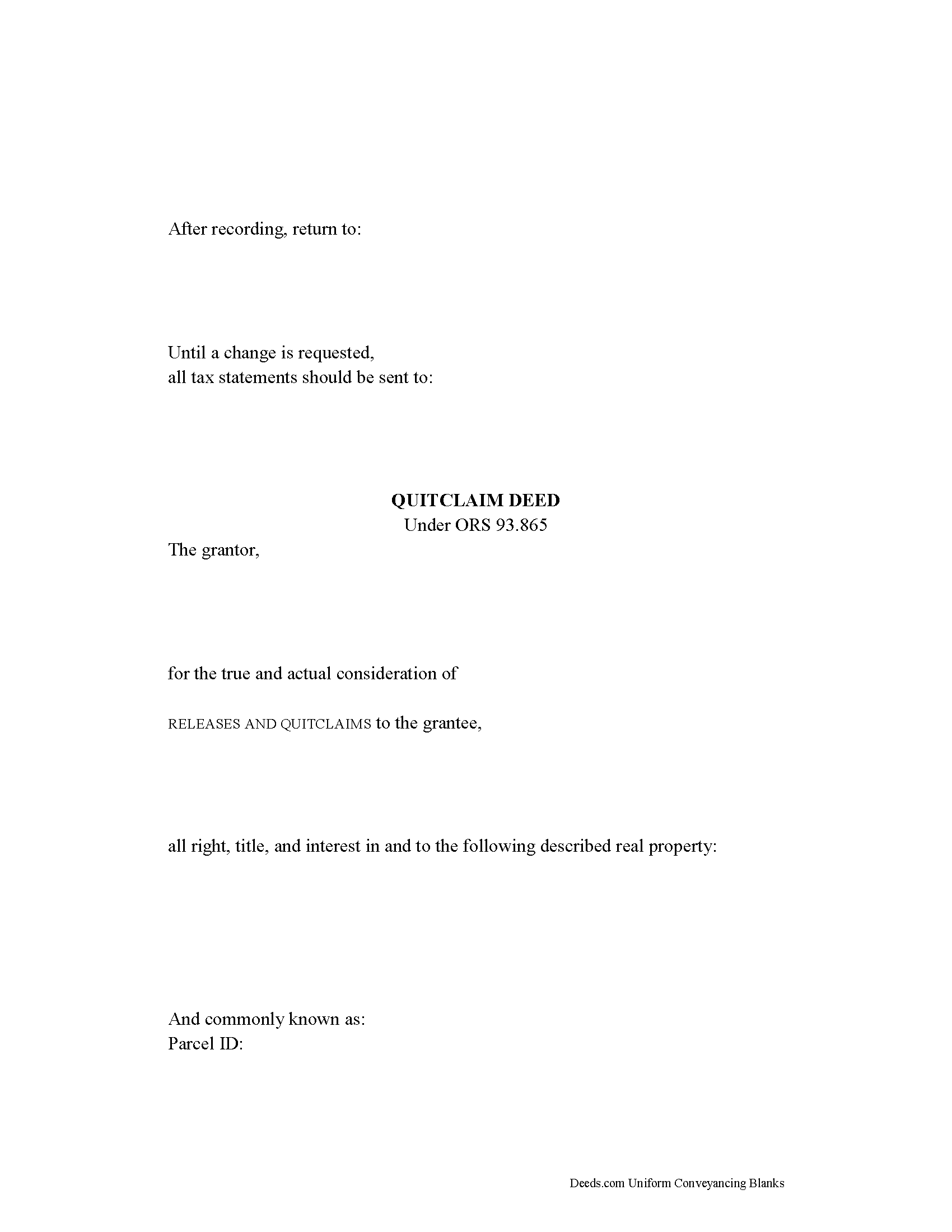

Douglas County Quitclaim Deed Form

Douglas County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Oregon recording and content requirements.

