Illinois Documents

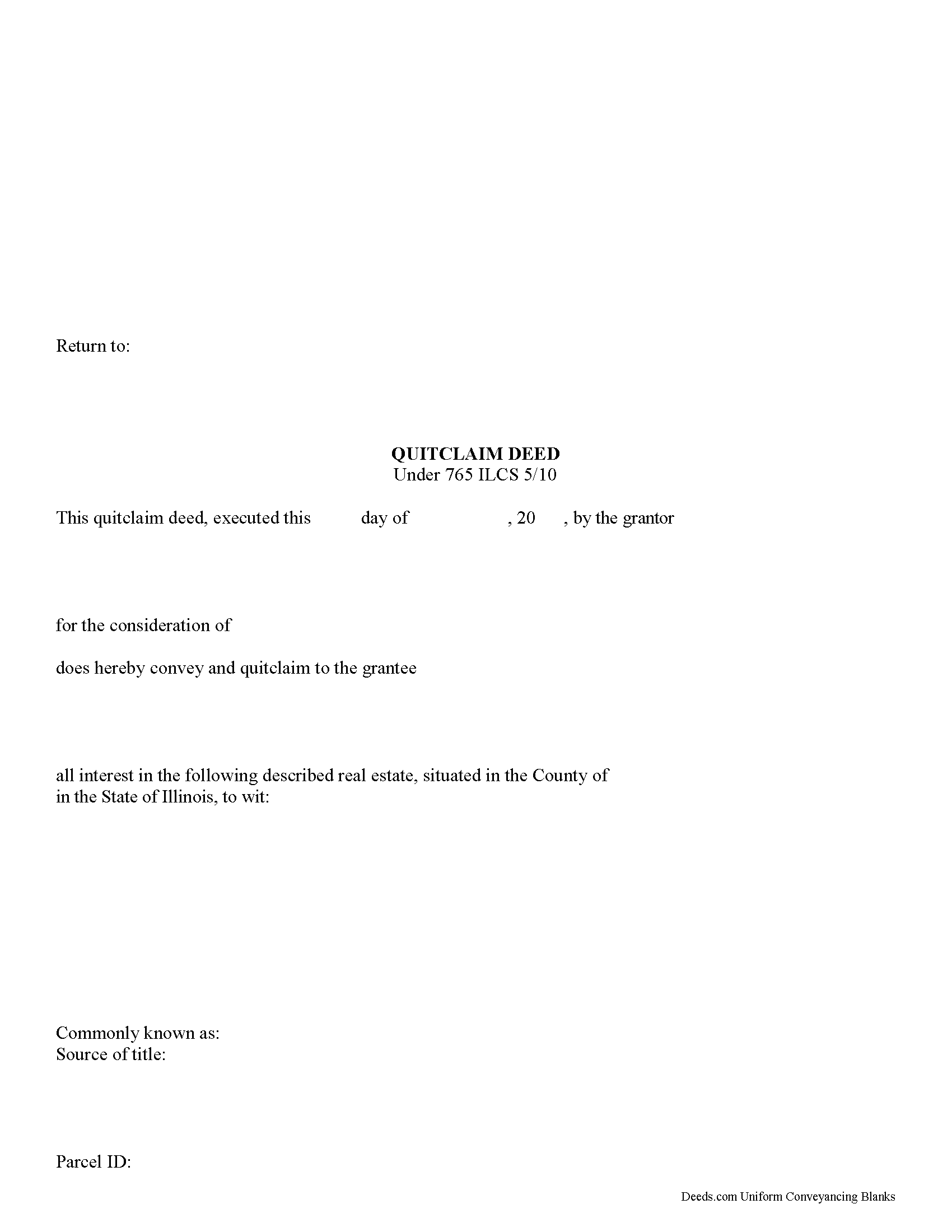

Quitclaim Deed

Quitclaim Deed Form Requirements for Illinois

765 ILCS 5/10 contains the basic statutory form and requirements for a quitclaim deed. In order to be valid, the quitclaim deed must contain the grantor's name and address, the grantee's name and address (55 ILCS 5/3-5020, 5026), the consideration (usually money), a complete legal description of the property, the county where the property is located, the date the deed was executed, and the grantor's notarized signature. 55 ILCS 5/3-5020.5 adds a few more essential details: a return address for use after recordation, and the document and book/page numbers from prior deeds relating to the specific parcel of real estate. 55 ILCS 5/3-5022 expands the necessary information to include a "prepared by" statement containing the name and address of the individual who prepared the quit claim deed. 55 ILCS 5/3-5027 states that in addition to the complete property description, the instrument must also contain the assessor's section or lot and block identifiers, and real estate index ID if available. Further, 765 ILCS 5/27 provides that if the quit claim deed is conveying a property identified as a homestead, both the grantor and his/her spouse mu... More Information about the Illinois Quitclaim Deed

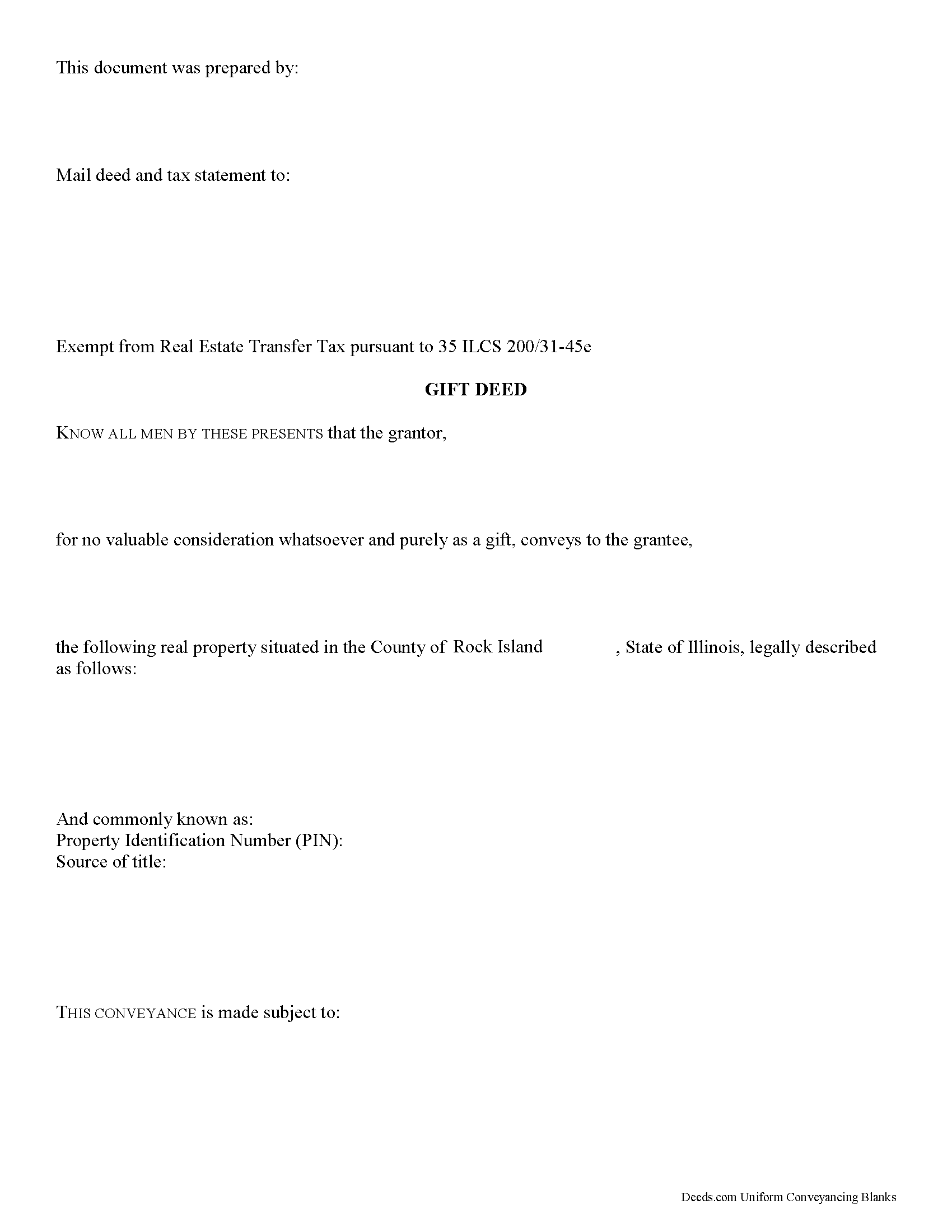

Gift Deed

Gifts of Real Property in Illinois

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language or references to any type of consideration can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting information, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or co-ownership. For Illinois residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. An estate conveyed to two or more unmarried persons is considered a tenancy in common, unless otherwise specified (765 ILCS 1005/1). A conveyance to a married couple vests as tenancy by entirety unless otherwise spec... More Information about the Illinois Gift Deed

