Navajo County Trustee Deed Form

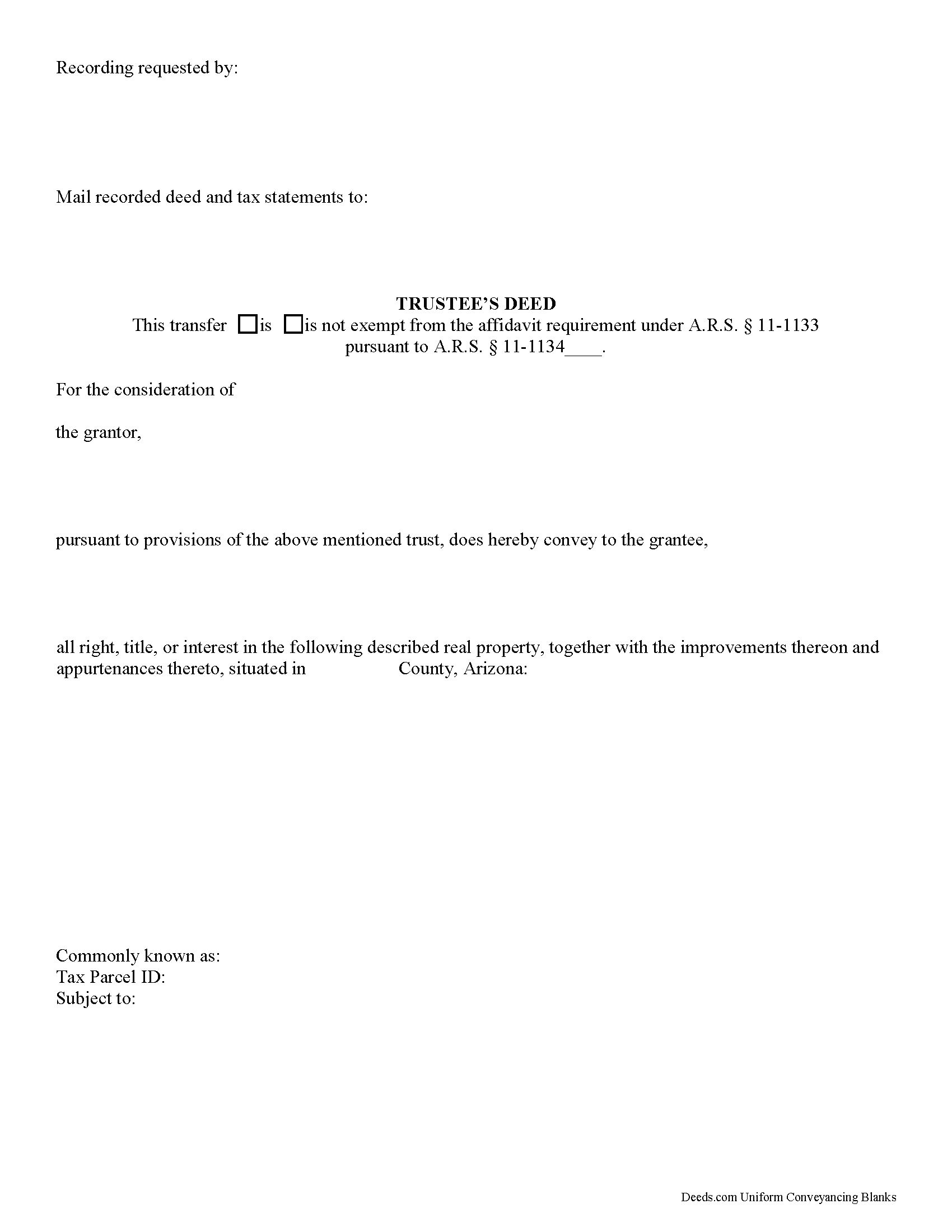

Navajo County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

