San Francisco County Deed Corrective Affidavit Form

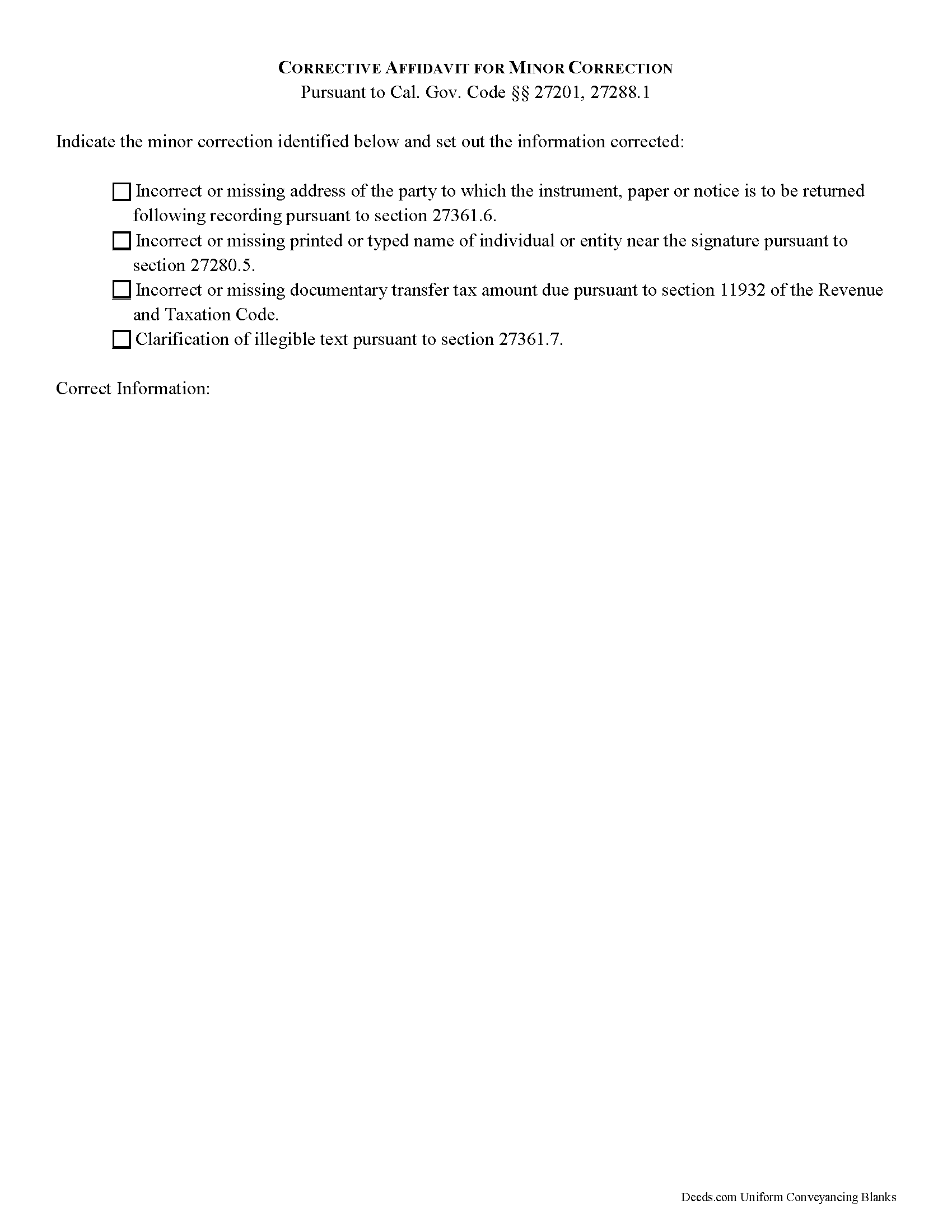

San Francisco County Corrective Affidavit for Minor Correction Form

Fill in the blank form formatted to comply with all recording and content requirements.