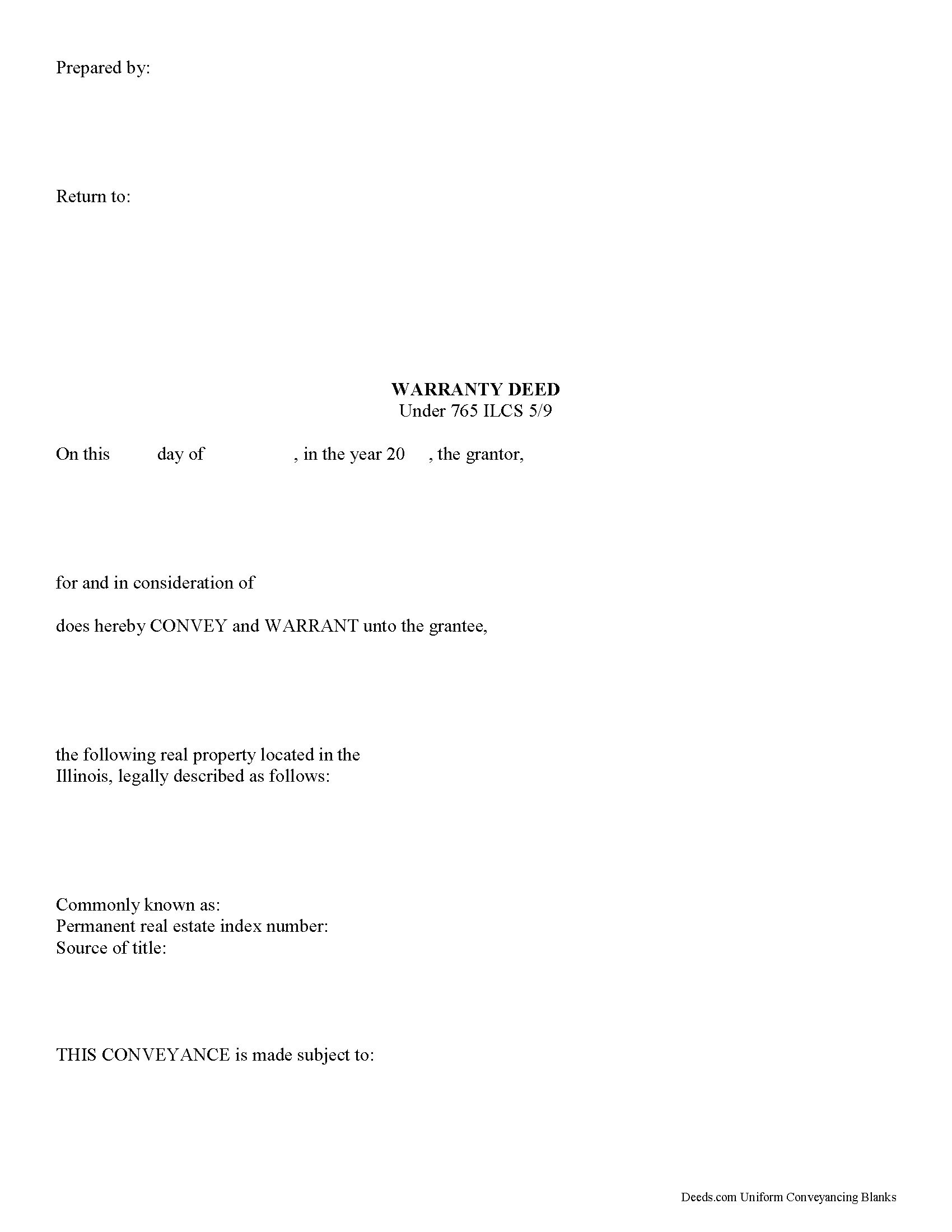

Warranty Deed

A warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). This type of deed provides protection for the grantee by confirming that the grantor holds clear title to the real estate and has the right to sell the property to the grantee. This guarantee extends throughout the property's history. The grantor also warrants that they did not encumber the property in a way prohibiting transfer, and that the deed references all easements, restrictions, or other agreements of record that relate to the specific parcel of land.

A lawful warranty deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Illinois residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless a joint tenancy or tenancy by the entirety is specified. (765 ILCS 1005/1, 1005/1c.).

As with any conveyance of real estate, wa... More Information about the Illinois Warranty Deed

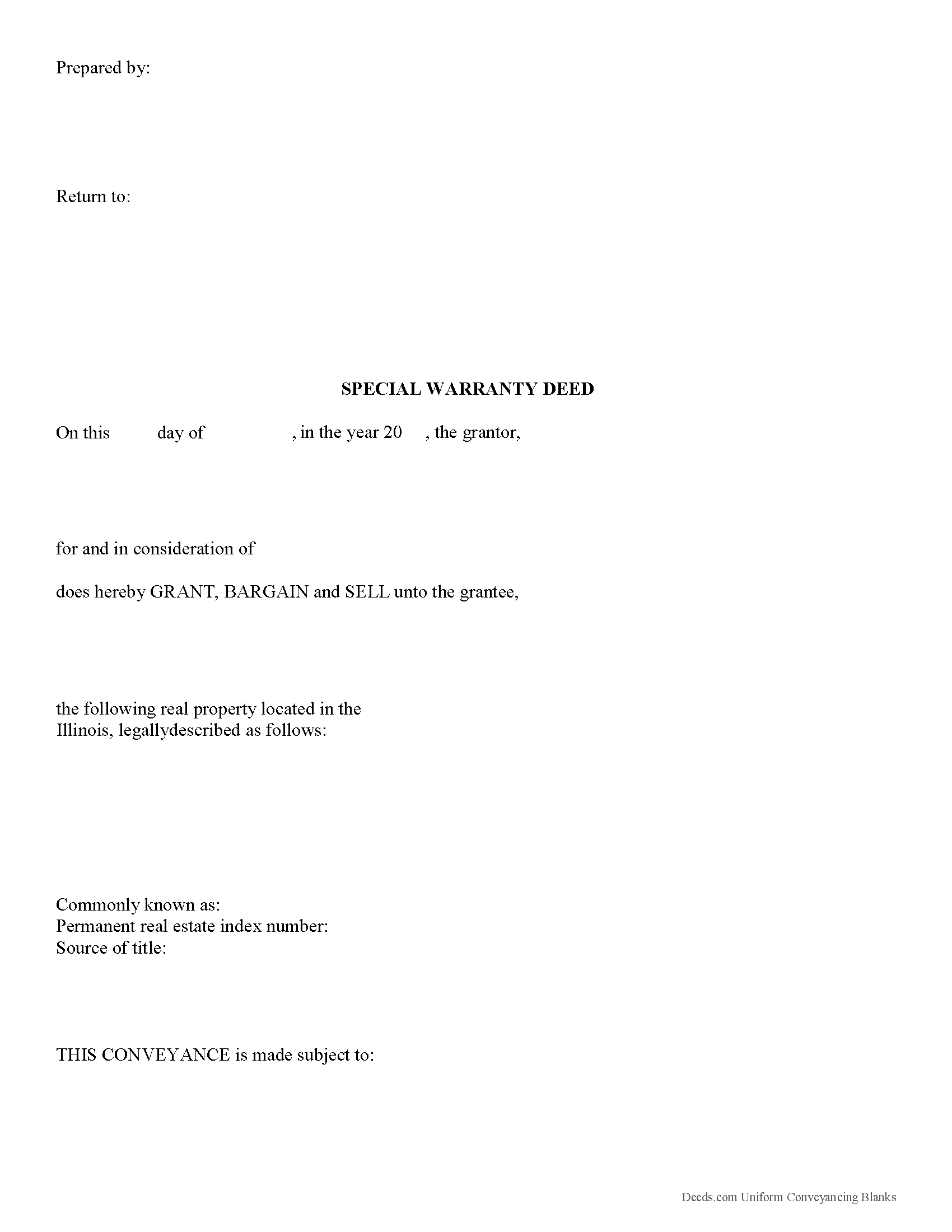

Special Warranty Deed

A special warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). Also referred to as a limited warranty deed, this type of deed provides significant liability protection for the grantor (seller), and less protection for the grantee (buyer). In a special warranty deed, the grantor only warrants against defects in the title during his or her ownership, and that he or she has an actual right to the title, and is authorized to sell it. Unlike a deed with full warranty, however, it does not guarantee that there are no other claims on the title of the property before the grantor owned the property, nor does it bind the grantor to defend against them. Because of the risk of unknown claims on the title, special warranty deeds are less common than traditional warranty deeds for residential real estate transactions.

A special warranty deed, once acknowledged, should be recorded in the recorder's office in the county where such lands are located. If it is acknowledged in Illinois, acknowledgements may be taken before a notary public, United States commissioner, county clerk, or any court, judge, clerk, or deputy ... More Information about the Illinois Special Warranty Deed

Grant Deed

A grant deed, also referred to as a bargain and sale deed, is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains covenants that the grantor has not previously sold the real property interest being conveyed to the grantee, and warrants that the property is conveyed to the grantee without any liens or encumbrances except for those specifically disclosed in the deed. Therefore, if the grantee later discovers that the grantor has sold the property to a third party, or if there are undisclosed encumbrances, the grantee may be able to sue the grantor for damages.

Lawful deeds include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Illinois residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless a joint tenancy or tenancy by the entirety is specified. (765 ILCS 1005/1, 1005/1c.).

As with any... More Information about the Illinois Grant Deed

Correction Deed

Use a correction or corrective deed to clear up a title flaw in a deed recorded in Illinois. This form allows for correction of errors in one or multiple sections of the deed.

When correcting an error in a deed in Illinois, there are two basic options: 1) re-record the original deed with corrections made on the face of it by striking out the wrong item; or 2) record a correction or corrective deed. While some counties prefer re-recording the original deed, others recommend the cleaner recording of a new deed. So it is always a good idea to check with the local recorder's office. The gravity of the error and correction it requires also will determine which option to choose. Use the re-recording of the original deed primarily for smaller typographical mistakes.

When correcting a minor error and re-recording the prior deed, use the original deed only, strike through the wrong information, and write the correction down close to it and by hand. Usually, a cover page must be added, stating the important identifiers, as well as the reason for re-recording. For a more involved error, the correction deed might be a better option. Except for the corrected error, it restates and confir... More Information about the Illinois Correction Deed

Easement Deed

An easement is the right to use the land of another for a specific purpose. An easement can exist in any portion of the real estate and can be made by agreement at any time, created by the seller when property is conveyed, or by operation of law. The creation of an easement always involves two separate parties, one of whom is the owner of the land over which the easement runs. Easements can be broken down into two categories: easements appurtenant and easements in gross.

An easement is recorded just like any other property interest in Illinois. This means that an easement deed should be signed and acknowledged by the grantor. If acknowledged in Illinois, acknowledgments can be made before a notary public, United States commissioner, county clerk, or any court, judge, clerk, or deputy clerk of such court. If acknowledgments are taken before a notary public or United States commissioner, the acknowledgment should be attested by his or her official seal. Acknowledgements taken before a judge or clerk of court should be attested by the seal of such court (765 ILCS 5/20). Easement deeds acknowledged outside of Illinois must still comply with the Illinois recording requirements and ca... More Information about the Illinois Easement Deed

Termination, Cancellation of Easement / Right of Way

Use this form to release, terminate, extinguish a previously recorded document that involves access to and from a property.

