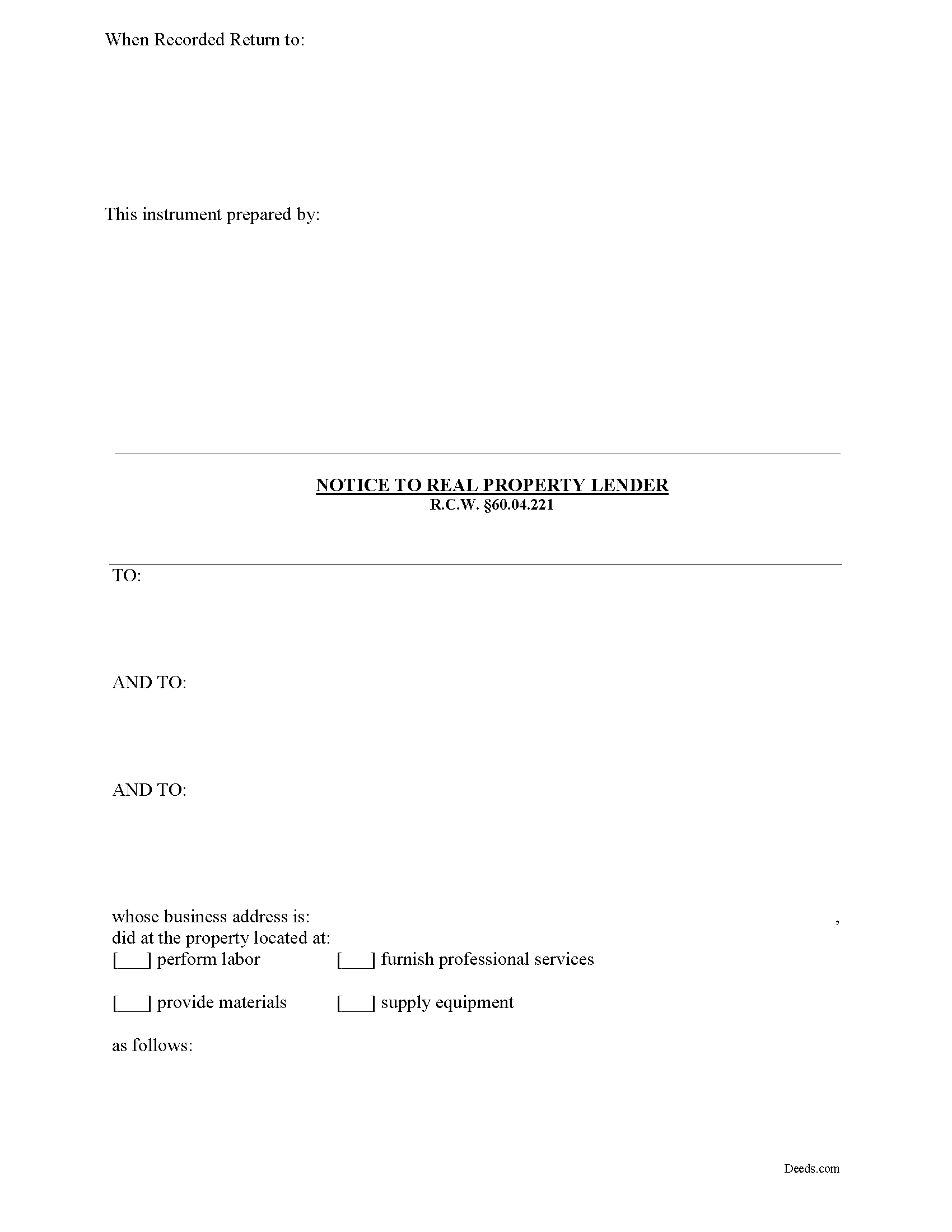

Washington Mechanics Lien Notice to Construction Lender

County Forms

Where is the property located?

Adams CountyAsotin CountyBenton CountyChelan CountyClallam CountyClark CountyColumbia CountyCowlitz CountyDouglas CountyFerry CountyFranklin CountyGarfield CountyGrant CountyGrays Harbor CountyIsland CountyJefferson CountyKing CountyKitsap CountyKittitas CountyKlickitat CountyLewis CountyLincoln CountyMason CountyOkanogan CountyPacific CountyPend Oreille CountyPierce CountySan Juan CountySkagit CountySkamania CountySnohomish CountySpokane CountyStevens CountyThurston CountyWahkiakum CountyWalla Walla CountyWhatcom CountyWhitman CountyYakima CountyMechanics Lien Notice to Construction Lender for Real Estate Located in Washington

Getting a Construction Lender to Withhold Funds

As part of the construction lien process, you might find it useful to send a notice to the construction lender ordering the lender to withhold distribution of funds from the loan proceeds until you are paid. This is another potential weapon in the lien claimant's arsenal. In some states, this notice is called as a "stop notice" because it instructions the lender to stop payment. The notice can be used as a first step or as an alternative to securing a mechanic's lien.

Any potential lien claimant who has not received a payment within five days after the date required by their contract, invoice, employee benefit plan agreement, or purchase order may give a notice to a construction lender within thirty-five days of the date required for payment of the contract, invoice, employee benefit plan agreement, or purchase order. See R.C.W. 60.04.221(1).

The notice must be signed by the potential lien claimant or some person authorized to act on his or her behalf. R.C.W. 60.04.221(2). The notice must be provided in writing to the lender at the office administering the construction financing, along with a copy given to the owner and the appropriate prime contractor. R.C.W. 60.04.221(3).

Two methods can be used to serve the notice: (1) mailing the notice by certified or registered mail to the lender, owner, and appropriate prime contractor; or (2) delivering or serving the notice personally and obtaining evidence of delivery in the form of a receipt or other acknowledgment signed by the lender, owner, and appropriate prime contractor, or an affidavit of service. Id.

The notice must include the following information: (1) the name of the person, firm, trustee, or corporation filing the notice, (2) the name of the prime contractor, common law agent, or construction agent ordering the same, (3) a common or street address of the real property being improved or the legal description of the real property, and (4) the name, business address, and telephone number of the lien claimant. R.C.W. 60.04.221(4).

After the lender receives a copy of the notice, the lender must then withhold from the next and subsequent draws the amount claimed to be due as stated in the notice. R.C.W. 60.04.221(5). Alternatively, the lender may obtain from the prime contractor or borrower a payment bond for the benefit of the potential lien claimant in an amount sufficient to cover the amount stated in the potential lien claimant's notice. Id. The lender is obligated to withhold amounts only to the extent that sufficient interim or construction financing funds remain undisbursed as of the date the lender receives the notice. Id.

Once the notice is received by the lender, sums that are withheld shall not be disbursed by the lender, except by the written agreement of the potential lien claimant, owner, and prime contractor, or court order. R.C.W. 60.04.221(6).

If the lender fails to abide by the terms of the notice, then the mortgage, deed of trust, or other encumbrance securing the lender will be made secondary to the lien of the potential lien claimant to the extent of the interim or construction financing wrongfully disbursed, but in no event more than the amount stated in the notice plus costs as fixed by the court, including reasonable attorneys' fees. R.C.W. 60.04.221(7).

Use caution in drafting the notice to the lender and ensure the form is accurate. If there are mistakes, any potential lien claimant will be liable for any loss, cost, or expense, including reasonable attorneys' fees and statutory costs, to a party injured thereby arising out of any unjust, excessive, or premature notice that is filed. R.C.W. 60.04.221(8).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. If you have any questions about the notice to lender document or any other issues related to liens, please consult with a Washington attorney.