Apache County Conditional Lien Waiver on Final Payment Form

Last validated December 11, 2025 by our Forms Development Team

Apache County Conditional Lien Waiver on Final Payment Form

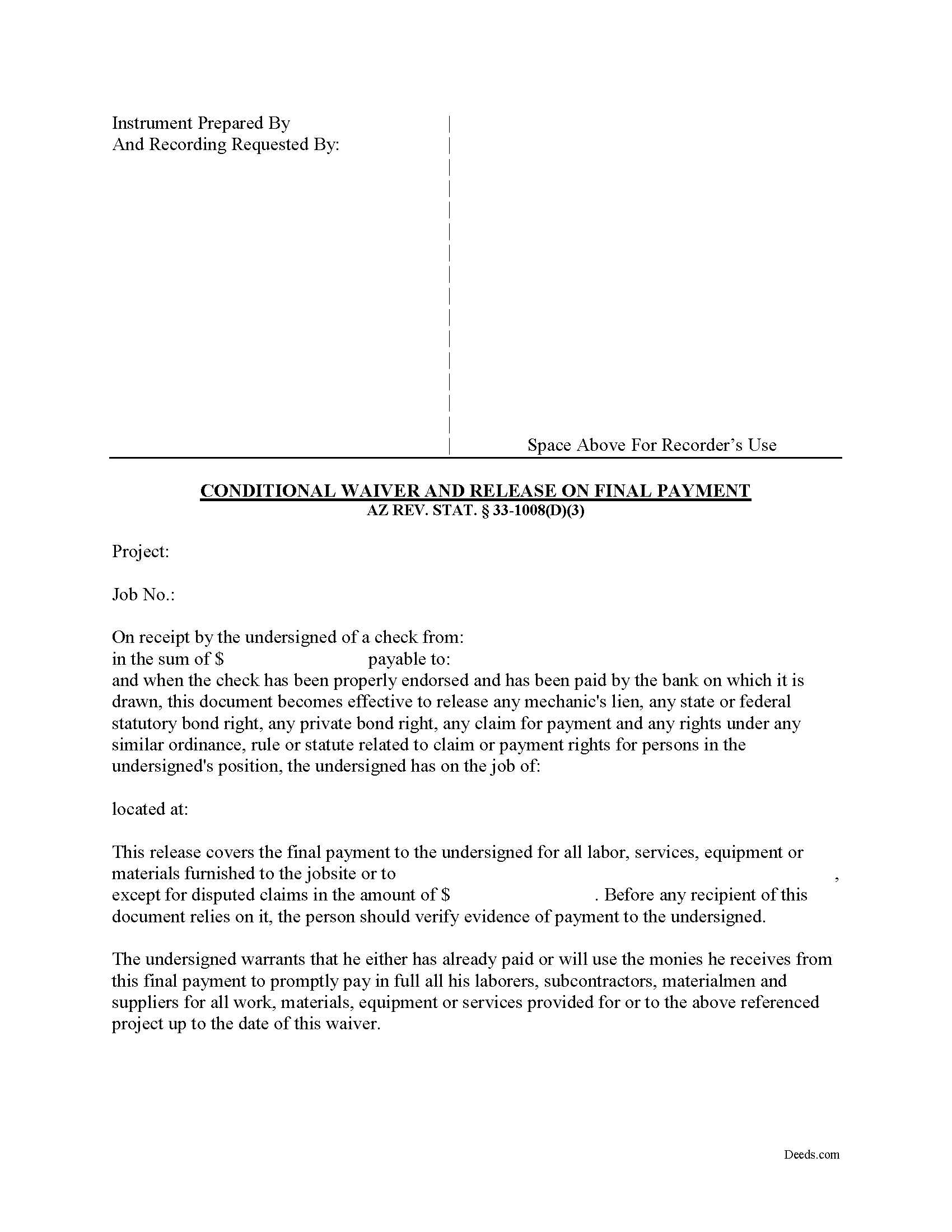

Fill in the blank form formatted to comply with all recording and content requirements.

