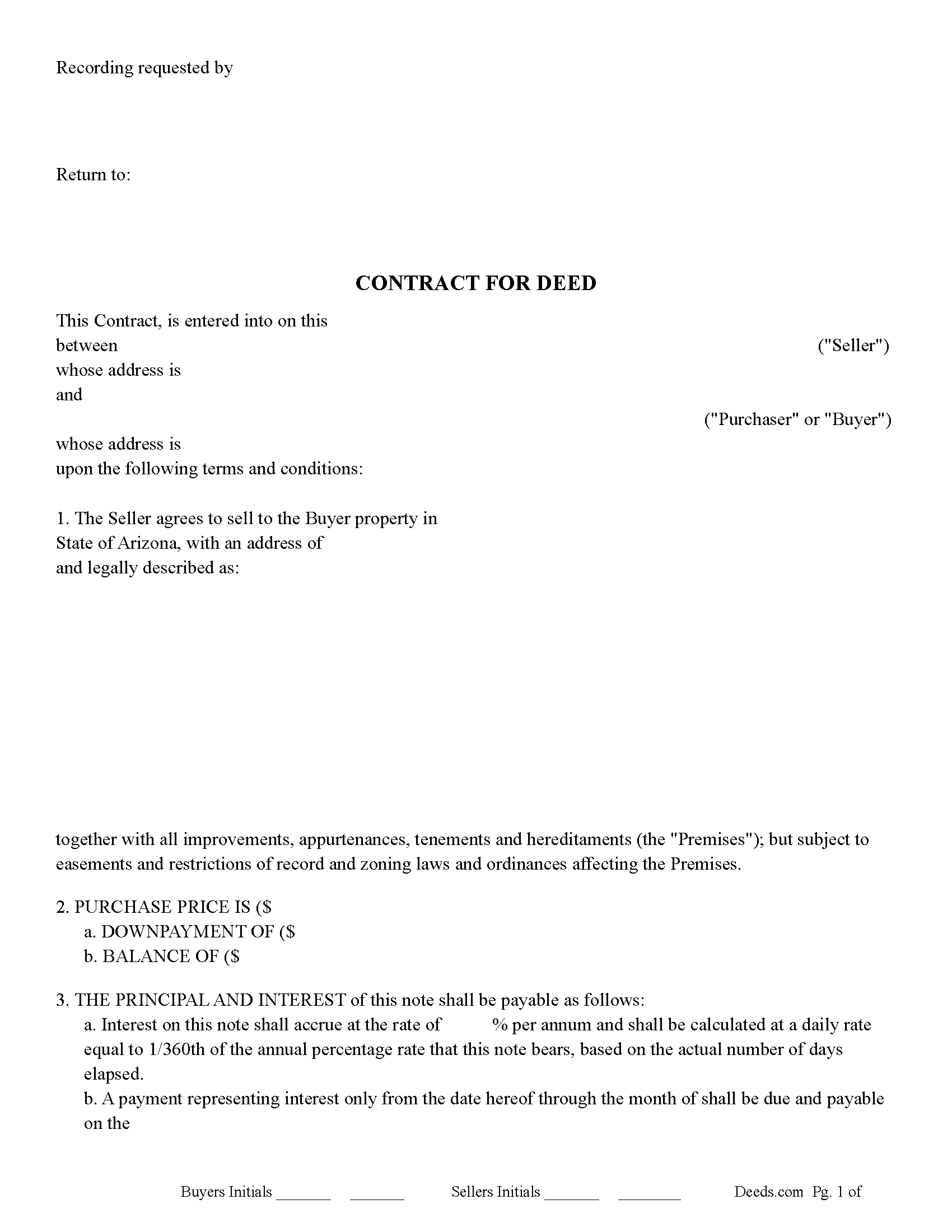

Apache County Contract for Deed Form

Apache County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Arizona recording and content requirements.

