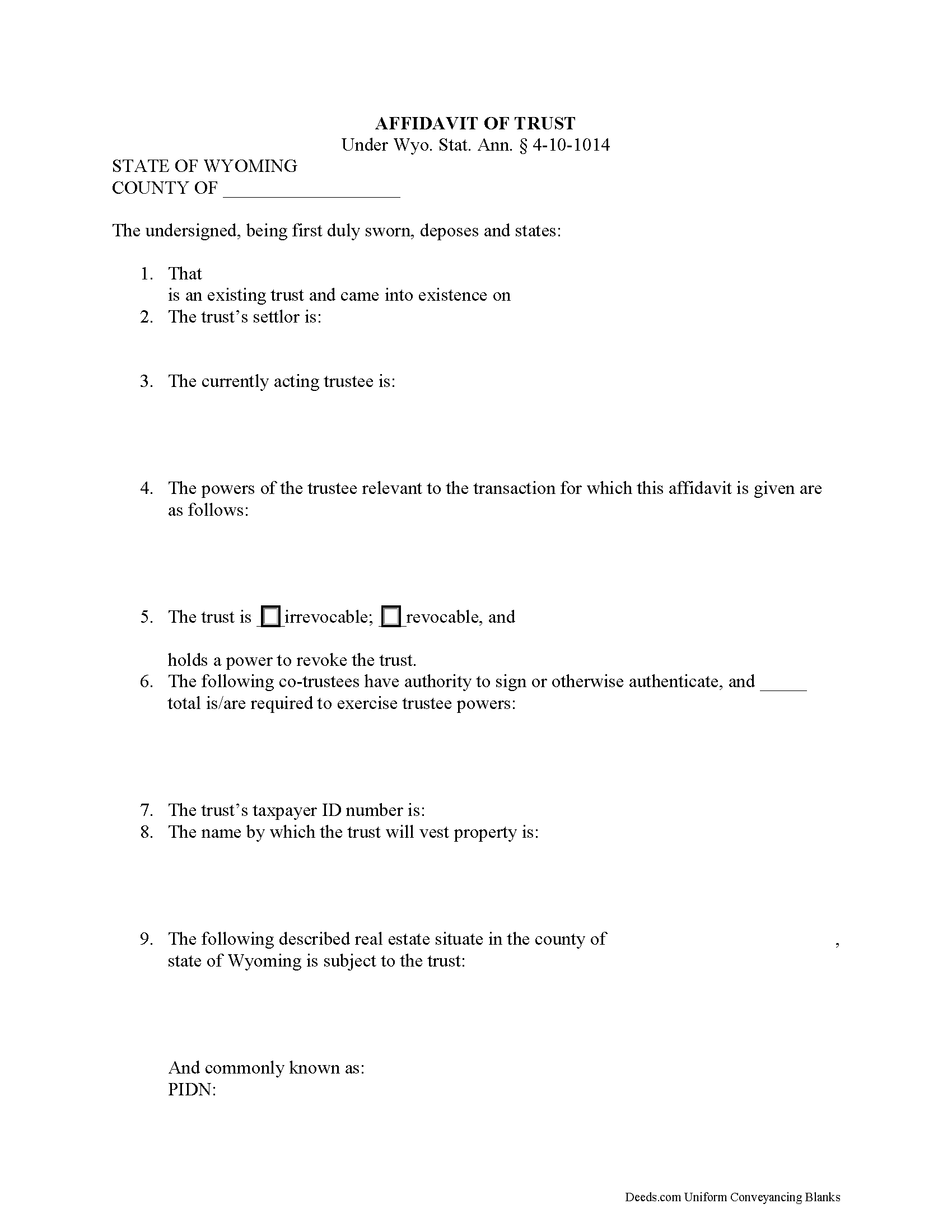

Crook County Affidavit of Trust Form

Crook County Affidavit of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

