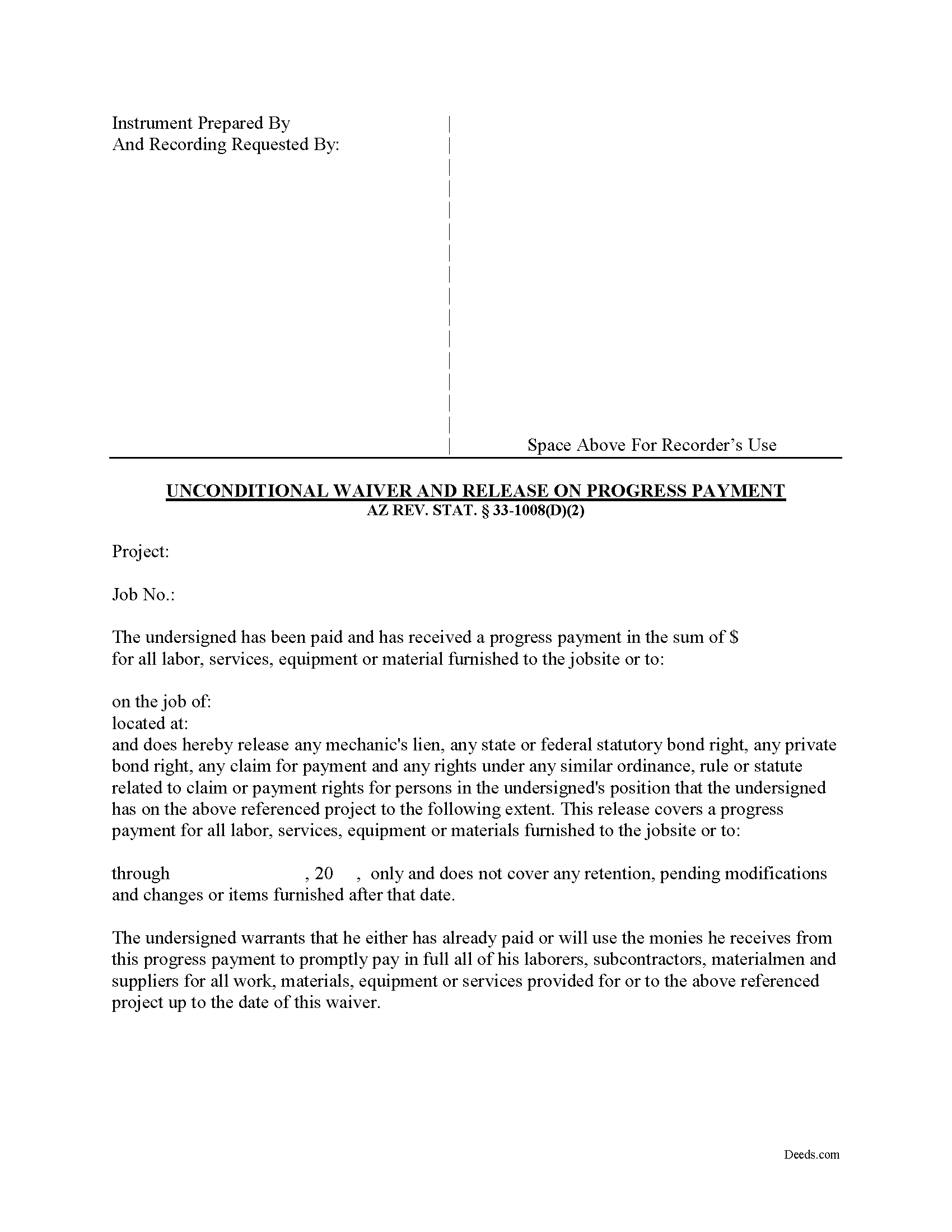

Pima County Unconditional Lien Waiver on Progress Payment Form

Pima County Unconditional Lien Waiver on Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