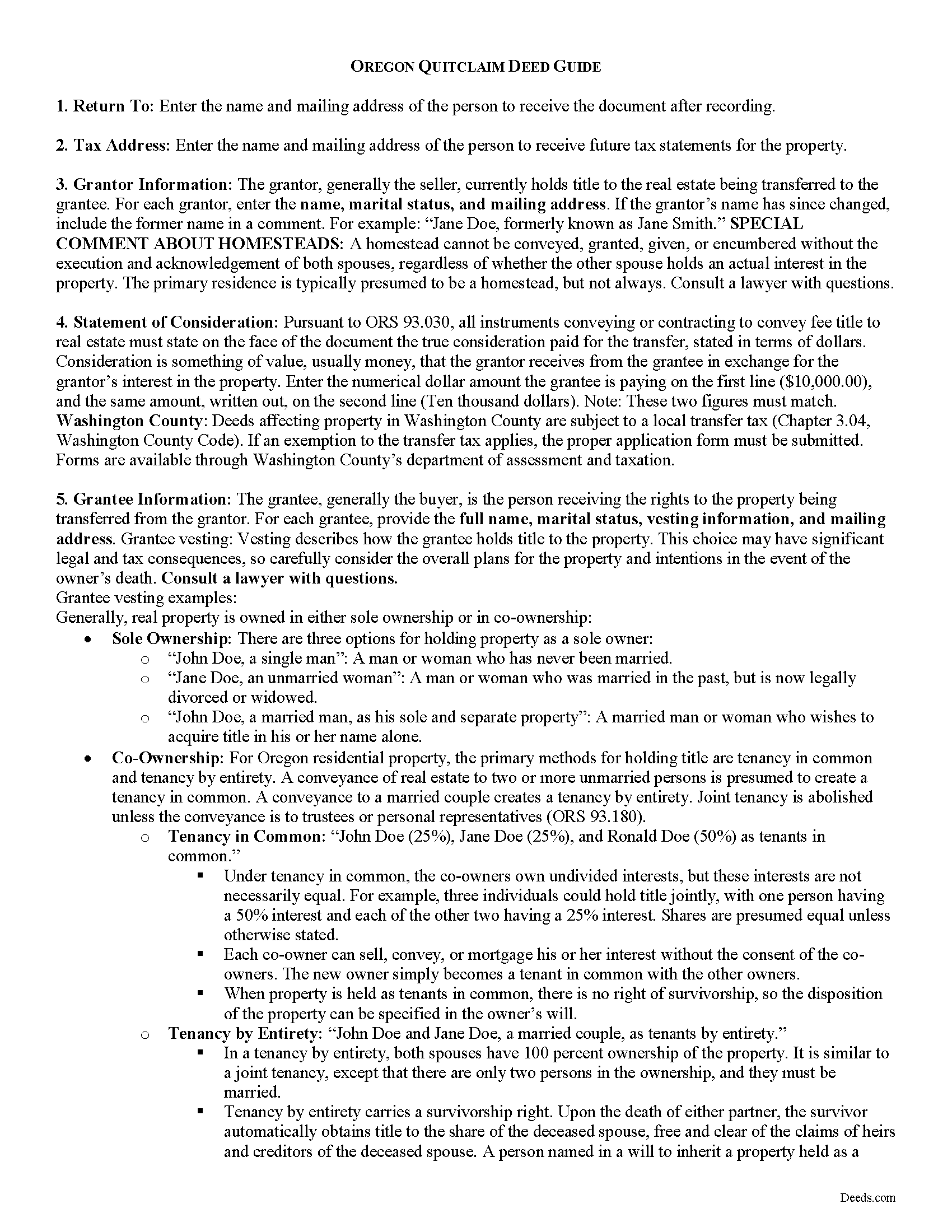

Douglas County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

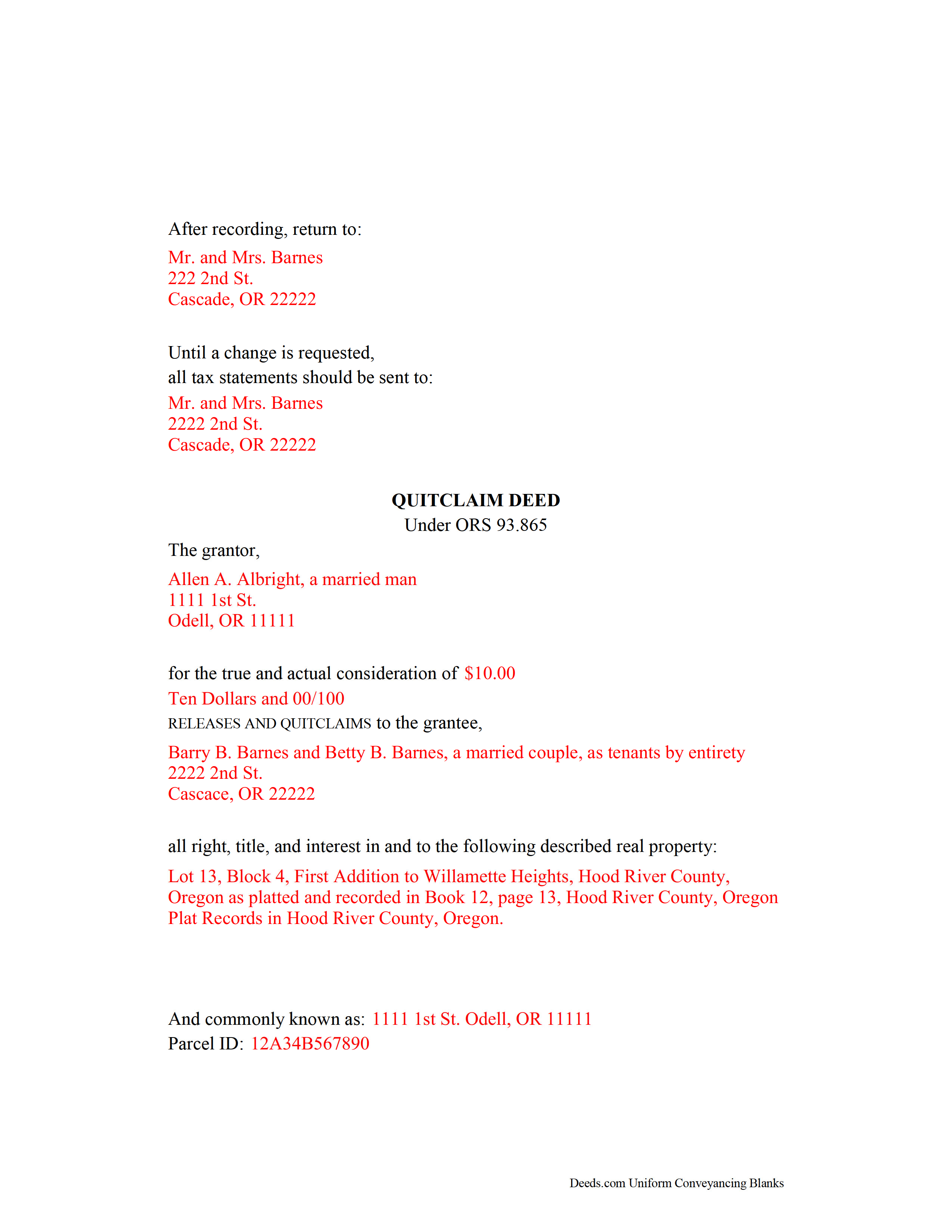

Douglas County Completed Example of the Quitclaim Deed Document

Example of a properly completed Oregon Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Douglas County documents included at no extra charge:

Where to Record Your Documents

County Clerk: Recording Division

Roseburg, Oregon 97470

Hours: 9:00 to noon & 1:00 to 4:00 Monday through Friday

Phone: (541) 440-4320

Recording Tips for Douglas County:

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Ask about accepted payment methods when you call ahead

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Douglas County

Properties in any of these areas use Douglas County forms:

- Azalea

- Camas Valley

- Canyonville

- Days Creek

- Dillard

- Drain

- Elkton

- Gardiner

- Glendale

- Glide

- Idleyld Park

- Myrtle Creek

- Oakland

- Reedsport

- Riddle

- Roseburg

- Scottsburg

- Sutherlin

- Tenmile

- Tiller

- Umpqua

- Wilbur

- Winchester

- Winston

- Yoncalla

Hours, fees, requirements, and more for Douglas County

How do I get my forms?

Forms are available for immediate download after payment. The Douglas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Douglas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Douglas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Douglas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Douglas County?

Recording fees in Douglas County vary. Contact the recorder's office at (541) 440-4320 for current fees.

Questions answered? Let's get started!

In Oregon, title to real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Oregon under ORS 93.865, and they convey real property in fee simple with no warranties of title. This type of deed only conveys the interest the grantor has at the time the deed is executed, and it does not guarantee that the grantor has good title or right to the property.

In Oregon, a lawful quitclaim deed includes the grantor's full name, mailing address, and marital status; the true consideration paid for the transfer (ORS 93.030); and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Oregon residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons is presumed to create a tenancy in common. A conveyance to a married couple creates a tenancy by entirety. Joint tenancy is abolished unless the conveyance is to trustees or personal representatives (ORS 93.180).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary.

Deeds affecting property in Washington County are subject to a local transfer tax (Chapter 3.04, Washington County Code). If an exemption to the transfer tax applies, the proper application form must be submitted. Forms are available through Washington County's department of assessment and taxation.

