Washington County Gift Deed Forms (Maryland)

Express Checkout

Form Package

Gift Deed

State

Maryland

Area

Washington County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Washington County specific forms and documents listed below are included in your immediate download package:

Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 2/19/2024

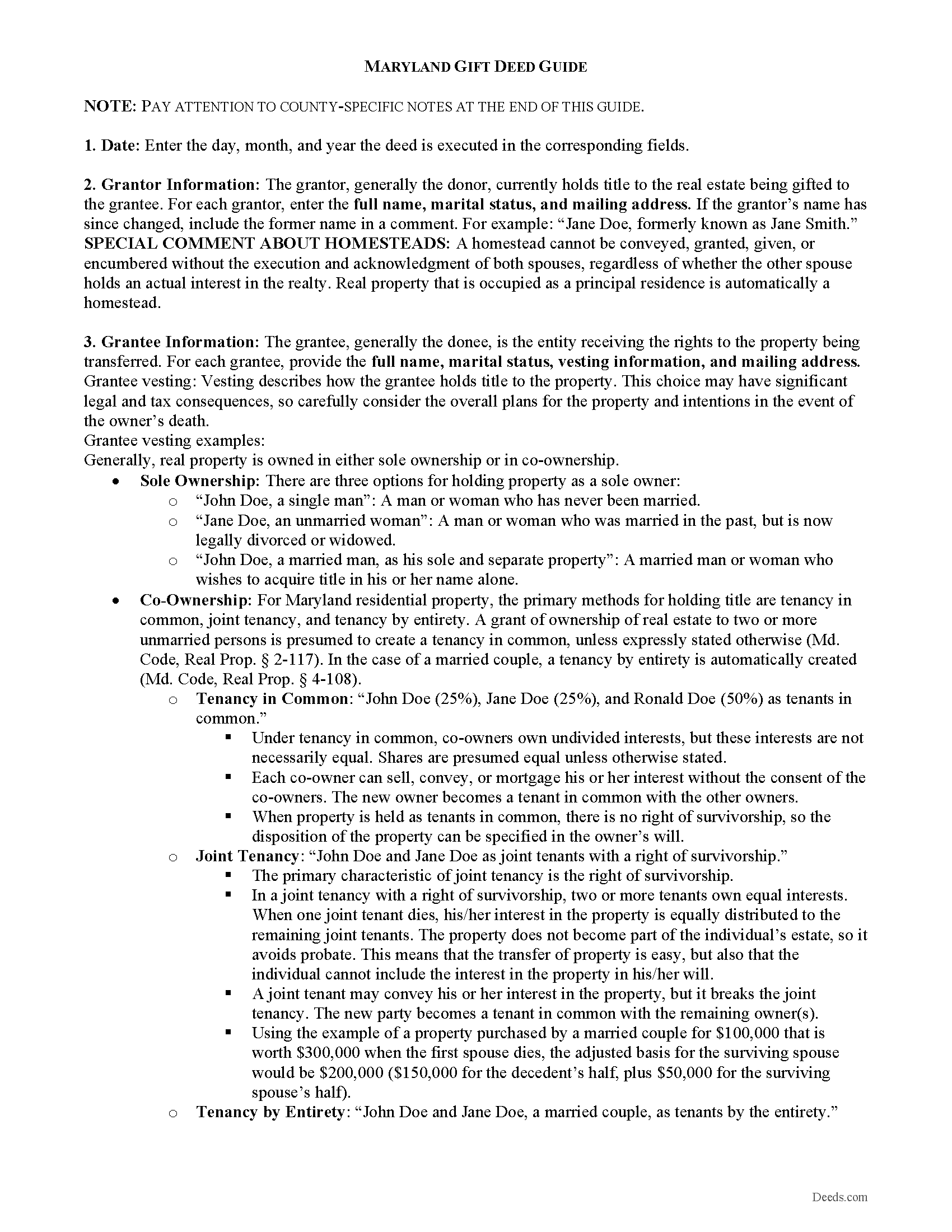

Gift Deed Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 3/21/2024

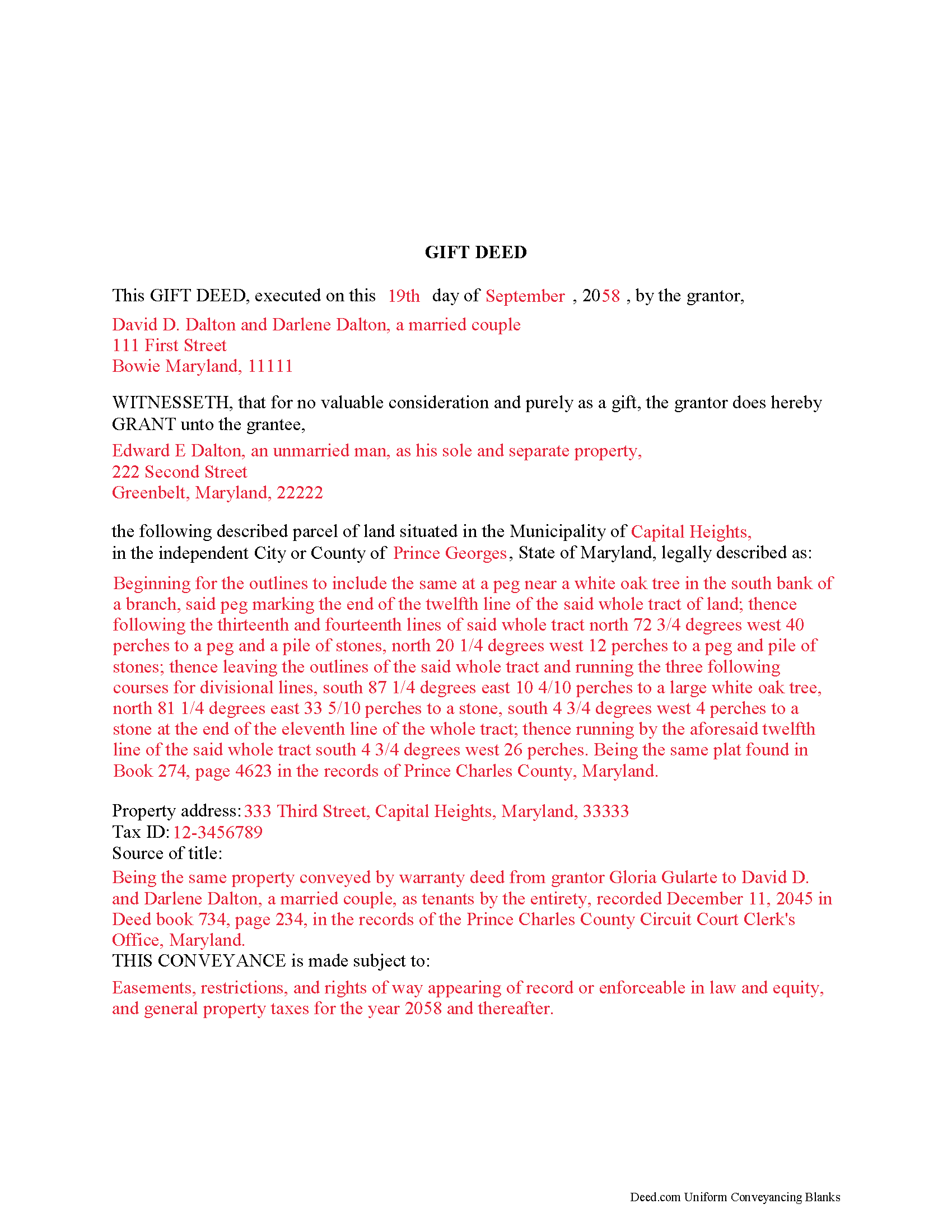

Completed Example of the Gift Deed Document

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 2/21/2024

Included Supplemental Documents

The following Maryland and Washington County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Maryland or Washington County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Washington County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Washington County Gift Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Gift Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Washington County that you need to transfer you would only need to order our forms once for all of your properties in Washington County.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Gift Deed Forms:

- Washington County

Including:

- Big Pool

- Boonsboro

- Brownsville

- Cascade

- Cavetown

- Chewsville

- Clear Spring

- Fairplay

- Funkstown

- Hagerstown

- Hancock

- Keedysville

- Maugansville

- Rohrersville

- Saint James

- Sharpsburg

- Smithsburg

- Williamsport

What is the Maryland Gift Deed

Gifts of Real Property in Maryland

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and given without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. Gift deeds must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed must also include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Maryland residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless expressly stated otherwise (Md. Code, Real Prop. 2-117). In the case of a married couple, a tenancy by entirety is automatically created (4-108).

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording as well. A State of Maryland Land Instrument Intake Sheet is required with every land instrument submitted for recording (Md. Code, Real Prop. 3--104(a)(1)(ii)). Before filing the deed, consult an attorney or the local recording office lawyer to ensure all state, county, municipal, and situation-specific requirements are being met. Record the completed deed at the local County Circuit Court Clerk's Office.

