Essex County Estate Tax Affidavit Form

Last validated February 13, 2026 by our Forms Development Team

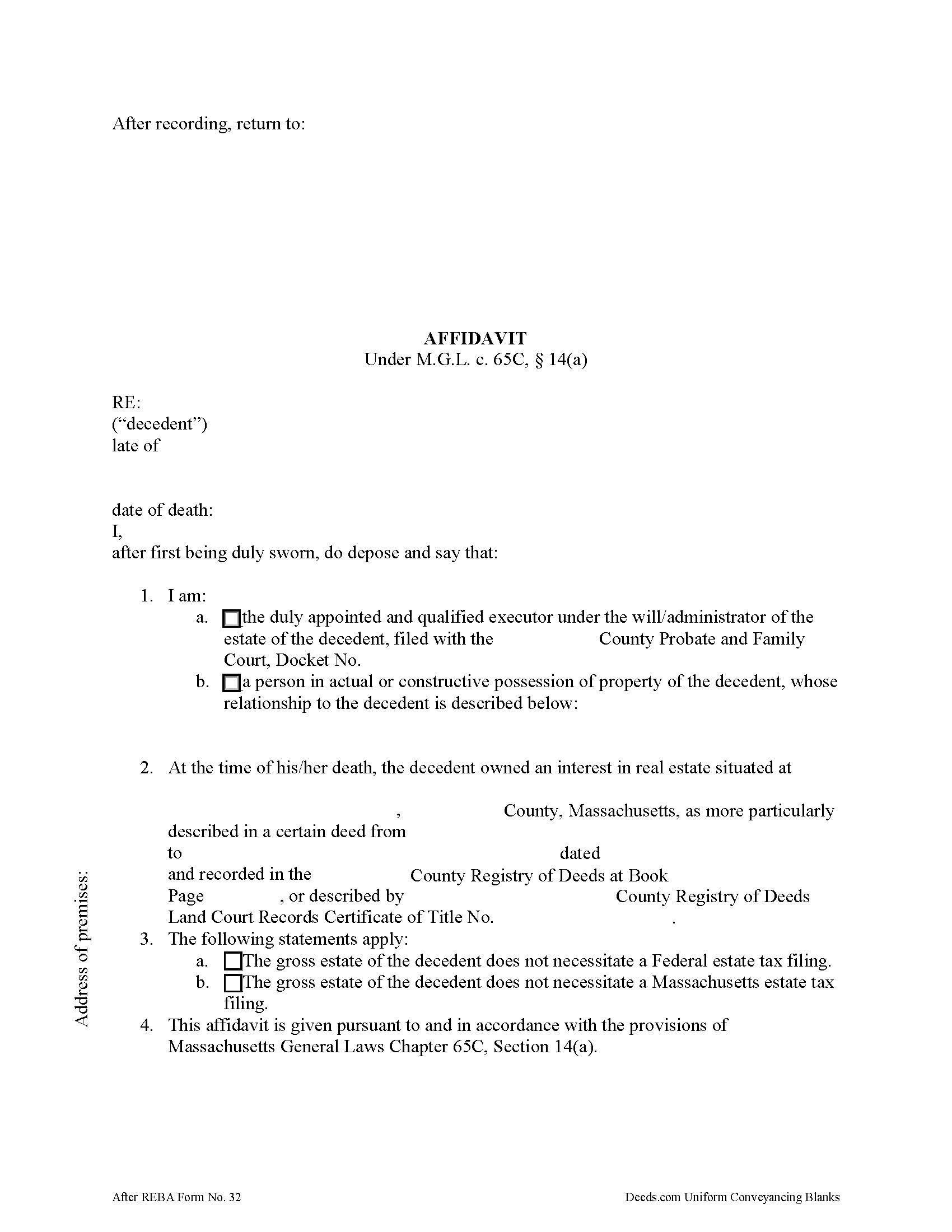

Essex County Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

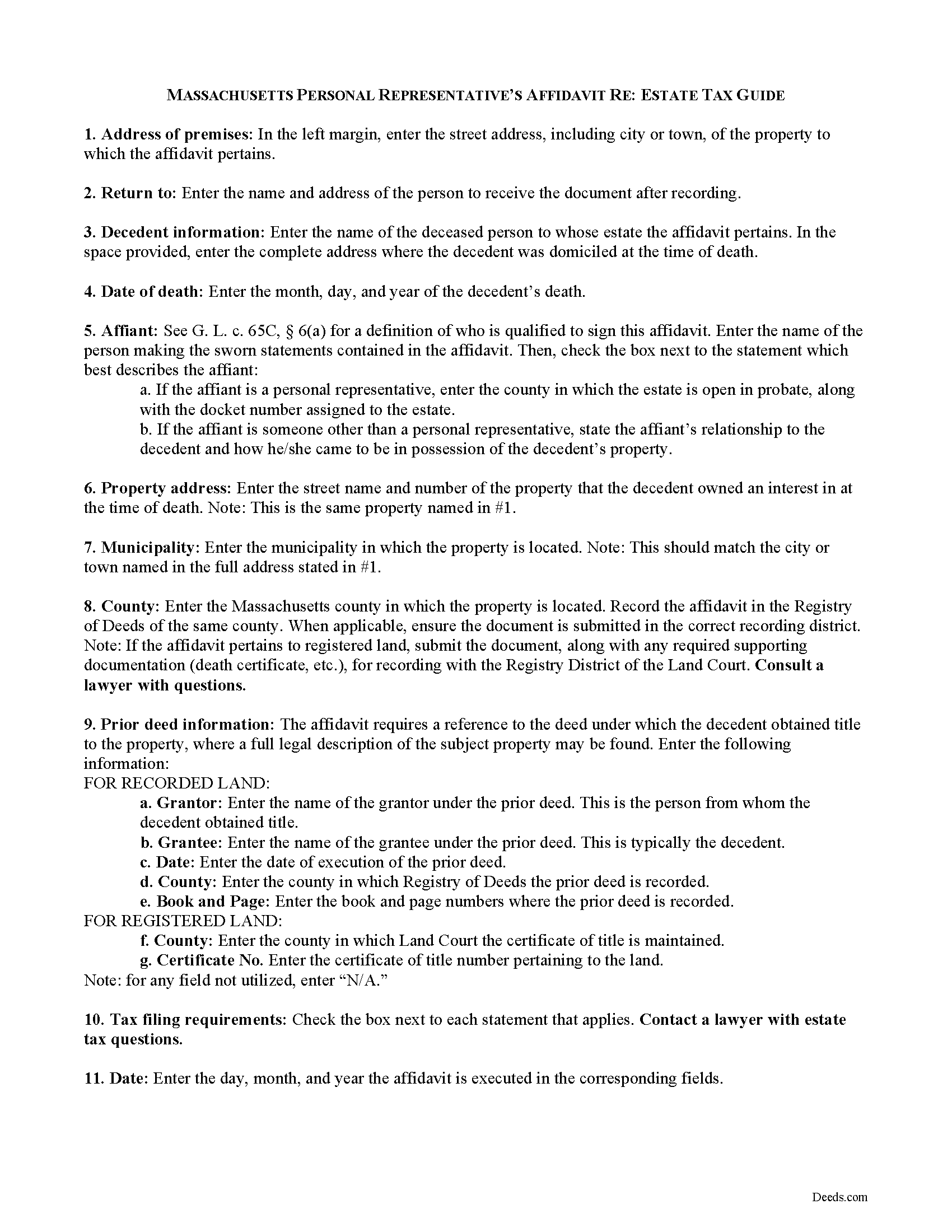

Essex County Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

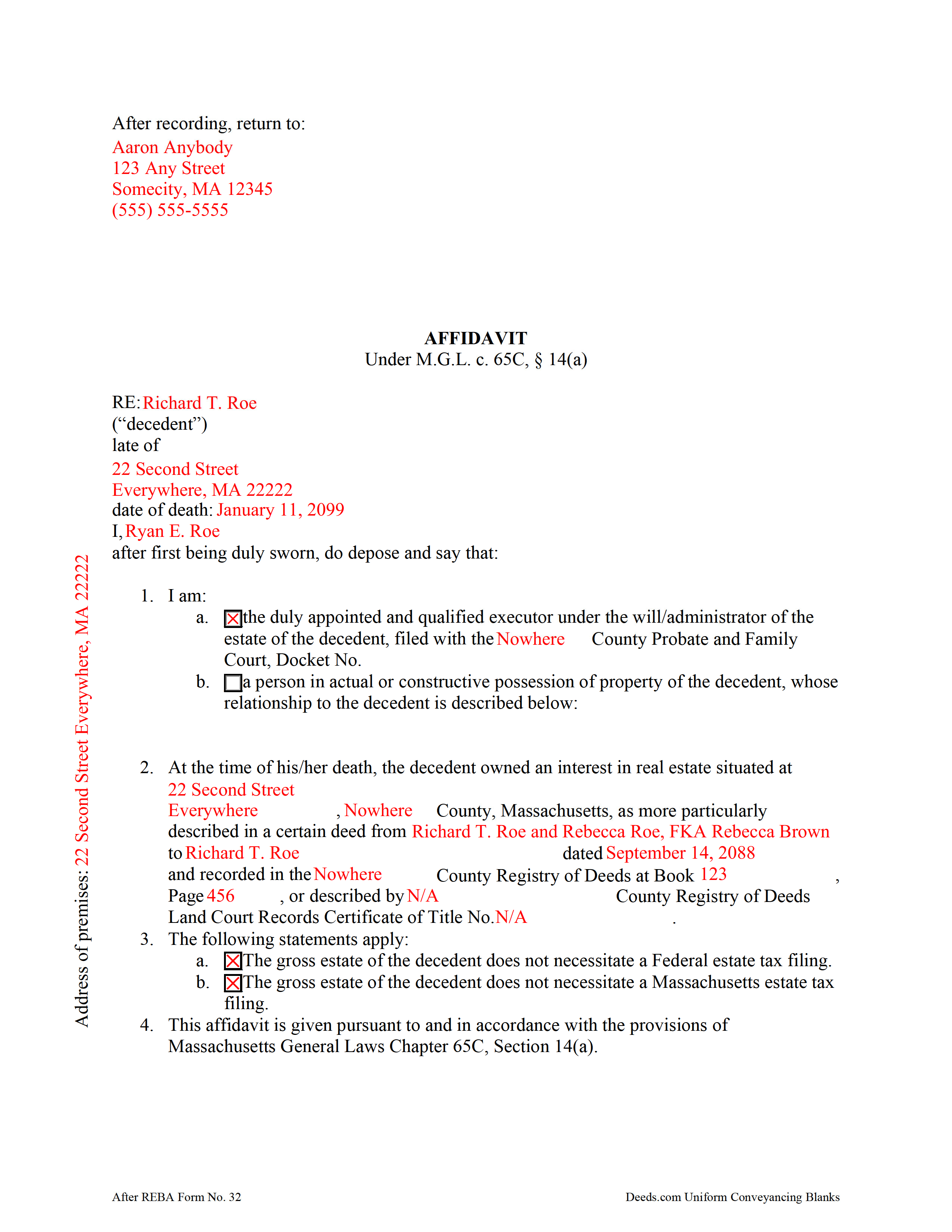

Essex County Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Essex County documents included at no extra charge:

Where to Record Your Documents

Essex County Registry of Deeds, Northern District

Lawrence, Massachusetts 01843

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (978) 557-1900

Essex County Register of Deeds, Southern District

Salem, Massachusetts 01970

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (978) 542-1704

Recording Tips for Essex County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Essex County

Properties in any of these areas use Essex County forms:

- Amesbury

- Andover

- Beverly

- Boxford

- Byfield

- Danvers

- Essex

- Georgetown

- Gloucester

- Groveland

- Hamilton

- Hathorne

- Haverhill

- Ipswich

- Lawrence

- Lynn

- Lynnfield

- Manchester

- Marblehead

- Merrimac

- Methuen

- Middleton

- Nahant

- Newbury

- Newburyport

- North Andover

- Peabody

- Prides Crossing

- Rockport

- Rowley

- Salem

- Salisbury

- Saugus

- South Hamilton

- Swampscott

- Topsfield

- Wenham

- West Boxford

- West Newbury

Hours, fees, requirements, and more for Essex County

How do I get my forms?

