Rutherford County Administrator Deed Form

Rutherford County Administrator Deed Form

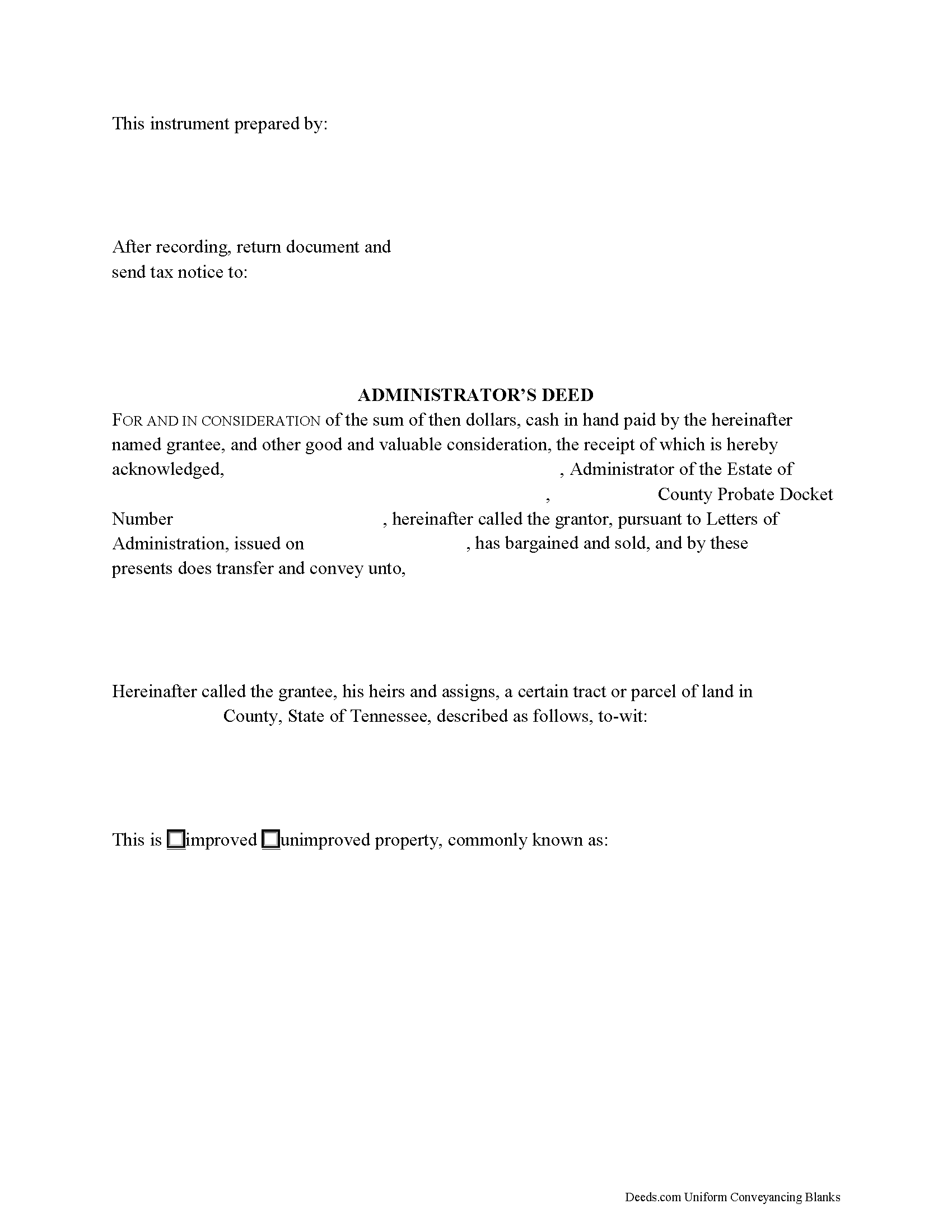

Fill in the blank form formatted to comply with all recording and content requirements.

