Download Tennessee Affidavit of Heirship Legal Forms

Tennessee Affidavit of Heirship Overview

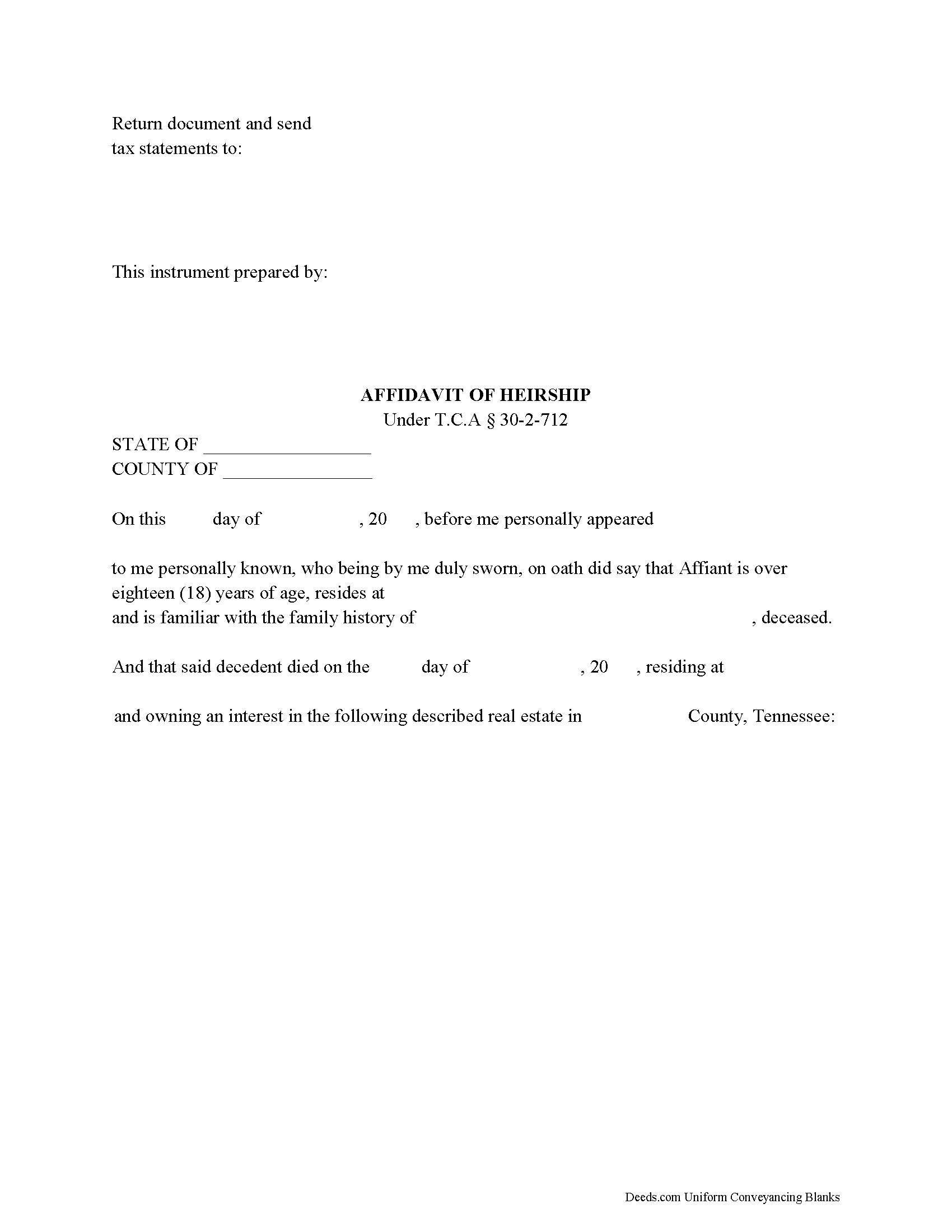

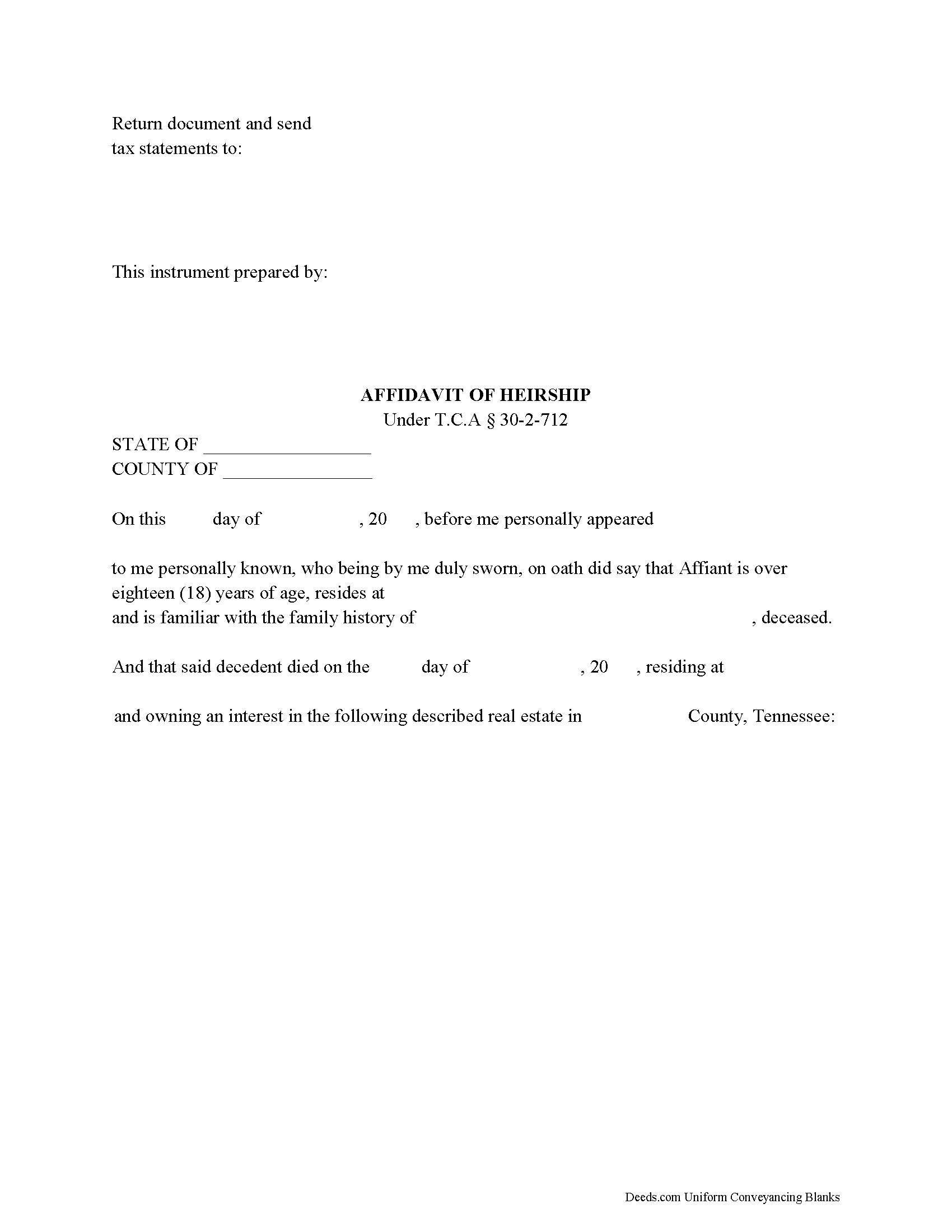

The affidavit of heirship, sometimes called an affidavit of inheritance, is a statutory form under T.C.A. 30-2-712.

An affidavit of heirship, when recorded, gives notice of a change in title following the death of a real property owner. It is typically recorded when the decedent has died intestate, or without a last will and testament. The affidavit names the decedent and the heirs who, by operation of law, are the current owners of the property.

The affiant, or person making the sworn statements contained in the affidavit, is anyone having knowledge of the facts contained within. A standard affidavit of heirship contains the legal description and map parcel number of the realty and lists the heirs by name, address, and relation to the decedent.

In addition, if not followed by a recorded deed from one or all heirs, the affidavit requires the tax bill address for tax statements on the property and a prior title reference stating the type of document and book, page, and recording date of the instrument granting title to the decedent.

This is a general affidavit of heirship. Your situation may require more specific information. Consult a lawyer when preparing the affidavit to ensure all necessary information is included and to understand the legal implications of the document.

(Tennessee AOH Package includes form, guidelines, and completed example)