Forms are available for immediate download after payment. The Essex County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Essex County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Essex County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Essex County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Essex County?

Recording fees in Essex County vary. Contact the recorder's office at (978) 557-1900 for current fees.

Questions answered? Let's get started!

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Important: Your property must be located in Essex County to use these forms. Documents should be recorded at the office below.

This Estate Tax Affidavit meets all recording requirements specific to Essex County.

Our Promise

The documents you receive here will meet, or exceed, the Essex County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Essex County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4651 Reviews )

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

Leroy B.

February 7th, 2020

I have a Timeshare in Florida and started looking to sell it. Just finally downloaded this site, it looks fairly simple. I will start getting more serious soon. Looking forward to working with Deeds.com.

Thank you!

Coralis M.

September 2nd, 2021

Fast, efficient and professional service! Thanks

Thank you!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Ernest B.

June 6th, 2021

Forms were perfect, recorded quickly with no issue.

Thank you!

Emmy M.

August 20th, 2020

I loved using this process to record my deeds. it was fast and everytime I sent a message I received a response very quickly. I am so glad they have this option. for the extra $15 to have the convenience to do it from home and not worry about finding parking, etc. so well worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

October 1st, 2020

Easy to use, fast!

Thank you!

Jeannette C.

October 22nd, 2021

Very useful service! This was easy and quick. It guides you through each step and emails update you during the process. Will use again!

Thank you!

Krissyn S.

November 29th, 2021

It was so easy to find, download, and use the form I needed. Literally took about 5 minutes and I was ready to go. I loved that the download included a sample form and a guide to help fill out the form properly.

Thank you for your feedback. We really appreciate it. Have a great day!

albert C.

May 21st, 2021

thumbs up

Thank you!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard H.

October 14th, 2022

It was a waste of time. I asked a question via your chat service. I received an acknowledgement that you received the question, that you might or might not answer it, and don't bother to reply to you email, as no one would read it. Confirming my belief that customer service is an oxymoron for most companies. (I doubt this review will ever appear on the site, or anyuhere else.)

Thank you!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Greg R.

January 17th, 2024

Great service especially living out of state for the documents in the state I required. Easy to use, understand forms with instructions and examples.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa D.

May 2nd, 2023

Great service, would be nice if it provided an address to send this to once completed!

Thank you for your feedback. We really appreciate it. Have a great day!