Apache County Conditional Lien Waiver on Final Payment Guide

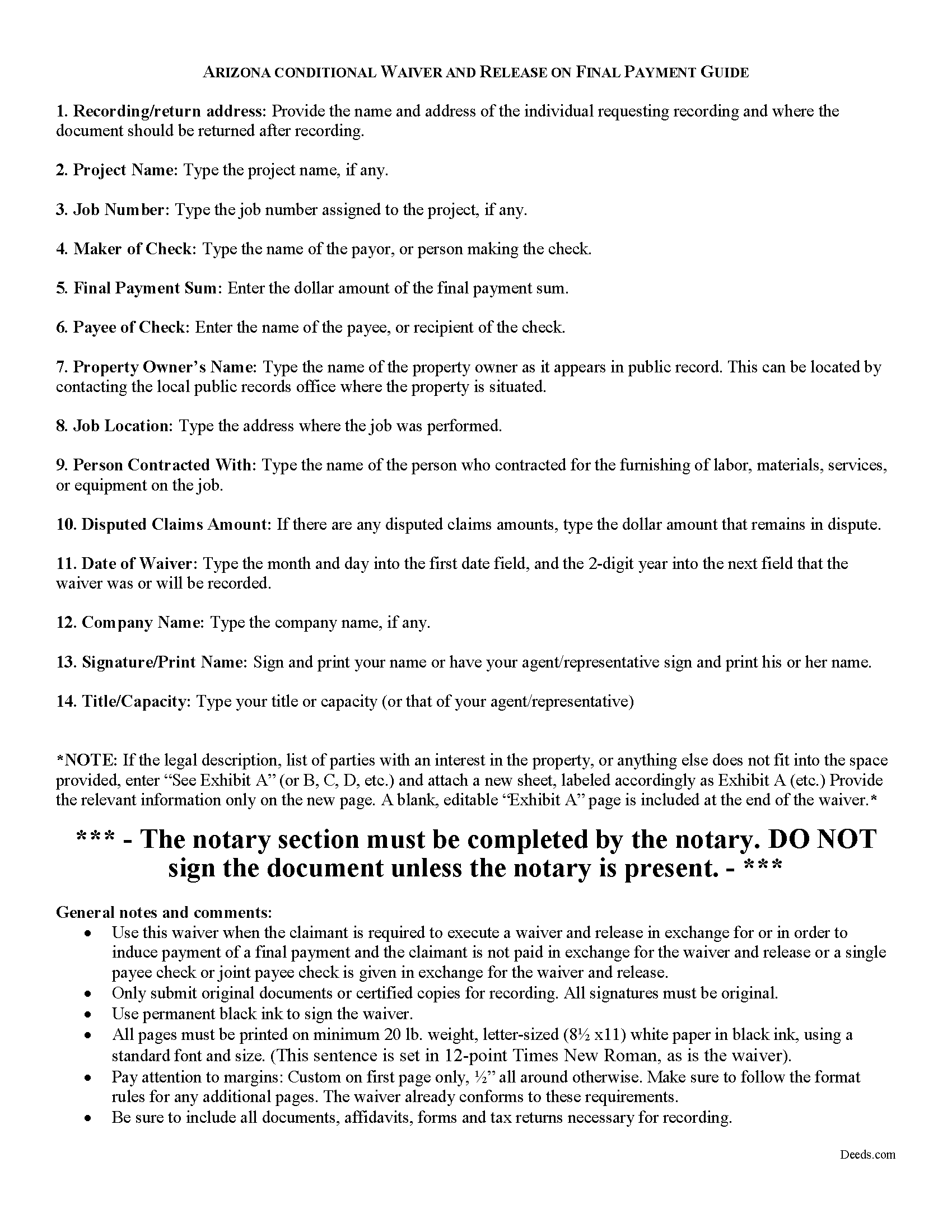

Line by line guide explaining every blank on the form.

Apache County Completed Example of the Conditional Lien Waiver on Final Payment Document