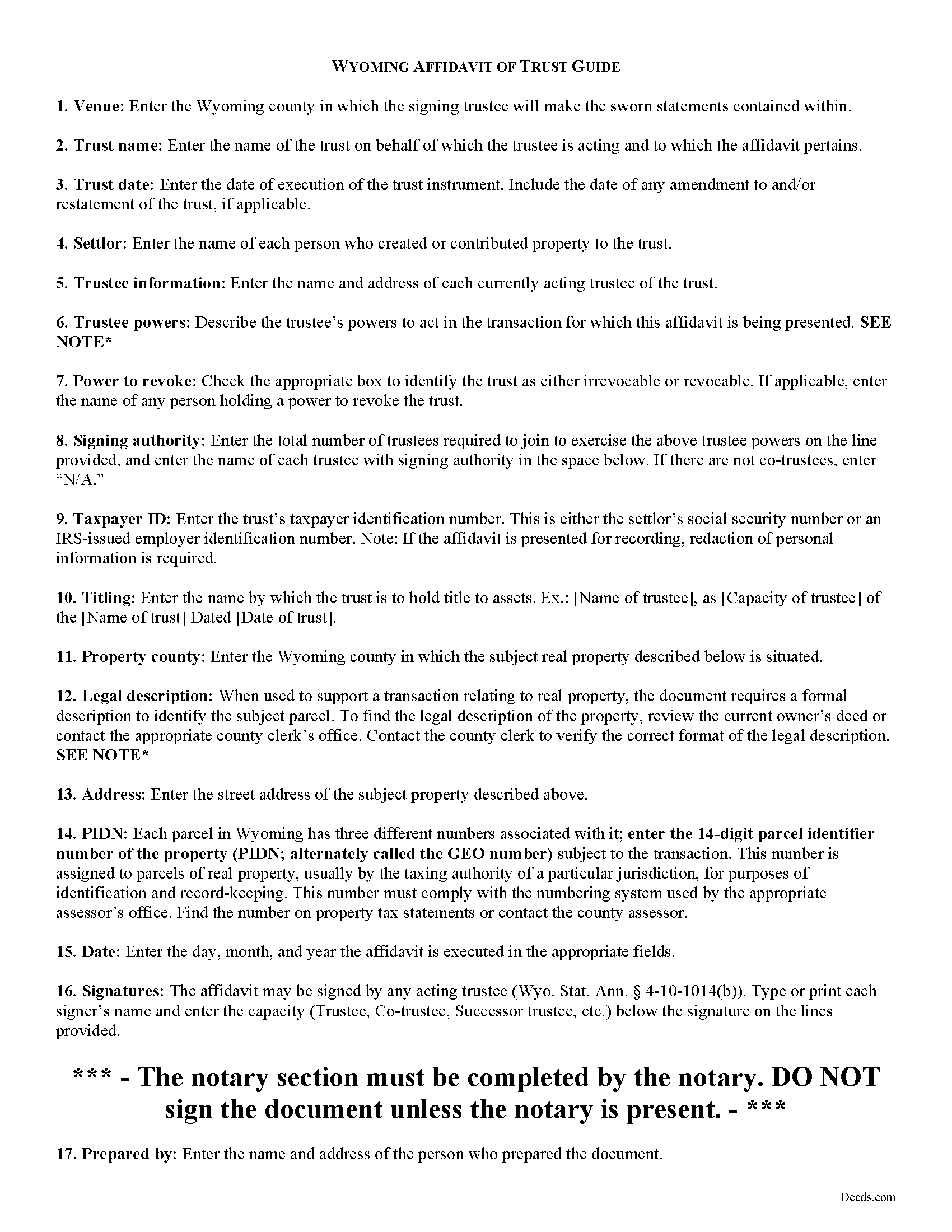

Crook County Affidavit of Trust Guide

Line by line guide explaining every blank on the form.

