Cochise County Revocation of Beneficiary Deed Form

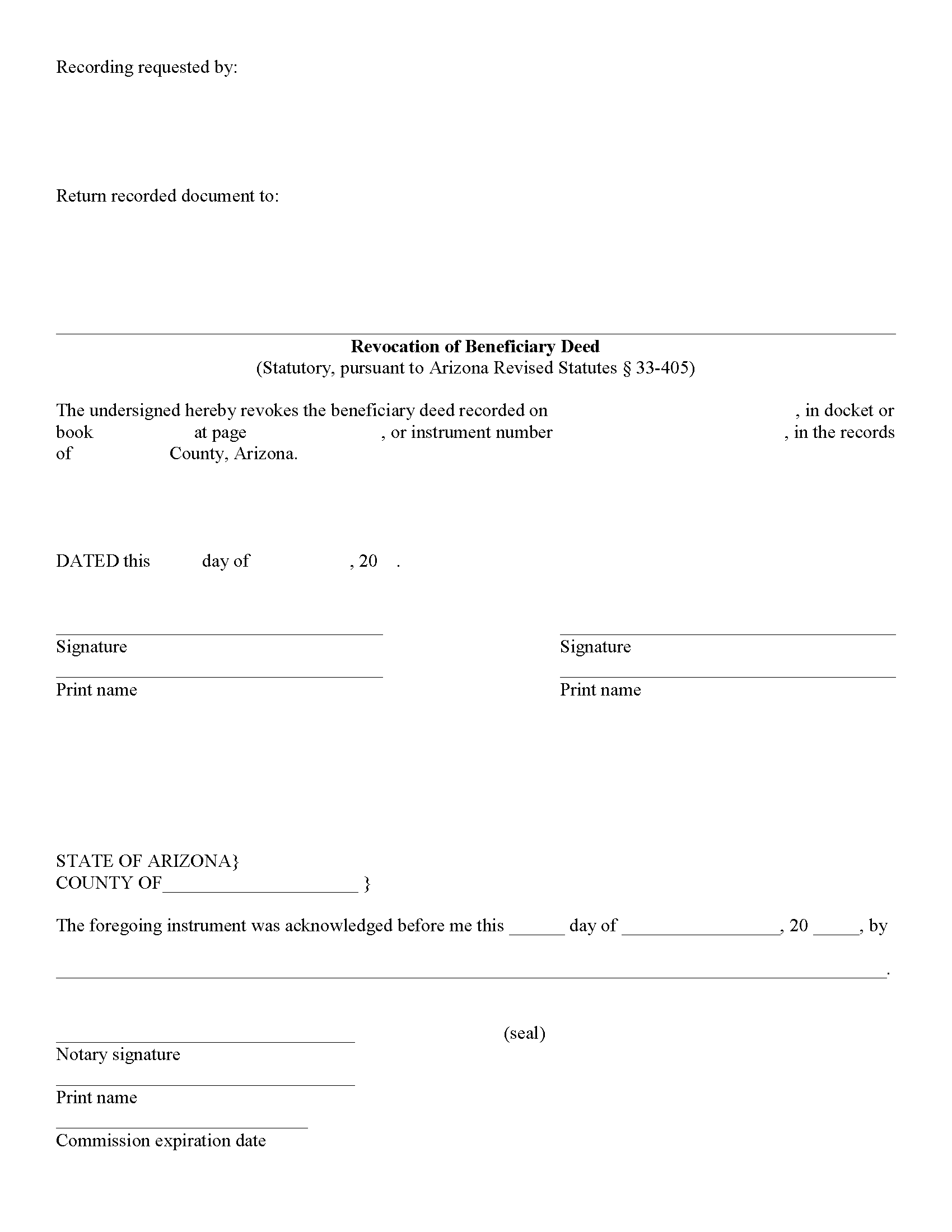

Cochise County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

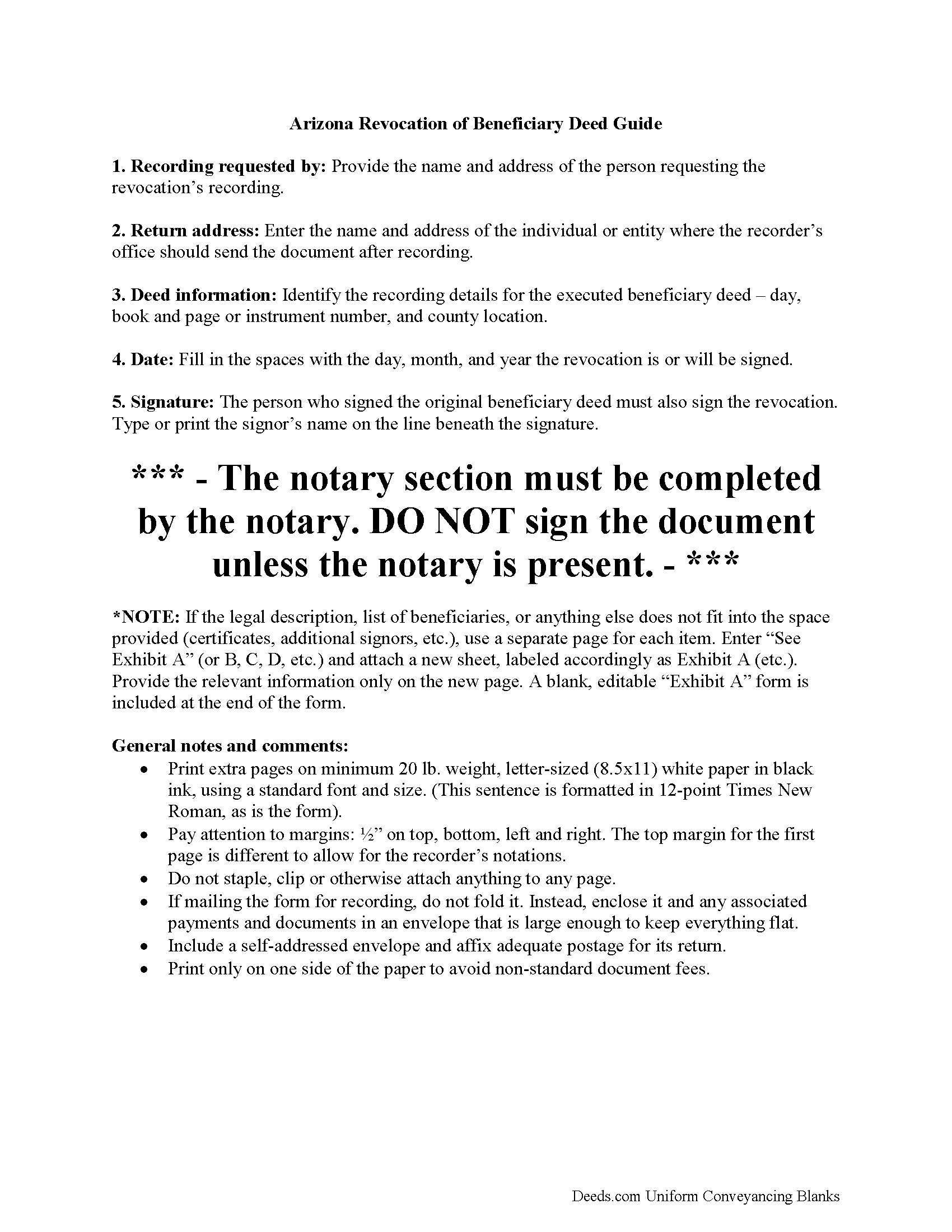

Cochise County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

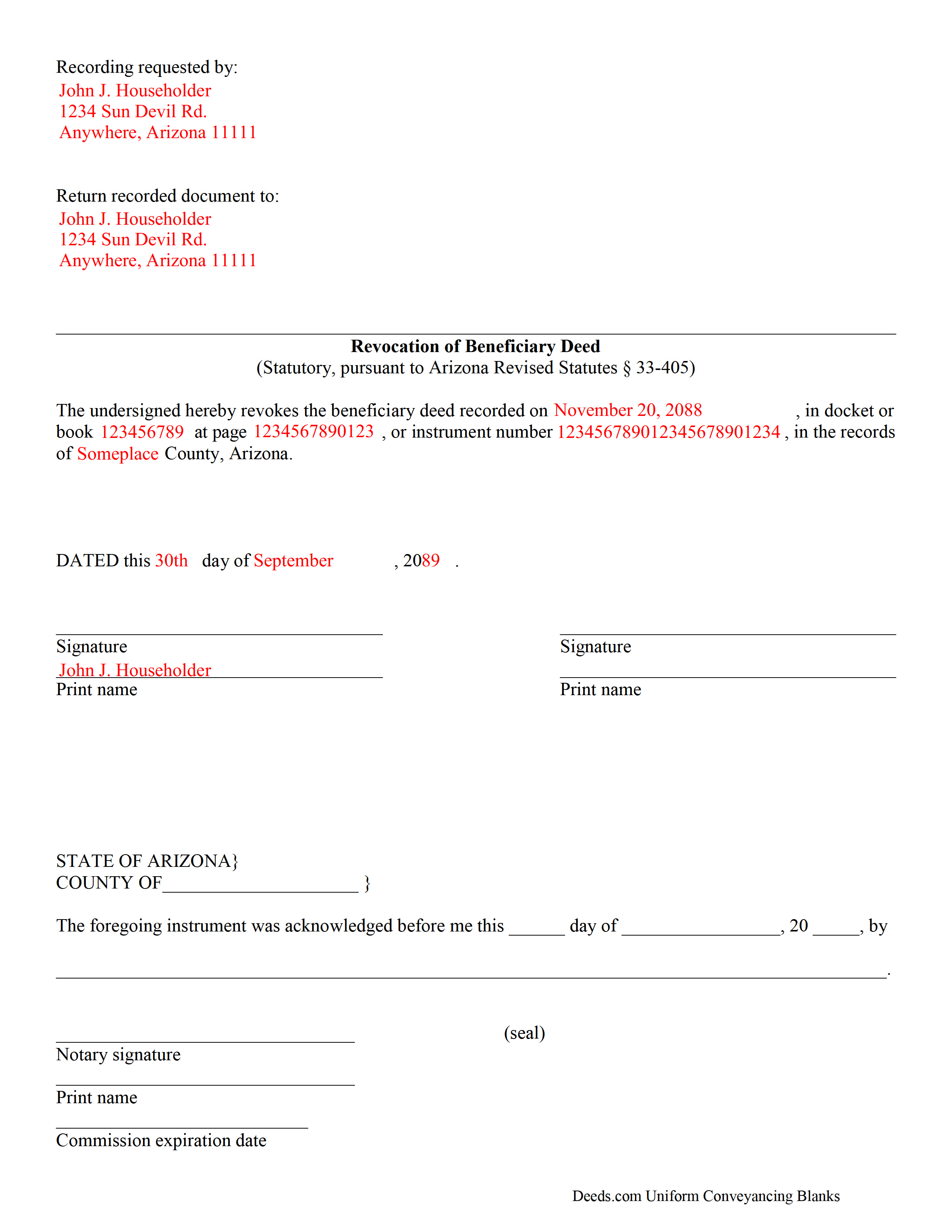

Cochise County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Cochise County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Bisbee, Arizona 85603

Hours: 8:00am - 5:00pm Monday - Friday

Phone: 520-432-8350

Recording Tips for Cochise County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Cochise County

Properties in any of these areas use Cochise County forms:

- Benson

- Bisbee

- Bowie

- Cochise

- Douglas

- Dragoon

- Elfrida

- Fort Huachuca

- Hereford

- Huachuca City

- Mc Neal

- Naco

- Pearce

- Pirtleville

- Pomerene

- Saint David

- San Simon

- Sierra Vista

- Tombstone

- Willcox

Hours, fees, requirements, and more for Cochise County

How do I get my forms?

Forms are available for immediate download after payment. The Cochise County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cochise County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cochise County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cochise County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cochise County?

Recording fees in Cochise County vary. Contact the recorder's office at 520-432-8350 for current fees.

Questions answered? Let's get started!

