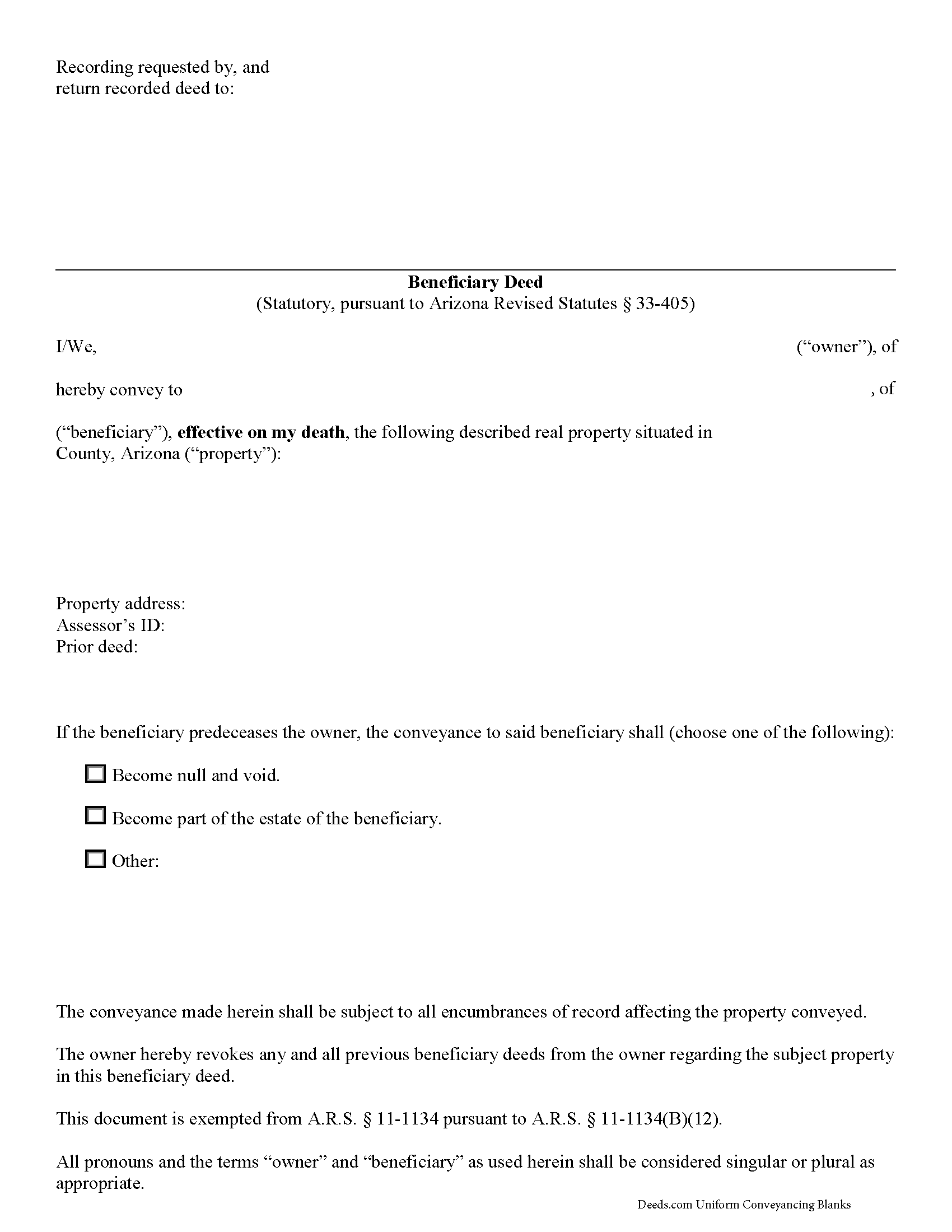

Apache County Beneficiary Deed Form

Apache County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

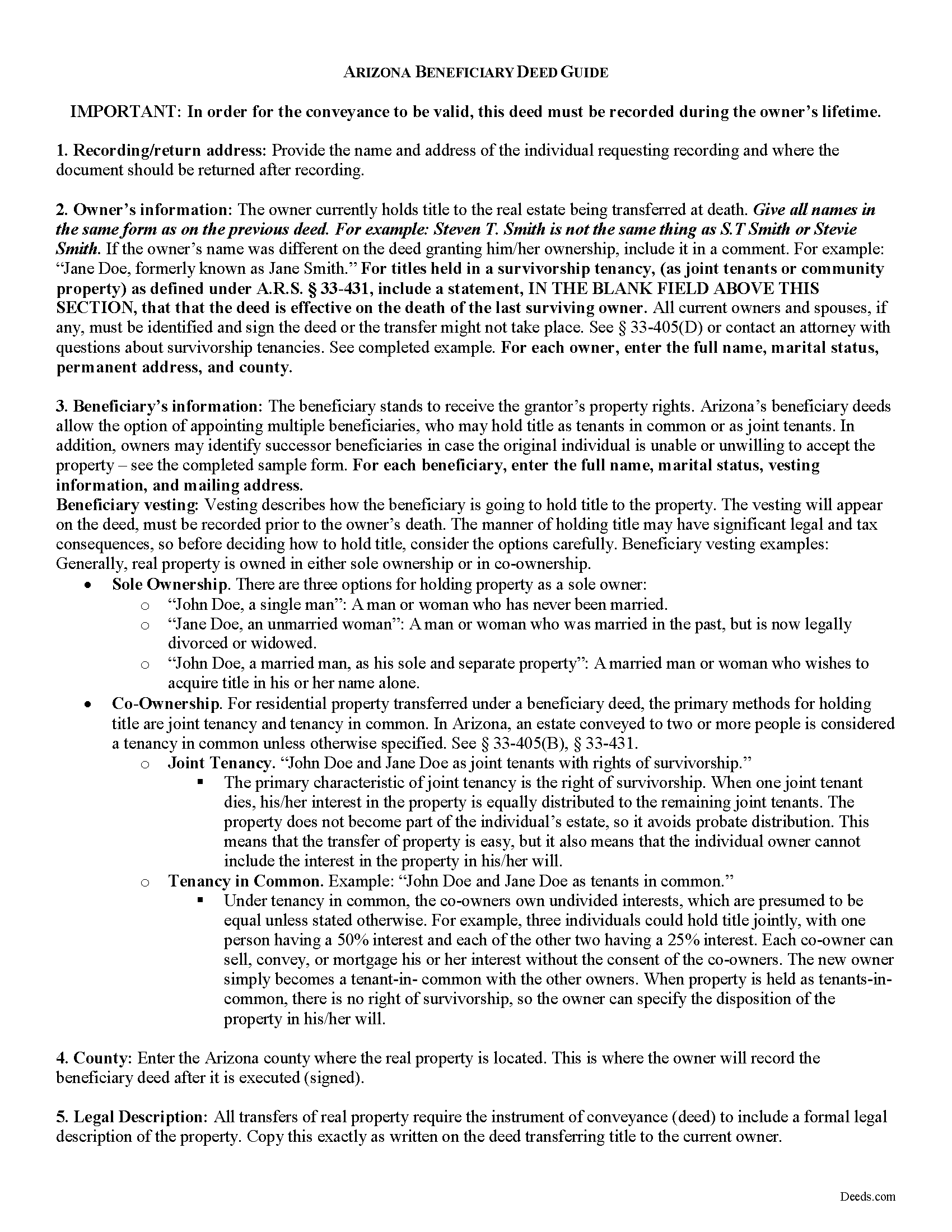

Apache County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

