Navajo County Unconditional Lien Waiver on Progress Payment Form

Last validated November 24, 2025 by our Forms Development Team

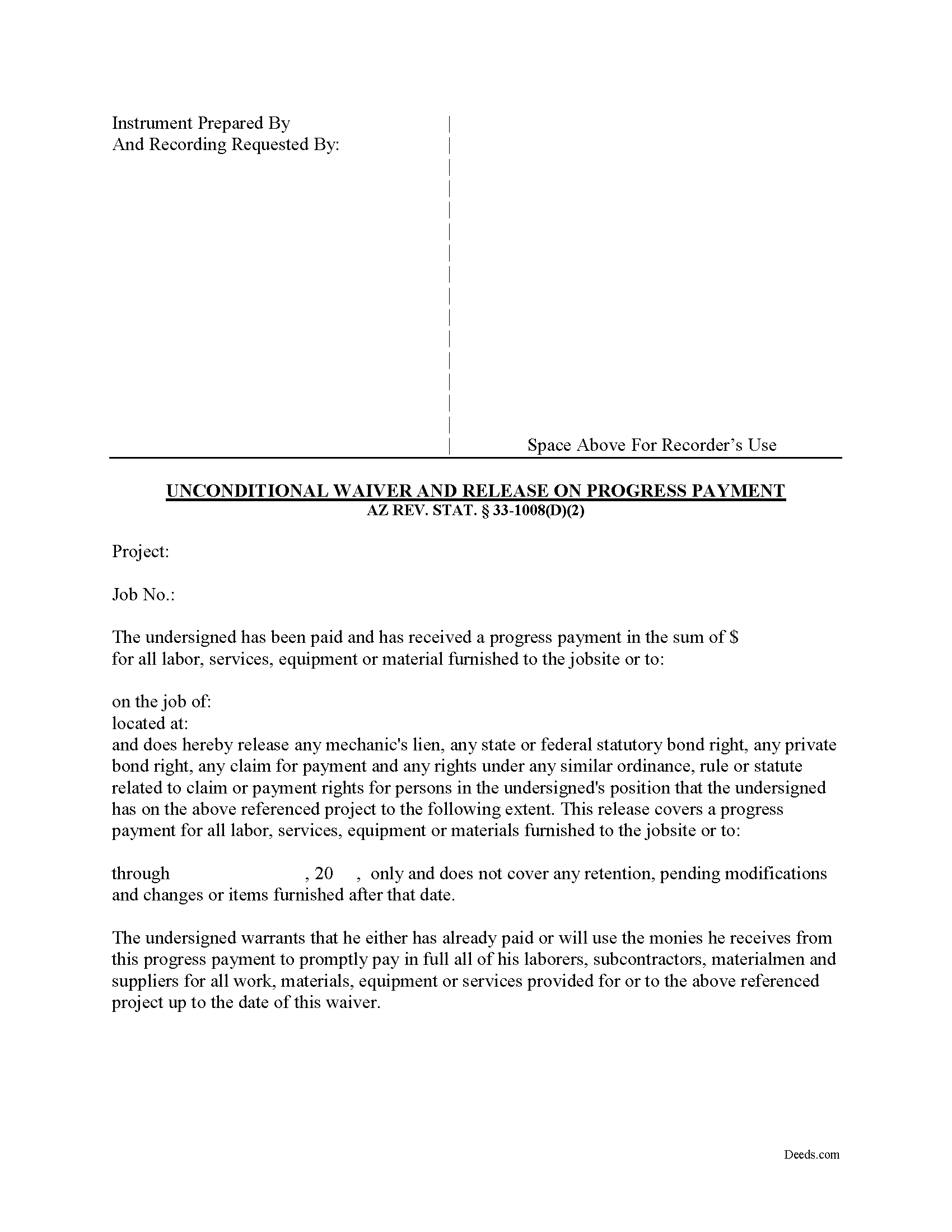

Navajo County Unconditional Lien Waiver on Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