Documents such as:

1. Easement Deeds or Agreements (An easement is a non-possessory interest in land, granting the right to use someone else's property for a specific purpose, like a driveway or utility line)

2. Access Roads

3. Right of Ways

4. Utility Easements (Power, Gas, Water, Sewer, Etc.)

5. Drainage Easements

This document allows the owner of the land, burdened by the access and the party that benefits from the access, to sign an agreement releasing the property from such access, ... More Information about the Illinois Termination, Cancellation of Easement / Right of Way

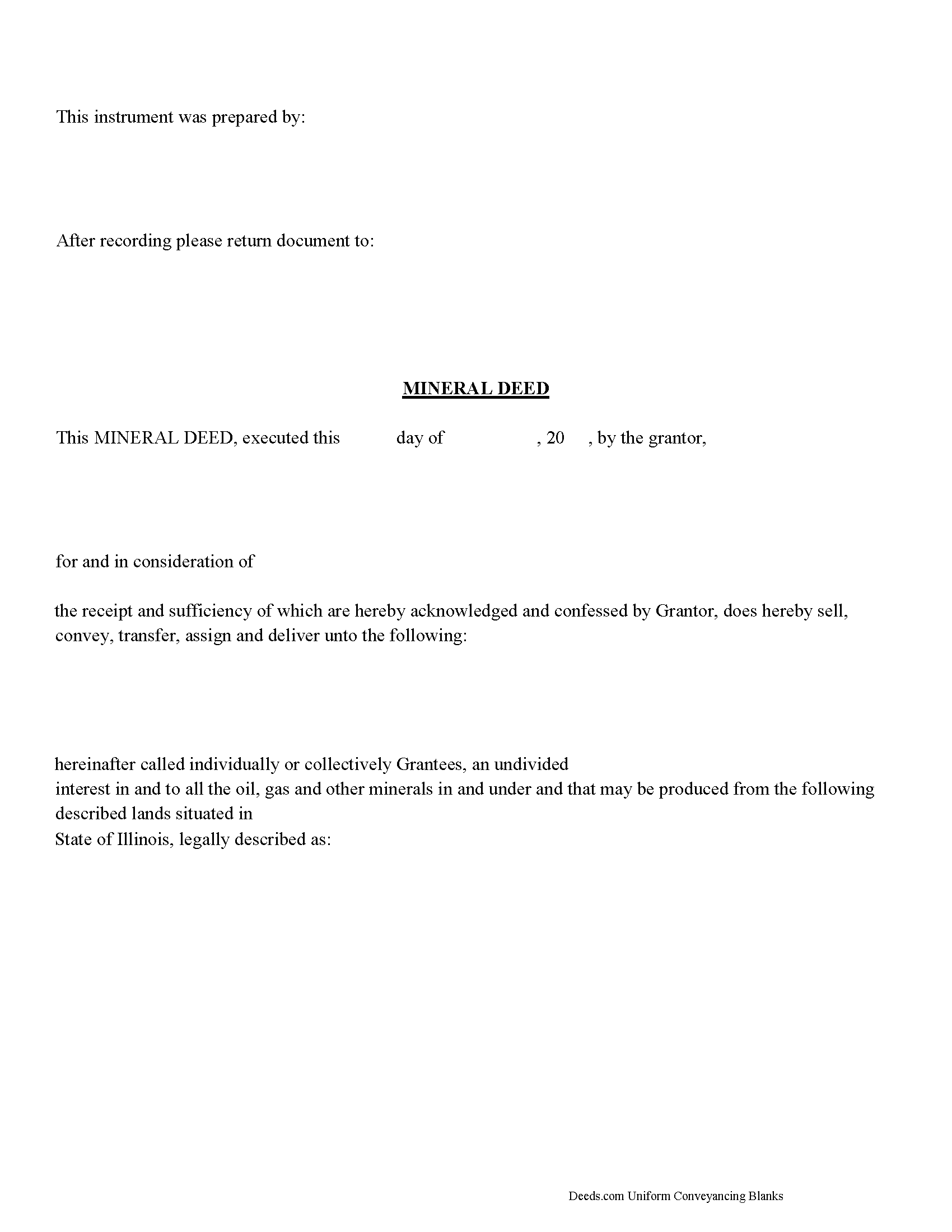

Mineral Deed

The General Mineral Deed in Illinois transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive and is made subject to any rights existing under any valid and subsisting oil and gas lease or leases of record.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

In this document the Grantor Warrants and will defend said Title to Grantee. Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Illinois Mineral Deed Package includes form, guidelines,... More Information about the Illinois Mineral Deed

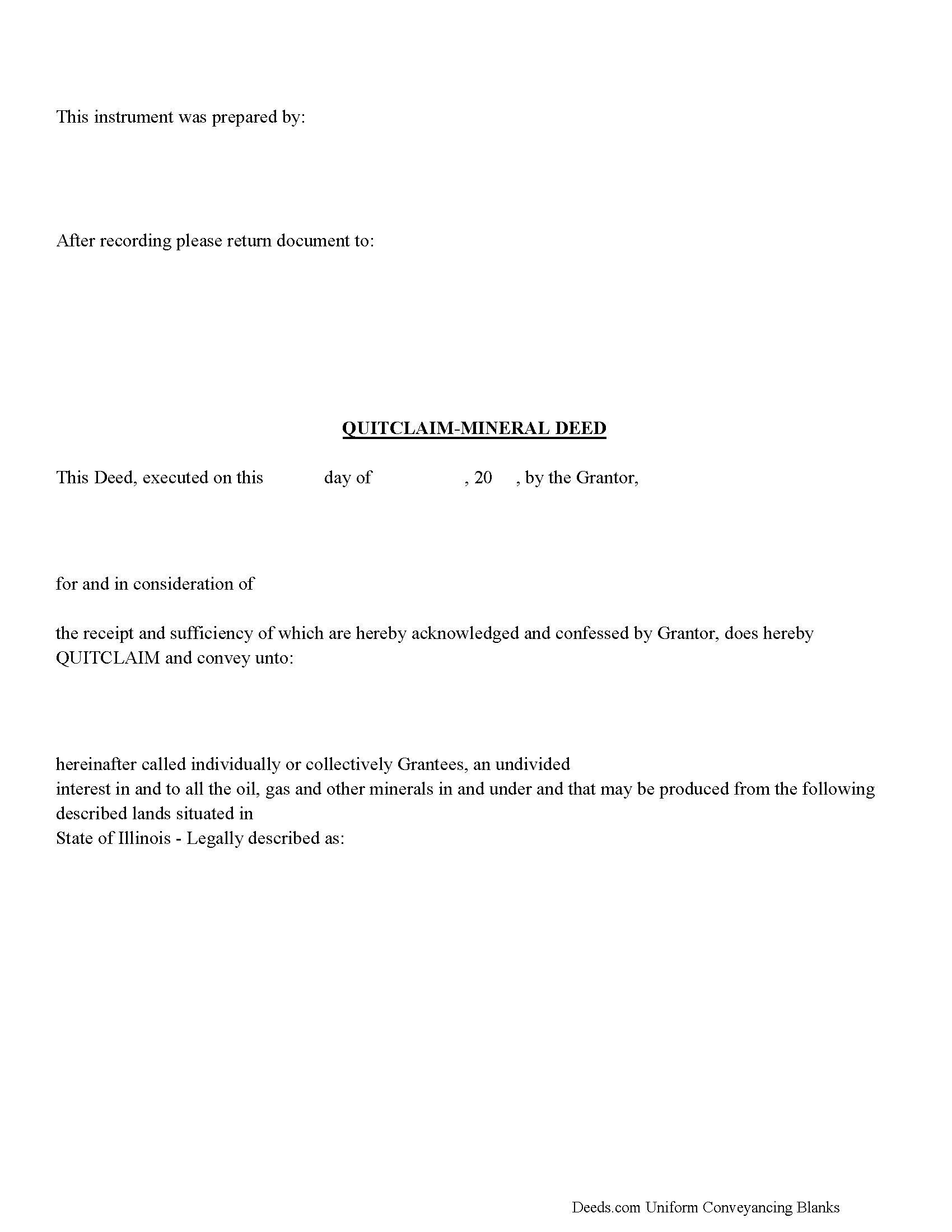

Mineral Deed with Quitclaim Covenants

The General Mineral Deed in Illinois Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer propert... More Information about the Illinois Mineral Deed with Quitclaim Covenants

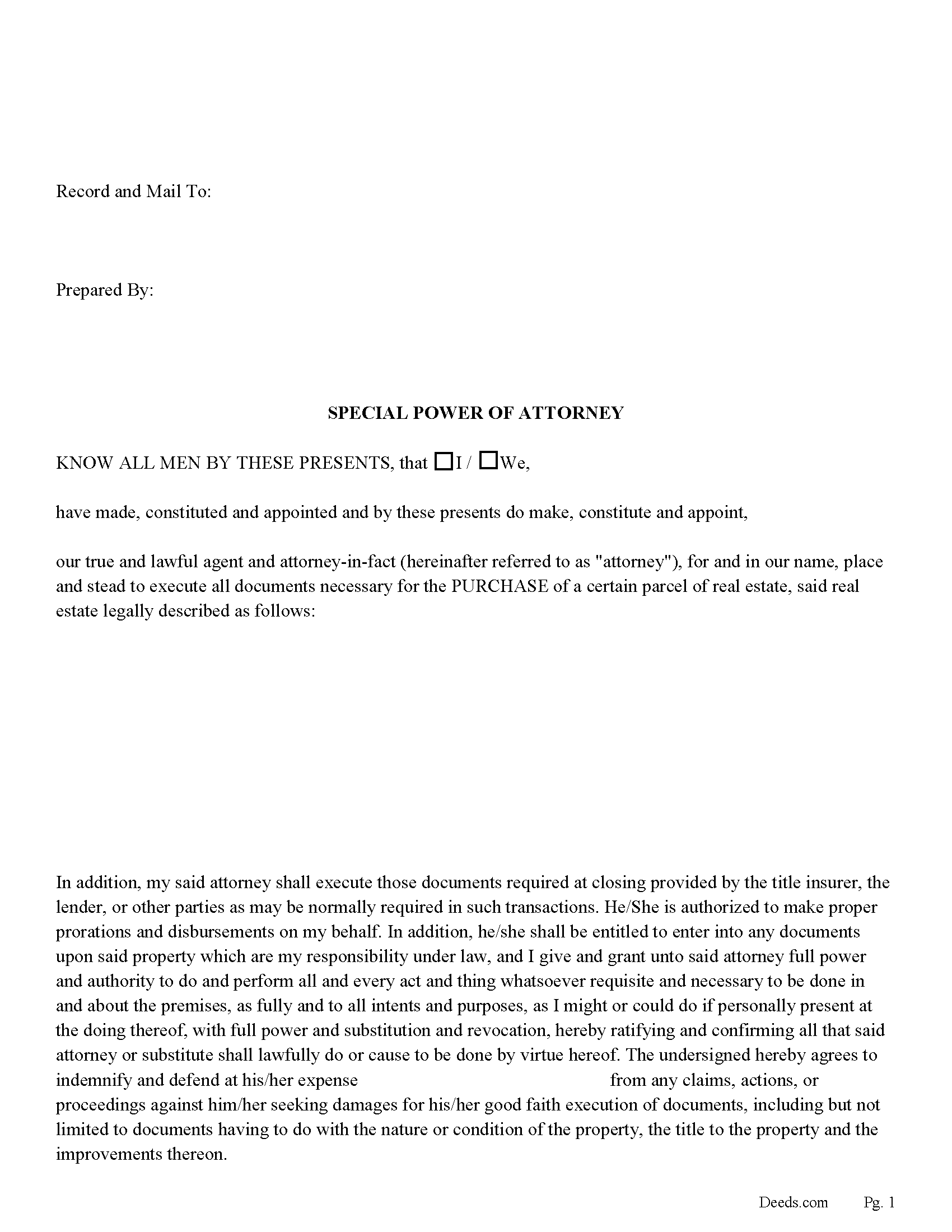

Special Power of Attorney for the Purchase of Property

Use this document to empower your agent with the right to PURCHASE a specific property on your behalf. The Agent shall be entitled to enter into any documents upon said property which are your responsibility under law, and you give and grant unto said agent full power and authority to do and perform all and every act and thing whatsoever requisite and necessary to be done in and about the premises, as fully and to all intents and purposes, as you might or could do if personally present at the doing thereof.