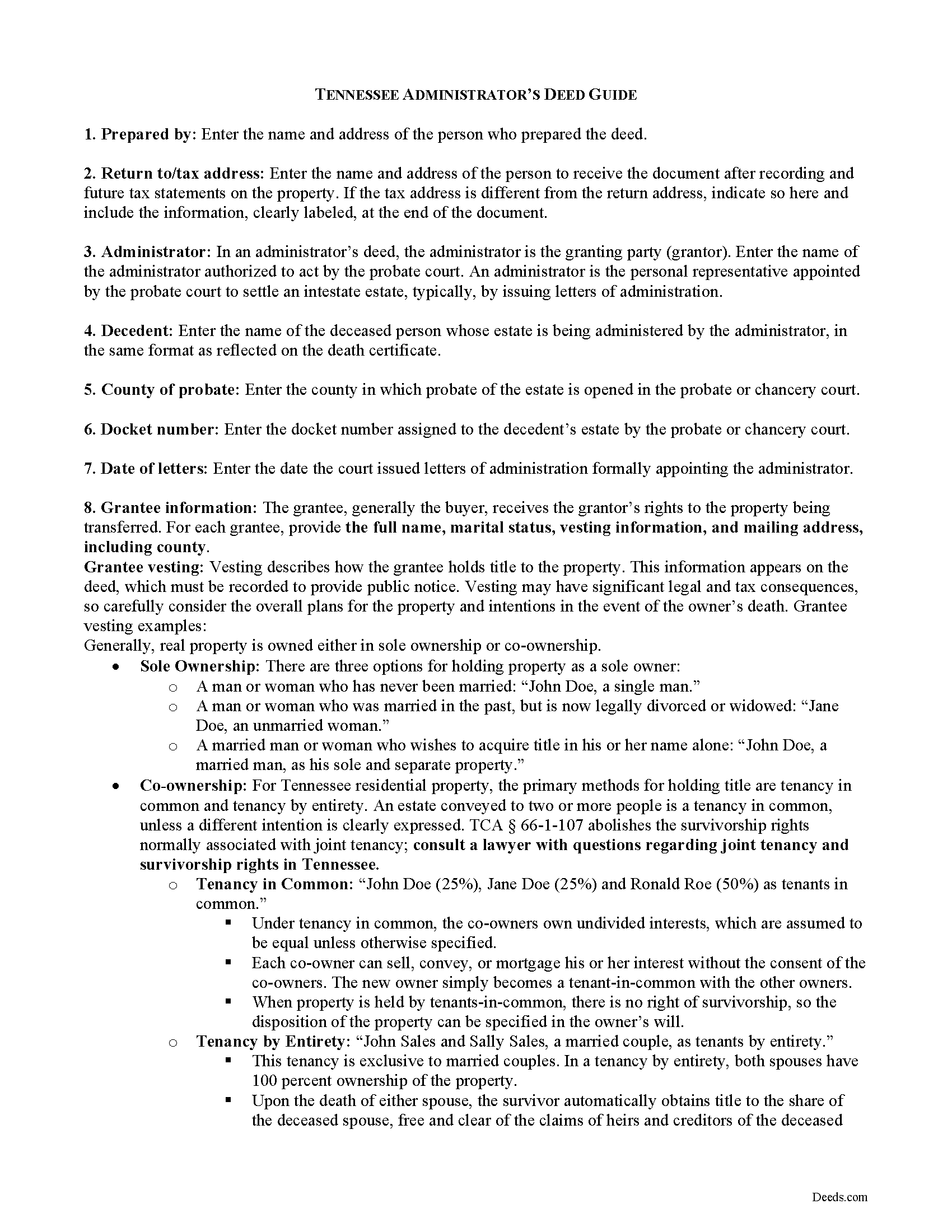

Rutherford County Administrator Deed Guide

Line by line guide explaining every blank on the form.

