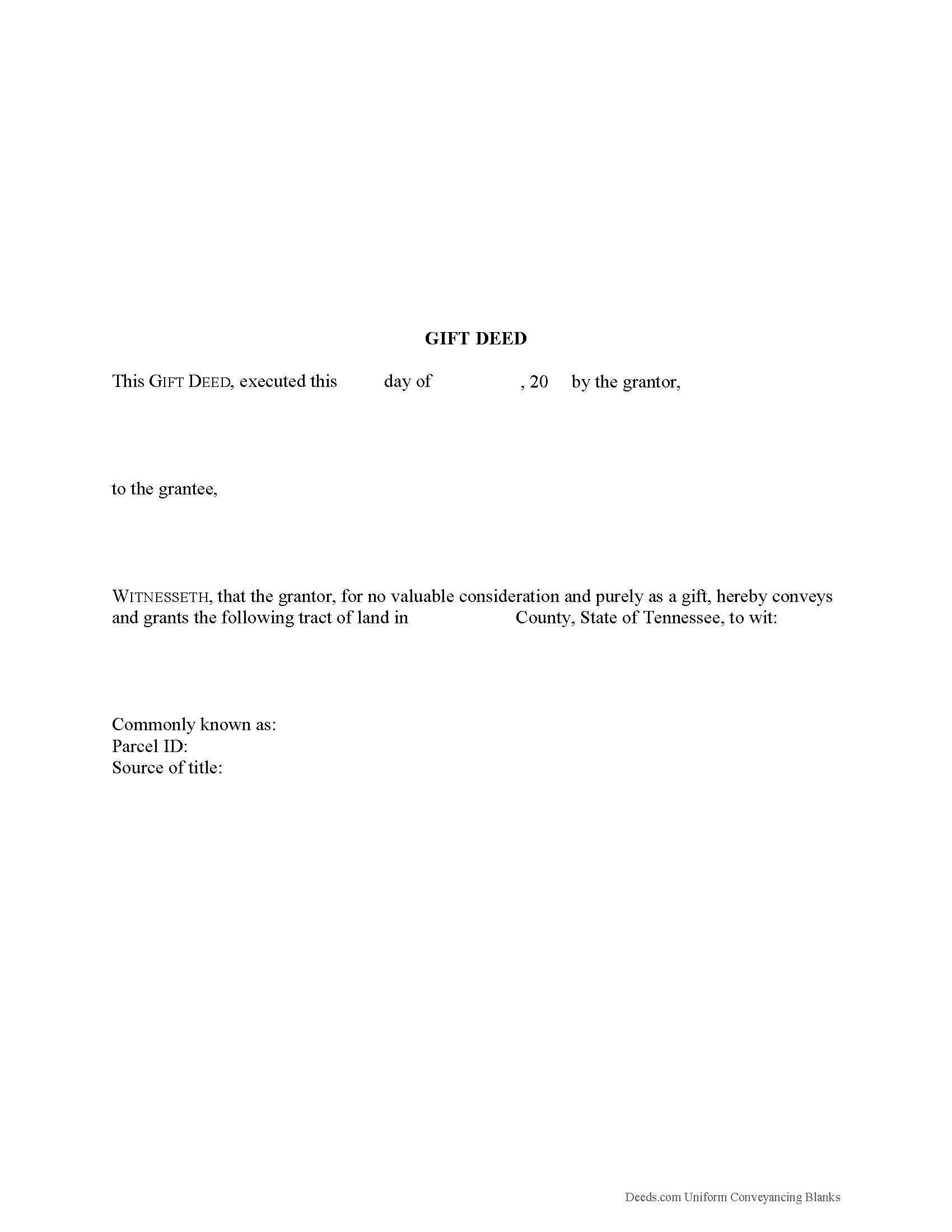

Hancock County Gift Deed Form

Hancock County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