For use in Illinois only.

(Illinois Special POA - Purchase Package includes form, guidelines, and completed example)... More Information about the Illinois Special Power of Attorney for the Purchase of Property

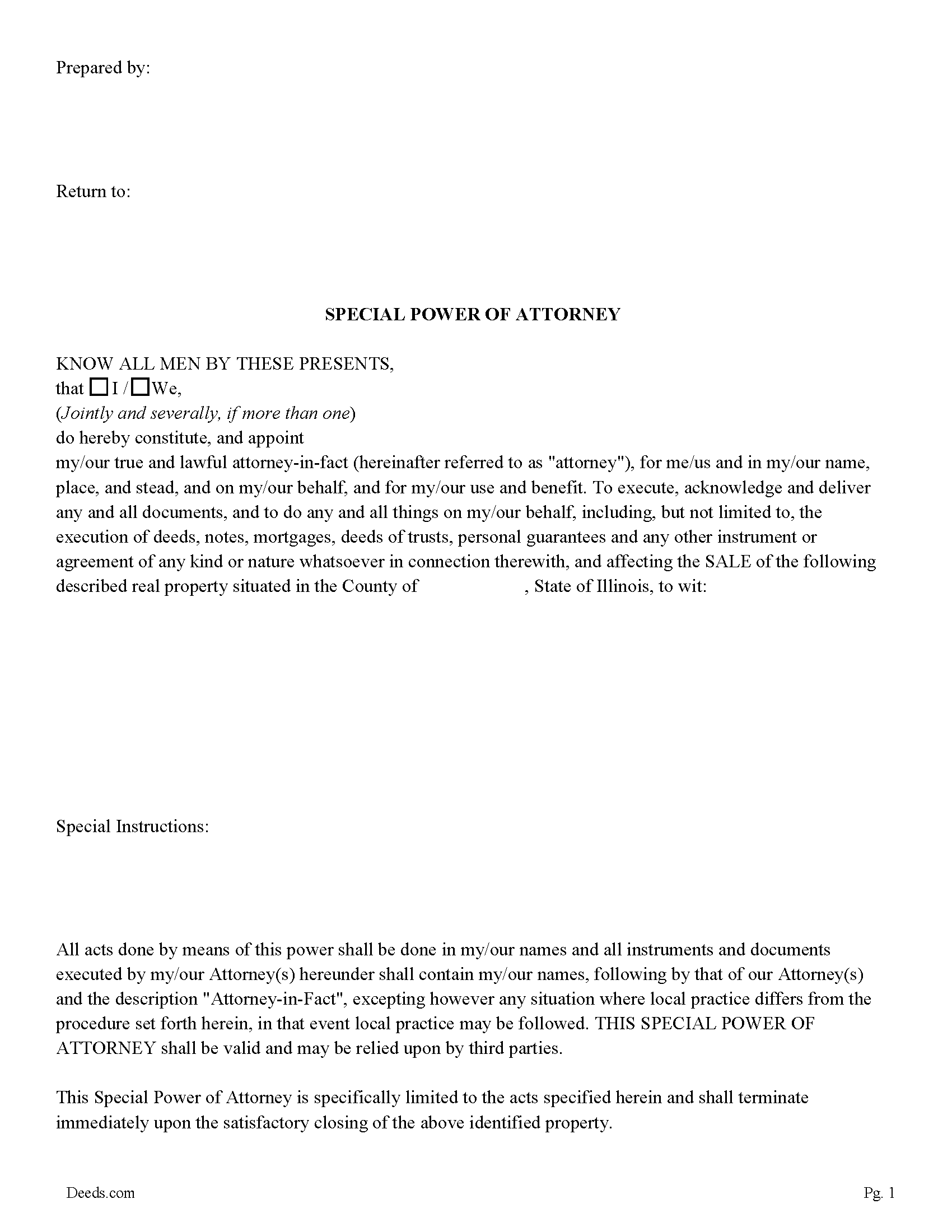

Special Power of Attorney for the Sale of Property

This form is used for the SALE of real property. The principle designates an agent and empowers him/her to act in all necessary legal documents and instruments for the sale of a specific property and terminates immediately upon the satisfactory closing of the specified property. It includes a "special instructions" section where the principle can limit or further define actions taken by the agent.

For use in Illinois Only.

(Illinois Special POA-Sale Package includes form, guidelines, and completed example)... More Information about the Illinois Special Power of Attorney for the Sale of Property

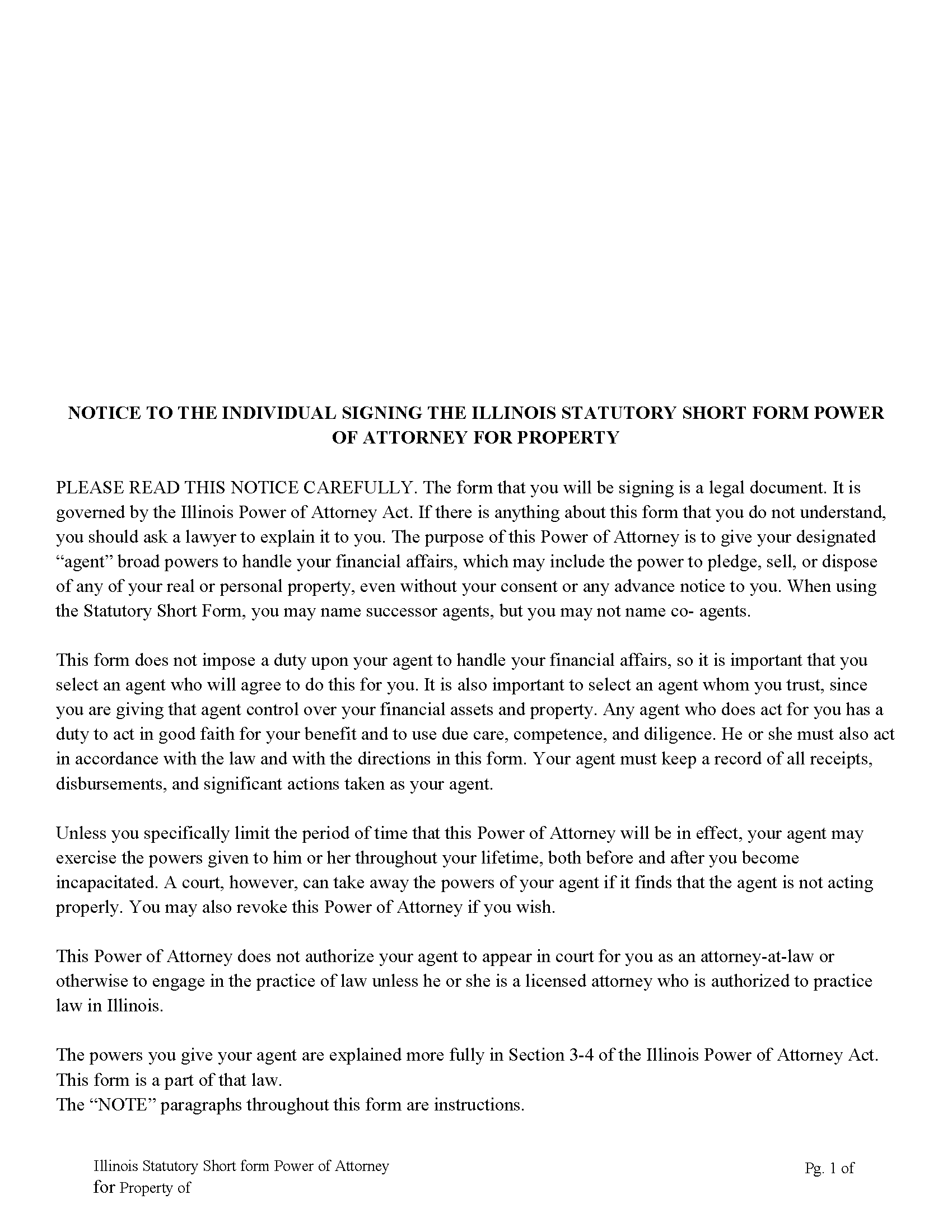

Statutory Short Form Power of Attorney for Property

This short for power of attorney allows for a primary agent and successor agents (agents who will act if the primary agent can't or won't act)

Categories that your agent can or can NOT perform. Each governed by Illinois Statutes.

(a) Real estate transactions.

(b) Financial institution transactions.

(c) Stock and bond transactions.

(d) Tangible personal property transactions.

(e) Safe deposit box transactions.

(f) Insurance and annuity transactions.

(g) Retirement plan transactions.

(h) Social Security, employment and military service benefits.

(i) Tax matters.

(j) Claims and litigation.

(k) Commodity and option transactions.

(l) Business operations.

(m) Borrowing transactions.

(n) Estate transactions.

(o) All other property transactions. (755 ILCS 45/3-4)

This is a recordable document, if you allow your agent to transfer real property, Title Companies and/or other third parties will usually require the power of attorney to be recorded before a transfer of real property can take place if it has not been done so previously. This power of attorney includes an addendum page to list real property.