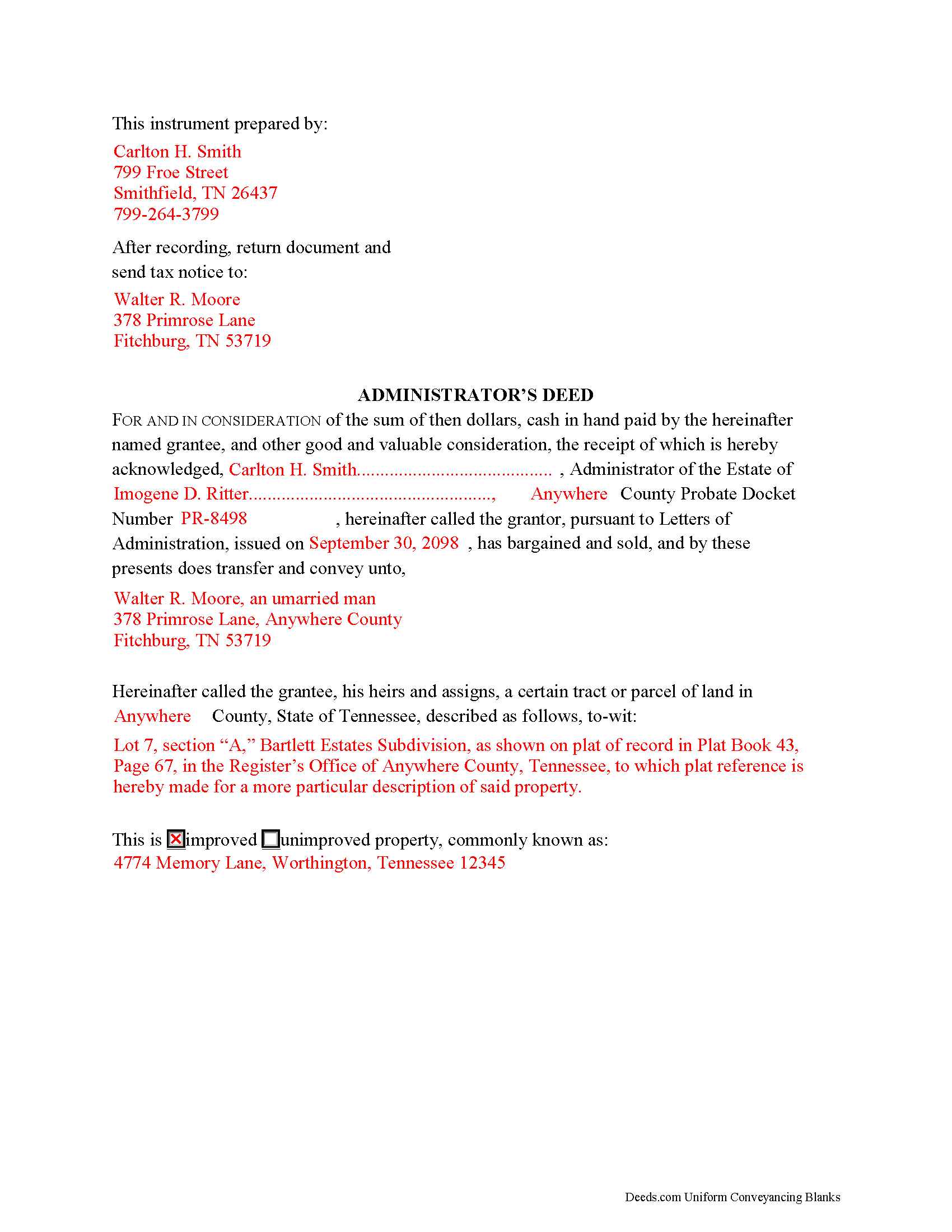

Rutherford County Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Rutherford County documents included at no extra charge:

Where to Record Your Documents

Rutherford County Register of Deeds

Murfreesboro, Tennessee 37130

Hours: 8:00 to 4:00 M-F

Phone: (615) 898-7870

Recording Tips for Rutherford County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Rutherford County

Properties in any of these areas use Rutherford County forms:

- Christiana

- Eagleville

- Fosterville

- La Vergne

- Lascassas

- Milton

- Murfreesboro

- Rockvale

- Smyrna

Hours, fees, requirements, and more for Rutherford County

How do I get my forms?