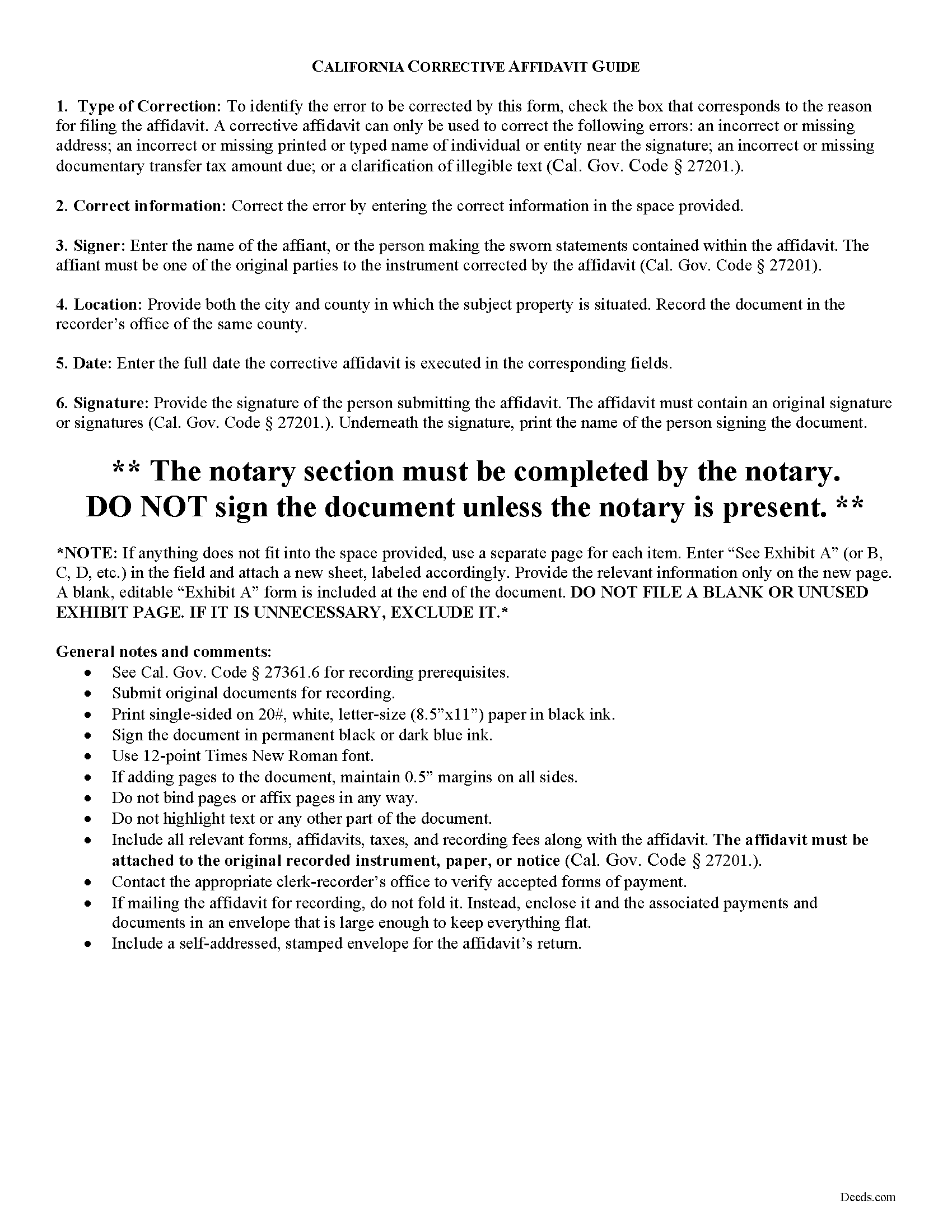

San Francisco County Corrective Affidavit Guide

Line by line guide explaining every blank on the form.