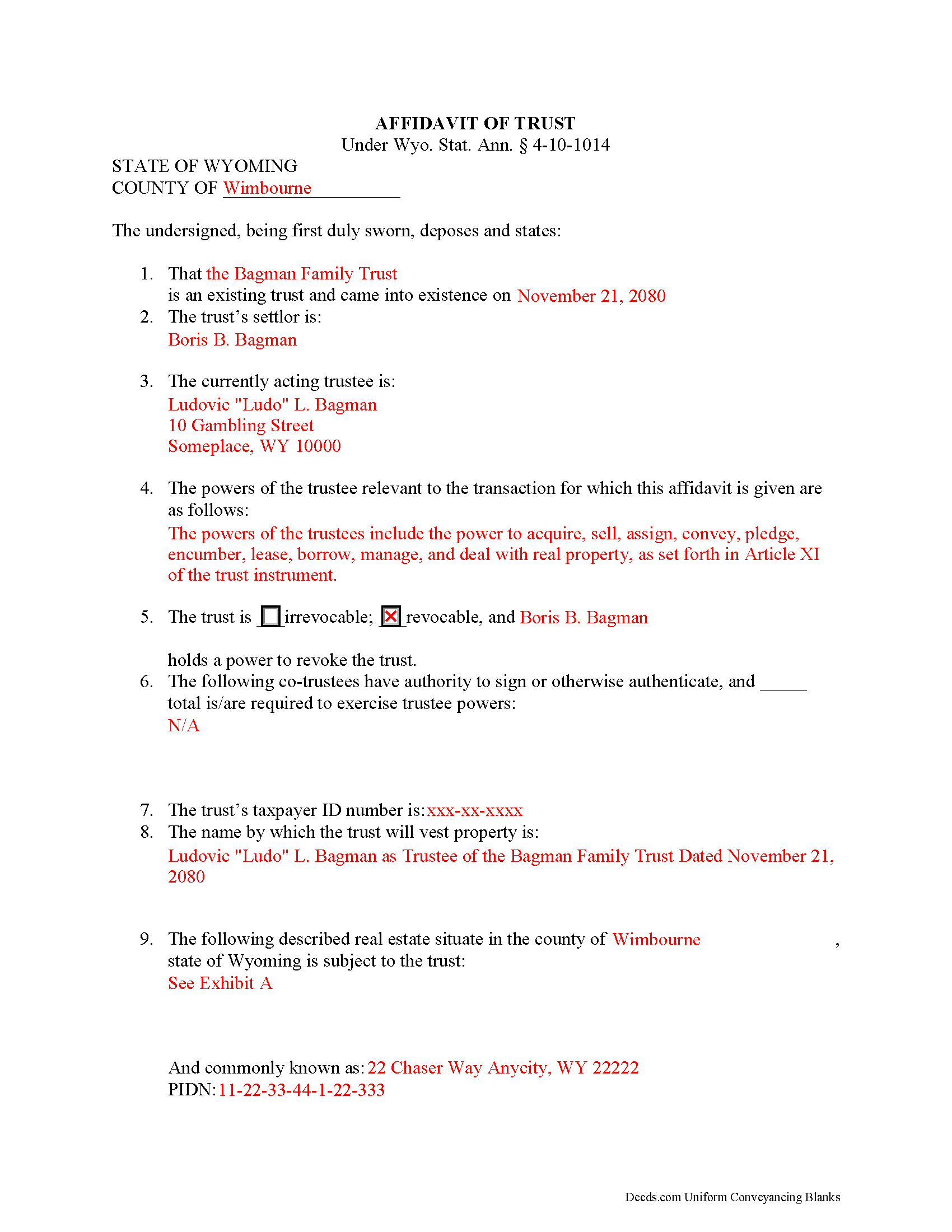

Crook County Completed Example of the Affidavit of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Crook County documents included at no extra charge:

Where to Record Your Documents

Crook County Clerk

Sundance, Wyoming 82729

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 283-1323

Recording Tips for Crook County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Crook County

Properties in any of these areas use Crook County forms:

- Aladdin

- Alva

- Beulah

- Devils Tower

- Hulett

- Moorcroft

- Sundance

Hours, fees, requirements, and more for Crook County

How do I get my forms?

Forms are available for immediate download after payment. The Crook County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Crook County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Crook County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Crook County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Crook County?

Recording fees in Crook County vary. Contact the recorder's office at (307) 283-1323 for current fees.

Questions answered? Let's get started!

