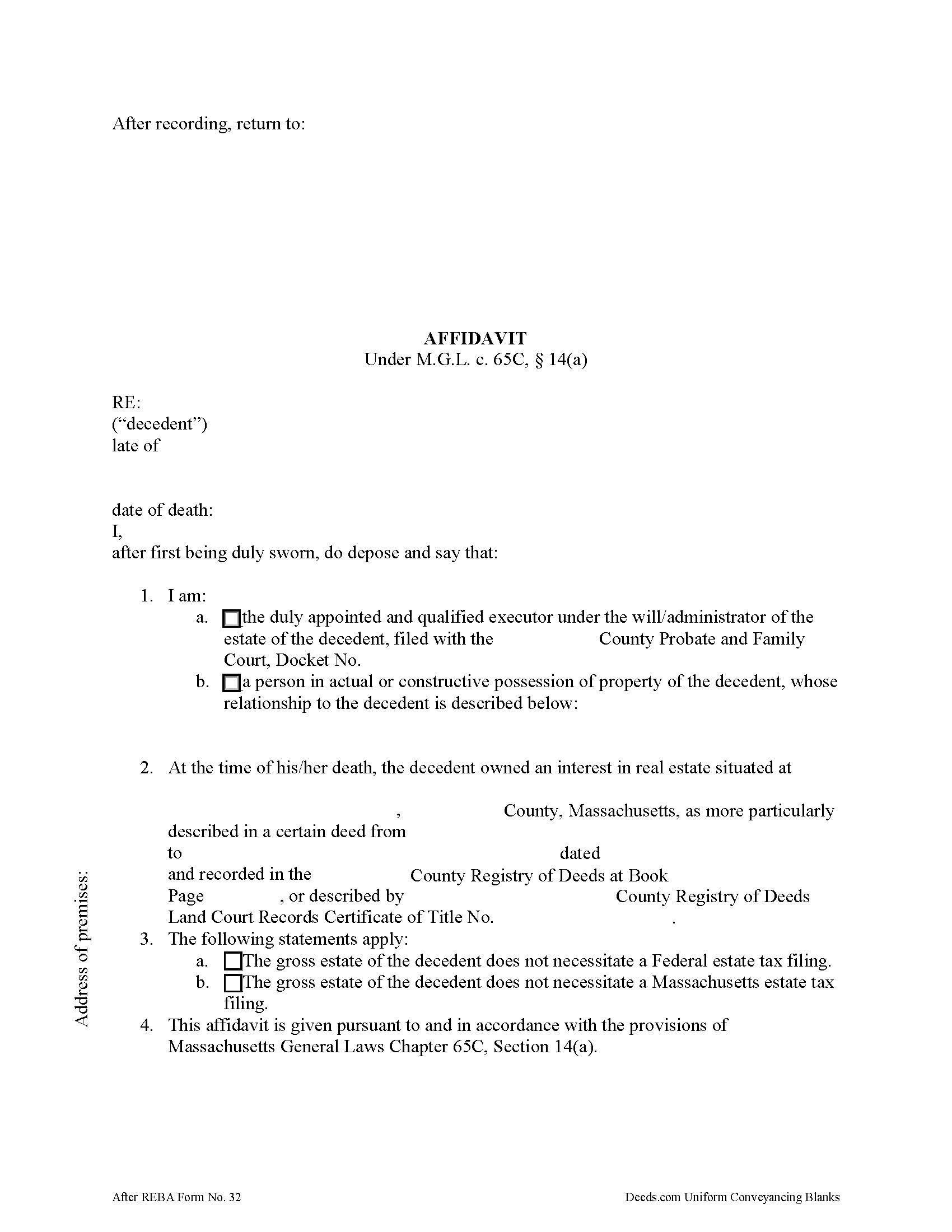

Hampden County Estate Tax Affidavit Form

Hampden County Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

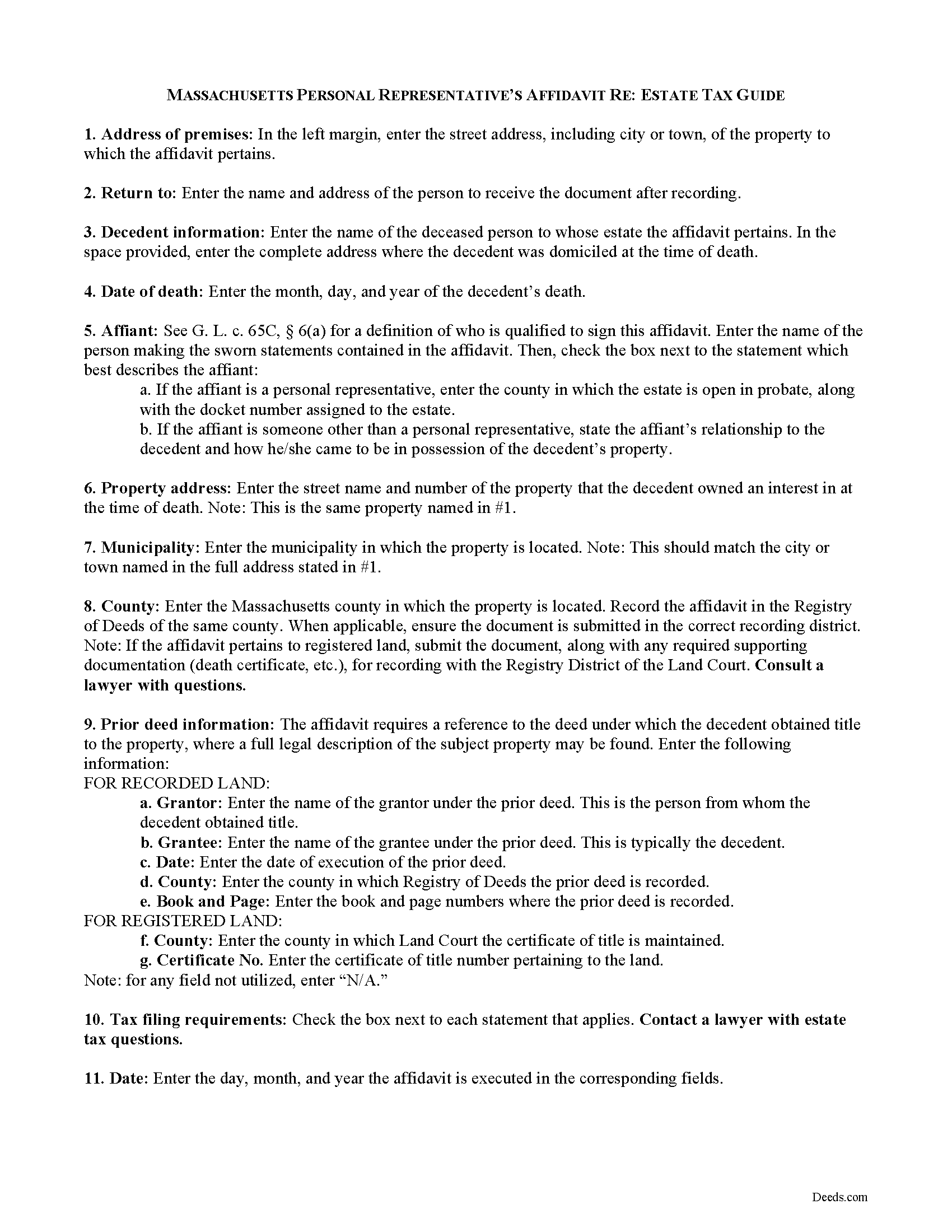

Hampden County Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

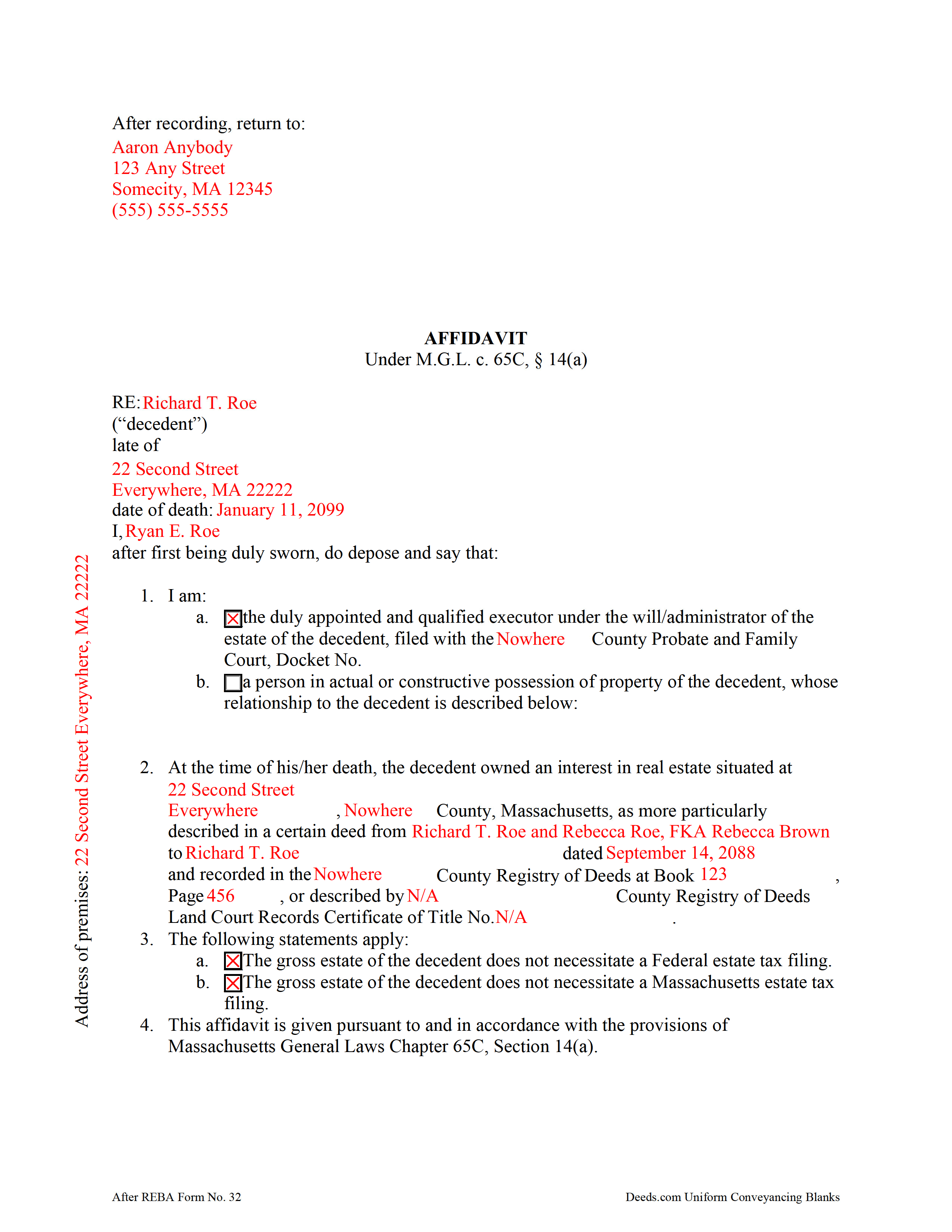

Hampden County Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Hampden County documents included at no extra charge:

Where to Record Your Documents

Hampden Registry of Deeds

Springfield, Massachusetts 01103

Hours: Monday through Friday 8:30 to 4:30 / Recording until 4:00

Phone: (413) 755-1722

Westfield Satellite Office

Westfield, Massachusetts 01085

Hours: Mon-Fri 9:00 to 12:00 & 1:00 to 4:00 / Recording Mon, Wed, Fri only

Phone: (413) 755-1722

Recording Tips for Hampden County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Hampden County

Properties in any of these areas use Hampden County forms:

- Agawam

- Blandford

- Bondsville

- Brimfield

- Chester

- Chicopee

- East Longmeadow

- Feeding Hills

- Granville

- Hampden

- Holland

- Holyoke

- Indian Orchard

- Longmeadow

- Ludlow

- Monson

- Palmer

- Russell

- Southwick

- Springfield

- Thorndike

- Three Rivers

- Wales

- West Springfield

- Westfield

- Wilbraham

- Woronoco

Hours, fees, requirements, and more for Hampden County

How do I get my forms?

Forms are available for immediate download after payment. The Hampden County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hampden County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hampden County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hampden County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hampden County?