Record the original completed deed, along with any additional materials, at the clerk's office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an Oregon lawyer with any questions related to the transfer of real property.

(Oregon QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Douglas County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Douglas County.

Our Promise

The documents you receive here will meet, or exceed, the Douglas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Douglas County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

David M.

September 29th, 2022

Holy cow. I was told by several people that getting a deed recorded would take 7-10 days. So I thought I'd give deeds.com a try with their e-filing service. I created my account and submitted my deed around 4:00 p.m. and it was recorded before I woke up the next morning. Awesome service! Totally worth the $19 service fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephenie A.

January 11th, 2019

No review provided.

Thank you!

Steven S.

June 22nd, 2020

Very convenient and great tool for my real estate business. I'm a fan and will be a repeat customer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenda C.

February 21st, 2021

It was easy to find what I was looking for. The instructions were easy to follow. The example given was most beneficial in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bonnie A.

March 3rd, 2020

I little struggle downloading the forms at first but support helped. After that it was a breeze, happy with everything.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan P.

October 6th, 2020

It was a pleasant surprise to find out how easy the site was to use! Clear directions! very user friendly!

Thank you!

Edwart D.

November 30th, 2021

I tend to not pay attention to the details and then blame other people. Thankfully Deeds.com has my back when I make silly mistakes.

Thank you!

Margaret M.

October 28th, 2019

Great job with these forms. Super easy and up to date, a rare find online these days. Thank you.

Thank you!

Stephen N.

February 11th, 2021

Excellent service.

Thank you!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

March 16th, 2021

Guidelines somewhat helpful. Forms fillable but not editable unless you buy an Adobe conversion service subscription. End product looks crude and amateurish. Fields can't be reduced or enlarged to accommodate unique data. Very disappointing.

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra P.

July 25th, 2020

Thank so much! It' was pretty easy with the help of my Brother in-law .

Thank you for your feedback. We really appreciate it. Have a great day!