Pima County Disclaimer of Interest Form

Pima County Disclaimer of Interest Form

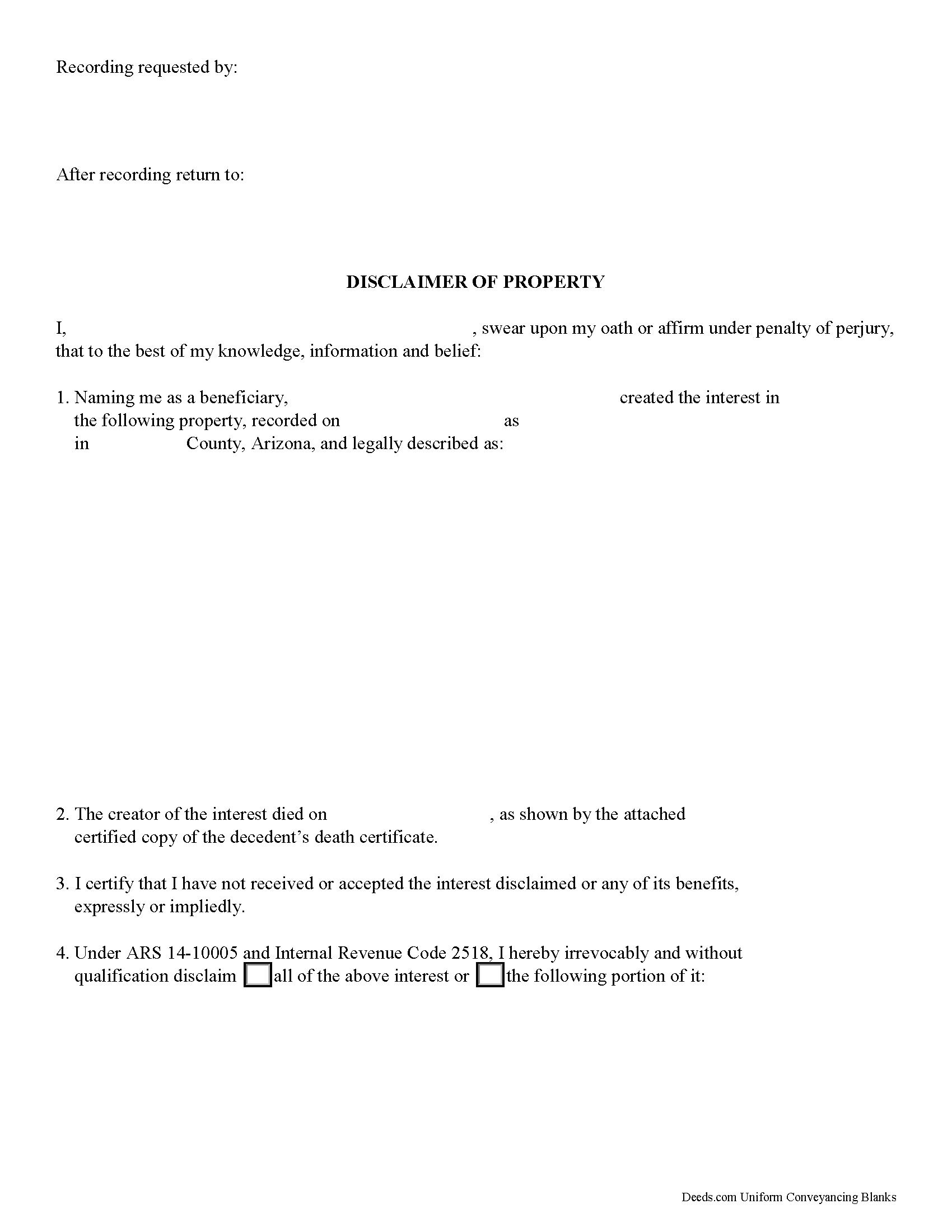

Fill in the blank form formatted to comply with all recording and content requirements.