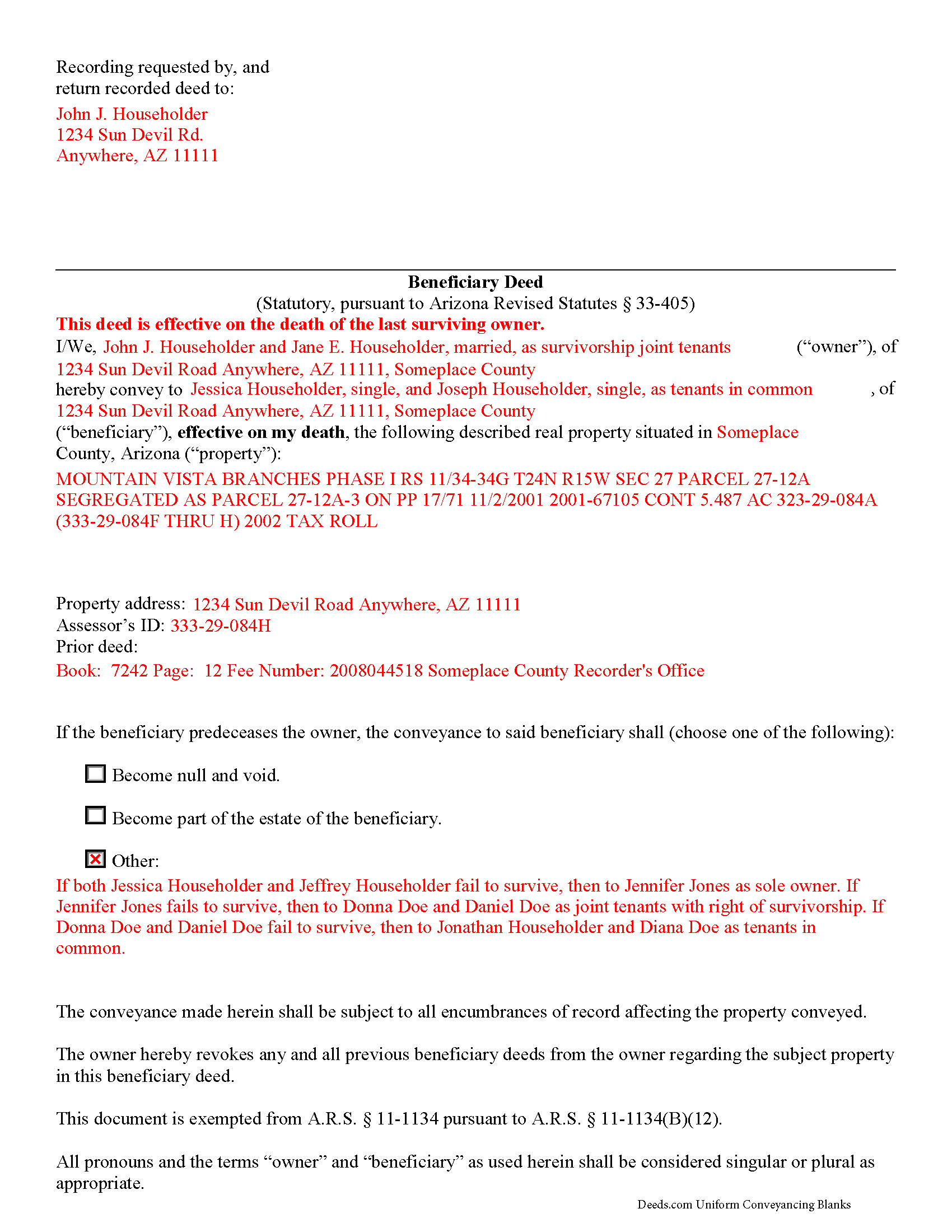

Apache County Completed Example of the Beneficiary Deed Document

Example of a properly completed Arizona Beneficiary Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Apache County documents included at no extra charge:

Where to Record Your Documents

County Recorder Office - County Annex Bldg

St. Johns, Arizona 85936

Hours: Monday through Thursday 6:30am - 5:30pm. Closed Fridays

Phone: 928-337-7515

Recorder's Sub Office

Springerville, Arizona

Hours: Mon, Tue 8:00 - 5:00, Wed 9:00 - 12:00

Phone:

