

Hours, fees, requirements, and more for Cochise County

How do I get my forms?

Forms are available for immediate download after payment. The Cochise County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cochise County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cochise County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cochise County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cochise County?

Recording fees in Cochise County vary. Contact the recorder's office at 520-432-8350 for current fees.

Questions answered? Let's get started!

Arizona Conditional Lien Waiver on Progress Payment

Lien waivers are part of the mechanic's lien process. The waiver is a document from a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. A conditional waiver is effective only when payment is received, usually verified by a check clearing the bank. So, a conditional waiver given after a progress payment releases the claimant's right to lien, up to a specified date, but only after the check used to pay clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(1).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Cochise County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Progress Payment meets all recording requirements specific to Cochise County.

Our Promise

The documents you receive here will meet, or exceed, the Cochise County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cochise County Conditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

William H.

August 4th, 2025

Was easy to find forms I needed and download was quick.

Thank you for your positive words! We’re thrilled to hear about your experience.

john o.

August 8th, 2020

very simple to use

Thank you!

sara g.

June 10th, 2019

THIS WAS A USER FRIENDLY FORM, WAS ABLE TO COMPLETE WITHIN A SHORT TIME. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

Ira S.

June 8th, 2022

Hi, 1. I need a password to be able to copy and paste from the deed. 2. It would be more convenient if all documents could be downloaded together. Ira

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem. Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description! Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

ALI T.

January 31st, 2024

It is very easy to use Deeds.Com to perform eRecording. The case staff are very professional and punctual. My eRecording package was completed within a day where it usually takes months. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank H.

September 22nd, 2022

Form and instructions were useful. But I suggest creating a form for transferring a deed pursuant to a trust. The existing form is based on a will going through probate so it doesn't fit the trust situation in some respects.

Thank you for your feedback. We really appreciate it. Have a great day!

christopher c.

May 22nd, 2025

Everything was professionally, handled and the process was simple and easy. I appreciated the responsiveness and recommendations from the reviewer of my package and look forward to getting my other submissions done. Wish I knew about this process sooner, thanks

Thanks, Christopher! We're glad the process was smooth and our team could help. Looking forward to assisting with your future submissions!

Janet J.

December 15th, 2022

These forms were very easy to both download and print, as well as fill out on the site and then print. The instructions are clear and concise. We have not yet been to the County to file them, but we are expecting no issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clayton M.

March 26th, 2020

Five stars from me. this is a very useful service with great results.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary R.

February 19th, 2024

Love to use DEEDS>COM

Thank you Mary.

Mary K.

October 25th, 2020

Fantastic way to record any deed! Done in less than a few hours, right to your inbox. Very small fee compared to driving to office or waiting for the mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel A.

April 25th, 2022

First time using Deeds.com. Downloaded the PDF forms for creating an Illinois Mortgage and Promissory Note. Filled them out, saved them, and printed them out. Going to send them to my Title Company for closing on a property. Save a bunch of money on not have to pay lawyer fees for creating the same legal documents that Deeds.com provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dean B.

September 17th, 2020

I needed to cut and paste my phone number with the dashes in order to use this website with my iPhone

Thank you!