Pima County Disclaimer of Interest Guide

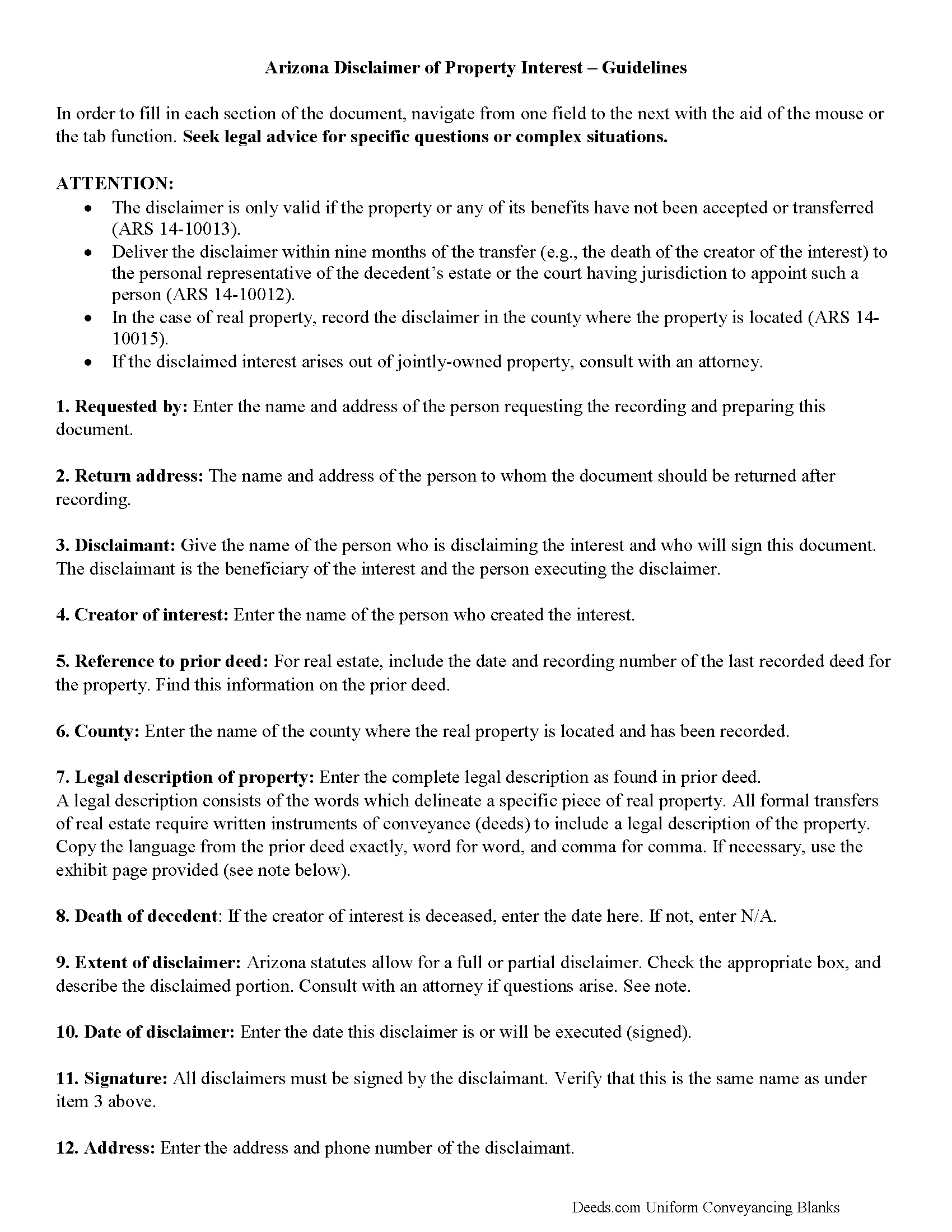

Line by line guide explaining every blank on the form.