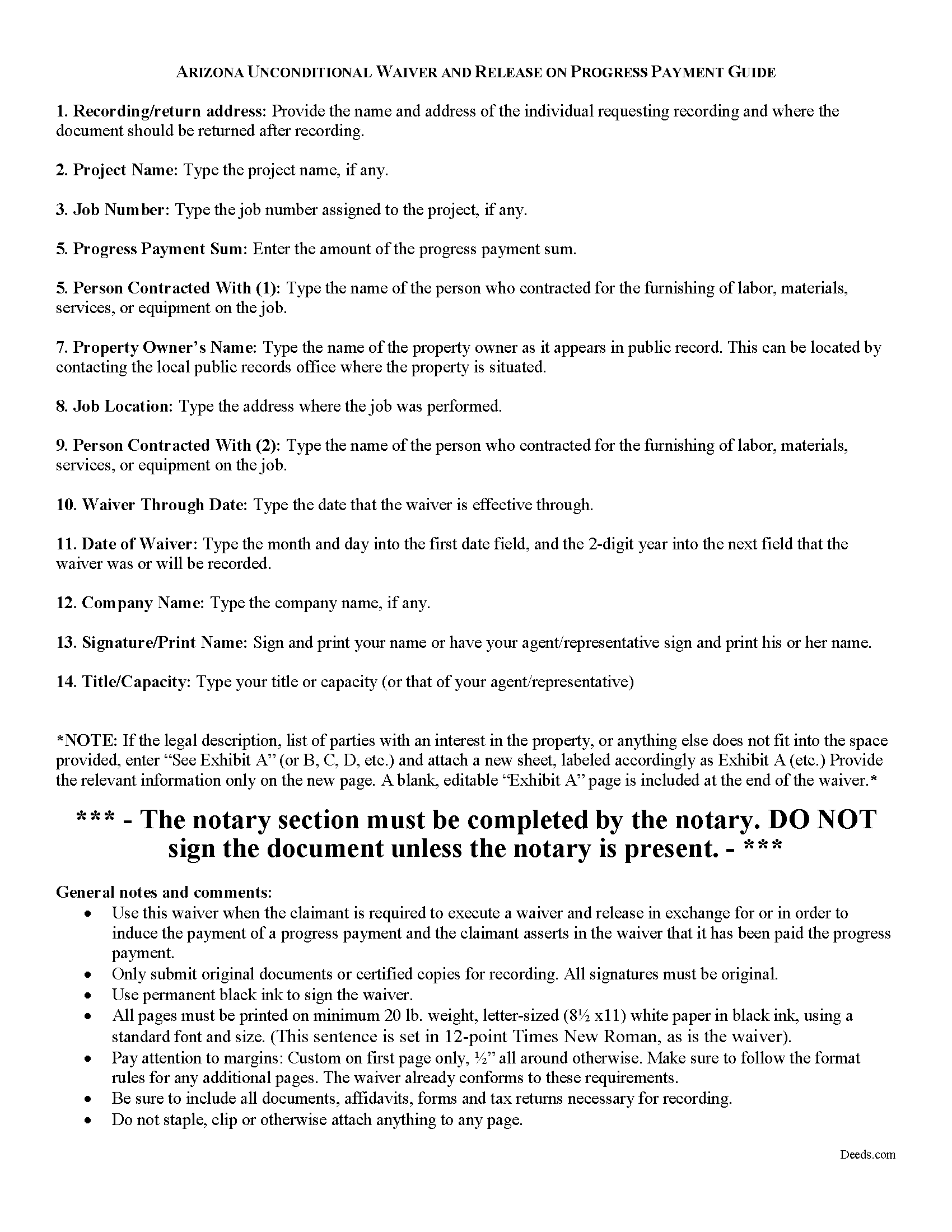

Navajo County Unconditional Lien Waiver of Progress Payment Guide

Line by line guide explaining every blank on the form.