Recording Tips for Apache County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Apache County

Properties in any of these areas use Apache County forms:

- Alpine

- Chambers

- Chinle

- Concho

- Dennehotso

- Eagar

- Fort Defiance

- Ganado

- Greer

- Houck

- Lukachukai

- Lupton

- Many Farms

- Mcnary

- Nazlini

- Nutrioso

- Petrified Forest Natl Pk

- Red Valley

- Rock Point

- Round Rock

- Saint Johns

- Saint Michaels

- Sanders

- Springerville

- Teec Nos Pos

- Tsaile

- Vernon

- Window Rock

Hours, fees, requirements, and more for Apache County

How do I get my forms?

Forms are available for immediate download after payment. The Apache County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Apache County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Apache County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Apache County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Apache County?

Recording fees in Apache County vary. Contact the recorder's office at 928-337-7515 for current fees.

Questions answered? Let's get started!

Arizona beneficiary deeds allow property owners to retain absolute control over their real estate, with the freedom to use, modify, or sell the land at will. The owner may also change the beneficiary or revoke the deed without any obligation to notify the beneficiary because the transfer of the remaining property rights is not finalized until the recipient records the appropriate documentation.

This instrument, governed by Arizona Revised Statutes 33-405, is a useful estate planning tool.

It gives owners/grantors of Arizona real estate the ability to initiate, but not complete, the transfer process to a designated beneficiary, while keeping all rights and title to the property during the owner's lifetime. This means the owner (grantor) may sell, rent, mortgage or otherwise use the property with no penalty for waste or obligation to the named beneficiary.

In addition, because the conveyance is not completed until the owner's death, he/she may change or remove beneficiary designations at will. Because of the potential for change, there is no obligation for the beneficiary/grantee to provide consideration (money or something else of value).

Arizona beneficiary deed must meet the statutory requirements as set forth in A.R.S. 33-405. This includes identifying the property owners (grantors), the beneficiaries, the real estate to be transferred, and other details as needed for the specific situation. The deed must also follow all state and local standards for recorded documents. The owner or owners must sign the deed in front of a notary and file the completed form with the land records for the county where the property is situated. After the owner's death, the remaining interest in land transfers to the beneficiary outside of the probate process.

NOTE: In order to be valid, this deed must be recorded, during the owner's lifetime, in the county where the land is situated.

This information is not a substitute for legal advice. Consult an attorney with questions about beneficiary deeds, or for any other issues related to estate planning or real property in Arizona.

(Arizona Beneficiary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Apache County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Apache County.

Our Promise

The documents you receive here will meet, or exceed, the Apache County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Apache County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Victor L.

June 2nd, 2021

In a subject that is overbearing, this site made it simple and understandable, all was explained well. Thank you.

Thank you!

Joan P.

March 18th, 2020

Thank you for combining all necessary documents in one simple location.

Thank you!

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!

Mary Z.

December 2nd, 2021

Awesome forms, easy to complete and print.

Thank you!

Jean T.

January 3rd, 2024

It's wonderful that these forms are easily accessible!

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah C.

April 30th, 2022

I just printed out my documents and they are so helpful. Now I will sit and fill out my documents and submit them to the PG County deed Office. Thanks for having this infomation online. Regards,

Thank you!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy N.

February 12th, 2022

Very easy to use. Appreicate the sample filled out forms and the guide book. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly R.

January 8th, 2019

Very easy to use. Very informative. I think this is a very good service and is worth the $19 especially if you value time.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynd P.

January 14th, 2019

Good

Thanks Lynd.

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RUTH A.

October 25th, 2024

I am so very thankful for the service that you provide for the public, thank you very much.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Stacey H.

October 23rd, 2024

This was my first time using Deeds.com and I was very impressed on the professionalism and the expediency of the recording. Will definitely be using them again. Stacey H.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!