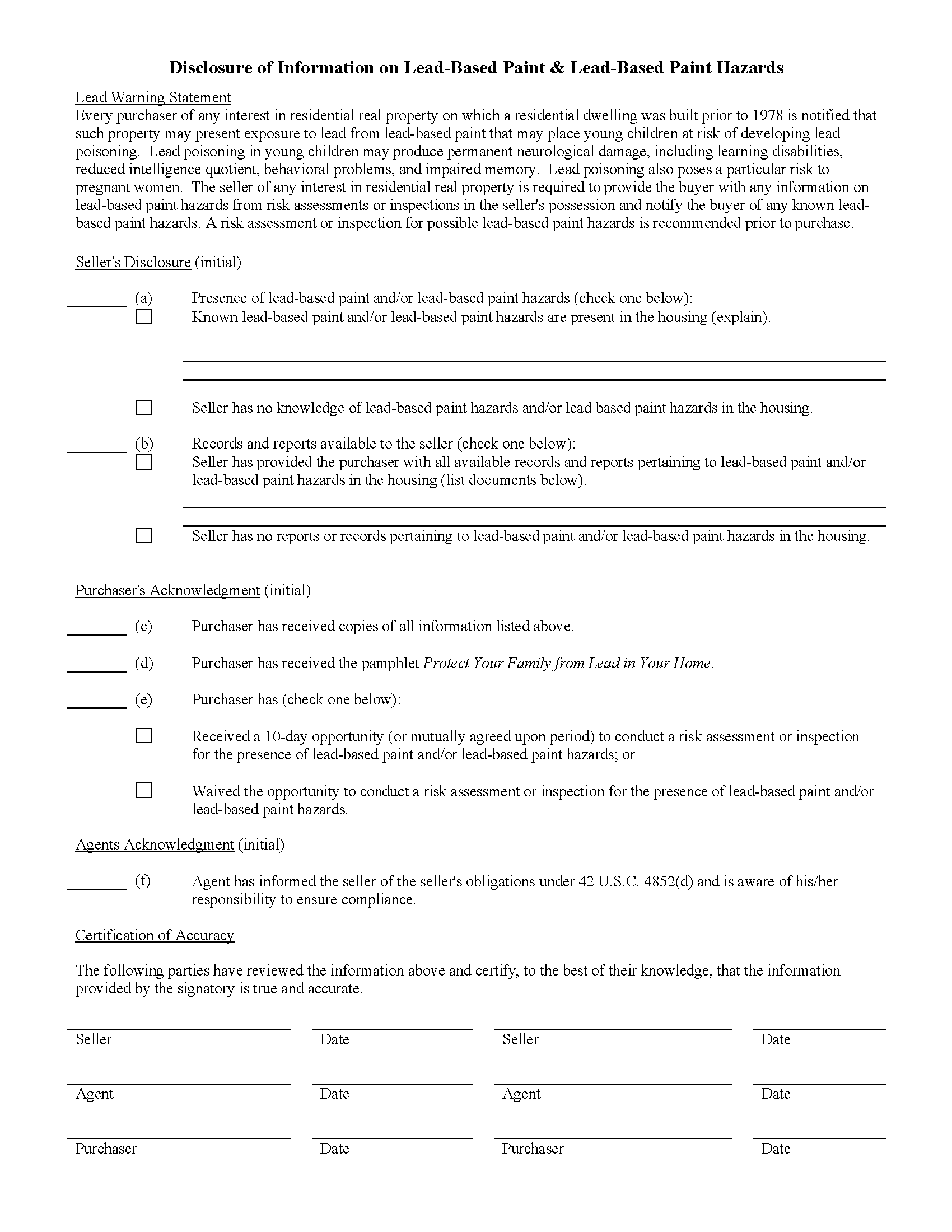

Apache County Lead Based Paint Disclosure Form

Disclosure form issued to buyer if applicable, typically residential property built before 1978