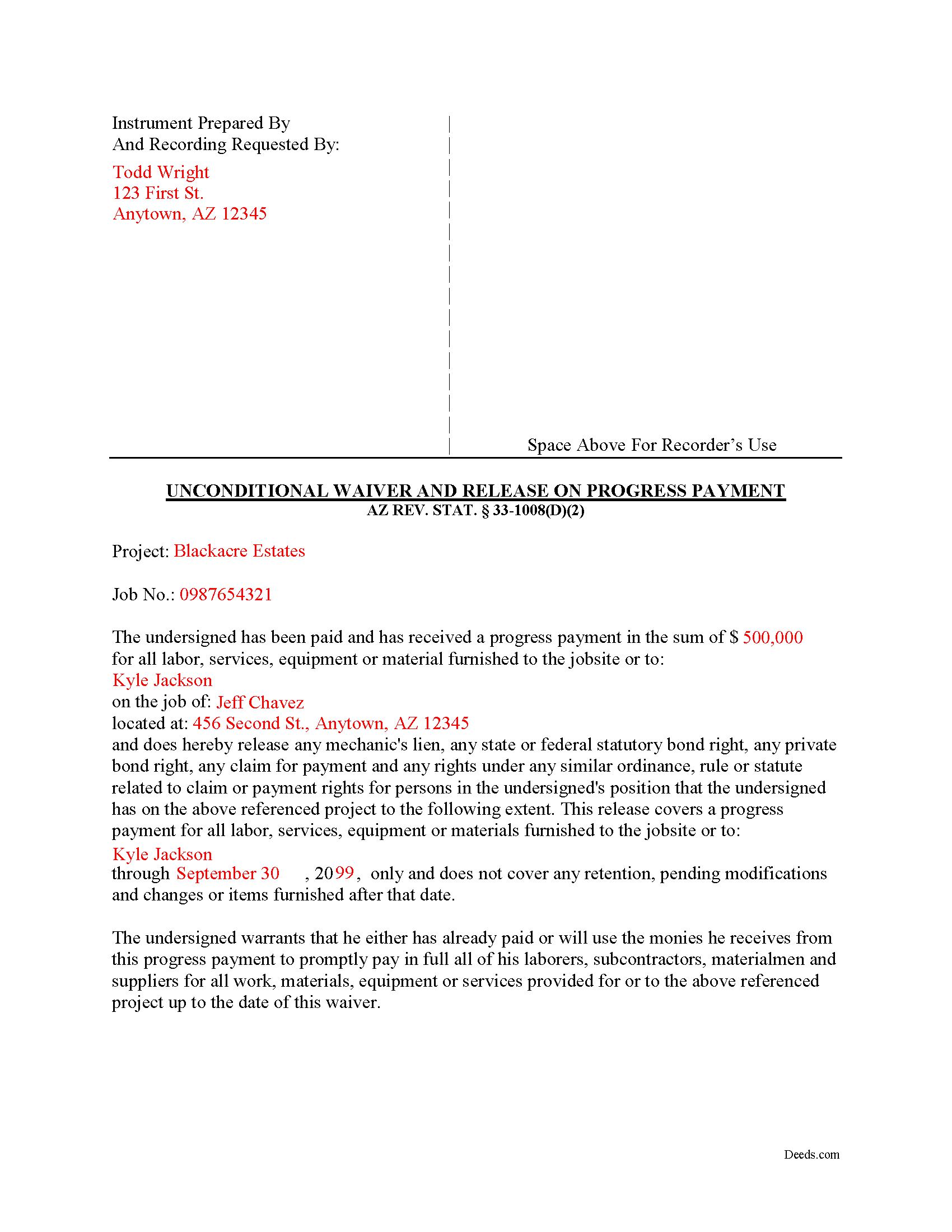

Navajo County Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Navajo County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Holbrook, Arizona 86025