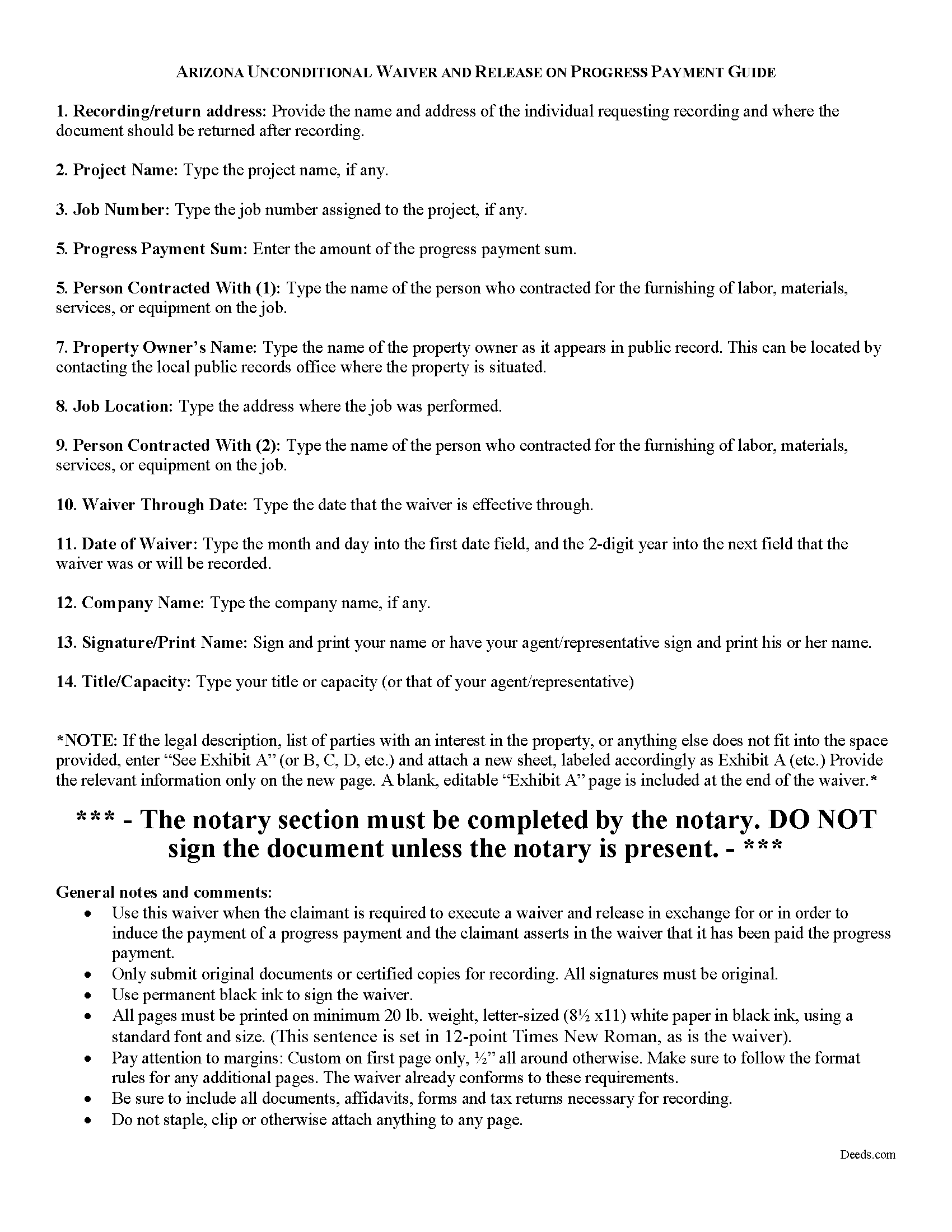

Pima County Unconditional Lien Waiver of Progress Payment Guide

Line by line guide explaining every blank on the form.