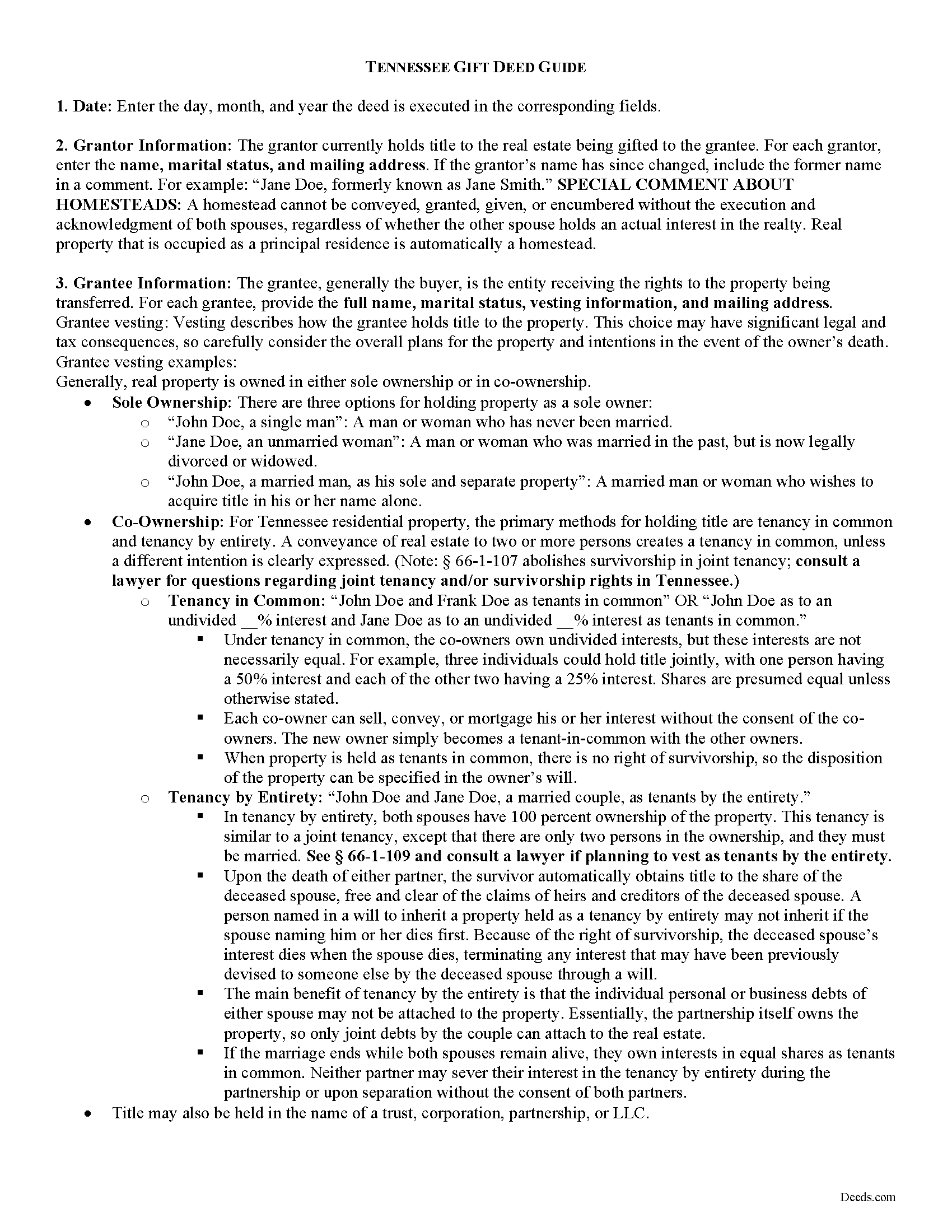

Hancock County Gift Deed Guide

Line by line guide explaining every blank on the form.