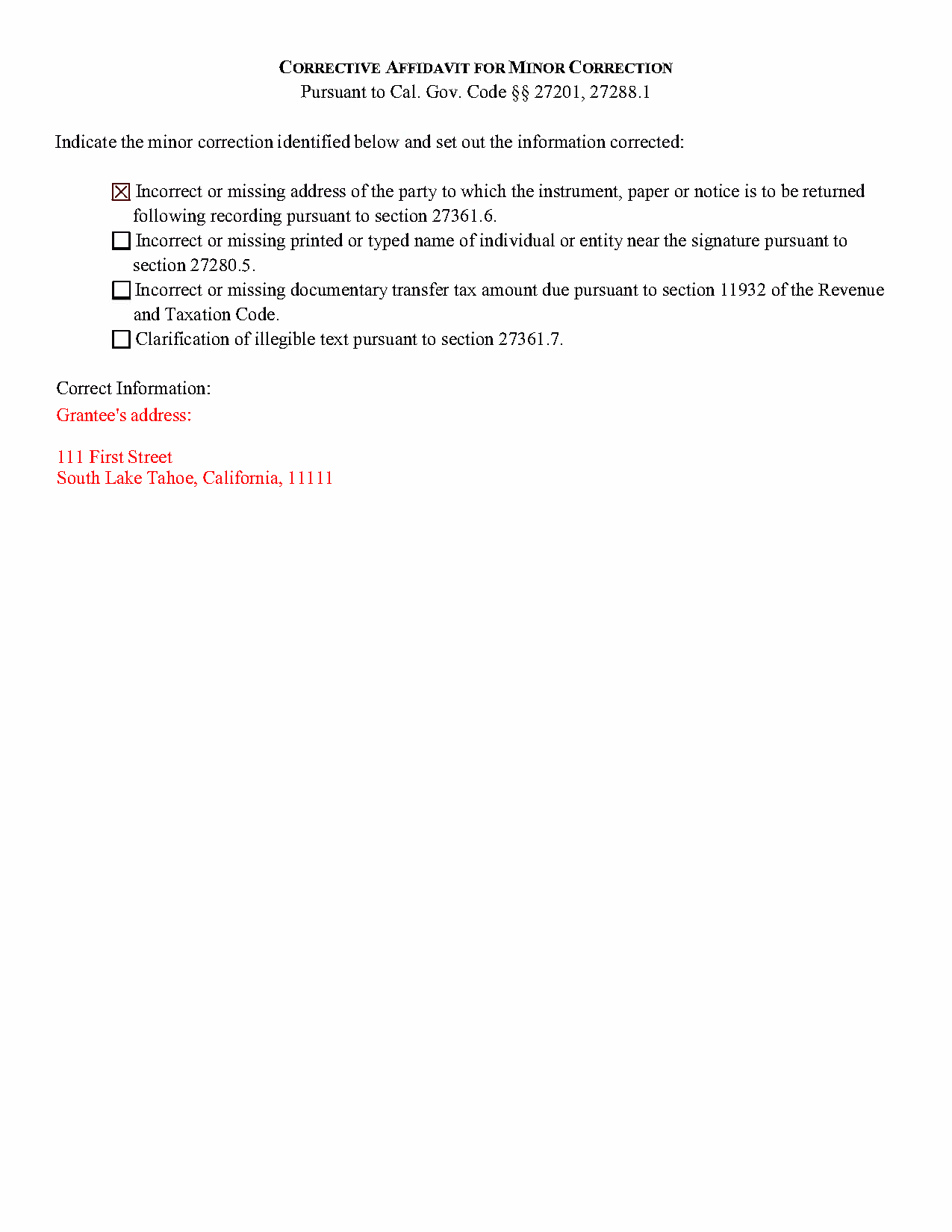

San Francisco County Completed Example of the Corrective Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and San Francisco County documents included at no extra charge:

Where to Record Your Documents

Assessor-Recorder's Main Office

San Francisco, California 94102-4698

Hours: Monday through Friday 8:00am - 5:00pm / Recording until 4:00pm

Phone: (415) 554-5596

Recording Tips for San Francisco County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in San Francisco County

Properties in any of these areas use San Francisco County forms:

- San Francisco

Hours, fees, requirements, and more for San Francisco County

How do I get my forms?

Forms are available for immediate download after payment. The San Francisco County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Francisco County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Francisco County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Francisco County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Francisco County?

Recording fees in San Francisco County vary. Contact the recorder's office at (415) 554-5596 for current fees.

Questions answered? Let's get started!

Corrective Affidavits in California

Typically, any rerecorded document must be resigned and acknowledged as a new document. However, an erroneous document will not be recorded as a new document if it is presented with a corrective affidavit (Cal. Gov. Code 27201.). A corrective affidavit is a statutory device under Cal. Gov. Code 27201, used to correct a minor error in a document that has been recorded at an earlier date.