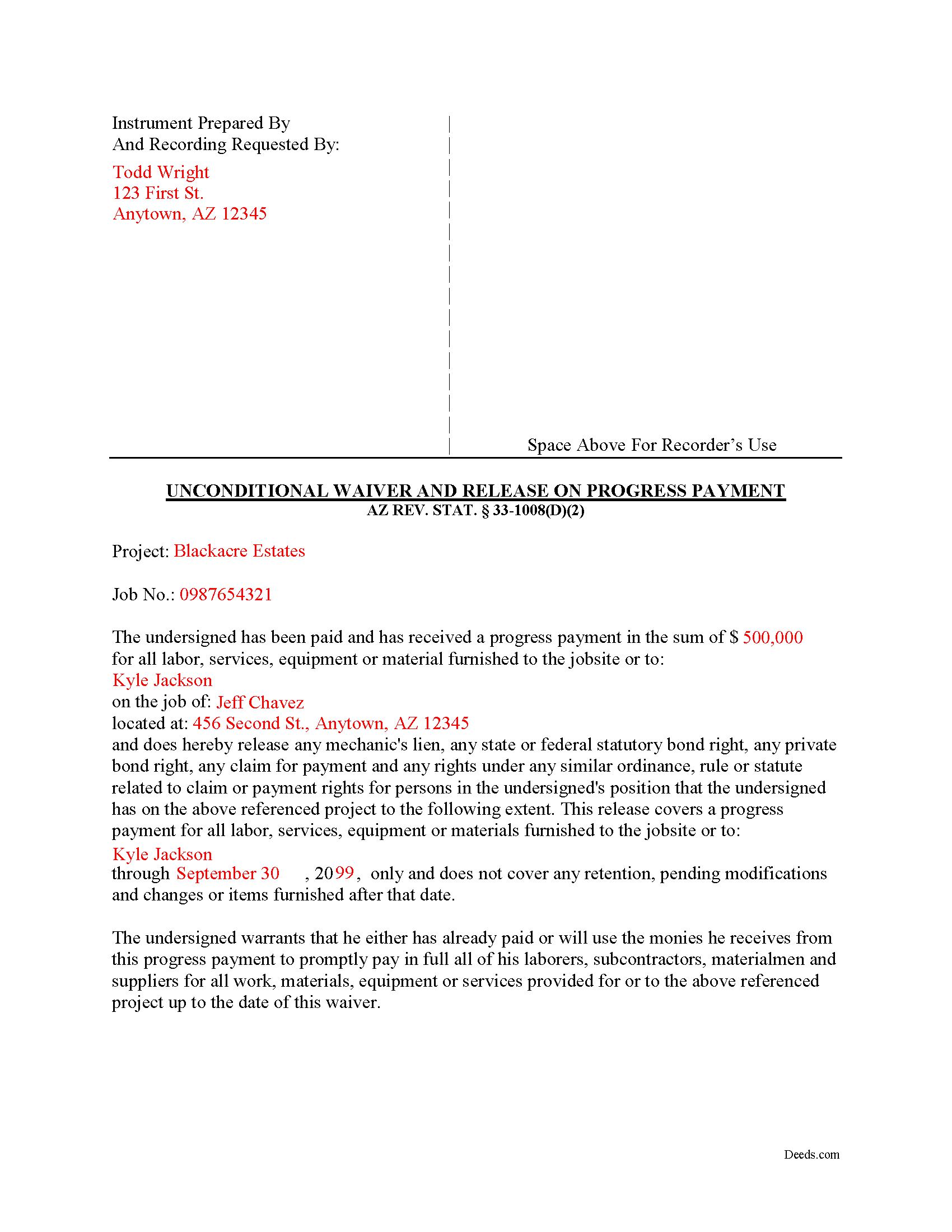

Pima County Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pima County documents included at no extra charge:

Where to Record Your Documents

Recorder: Main Office

Tucson, Arizona 85701

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: 520) 740-4350

Recorder: Eastside Office

Tucson, Arizona 85710

Hours: Monday through Friday 8:00 to noon & 1:00 to 5:00

Phone: 520) 740-4350

Recording Tips for Pima County:

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Pima County

Properties in any of these areas use Pima County forms:

- Ajo

- Arivaca

- Catalina

- Cortaro

- Green Valley

- Lukeville

- Marana

- Mount Lemmon

- Rillito

- Sahuarita

- Sasabe

- Sells

- Topawa

- Tucson

- Vail

Hours, fees, requirements, and more for Pima County

How do I get my forms?

Forms are available for immediate download after payment. The Pima County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pima County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pima County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pima County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pima County?

Recording fees in Pima County vary. Contact the recorder's office at 520) 740-4350 for current fees.

Questions answered? Let's get started!

Lien waivers are part of the Arizona mechanic's lien process. The waiver, given by a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. Unconditional waivers do not require payment confirmation, but conditional waivers are effective only when payment is received, usually verified by a check clearing the bank. So, an unconditional waiver given after a partial payment releases a portion the claimant's right to lien, regardless of whether or not after any check used to pay the bill clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(2).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Pima County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver on Progress Payment meets all recording requirements specific to Pima County.

Our Promise

The documents you receive here will meet, or exceed, the Pima County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pima County Unconditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!

D F.

March 3rd, 2020

Find what i was looking for, and got the answers to my questions!! Thank you

Thank you!

Ardelle P.

January 2nd, 2019

Extremely happy with this. Easy to use and very professional looking form when completed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia G.

January 19th, 2021

Oh my goodness! Y'all are an answer to prayers! You provided all the forms necessary in one convenient packet, and at a VERY reasonable price! I can't thank y'all enough for helping my family & myself with what could've been a difficult and expensive situation! God bless you for your time and talent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

August 18th, 2022

I ordered my gift deed forms one evening, filled them out the next day, and registered them with the register of deeds the next morning. Boom. Done! Easy peasy, no lawyer expense!

Thank you!

John Z.

April 14th, 2022

This was an easy to use program. Easy payment. documents are on my desktop ready to fill out. I will have to update after my property transfer. Zuna

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Benjamin D.

June 30th, 2020

THANK YOU. Your materials are excellent and provided the information and guidance requested and needed.

Thank you!

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa P.

March 17th, 2021

Wonderful forms. It's nice that they were formatted perfectly for my county, it's real easy to miss a requirement (margines, font size, and so on) and end up with a rejection or higher recording fee. Good job folks!

Thank you!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Jennifer O.

March 2nd, 2022

Quick, easy, affordable, eliminated the need for a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

April 17th, 2024

Great service that satisfied all my needs. Great prices too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!