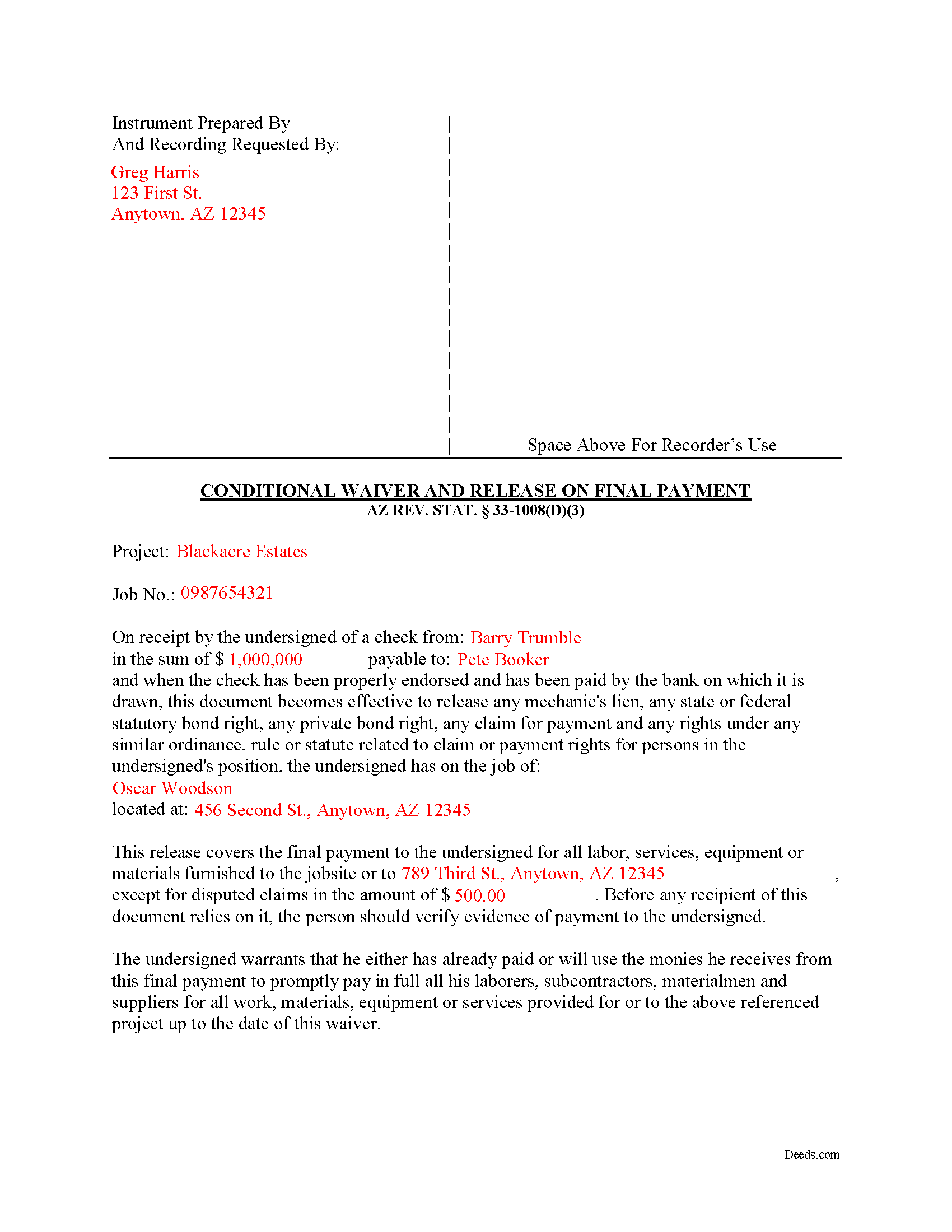

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Apache County documents included at no extra charge:

Where to Record Your Documents

County Recorder Office - County Annex Bldg

St. Johns, Arizona 85936

Hours: Monday through Thursday 6:30am - 5:30pm. Closed Fridays

Phone: 928-337-7515

Recorder's Sub Office

Springerville, Arizona

Hours: Mon, Tue 8:00 - 5:00, Wed 9:00 - 12:00

Phone:

Recording Tips for Apache County:

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Apache County

Properties in any of these areas use Apache County forms:

- Alpine

- Chambers

- Chinle

- Concho

- Dennehotso

- Eagar

- Fort Defiance

- Ganado

- Greer

- Houck

- Lukachukai

- Lupton

- Many Farms

- Mcnary

- Nazlini

- Nutrioso

- Petrified Forest Natl Pk

- Red Valley

- Rock Point

- Round Rock

- Saint Johns

- Saint Michaels

- Sanders

- Springerville

- Teec Nos Pos

- Tsaile

- Vernon

- Window Rock

Hours, fees, requirements, and more for Apache County

How do I get my forms?

Forms are available for immediate download after payment. The Apache County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Apache County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Apache County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Apache County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Apache County?

Recording fees in Apache County vary. Contact the recorder's office at 928-337-7515 for current fees.

Questions answered? Let's get started!

Lien waivers are part of the Arizona mechanic's lien process. The waiver, given by a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. Unconditional waivers take effect without payment confirmation, but conditional waivers are effective only when payment is received, usually verified by a check clearing the bank. So, a conditional waiver given after the final payment releases the claimant's right to lien, but only after any check used to pay the bill clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(3).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Apache County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Apache County.

Our Promise

The documents you receive here will meet, or exceed, the Apache County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Apache County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4622 Reviews )

Timothy P.

February 2nd, 2019

Straightforward, easy to navigate, saves time and gas = a real value for the price!

Thank you for your feedback. We really appreciate it. Have a great day!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you!

Robert W.

March 26th, 2020

Easier than I thought. No problem Nice service

Thank you!

Daren R.

March 4th, 2023

I believe that you should wait until a pending file is completed before asking for feedback. Thank you. Daren

Thank you!

Jay B.

March 17th, 2021

I've never had a problem locating the records I need. I can't imagine what can be done to improve the service.

Thank you!

YU LI K.

December 27th, 2023

Very easy to find the document I need and easy to download

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

BILL G.

October 22nd, 2019

Slick

Thank you!

Allen H.

April 30th, 2021

Your program was invaluable to us, I used it for my Mom's estate and when she passed the transition was seamless and no probate was involved. I am going to use this for myself to transfer my property over to my children in upon my death. Can't say enough positive things about it. Thanks, Allen

Thank you!

David M.

May 21st, 2020

Extremely easy to use. The sample completed document was very helpful. I really appreciated not having to spend a few hundred dollars for a lawyer to generate a document that I can produce myself for a small fraction of the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Steve B.

February 6th, 2020

Good format. Timely response. Adding a photo of the property would be a good improvement.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

August 1st, 2020

Easy peezy.

Thank you!

Michael H.

April 8th, 2020

Very responsive and thorough. Glad to have found such a great company for our recording needs.

Thank you!

Michaela D.

February 27th, 2019

I purchased this form to add my boyfriend to the deed of our home. He owns his own business so he cannot be on our mortgage. The guide doesn't clearly explain adding a person rather than focusing on transferring during a purchase or selling of a home. For future, I'd recommend make a few different examples for those who are trying to use this for the other options a Quit Claim Deed is needed for.

Thank you for your feedback. We really appreciate it. Have a great day!