Forms are available for immediate download after payment. The Rutherford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rutherford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rutherford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rutherford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rutherford County?

Recording fees in Rutherford County vary. Contact the recorder's office at (615) 898-7870 for current fees.

Questions answered? Let's get started!

Use an administrator's deed to transfer title to a decedent's real property to a purchaser following a sale. An administrator's deed names the duly authorized and acting administrator of the estate of the deceased as the granting party. This is the person to whom the probate court has issued letters of administration.

Typically, administrators' deeds contain fiduciary covenants akin to those found in a special warranty deed, and the deed may even be indexed as a special warranty deed in the county land records. The warranty of title in a special (limited) warranty deed only covers the period that the grantor held title to the property, along with covenants that the grantor is lawfully seized and possessed of the property in fee simple and has a good right to convey it, and that the property is unencumbered, unless noted on the face of the deed.

A sale of realty from the decedent's estate may be required when the decedent's personal property is insufficient to pay the estate's debts. A petition of the court for a decree of sale is required before an administrator can make a sale (T.C.A. 30-2-402). The court may order a sale if there is sufficient evidence, upon hearing, that the land should be sold.

Fiduciary deeds follow the same formalities as any deed affecting title to real property, which include a legal description of the subject parcel, the parcel and map numbers assigned by the taxing authority, and a recitation of the grantor's source of title. In addition, the deed notes whether the subject parcel is improved or unimproved property. Any restrictions on the property should be noted on the face of the deed.

Instruments in Tennessee also require an oath of value (T.C.A. 67-4-409(a)). On any type of warranty deed, the oath reflects the consideration made for the transfer or what was given for the transfer, or the value of the property, whichever is greater. This oath is made and signed by the grantee or the grantee's buyer or agent, typically at the time of recording, as directed by the document's preparer. Conveyance tax is levied based on the amount reflected in the oath of consideration and is due upon recording.

Record deeds and instruments relating to real property in the Register of Deeds' office of the county where the subject land is situated. Instruments affecting interests in real property must meet state and county requirements for form and content, and should reflect the preparer's name and address, the property tax address, and signature of the granting party, made in the presence of a notary public. Include any requisite documentation with the deed, which may include a certificate of probate, certified copies of a will, and/or related probate orders.

The information provided here is not a substitute for legal advice and does not address specific probate situations. Consult an attorney licensed in the State of Tennessee with questions regarding administrators' deeds and probate procedures in that state, as each situation is unique.

(Tennessee AD Package includes form, guidelines, and completed example)

Important: Your property must be located in Rutherford County to use these forms. Documents should be recorded at the office below.

This Administrator Deed meets all recording requirements specific to Rutherford County.

Our Promise

The documents you receive here will meet, or exceed, the Rutherford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rutherford County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

VALETA J.

April 15th, 2022

Easy to navigate

Thank you!

Nancy C.

April 3rd, 2024

Easy to use, found what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Duncan M.

January 24th, 2019

Forms are fine, but the inability to download a completed form is not. Nor is the ability to convert to another format. Everytime I went to download, the form erased. I didn't have a printer available, so everything I did was to waste.

Thank you for your feedback Duncan. The blank forms should be downloaded first and then completed on your computer.

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken W.

March 24th, 2025

Deeds.com provides outstanding service! Quick e-recording, at a reasonable price, and if there are any issues, they work with you to resolve them. I'm recommending them to everyone I know who buys and sells land.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

March 25th, 2022

It was great

Thank you!

Carol M.

January 13th, 2020

Great service

Thank you!

Christine B.

April 16th, 2021

The site was easy to navigate.

Thank you!

willie jr t.

November 23rd, 2020

Awesome! Thanks so so much!

Thank you!

MATTHEW R.

March 12th, 2021

Absolutely amazing throughout the whole process

Thank you!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

Edward S.

June 10th, 2020

I was able to e-record 3 document with ease. The Middlesex registry of deeds is closed due to COVID-19 and this was my only option. Even if it was open, this is much faster and saves me time and money on parking ..etc. Great services.

Thank you!