(Illinois Statutory POA Package includes form, guidelines, and ... More Information about the Illinois Statutory Short Form Power of Attorney for Property

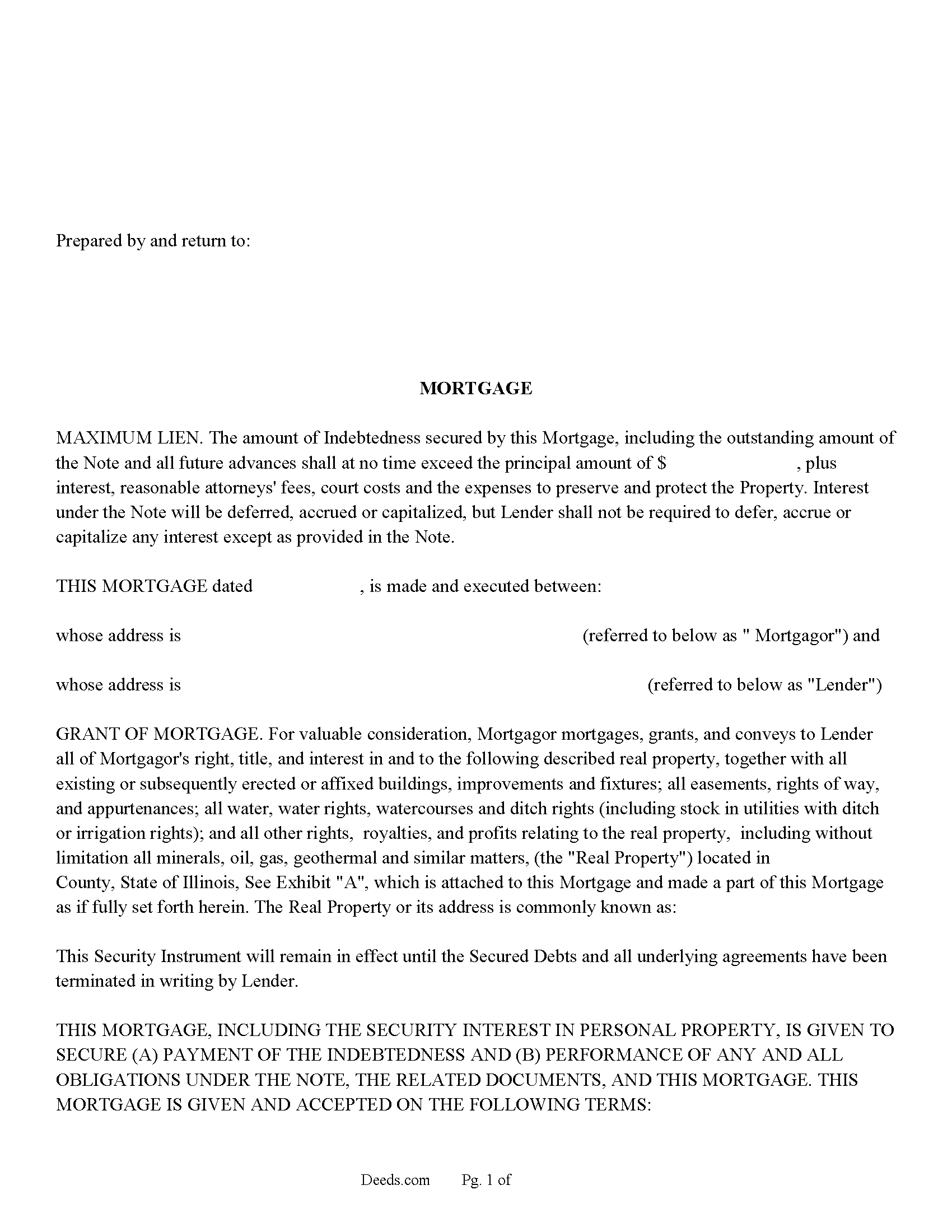

Mortgage Secured by Promissory Note

This Mortgage has stringent default provisions that is typically suited for a private Lender with financing of residential property, small business property, Rental units (up to 4 units), Condominiums, planned unit development and vacant land.

EVENTS OF DEFAULT. Each of the following, at Lender's option, shall constitute an Event of Default under this Mortgage:

Payment Default. Mortgagor fails to make any payment when due under the Indebtedness.

Default on Other Payments.

Other Defaults.

Default in Favor of Third Parties.

False Statements.

Defective Collateralization.

Death or Insolvency.

Creditor or Forfeiture Proceedings.

Events Affecting Guarantor.

Adverse Change.

RIGHTS AND REMEDIES ON DEFAULT. Upon the occurrence of an Event of Default and at any time thereafter, Lender, at Lender's option, may exercise any one or more of the following rights and remedies, in addition to any other rights or remedies provided by law:

Accelerate Indebtedness.

UCC Remedies.

Appoint Receiver.

Judicial Foreclosure.

Nonjudicial Sale.

Deficiency Judgment.

Tenancy at Sufferance.

Other Remedies - Lender shall have all other rights and remedies provided in this M... More Information about the Illinois Mortgage Secured by Promissory Note

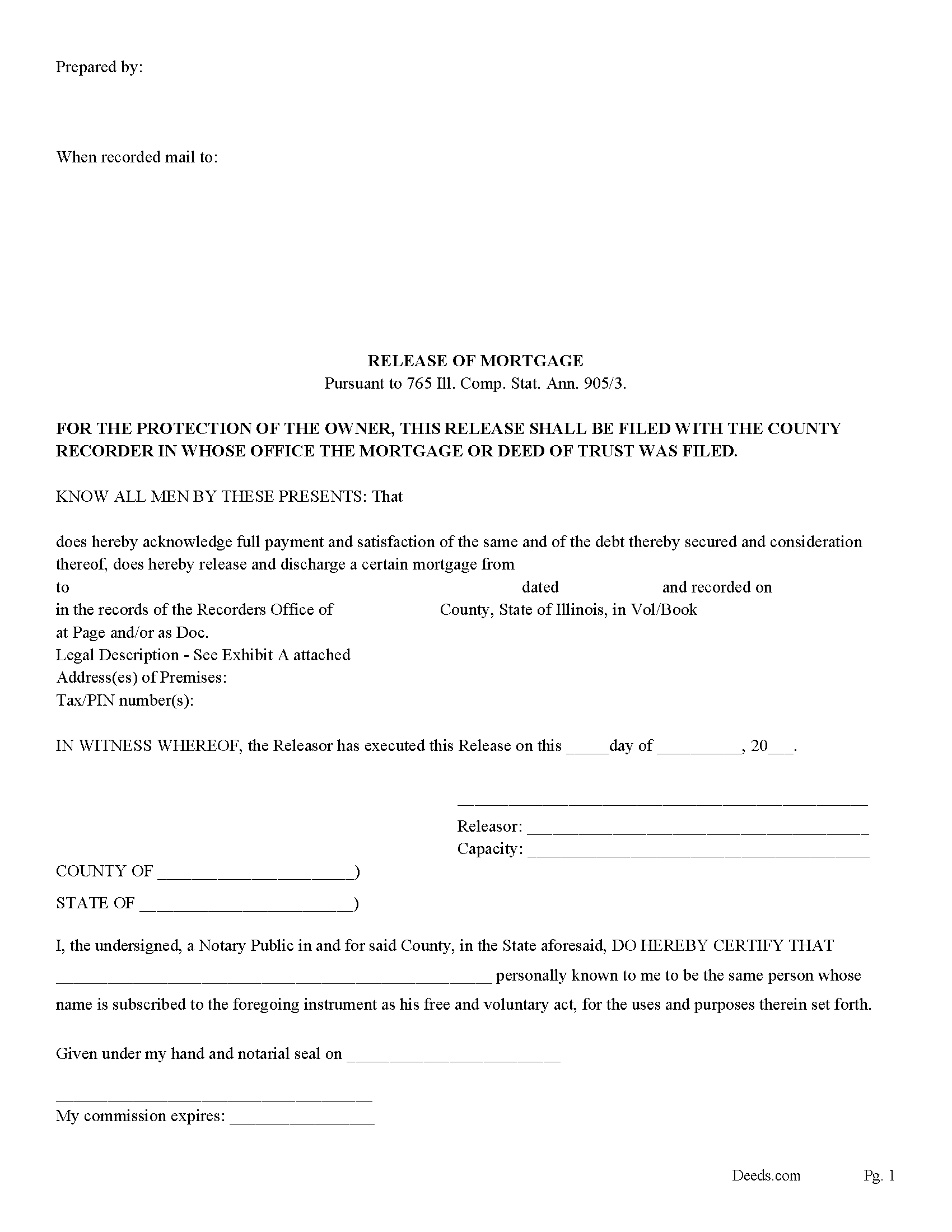

Release of Mortgage

This form may be used by the current mortgage holder or representative to release a mortgage that is paid in full.

To avoid penalty the (mortgagee)/lender, (his or her executor or administrator, heirs and assigns), generally has (30 days) to file the release (after the payment of the debt secured by such mortgage) (765 ILCS 905/4)

(765 ILCS 905/3) (from Ch. 95, par. 53)

Sec. 3. An instrument in writing which releases a mortgage or trust deed of real property may be acknowledged or proved in the same manner as deeds for the conveyance of land.

(Source: Laws 1961, 1st Spec.Sess., p. 42.)

If the release is delivered to the mortgagor or grantor, it must have imprinted on its face in bold letters at least 1/4 inch in height the following: "FOR THE PROTECTION OF THE OWNER, THIS RELEASE SHALL BE FILED WITH THE RECORDER OR THE REGISTRAR OF TITLES IN WHOSE OFFICE THE MORTGAGE OR DEED OF TRUST WAS FILED".

(765 ILCS 905/2)

(Illinois Release of Mortgage Package includes form, guidelines, and completed example)

... More Information about the Illinois Release of Mortgage

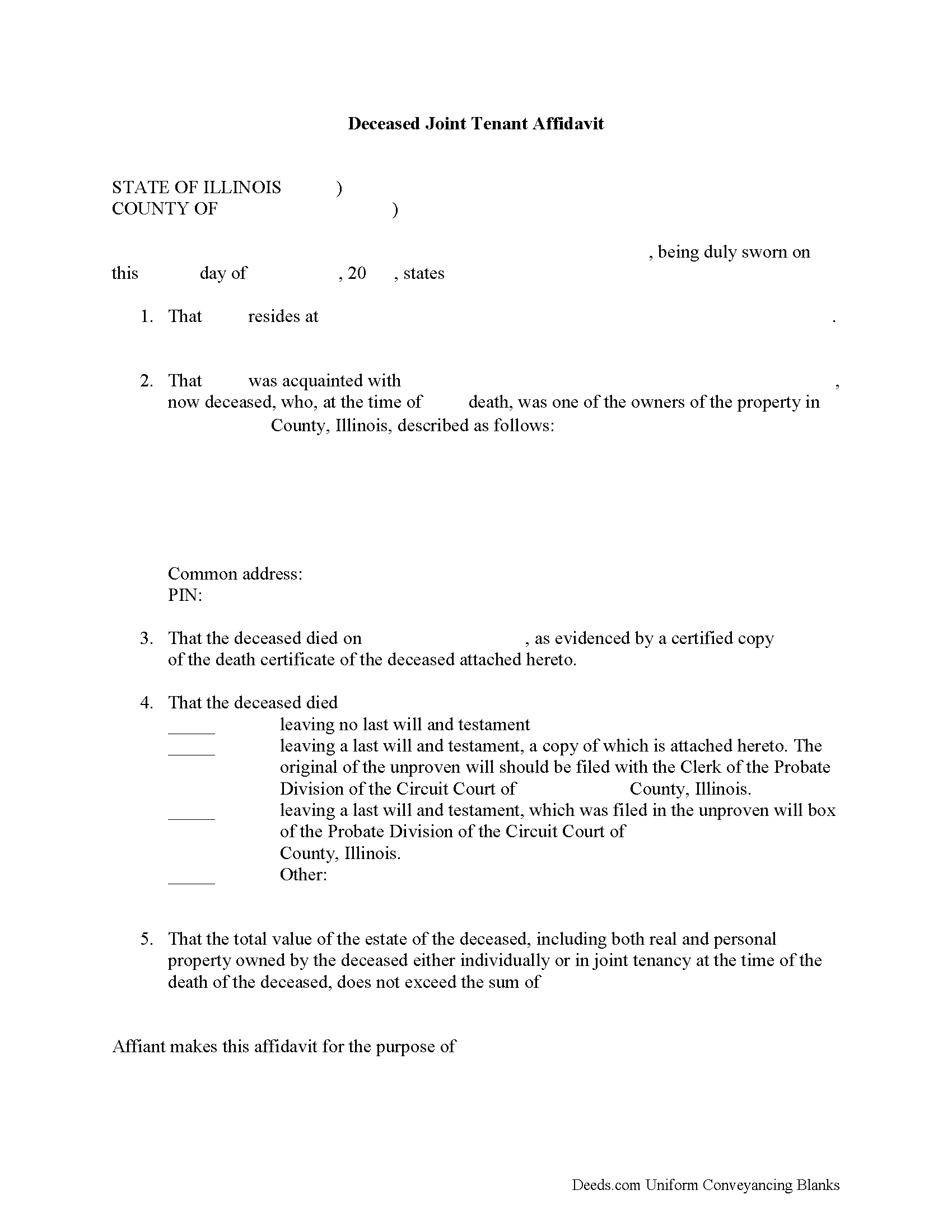

Deceased Joint Tenant Affidavit

Complete this affidavit and submit it, along with a certified copy of the decedent's death certificate (required) and last will and testament (if available), to the county office responsible for maintaining land records. Once recorded, it serves as public notice of the change in property ownership.