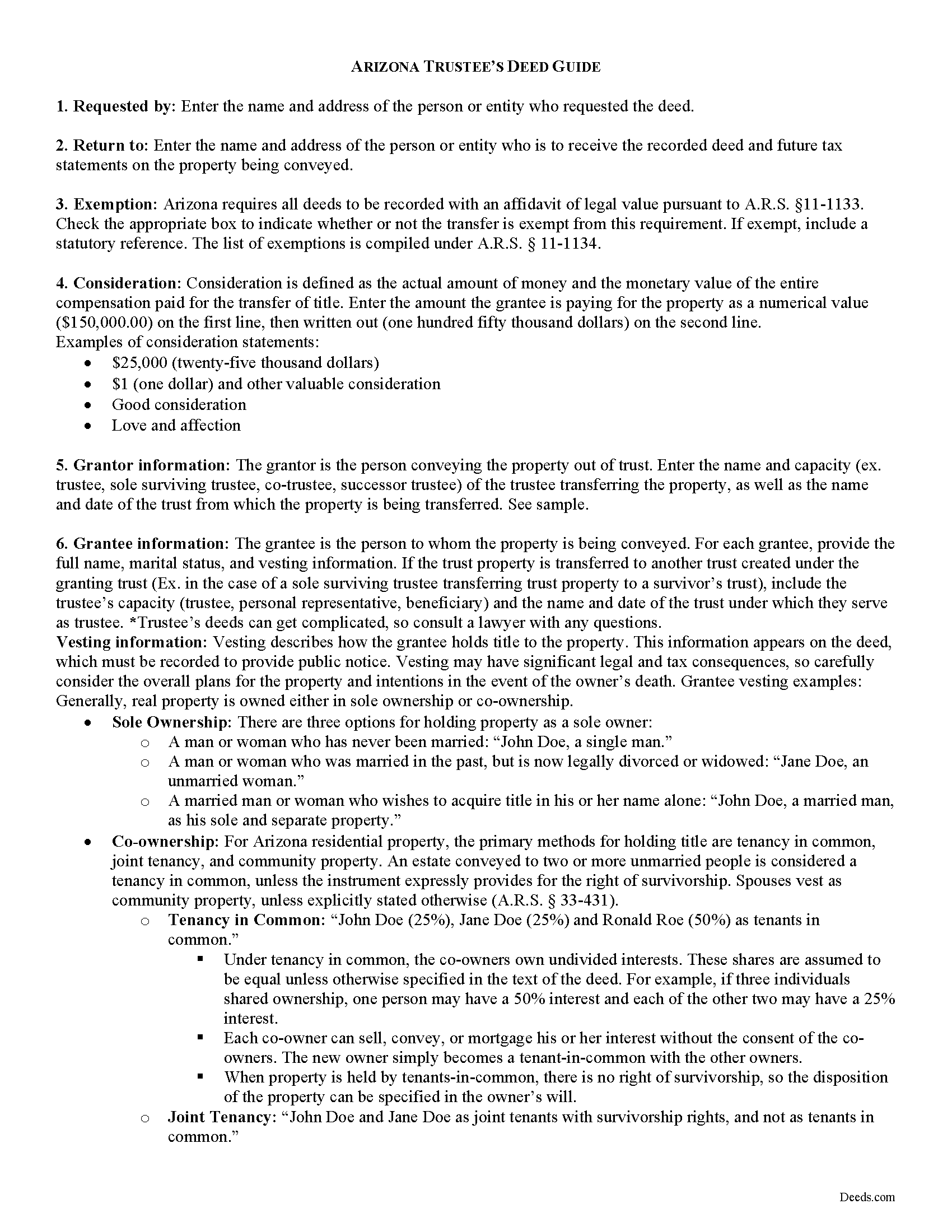

Navajo County Trustee Deed Guide

Line by line guide explaining every blank on the form.