Hours: Monday thru Friday 8:00 am until 4:30 pm

Phone: 928-524-4194

Recording Tips for Navajo County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Navajo County

Properties in any of these areas use Navajo County forms:

- Blue Gap

- Cibecue

- Clay Springs

- Fort Apache

- Heber

- Holbrook

- Hotevilla

- Indian Wells

- Joseph City

- Kayenta

- Keams Canyon

- Kykotsmovi Village

- Lakeside

- Overgaard

- Pinedale

- Pinetop

- Pinon

- Polacca

- Second Mesa

- Shonto

- Show Low

- Snowflake

- Sun Valley

- Taylor

- White Mountain Lake

- Whiteriver

- Winslow

- Woodruff

Hours, fees, requirements, and more for Navajo County

How do I get my forms?

Forms are available for immediate download after payment. The Navajo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Navajo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Navajo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Navajo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Navajo County?

Recording fees in Navajo County vary. Contact the recorder's office at 928-524-4194 for current fees.

Questions answered? Let's get started!

Lien waivers are part of the Arizona mechanic's lien process. The waiver, given by a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. Unconditional waivers do not require payment confirmation, but conditional waivers are effective only when payment is received, usually verified by a check clearing the bank. So, an unconditional waiver given after a partial payment releases a portion the claimant's right to lien, regardless of whether or not after any check used to pay the bill clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(2).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Navajo County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver on Progress Payment meets all recording requirements specific to Navajo County.

Our Promise

The documents you receive here will meet, or exceed, the Navajo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Navajo County Unconditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

LAWRENCE P.

December 7th, 2021

How about a single button zip download of the files displayed instead of downloading them one at a time?

Thank you for your feedback. We really appreciate it. Have a great day!

WJ H.

December 6th, 2021

The Quit Claim Deed for the state of Ohio worked for me, saving me the cost of an attorney doing it. O.K., maybe that wouldn't have amounted to more than a few hundred dollars, but anywhere I thought I could save money (and learn something new on top of it) is something I want to do. That said, be forwarned. While I'm not an attorney I'm not averse to spending many hours researching the lingo found in this kind of form and thoroughly understanding exactly how everything has to be filled in. I should add that my ex-wife and I remain friends and she was the one giving me the property/house (thus, technically I filled out the forms on her behalf). Because there was no personal conflict, it made it easier to undertake. Lastly, what others have said about the county office where you must file a Quit Claim Deed not being helpful, that's true in the sense that they do not want to be instructing non-attorneys on filling out the necessary forms. I did take a preliminary draft set of the forms to the county office but was VERY CAREFUL about explaining that I only needed a couple of questions answered about procedure for submitting the final documents. They were helpful once I made it clear I wasn't asking them for "legal advice". And their help was critical as the final submittals requires stopping at three different offices (MapDocuments, Auditor and finally the Recorder's office). So I say thank you to Deeds.com. Their service for the Quit Claim Deed was invaluable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Maria F.

June 26th, 2020

Easy forms to follow. Thank you for this service. You can even file them through e-filing. Great service. Thanks. Maria F.

Thank you!

Karen L.

October 8th, 2021

My card was charged twice in error, I contacted deeds.com and within minutes, the error was corrected! Fast service, thank you deed.com

Thank you!

michael b.

June 26th, 2020

Your web site is very user friendly and easy to navigate I was very pleased with the experience

Thank you!

Kimberly K.

January 29th, 2020

Easy to use was very satisfied with service would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

KAREN I.

May 14th, 2024

it worked. fantastic. thanks!

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Walter R.

February 15th, 2022

I was able to get all the Forms I required and it was straight forward and easy. Thank you , Walt R.

Thank you!

luisana w.

September 9th, 2022

Super easy, excellente

Thank you!

Angela B.

September 19th, 2020

Great forms! Quick, easy, and to the point. The completed document, when printed out, looks really professional.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William A B.

May 20th, 2020

Good service...deed release form as required.

Thank you!