(Illinois Deceased Joint Tenant Package includes form, guidelines, and completed example)... More Information about the Illinois Deceased Joint Tenant Affidavit

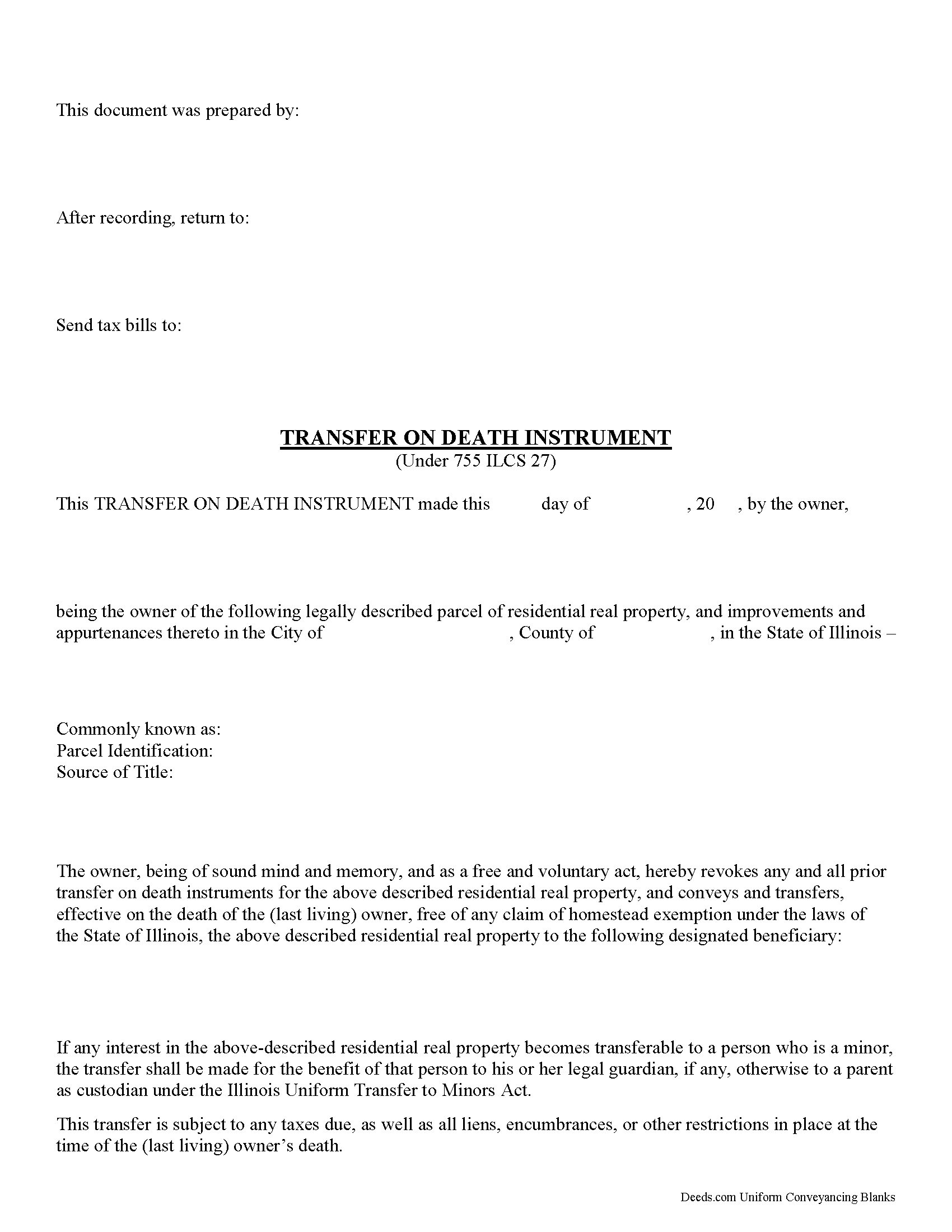

Transfer on Death Instrument

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)... More Information about the Illinois Transfer on Death Instrument

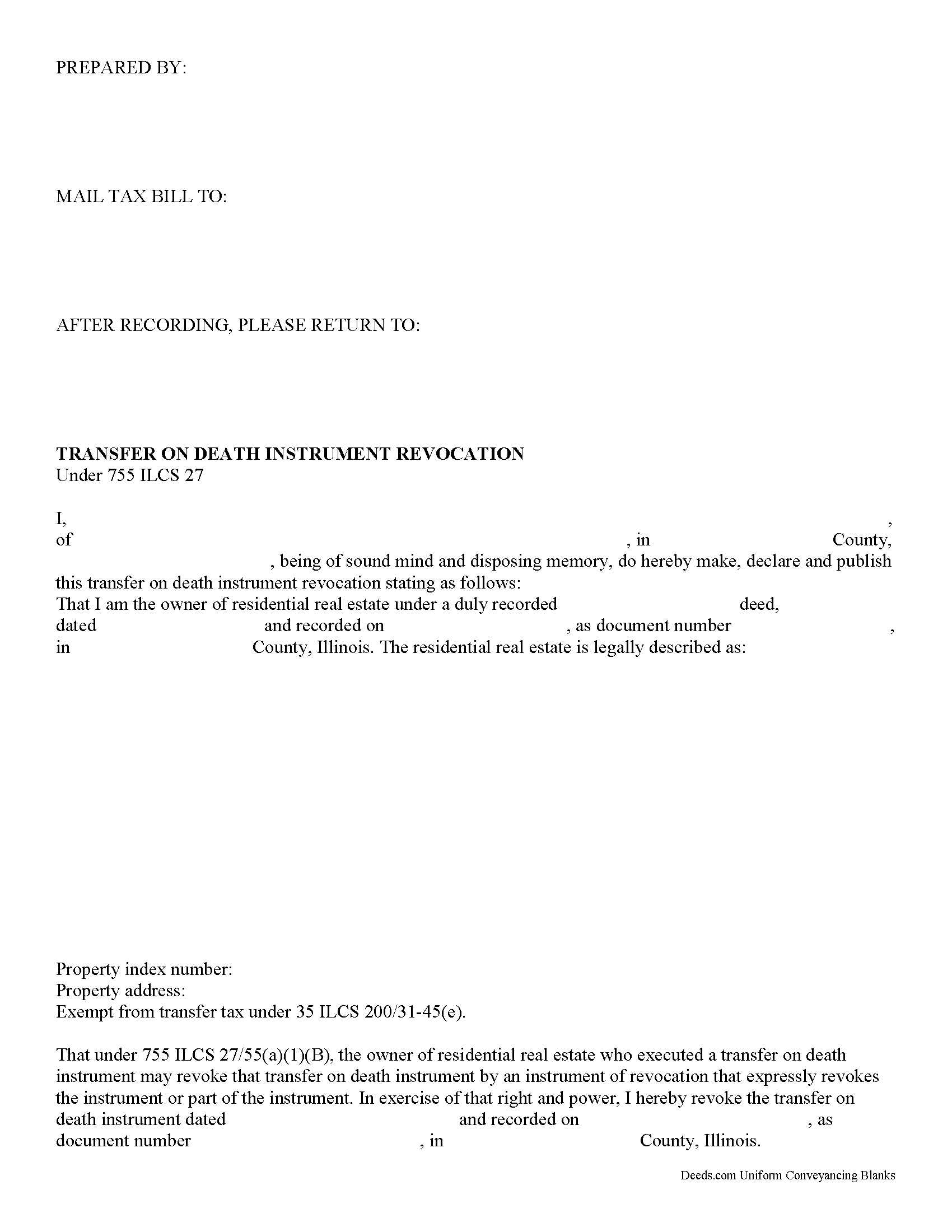

Transfer on Death Revocation

Revoking an Illinois transfer on death instrument is governed by 755 ILCS 27.

One of the many useful aspects of the Illinois transfer on death instrument (TODI) is the ability to revoke it with no penalty to the owner and no obligation to the beneficiary. If the owner, who already executed and recorded a TODI, decides, for any reason, to cancel the future transfer, completing, executing, and recording a revocation will negate the prior document and prevent the former beneficiary from gaining ownership of the residential real property covered by the TODI.

Complete, sign, and record this form to revoke a previously executed and recorded transfer on death instrument for residential real property in the state of Illinois.

Note that the requirements for executing a revocation are similar to those of the TODI. The owner must sign the revocation in the presence of two adult witnesses who are not otherwise involved with the transaction. Additionally, a notary public or other individual who is authorized by the courts to administer oaths must be present to certify the identities and signatures of the owner and the witnesses.