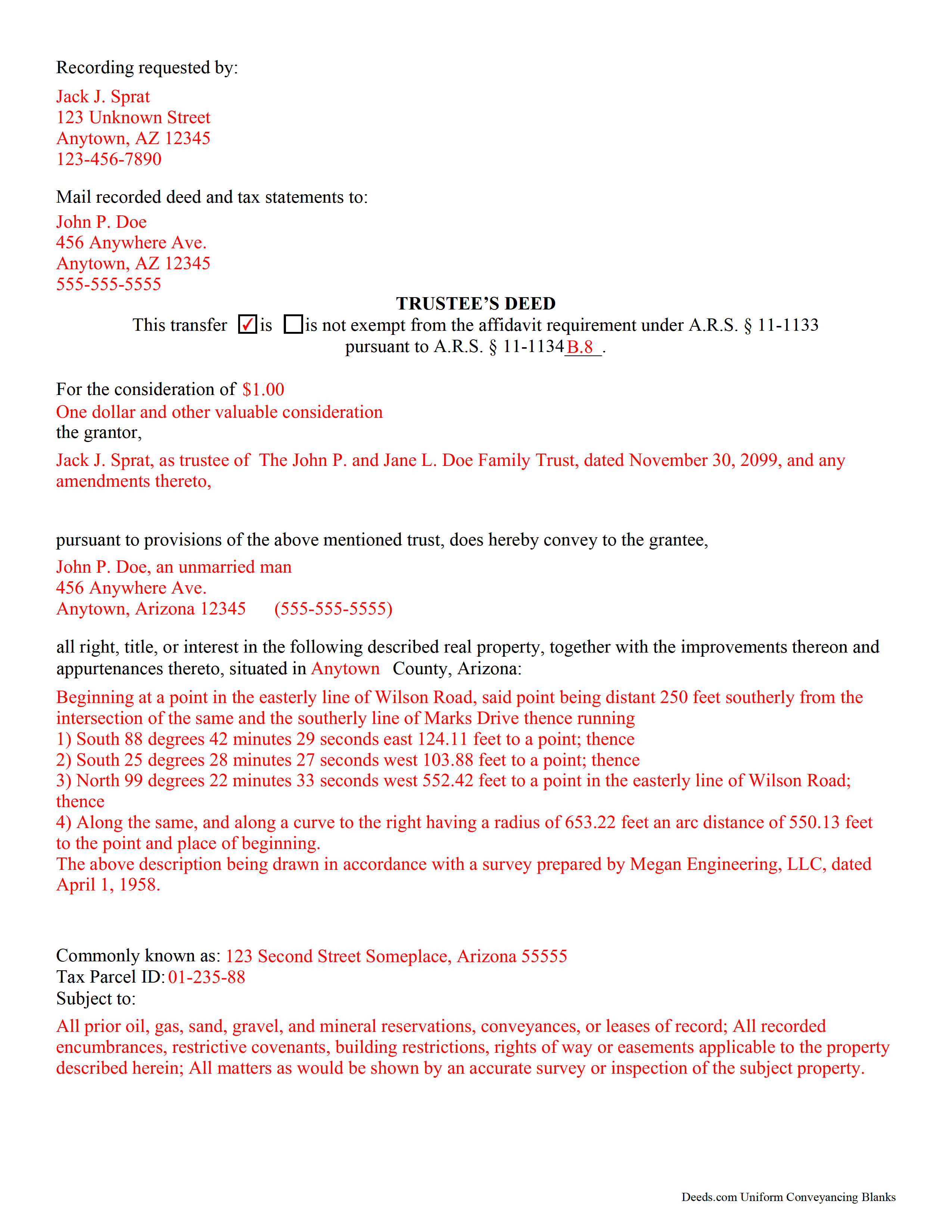

Navajo County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Navajo County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Holbrook, Arizona 86025

Hours: Monday thru Friday 8:00 am until 4:30 pm

Phone: 928-524-4194

Recording Tips for Navajo County:

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Navajo County

Properties in any of these areas use Navajo County forms:

- Blue Gap

- Cibecue

- Clay Springs

- Fort Apache

- Heber

- Holbrook

- Hotevilla

- Indian Wells

- Joseph City

- Kayenta

- Keams Canyon

- Kykotsmovi Village

- Lakeside

- Overgaard

- Pinedale

- Pinetop

- Pinon

- Polacca

- Second Mesa

- Shonto

- Show Low

- Snowflake

- Sun Valley

- Taylor

- White Mountain Lake

- Whiteriver

- Winslow

- Woodruff

Hours, fees, requirements, and more for Navajo County

How do I get my forms?