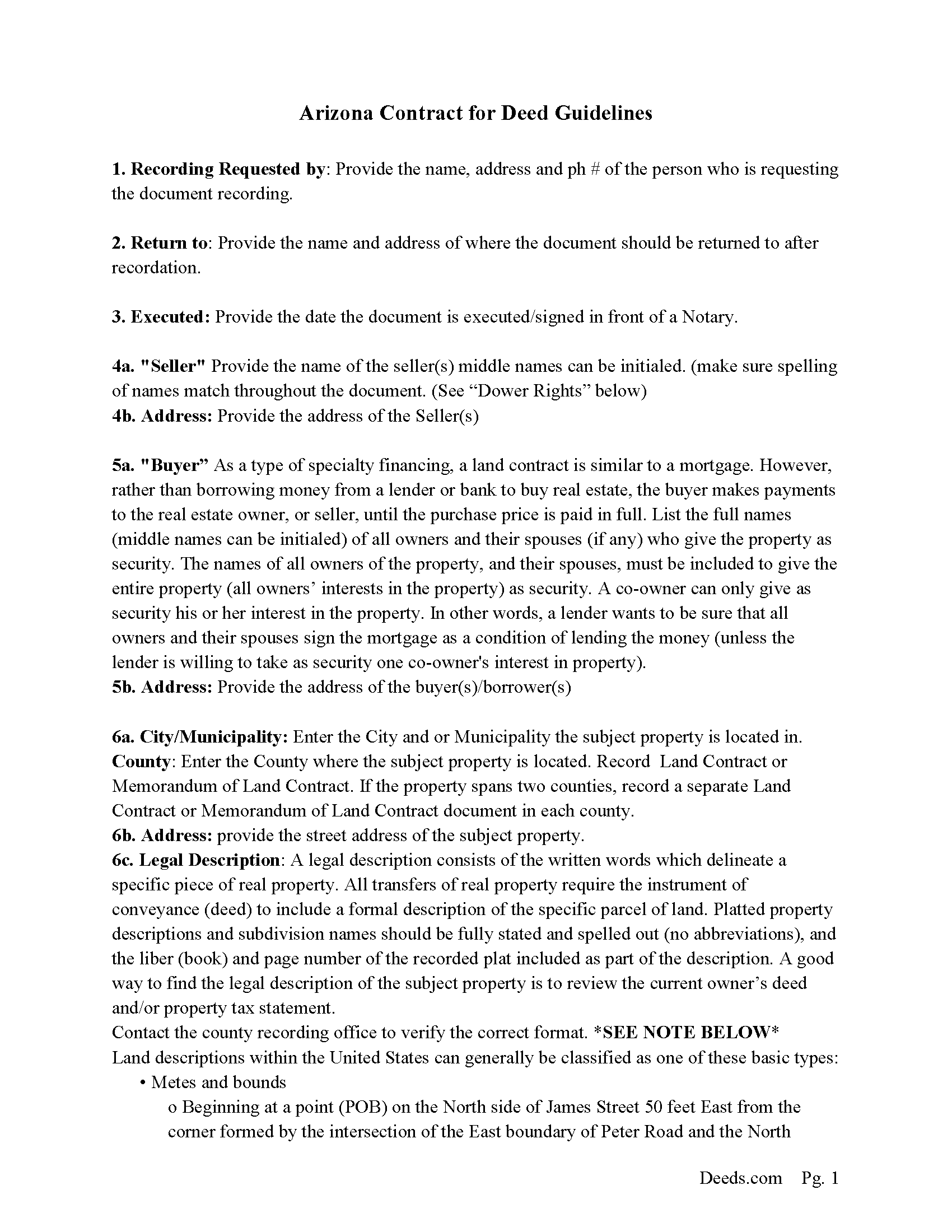

Apache County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

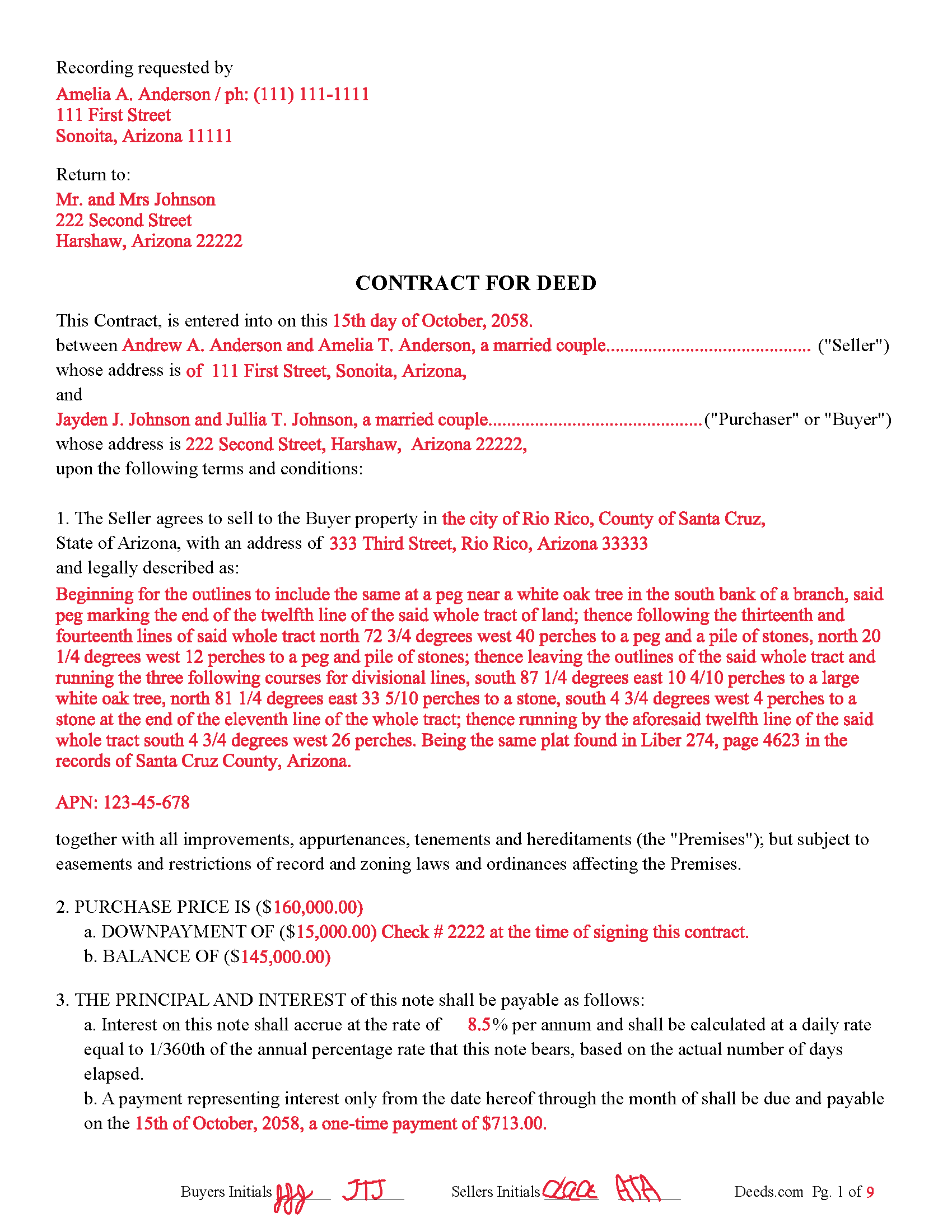

Apache County Completed Example of the Contract for Deed Document

Example of a properly completed Arizona Contract for Deed document for reference.

Apache County Residential Sellers Property Disclosure Statement

Required for residential property.