(Illinois Transfer on Death Revocation Package includ... More Information about the Illinois Transfer on Death Revocation

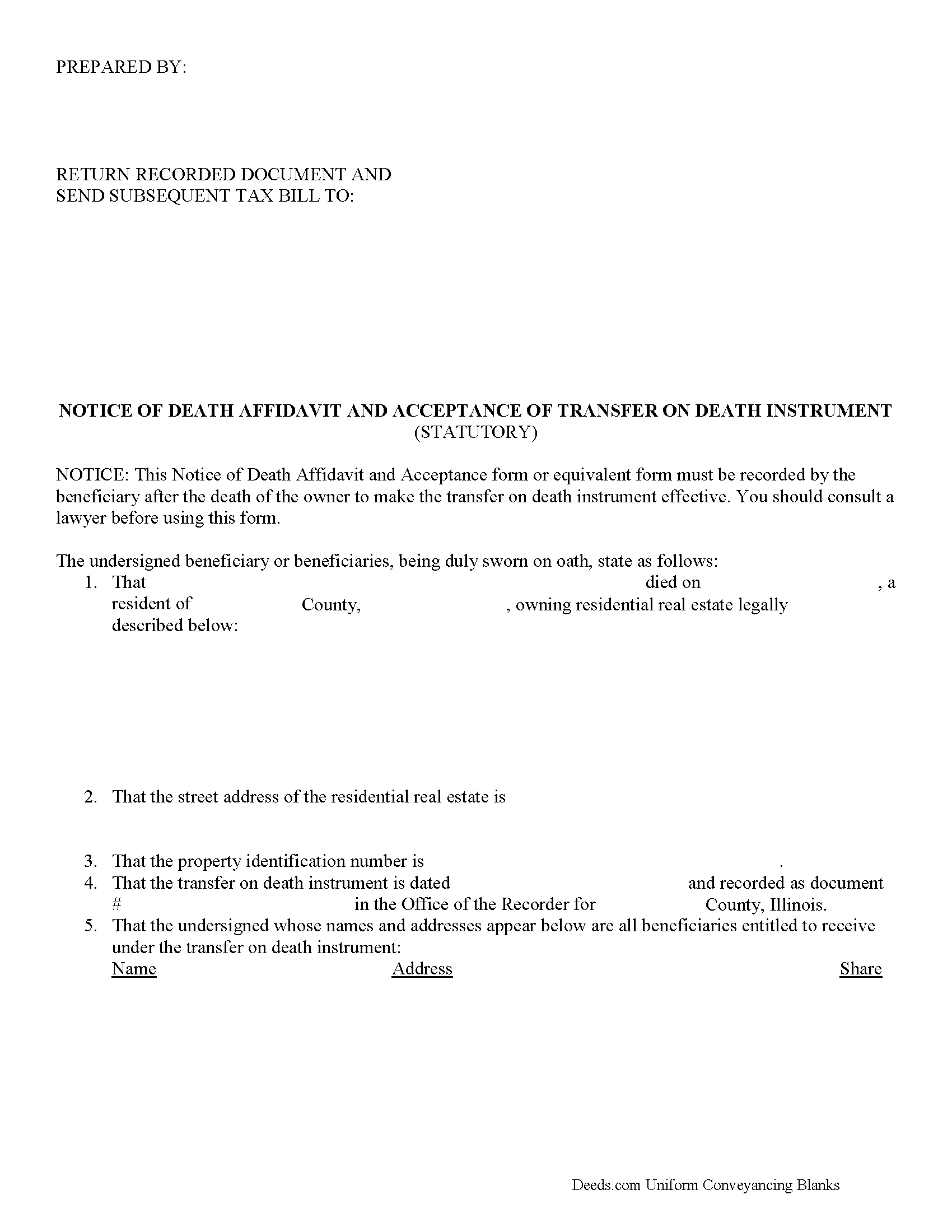

Notice of Death Affidavit and Acceptance

Complete and record this required statutory affidavit to finalize the transfer of residential real property initiated with the Illinois transfer on death instrument as governed by 755 ILSC 27.

A transfer on death instrument is effective as of the owner's death upon the filing of a notice of death affidavit and acceptance by the beneficiary or beneficiaries in the office of the recorder in the county or counties where the residential real estate is located. The notice of death affidavit and acceptance shall contain the name and address of each beneficiary who shall take under the transfer on death instrument, a legal description of the property, the street address, and parcel identification number of the residential real estate, the name of the deceased owner, and the date of death. The notice of death affidavit and acceptance shall be signed by each beneficiary or by the beneficiary's authorized representative.

(Illinois Notice of Death Affidavit Package includes form, guidelines, and completed example)... More Information about the Illinois Notice of Death Affidavit and Acceptance

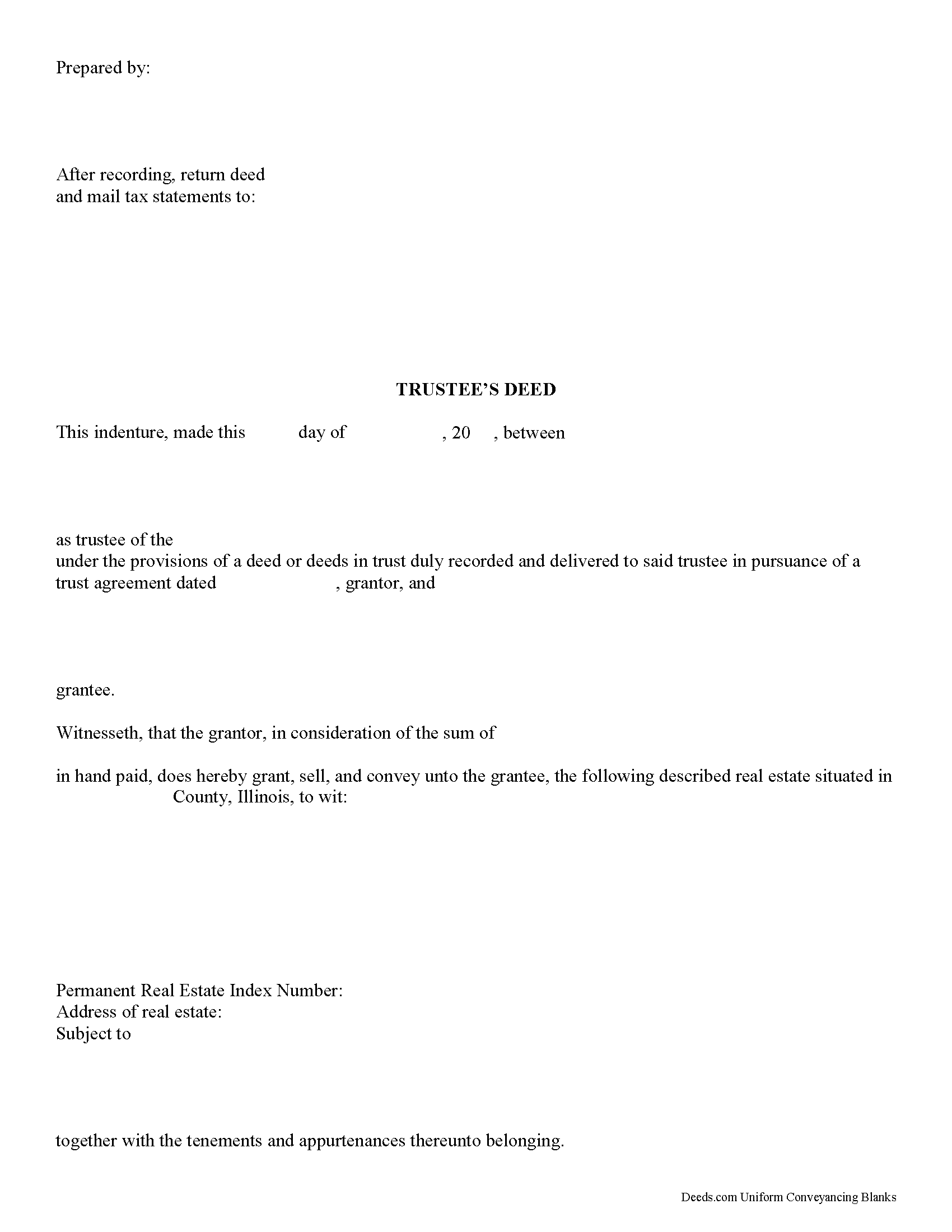

Trustee Deed

In Illinois, a trustee's deed is used to transfer real property out of a trust. The deed is named for the person executing it -- the trustee. According to Black's Law Dictionary, 8th ed., a trustee is someone who, having legal title to property, holds it in trust for the benefit of another and owes a fiduciary duty to that beneficiary. A fiduciary is someone who must exercise a high standard of care in managing another's money or property.

The trustee's deed establishes basic information about the trust, such as the name and date of the trust document. The trustee serves as the grantor in the deed, and transfers the title into the grantee's name. As with all other conveyances of real property, the deed requires a legal description of the property being conveyed, as well as a Property Identification Number (PIN) and commonly known address. For a valid transfer, the trustee must sign the deed in the presence of a notary, who confirms (notarizes) the signature.

(Illinois Trustee Deed Package includes form, guidelines, and completed example)

... More Information about the Illinois Trustee Deed

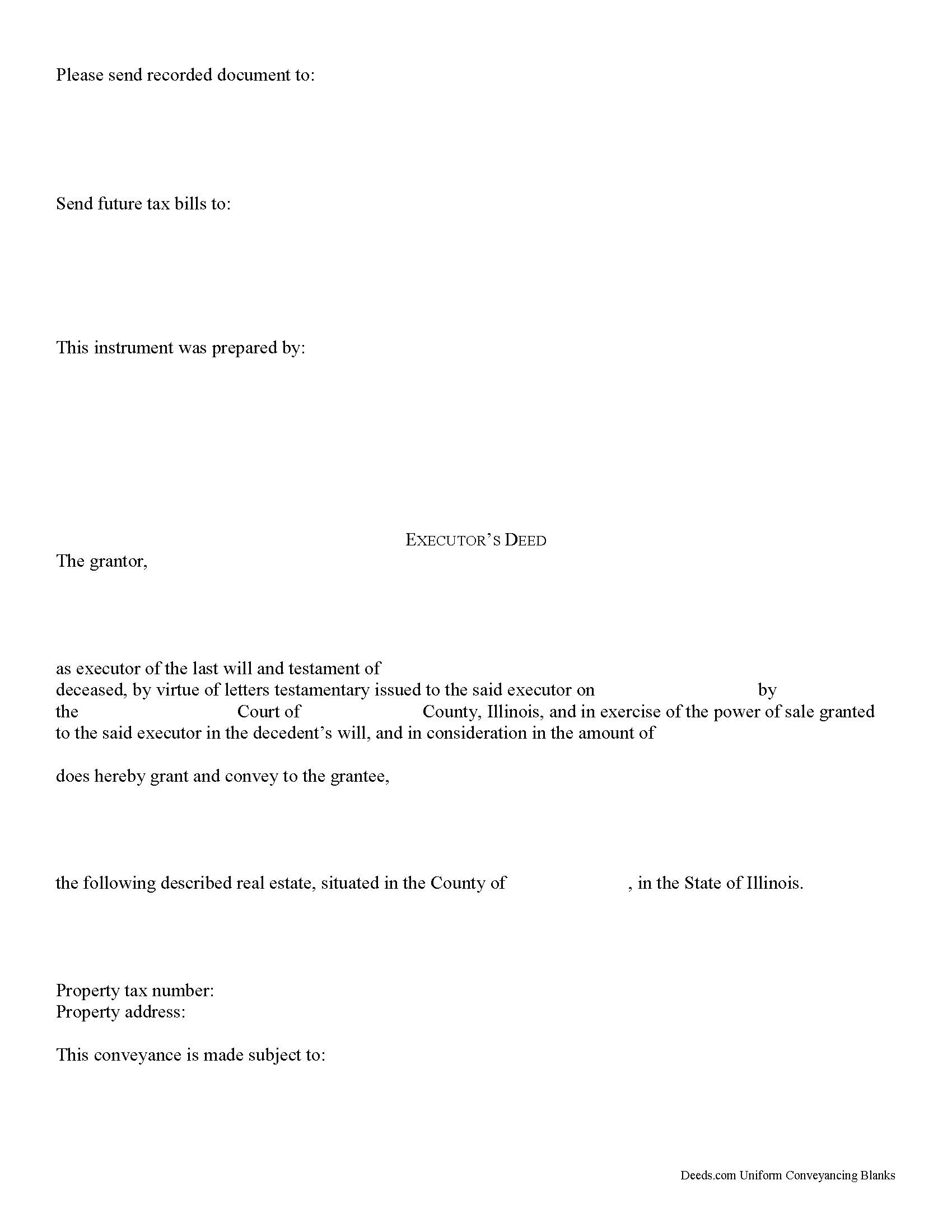

Executor Deed

Find the laws governing the probate administration of real estate at 755 ILCS 5/20.