Recording fees in Hampden County vary. Contact the recorder's office at (413) 755-1722 for current fees.

Questions answered? Let's get started!

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Important: Your property must be located in Hampden County to use these forms. Documents should be recorded at the office below.

This Estate Tax Affidavit meets all recording requirements specific to Hampden County.

Our Promise

The documents you receive here will meet, or exceed, the Hampden County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hampden County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Johanna R.

April 21st, 2022

As soon as payment was received the forms were downloaded, printed and were useable. The guide was helpful and I was able to get my forms filled out and filed with no problem here in Linn County Oregon. I would recommend the site to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara S.

June 12th, 2021

Thanks for this service. I believe it will be all I need. Will know for sure within a week

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Troy B.

July 8th, 2020

Very pleased with website very simple to navigate through

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy B.

March 20th, 2020

I was happy with the way this worked and the quick responses. Unfortunately, my documents could not be pulled. I will use this service again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Marion R.

January 30th, 2019

YOU WERE NOT ABLE TO PROVIDE SERVICE IN THE COUNTY WE NEEDED IN NEW MEXICO. YOUR RESPONSE WAS QUICK SO I APPRECIATE THAT. THANK YOU

Thank you for your feedback Marion.

CHERYL G.

April 11th, 2022

After my county rejected a deed from another company, I researched better and purchased my Lady Bird Deed from Deeds.com. Very simple, received everything immediately. Printed out sample and guide sheets and filled out my deed. Very thorough and easy to understand. All the additional forms were awesome. And the best part is, my county recorded my deed this morning! WooHoo! Very happy customer! Thank you!

Glad to hear! Thanks for taking the time to leave your review. We appreciate you. Have a great day.

Beth O.

January 15th, 2023

Easy peasy! Thank y'all so much.

Thank you!

Lenore B.

January 13th, 2019

Thank you for making this deed available. The guide was such a big help.

Thanks Lenore, have a great day!

Jana H.

December 23rd, 2020

I love this recording service! They are so fast and let me know in advance if they think something is wrong and will be rejected! They are reasonably priced too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James T.

July 12th, 2021

Very easy to use. Straightforward and informative

Thank you for your feedback. We really appreciate it. Have a great day!

John L.

April 22nd, 2023

WOW, This site saved me from going to a lawyer. Not only do they give you great directions, they also include a sample that is extremely helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert A.

August 5th, 2020

A well constructed site, easy to navigate and a pleasure to use. I'd give it a 10 on 10

Thank you for your feedback. We really appreciate it. Have a great day!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!