This statutory form meets or exceeds the requirements for revoking an Arizona beneficiary deed.

Arizona's beneficiary deeds are governed by A.R.S. 33-405. The statute provides forms and requirements for managing beneficiary deeds. One aspect of that management is the ability to revoke the deed.

(Arizona Revocation of Beneficiary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Cochise County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Cochise County.

Our Promise

The documents you receive here will meet, or exceed, the Cochise County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cochise County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

James B.

June 9th, 2019

Reliable and fast. A great assest.

Thank you!

Alan C.

December 10th, 2020

I thought the instructions could have been a little better. I didn't know how to do this if the spouses are married but living in separate residences. Also I didn't understand the "Prior Instrument Reference". That should be explained better. Very sketchy instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Kevin R.

August 22nd, 2023

I have been using Deeds.com for the last 2 years and find them very easy to use and expedient on all my recordings. Highly recommend.

Thank you for the kind words Kevin. We appreciate you.

Ron D.

June 2nd, 2024

The State form I chose was valid and accurate. However, I found the ability to enter information was inadequate and difficult. Converted the form to a Word document and was then able to enter the information I needed to.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Michael T.

July 6th, 2020

Quick, simple and easy.

Thank you!

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!

Larry R.

December 8th, 2020

I appreciate the opportunity to take care of business without the hassle of parking, security checks and lines. It was all done quickly and easily.

Thank you!

Paula S.

September 24th, 2019

I highly recommend this website. It was quick and easy with very helpful guides and examples! I am so very thankful that I stumbled across the Deed website! Definitely worth every penny spent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave S.

May 1st, 2019

Easy to use and get forms I needed. Corporate need for an invoice/receipt could be a bit easier - have to print screen to get any info.

Thank you for your feedback Dave, we really appreciate it.

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Duane R.

May 12th, 2019

Your site was very easy to use and provided all the information needed.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID K.

April 5th, 2019

Good so far could use more examples for each section of info. needed. ex. (parcel and alt.ID info where to find and etc. #2 more examples. If it was not for the red print examples helping to fill the form out I could have downloaded free forms, the examples are what made me choose your form !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOSEPH W.

September 17th, 2021

Easy peezy!

Thank you!