Minor errors are those that, when corrected, cause no actual change in the substance of the document. Section 27201 of the Government Code states that a corrective affidavit can only be used to correct the following: an incorrect or missing return address; a clarification of illegible text; an incorrect or missing printed or typed name near the signature; or an incorrect or missing documentary transfer tax amount due.

More extensive corrections to recorded documents typically require a new deed. Adding or removing a grantee, for example, or making material changes to the legal description, may all require a new document of conveyance. When in doubt about the appropriate vehicle to address the error, consult with a lawyer.

A correction deed is exempt from transfer tax because no transfer is being made, and no consideration is exchanged (Cal. Rev. and Tax. Code 11911). Some counties demand a documentary transfer tax affidavit stating the reason for the exemption, to be filed in addition to the other documents being recorded, so check the county recorder's website to confirm any local requirements.

For the correction to be valid, the affidavit must be attached to the original recorded document with a cover sheet complying with Cal. Gov. Code 27361.6, stating the reason for rerecording on the cover sheet, by the person who submitted the original document for recording (Cal. Gov. Code 27201.).

The affidavit itself must include the information corrected, be certified by the party submitting the affidavit under penalty of perjury, and be acknowledged pursuant to Cal. Gov. Code 27287. The affidavit can be acknowledged by any one of the officials listed in Cal. Civ. Code 1181. Finally, the form must meet all state and local standards for recorded documents. Submit the completed affidavit, along with any necessary supporting materials, to the local recording office to correct and update the public data.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective affidavits, or for any other issues related to real property in California.

(California Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in San Francisco County to use these forms. Documents should be recorded at the office below.

This Deed Corrective Affidavit meets all recording requirements specific to San Francisco County.

Our Promise

The documents you receive here will meet, or exceed, the San Francisco County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Francisco County Deed Corrective Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Kay C.

November 16th, 2020

that worked great I like to see what I'm filling out and the extra info is really helpful..

Thank you!

Patricia C.

July 11th, 2019

The website works fine. The process of changing my Mineral Deed is sure more expensive in Texas. But I appreciate the convenience of the website and the pages of directions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Greg F.

October 14th, 2022

Sorry that this a little late. I'm VERY HAPPY with everything. The deeds paperwork was just what I was looking for. It was very to fill out, it was different than n the folks used years ago. I called the county clerk, and they were very helpful. Thank you for the paperwork it was easy to use and understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Terri S.

October 16th, 2019

Form was easy to complete, price was reasonable and everything worked out just fine. Would absolutely use this service again if needed, Thank you :)

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy K.

April 7th, 2021

Excellent service. Fast turnaround within one day. Reasonable pricing for services.

Thank you!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth J.

June 15th, 2021

Great product; Got the Job done.

Thank you!

Philip S.

May 2nd, 2019

You're service saved the day! I had gone to several lawyers and title companies who all said, at a Minimum, preparing a deed costs $1000... Through your service and some work reading about the requirements as well as calling my county clerks office, I was able to complete the deed and it read accepted and recorded today! Thanks so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher S.

October 5th, 2024

very easy to use, and comprehensive...I like the e-recording package

We are grateful for your feedback and looking forward to serving you again. Thank you!

Rip V.

October 5th, 2022

Found the forms I needed but had to type these out my self in Word since these forms do not allow any information to be saved. I understand you want this to be proprietary information but you failed to deliver a usable product. I printed this template and built my own in microsoft word. Good examples and instructions with poor execution. I lost hours of typing and nearly lost real estate deals due to these documents not being in a format ready to use. Will be using another service next time or buying these as guides alone.

Thank you for taking the time to leave your feedback. Sorry to hear of the struggle you had using our forms. We will look into the issues you reported to see what we can do to provide a better product. For your trouble we have provided a full refund of your order.

Leonard D.

May 2nd, 2019

I'm still working on it. I'm surprised that it appears so much information has to be included about beneficiaries.

Thank you!

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Biagio V.

July 16th, 2022

Process was quick , through and completed with no problems. Excellent service for the price involved.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank T.

March 20th, 2021

Site was very helpful in getting the form needed to file a Quitclaim and the procedures to complete the task

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elango R.

November 9th, 2020

It was so easy to use the site and got recording done in a day. Very happy with experience.

Thank you!