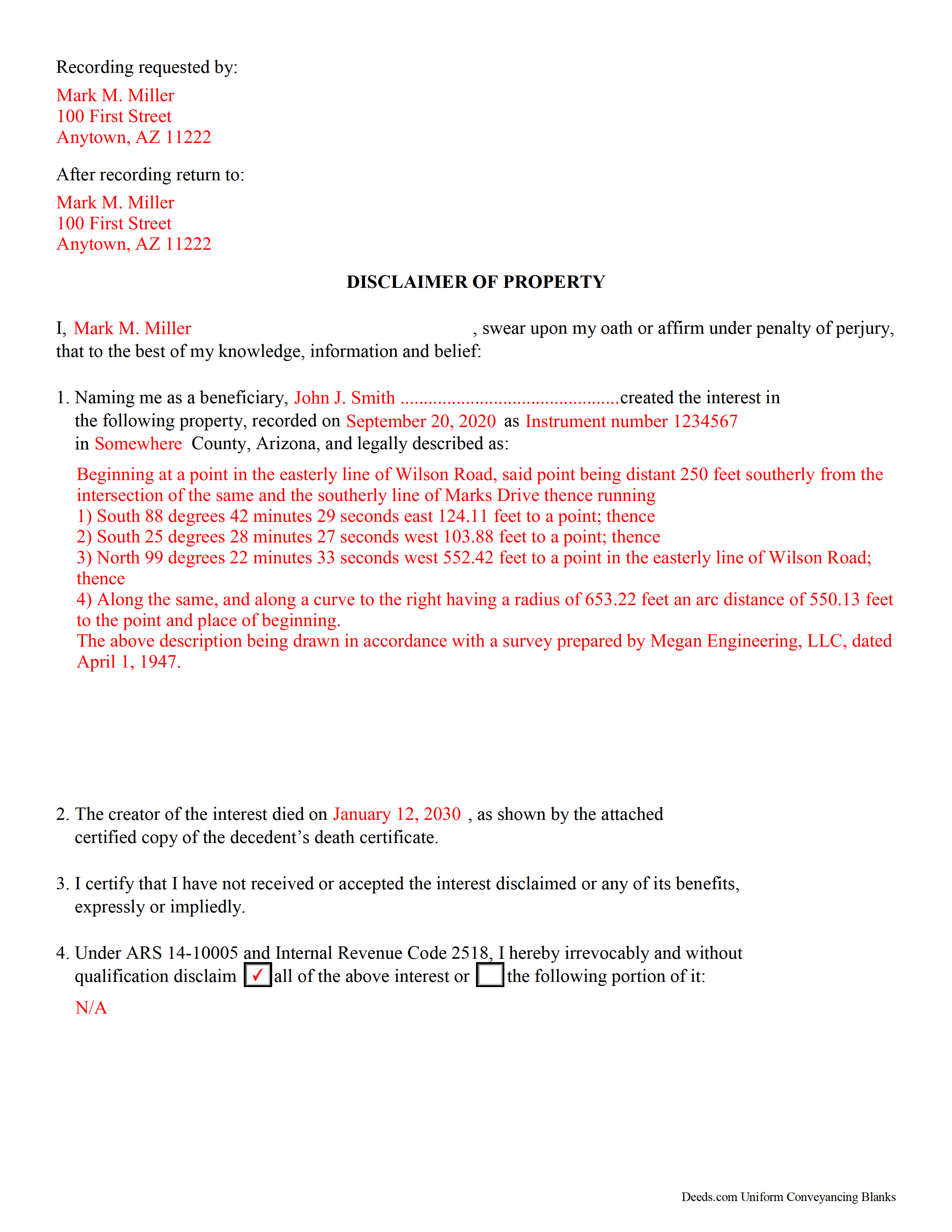

Pima County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pima County documents included at no extra charge:

Where to Record Your Documents

Recorder: Main Office

Tucson, Arizona 85701

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: 520) 740-4350

Recorder: Eastside Office

Tucson, Arizona 85710

Hours: Monday through Friday 8:00 to noon & 1:00 to 5:00

Phone: 520) 740-4350

Recording Tips for Pima County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Pima County

Properties in any of these areas use Pima County forms:

- Ajo

- Arivaca

- Catalina

- Cortaro

- Green Valley

- Lukeville

- Marana

- Mount Lemmon

- Rillito

- Sahuarita

- Sasabe

- Sells

- Topawa

- Tucson

- Vail

Hours, fees, requirements, and more for Pima County

How do I get my forms?

Forms are available for immediate download after payment. The Pima County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pima County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pima County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pima County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pima County?

Recording fees in Pima County vary. Contact the recorder's office at 520) 740-4350 for current fees.

Questions answered? Let's get started!

Under the Arizona Uniform Disclaimer of Property Interests Act, found at ARS Title 14, Chapter 10, the beneficiary of an interest in property may renounce the gift, either in part or in full. Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (see ARS 14-10013).

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant in front of a notary (see ARS 14-10005(C)).

File the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) with the probate court (ARS 14-10012). In the case of real property, acknowledge the disclaimer as is required for a deed and record it in the county where the property is located (ARS 14-10015). In addition, deliver a copy of the disclaimer to the person or legal entity with current custody or possession of the property.

A disclaimer is irrevocable and binding for the disclaiming party, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

Important: Your property must be located in Pima County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Pima County.

Our Promise

The documents you receive here will meet, or exceed, the Pima County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pima County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Timothy K.

February 23rd, 2019

Great company to work with, quick responses.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fay J.

July 30th, 2020

instead of the rep giving me instructions on how to summit the documents,with 3 pages, he or she told me i had all night to figure it out!!! wow...because of that i rate the service very poorly...fast to get it done but very poor customer service...so...i give them a 2.5 rating.

Thank you for your feedback, have a wonderful day Fay.

DEBORAH H.

December 9th, 2023

I found everything I needed

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Sander G.

December 4th, 2019

Good but knocked off a star because the download file names are mostly numbers instead of recognizable names of the file contents (e.g., Promissory_Note_blank.pdf). Renaming would be a great help!

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven N.

November 7th, 2024

I was introduced to Deeds.com from my title company. I wanted the title company to do a courtesy recording for me and they suggested Deeds.com. Best suggestion in a while. The interface to use the website was seemlessly easy. The communication with the service staff was thorough and prompt. After the initial verification process (which the photo app was a little tricky), everything was easy. Will use them again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

ALYSSA J.

August 26th, 2020

I was unable to end up going through with the deed process on my own as it was out of my realm. I suspect if I knew what I was actually doing when completing a deed, it would of been sufficient. I ended up having to go through an attorney to complete the deed.

Glad to hear you sought the assistance of a legal professional familiar with your specific situation, we always recommend that to anyone who is not completely sure of what they are doing. Have a wonderful day.

Valerie R.

October 7th, 2020

My expereince with Deeds.com was easy and efficent. Great way to efile documents during these trying times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John T.

February 26th, 2021

Amazing! Very helpful. Very specific.

Thank you for your feedback. We really appreciate it. Have a great day!

JJ G.

September 18th, 2020

Was very easy and helpful. No going down to the courthouse

Thank you!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

Joseph R.

February 17th, 2021

So easy to use. I like the way they kept me informed to the progress being made on my filing. If the occasion occurs I'll definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita H.

April 2nd, 2025

Easy way to get forms that I needed. Would buy again from you if needed.

Thank you for your positive words! We’re thrilled to hear about your experience.

Donald S.

July 7th, 2020

Good

Thank you!