Forms are available for immediate download after payment. The Navajo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Navajo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Navajo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Navajo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Navajo County?

Recording fees in Navajo County vary. Contact the recorder's office at 928-524-4194 for current fees.

Questions answered? Let's get started!

The function of a trustee's deed is to transfer real property out of a trust. In Arizona, a separate form, called a Trustee's Deed Upon Sale, is used in cases of foreclosure to transfer real property under a deed of trust to a grantee who has purchased the property at public auction. Both versions are named for the person using the deed.

In a trustee's deed, the trustee serves as the grantor to convey real property out of the trust and to the grantee. The power of the trustee to sell trust property is granted by the terms of a trust agreement previously executed between the settlor and the trustee. The settlor is the party who originally conveyed the property into the trust (A.R.S 14-10103(16)).

In addition to meeting the content and formatting requirements of traditional conveyances such as warranty or quitclaim deeds, trustee's deeds also include identification of the trustee, information about the trust, and the disclosure of the trust's beneficiaries.

In many cases, a trustee's deed is used to transfer property out of a trust and to a trust beneficiary with only nominal actual consideration for the transfer. A trust beneficiary is someone who has either a present or future interest in the trust (A.R.S 14-10103(2)(a)). Because the transfer is generally made "for good and valuable consideration," or a similar variant, it functions similarly to an inter vivos deed (a deed granting property as a gift from one living person to another). In this instance, the transfer is exempt from the affidavit of legal value requirement pursuant to A.R.S. 11-1134(B)(8).

A trustee also uses a trustee's deed to transfer real property held in a trust to the trustee of a separate trust, as is the case when a sole surviving trustee wishes to transfer trust property into a survivor's trust created under the original trust.

As with other types of conveyances, trustee's deeds need to be signed in the presence of a notary public, notarized, and recorded in the office of the recorder in the Arizona county where the property is located.

Transferring real estate out of a trust is often a simple process, but trust laws and regulations can be tricky. Don't hesitate to contact an attorney for help with questions or for a complex situation.

Important: Your property must be located in Navajo County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Navajo County.

Our Promise

The documents you receive here will meet, or exceed, the Navajo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Navajo County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce S.

November 5th, 2021

I am very pleased with Deeds.com. I have every form and information I need to meet Legal requirements. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Raj J.

December 2nd, 2020

Perfect, thanks

Thank you!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Russell L.

November 9th, 2021

Your Personal Representative's Deed and example for the state of PA were extremely helpful. Exactly what I needed! Two feedback comments: 1. Valuation Factors/Short List in my download is an outdated table dated July 2020. The PA Dept of Revenue website has a more current table dated June 2021. (Maybe same for Valuation Factors/Long List, which I didn't use.) 2. Notarization section on deed page 3 has a gender-related input needed, which confused the Notary Public representative where I live in the state of CO. Notary input the word she to apply to my wife, but wasn't clear to him if the gender input applied to the Grantor or the Notary. He assumed Grantor. Also in our non-binary world, some might find that wording offensive. Thanks again for your documents. Russ Lewis

Thank you!

William G.

July 21st, 2023

Exactly what I needed and saved me a bundle by not having to hire an attorney. My county clerk said it was exactly correct.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Nora T.

March 10th, 2023

The forms are easy to fill in but too restricted for editing.

Thank you!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Rebecca F.

November 4th, 2021

Forms were great. I wasn't able to find them anywhere. Even the county recorder didn't have them

Thank you for your feedback. We really appreciate it. Have a great day!

Sonia C.

July 11th, 2021

Ordered and received the appropriate quitclaim deed docs for my area. Recorded with no questions or issues. All arounds solid product and service.

Thank you for your feedback. We really appreciate it. Have a great day!

John Q.

June 26th, 2020

I downloaded the forms, which was very easy, and filled them out with the help of the very helpful instructions! I was able to go down to my court house and file the forms within 24 hours of downloading! I am at peace knowing my son's will avoid a lot of headaches when I pass because my property deed will transfer to them without probate court TOD !!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!