The IRS levies a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. Gifts of real property in Maryland are subject to this federal gift tax, but there is no corresponding state tax. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that gifts valued below $15,000 do not require a federal gift tax return (Form 709). Even so, grantors should consider filing one for many gifts of real property [2]. The grantor is responsible for paying the federal gift tax; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state tax laws, consult a tax specialist.

[1] https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Maryland GD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4317 Reviews)

Dyanna B.

April 23rd, 2024

Got what I needed. Easy access.

Thank you for your positive words! We’re thrilled to hear about your experience.

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!

Michael M.

April 17th, 2024

Great service that satisfied all my needs. Great prices too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David P.

February 23rd, 2019

Thank you. I was just looking but still think it is a great website. Used it a couple of years ago for a deed. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Bonnie A.

September 27th, 2021

I wish you could send copy in mail

Thank you for your feedback. We really appreciate it. Have a great day!

suzanne m.

April 9th, 2020

Finding what I needed was quick and easy.

Thank you!

Carlos M.

January 4th, 2023

so far so good. thanks

Thank you!

SHIRLEY H.

September 21st, 2022

I like that they have all the forms, but I could not find it they would submit the forms to the recorders office

Thank you!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.

carrie m.

March 3rd, 2020

I was excited because I really wanted to see and get a copy of the Deed to my property. The personal/Staff responsible for setting up that plan did an excellent/outstanding job. Thanks so much and keep up the great work.

Carrie

Thank you for your feedback. We really appreciate it. Have a great day!

RONDA S.

March 18th, 2021

I just love this site!

Thank you!

Eric M.

April 8th, 2021

Easy process and staff was very helpful

Thank you for your feedback. We really appreciate it. Have a great day!

B A A.

March 9th, 2023

So far I like the ease of availability of the site and the help guides.

Thank you for your feedback. We really appreciate it. Have a great day!

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round.

Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nola B.

May 18th, 2021

I like the form except the title should be ENHANCED LIFE ESTATE DEED and not Quit Claim Deed

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.