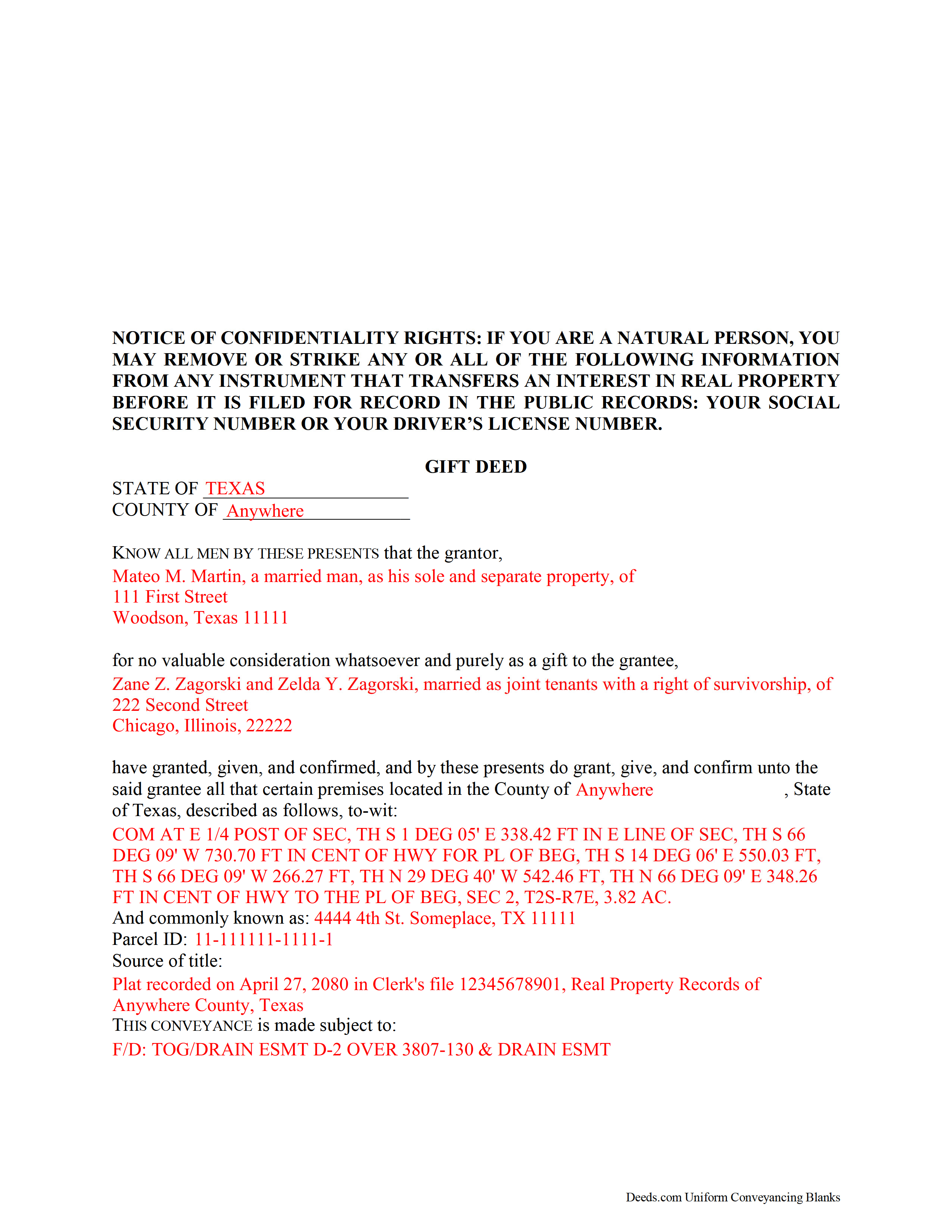

Hancock County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Hancock County documents included at no extra charge:

Where to Record Your Documents

Hancock County Register of Deeds

Sneedville, Tennessee 37869

Hours: 8:00 to 4:00 M-F

Phone: (423) 733-4545

Recording Tips for Hancock County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Hancock County

Properties in any of these areas use Hancock County forms:

- Kyles Ford

- Sneedville

Hours, fees, requirements, and more for Hancock County

How do I get my forms?

Forms are available for immediate download after payment. The Hancock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hancock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hancock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hancock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hancock County?

Recording fees in Hancock County vary. Contact the recorder's office at (423) 733-4545 for current fees.

Questions answered? Let's get started!

Gifts of Real Property in Tennessee

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. A gift deed must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Tennessee residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a different intention is clearly expressed. (Note: 66-1-107 abolishes survivorship in joint tenancy; consult a lawyer for questions regarding joint tenancy and/or survivorship rights in Tennessee.)

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. At the end of the legal description of the property, include the name, license number, and address of the surveyor who prepared the boundary survey from which the description was prepared (T.C.A. 66-24-121). Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Record the completed deed, along with a completed Oath of Consideration (T.C.A 67-4-409) at the local county Recorder's office.

The IRS implements a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. But, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a grantor may benefit from filing a Form 709 [2].

In Tennessee, there is no state gift tax. Gifts of real property in Tennessee are, however, subject to the federal gift tax, which the grantor is responsible for paying; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1]

https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Tennessee Gift Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hancock County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Hancock County.

Our Promise

The documents you receive here will meet, or exceed, the Hancock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hancock County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

William P.

October 31st, 2019

I was very pleased with the end results regarding Quitclaim deeds.

Thank you!

Tammy L.

August 20th, 2025

Very Poor and useles, a scam, don't waste your money, those templates are useless and do Not give you Any valid,proper, meeningful wording to use, did Not Help me, nothing more than what a 5th grader can come up with as far as wording or example..I feel I was riped off and this is a total scam... nothing useful

We appreciate all feedback, even when it’s critical. Thousands of customers have successfully used our documents, but they are not for everyone. These are reviewed, fill-in-the-blank templates that provide the wording and structure required by law. Some situations call for more personalized guidance or hand-holding than templates alone can provide, and in those cases an attorney may be the better option.

KELLY S.

May 31st, 2022

Thank you for being here. very easy to understand and your site is great. I will always use you.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruthea M.

March 18th, 2025

It was easy to download, but you need to open an account before doing so. That was not clear.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

DAVID S.

January 16th, 2019

I was very impressed with the speed at which information was retrieved on my very first search. Unfortunately, the county we were looking for is behind times and has not digitized its information. I will be using Deeds.Com again and appreciate that I was not charged for no information being returned back. Thank You David S

Thank you for your feedback. We really appreciate it. Have a great day!

yvonne e.

July 19th, 2020

Poor communication. Confusing charges. (Waiting for explanation) overall, not thrilled and at this point would not recommend.

Sorry to hear of your confusion. We've gone ahead and canceled your order. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Martin M.

November 14th, 2020

This site is great. Simple to use with excellent instructions. Will recommend to others.

Thank you!

Stephen B.

May 9th, 2020

They have been fabulous not only for getting me the Title and Property info I needed quickly, but also for determining which Deed (of many) that I actually needed. They are an outstanding resource for any real estate investor, property owner, Realtor, or attorney.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory K.

October 18th, 2021

Easy to work with. Fair price. Nice, efficient service. Would definitely use Deeds.com again for any legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!

Sheron W.

May 23rd, 2022

I've used Deeds.com for a few years. The service is good, and orders are completed fast. I will continue using them and I recommend them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymundo M.

November 1st, 2023

Very fast and smooth process, thank you for your quick answers and follow up.

Thank you for your feedback. We really appreciate it. Have a great day!