In a trust relationship, a settlor transfers one or more assets to another (the trustee), who holds and manages them for the benefit of a third (the beneficiary). In a living trust, the settlor indicates the intent to create a trust by executing a document called the trust instrument. This document sets out the trust's provisions and allows the settlor to plan how his assets will be distributed upon his death, without the requirement that his estate go through probate.

In the place of the entire trust document, a trustee in Wyoming may present an affidavit of trust to any person who is not a trust beneficiary. Codified as part of the Uniform Trust Code at Wyo. Stat. Ann. 4-10-1014, the document certifies that a trust exists and that the trustee has the authority to engage in the business at-hand with the recipient on behalf of said trust. Instead of summarizing the entire trust agreement, the affidavit contains only the information relevant to the current transaction, allowing the settlor to maintain the privacy of his/her estate plans (including the identity of trust beneficiaries).

As specified by statute, the affidavit is signed and sworn to before an appropriate official. Other requirements include the name and date of trust; the name of the settlor; the name and address of the current trustee; and a description of the relevant powers of the trustee. In addition, the document identifies any person who holds a power to revoke the trust, if applicable, and, if there are multiple trustees, it stipulates which trustees have signing authority and how many, if fewer than all, are required to act jointly to perform the powers listed. Wyoming also requires the trust's taxpayer identification number.

The form includes the name by which the trust vests title to property, and, when used in transactions pertaining to real property interests, may include a legal description of the subject property held in trust. Further, the trustee certifies that the trust has not been amended, modified, or revoked in a manner that invalidates any of the statements contained within the certificate. Persons dealing with trustees are protected by the provisions of 4-10-1014.

Consult a lawyer with questions regarding affidavits of trust or other issues relating to trust property in Wyoming.

(Wyoming AOT Package includes form, guidelines, and completed example)

Important: Your property must be located in Crook County to use these forms. Documents should be recorded at the office below.

This Affidavit of Trust meets all recording requirements specific to Crook County.

Our Promise

The documents you receive here will meet, or exceed, the Crook County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Crook County Affidavit of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Patricia A.

December 13th, 2022

This service was a godsend since I am currently disabled.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather R.

May 31st, 2019

Fast and convenient service.

Thank you Heather, we appreciate your feedback.

John W.

June 3rd, 2021

The Staff are very helpful if needed and the process is amazingly simple and efficient!

Thank you!

Camille L.

January 20th, 2022

very user friendly!

Thank you!

Robert P.

October 22nd, 2020

Excellent product. Wish I had found this site a week earlier. It would have saved me many hours of struggle and $40.00 in notary fees. Thanks and I will recommend to anyone needing forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary K.

July 26th, 2019

Easy to use site. Good job, it works with no stress.

Thank you!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

thomas C.

July 7th, 2020

Thank you for being there for me when I couldn't get it done myself. I was a little confused with the operation at first but then became easy. I will definitely be using you again and again. Even after the pandemic is over.It's approximately 15 miles one way to downtown Orlando to do what you did for me sitting at my house

Glad we could help Thomas, have a great day!

Thomas W.

June 30th, 2020

Fast, efficient, and helpful. I don't often have documents that need recording but I found Deeds.com incredibly handy. It cost me no more and probably less than if I'd gone in to do it myself. It was especially helpful during this Covid-19 stay-at-home time. It all happened within a couple of hours and I had my recorded copies in my hands.

Thank you for your feedback. We really appreciate it. Have a great day!

Jane N.

March 7th, 2019

This worked. Saved me a trip to get a copy of a deed. Cost less than the parking fee. Very convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank R.

January 20th, 2020

Our notary. Marie was prompt, courteous and professional. Would definitely use again and reccomend

Thank you for your feedback. We really appreciate it. Have a great day!

Gjnana D.

April 23rd, 2022

These guidelines and form helped me lot in preparing quit deed to add my spouse's name in tittle property

Thank you for your feedback. We really appreciate it. Have a great day!

Tracey B.

January 7th, 2019

Has no problems at all, everything was perfect. TB

Thanks Tracey, we appreciate your feedback.

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael K.

April 21st, 2020

Service seems smooth. I just wonder what the turn around time on recording is (I need proof of recordation).

Thank you!