Apache County Protect your family from lead based paint

If applicable issue to buyers

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Apache County documents included at no extra charge:

Where to Record Your Documents

County Recorder Office - County Annex Bldg

St. Johns, Arizona 85936

Hours: Monday through Thursday 6:30am - 5:30pm. Closed Fridays

Phone: 928-337-7515

Recorder's Sub Office

Springerville, Arizona

Hours: Mon, Tue 8:00 - 5:00, Wed 9:00 - 12:00

Phone:

Recording Tips for Apache County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- If mailing documents, use certified mail with return receipt

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Apache County

Properties in any of these areas use Apache County forms:

- Alpine

- Chambers

- Chinle

- Concho

- Dennehotso

- Eagar

- Fort Defiance

- Ganado

- Greer

- Houck

- Lukachukai

- Lupton

- Many Farms

- Mcnary

- Nazlini

- Nutrioso

- Petrified Forest Natl Pk

- Red Valley

- Rock Point

- Round Rock

- Saint Johns

- Saint Michaels

- Sanders

- Springerville

- Teec Nos Pos

- Tsaile

- Vernon

- Window Rock

Hours, fees, requirements, and more for Apache County

How do I get my forms?

Forms are available for immediate download after payment. The Apache County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Apache County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Apache County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Apache County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Apache County?

Recording fees in Apache County vary. Contact the recorder's office at 928-337-7515 for current fees.

Questions answered? Let's get started!

Arizona Revised Statutes Title 33. Property § 33-741. Definitions

1. “Account servicing agent” means a joint agent of seller and purchaser, appointed under the contract or under a separate agreement executed by the seller and the purchaser, to hold documents and collect monies due under the contract, who does business under the laws of this state as a bank, trust company, escrow agent, savings and loan association, insurance company or real estate broker, or who is licensed, chartered or regulated by the federal deposit insurance corporation or the comptroller of the currency, or who is a member of the state bar of Arizona.

2. “Contract” means a contract for conveyance of real property, a contract for deed, a contract to convey, an agreement for sale or any similar contract through which a seller has conveyed to a purchaser equitable title in property and under which the seller is obligated to convey to the purchaser the remainder of the seller's title in the property, whether legal or equitable, on payment in full of all monies due under the contract. This article does not apply to purchase contracts and receipts, escrow instructions or similar executory contracts which are intended to control the rights and obligations of the parties to executory contracts pending the closing of a sale or purchase transaction.

3. “Monies due under the contract” means:

(a) Any principal and interest payments which are currently due and payable to the seller.

(b) Any principal and interest payments which are currently due and payable to other persons who hold existing liens and encumbrances on the property, the unpaid principal portion of which constitutes a portion of the purchase price, as stated in the contract, if the principal and interest payments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(c) Any delinquent taxes and assessments, including interest and penalty, due and payable to any governmental entity authorized to impose liens on the property which are the purchaser's obligations under the contract, if the taxes and assessments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(d) Any unpaid premiums for any policy or policies of insurance which are the obligation of the purchaser to maintain under the contract, if the premiums were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

4. “Payoff deed” means the deed that the seller is obligated to deliver to the purchaser on payment in full of all monies due under the contract to convey to the purchaser the remainder of the seller's title in the property, whether legal or equitable, as prescribed by the terms of the contract.

5. “Property” means the real property described in the contract and any personal property included under the contract.

6. “Purchaser” means the person or any successor in interest to the person who has contracted to purchase the seller's title to the property which is the subject of the contract.

7. “Seller” means the person or any successor in interest to the person who has contracted to convey his title to the property which is the subject of the contract.

33-742. Forfeiture of interest of purchaser in default under contract

A. If a purchaser is in default by failing to pay monies due under the contract, a seller may, after expiration of the applicable period stated in subsection D of this section and after serving the notice of election to forfeit stated in section 33-743, complete the forfeiture of the purchaser's interest in the property in the manner provided by section 33-744 or 33-745. If the contract provides that the seller may elect to accelerate the principal balance due under the contract to the seller on the purchaser's failure to pay the monies due, the seller may accelerate the principal balance due to the seller at any time after the purchaser has failed to pay the monies due under the contract. The acceleration may occur before or after the expiration of the applicable period stated in subsection D of this section and without serving the notice of election to forfeit stated in section 33-743. If the seller elects to accelerate the principal balance due to the seller, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748. If a purchaser is in default under the contract for reasons other than failing to pay monies due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748.

B. The interest of a purchaser in any personal property included in a contract is subject to forfeiture or foreclosure in the same manner as the real property, except that forfeiture or foreclosure does not affect or impair the rights of a holder of a security interest whose interest in the personal property is not subordinate to that of the seller.

C. If a contract provides that time is of the essence, a waiver of that provision occurs only if the seller has accepted monies due under the contract in an amount which is less than the total monies due under the contract at the time of the acceptance. Receipt of any monies due under the contract by an account servicing agency does not constitute acceptance by the seller. A seller's delay in exercising any remedy granted either by the contract or by law does not constitute a waiver of a time is of the essence provision. If the time of the essence provision has been waived, the seller may reinstate the provision by serving a written notice on the purchaser and the account servicing agent, if one has been appointed, requiring strict performance of the purchaser's obligations to pay monies due under the contract. The notice shall be served, either by delivery in person or deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the date on which the seller will require the purchaser to pay the monies due under the contract. A copy of the notice need not be recorded in the county in which the real property is located or served on any person other than the purchaser and the account servicing agent, if one has been appointed.

D. Forfeiture of the interest of a purchaser in the property for failure to pay monies due under the contract may be enforced only after expiration of the following periods after the date such monies were due:

1. If there has been paid less than twenty per cent of the purchase price, thirty days.

2. If there has been paid twenty per cent, or more, but less than thirty per cent of the purchase price, sixty days.

3. If there has been paid thirty per cent, or more, but less than fifty per cent of the purchase price, one hundred and twenty days.

4. If there has been paid fifty per cent, or more, of the purchase price, nine months.

E. For the purpose of computing the percentage of the purchase price paid under subsection D of this section, the total of only the following constitutes payments on the purchase price:

1. Down payments paid to the seller.

2. Principal payments paid to the seller on the contract.

3. Principal payments paid to other persons who hold liens or encumbrances on the property, the principal portion of which constitutes a portion of the purchase price, as stated under the contract.

Use this form for the sale of residential property, vacant land, condominiums, rental property and planned unit developments.

Important: Your property must be located in Apache County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Apache County.

Our Promise

The documents you receive here will meet, or exceed, the Apache County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Apache County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

F Michael C.

June 15th, 2021

Very easy to use and no hidden costs. You get to download whatever you need and can save it and even reuse it. So it's like having your own library of form that you pay for once. They even give you more related forms than you ask for and it turned out we needed some if those forms as well. The forms meet what our county requires for margins in records and so on. So I will use deeds.com again when I need a different kind of legal form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Keith H.

May 18th, 2021

These forms were helpful and comprehensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Norma V.

May 9th, 2020

So far it's been great. My 2 deeds were accepted and prepared for recording very quickly. Now I am waiting for the County to record them and Deeds.com to e-send them back to me. Very impressive!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Susan K.

May 26th, 2022

First time using DEEDS.COM and very helpful with documents to fill out. I highly recommend this company for all your needs .Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda M L.

September 7th, 2023

Easy to use, documents look good, but pretty expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell D.

June 6th, 2023

Thx. Easy to research and download. Now proof is in the pudding. :-)

Thank you for your feedback. We really appreciate it. Have a great day!

Ann K.

March 4th, 2020

I ordered a Quit Claim Deed for my county. Once I read the detailed instructions and filled it out I submitted it to the local Register of Deeds and it was filed on the spot while I waited! Thank you, you made a difficult and expensive task easy (for a laymen with no knowledge) at little expense. Highly recommend your site!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Rosa S.

June 6th, 2019

I am pleased with how easy it was to download the will. Now just have to get it filled in and filed at Tax Office. Thank you for making it simple to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

August 2nd, 2021

Very nice. easy to use and not too expensive.

Thank you!

Lisa W.

May 25th, 2022

The easiest thing to use ever. Amazing and extremely prompt support. They get the job done with all the information you might need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David S.

February 25th, 2020

All Star Support and less than a one day turnaround. Outstanding service. Thank you !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela P.

October 12th, 2019

I liked the speed and efficiency of your website.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel D.

February 9th, 2020

Well done. A little pricy.

Thank you!