The executor of an estate is a person named in the decedent's will to manage the distribution of the estate's assets.

An executor's deed is a special document used by the executor of a decedent's estate to transfer real property out of that estate. This document must meet the same form and content standards as so-called "regular" warranty or quitclaim deeds, and incorporate additional information related to the specific transaction. The details may vary based on the situation, but typically include facts about the decedent and the nature of the probate case. (765 ILCS 5/12)

Depending on the case, the executor might include documents such as letters from the probate court or a certified copy of the death certificate when recording the deed. Consult with the court officer or attorney supervising the distribution to confirm which, if any, supporting documentation might be required. After the deed is executed (signed in front of a notary), confirm it with the court if necessary, then file it in the public records for the Illinois county where the property is located.

This information appli... More Information about the Illinois Executor Deed

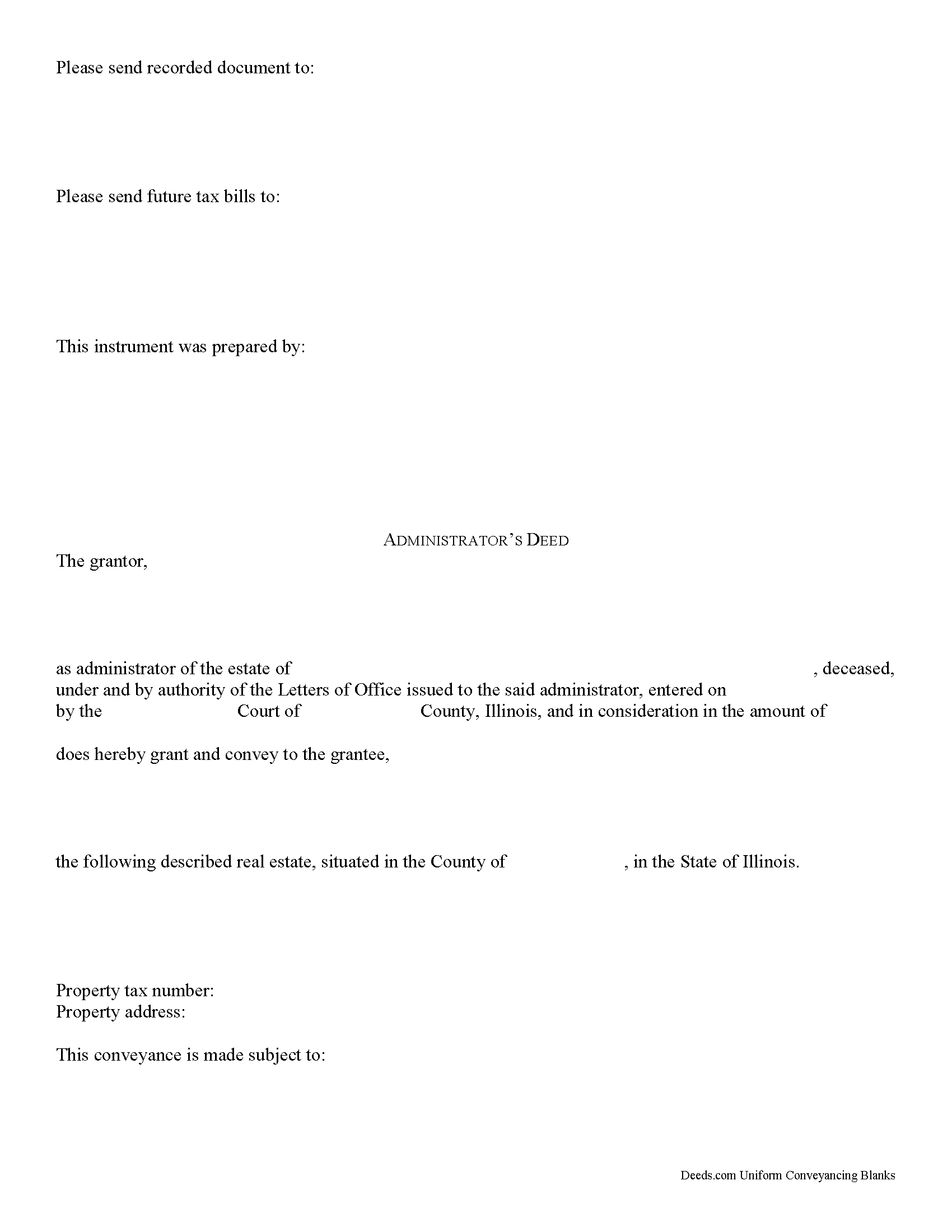

Administrator Deed

Review the Illinois laws governing the probate administration of real estate at 755 ILCS 5/20.

Administrators are individuals appointed by the probate court to handle the distribution of a probate estate. In general, this happens when the decedent died without a will (intestate), but they can also replace named executors who are is unable to perform the necessary tasks, and no suitable alternates are found.

An administrator's deed is a special document used by the authorized administrator of a decedent's estate to transfer real property out of that estate. It must meet the same form and content standards as so-called "regular" warranty or quitclaim deeds, and incorporate additional information related to the specific transaction. The details may vary based on the situation, but typically include facts about the decedent and the nature of the probate case. (765 ILCS 5/12).

Depending on the case, the administrator might need to include documents such as letters from the probate court or a certified copy of the death certificate when recording the deed. Consult with the court officer or attorney supervising the distribution to confirm which, if any, supporting documentatio... More Information about the Illinois Administrator Deed

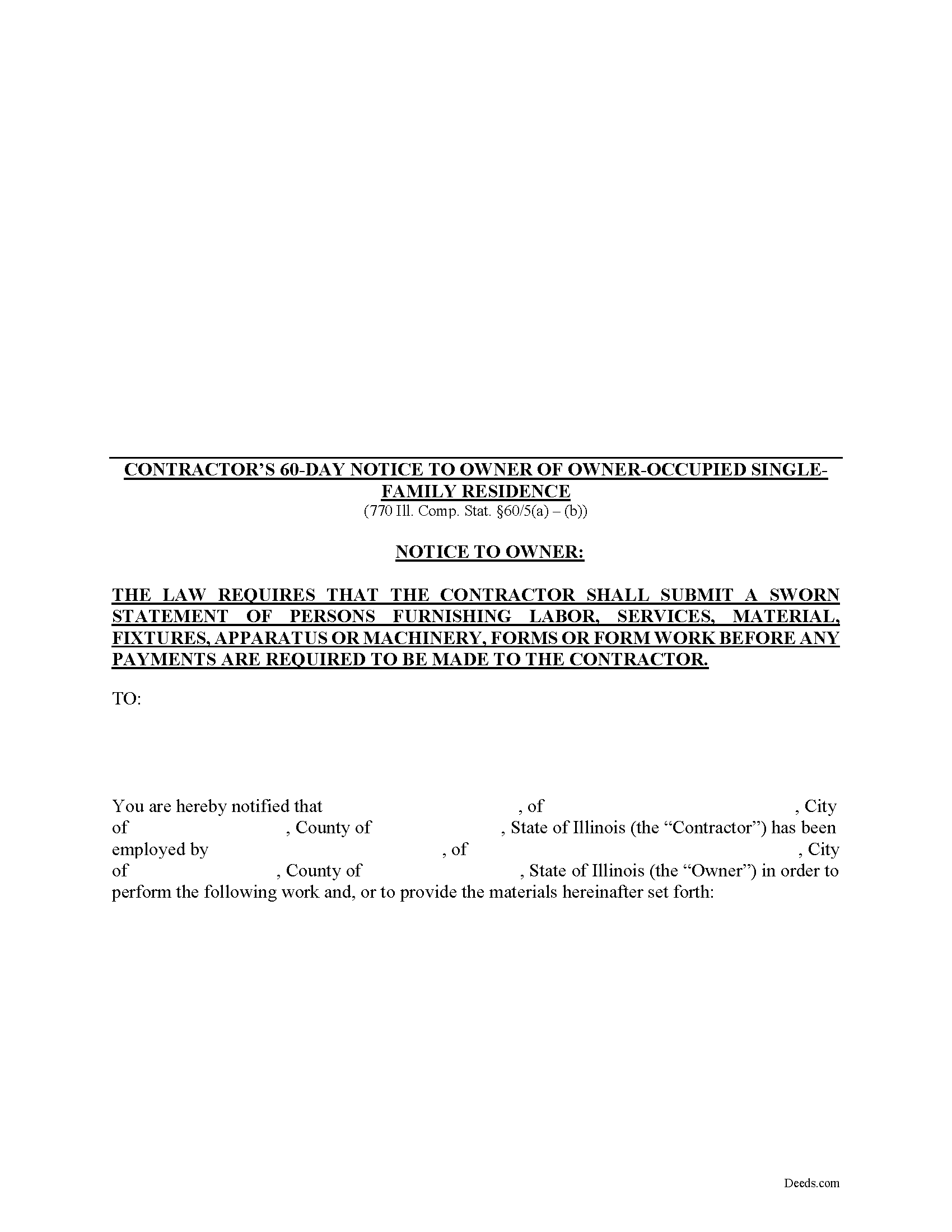

Contractor 60-Day Residential Notice

In Illinois, a contractor furnishing labor, services, material, fixtures, apparatus or machinery must provide a work notice to a residential owner setting forth the contract price, description of work, names and addresses of all subcontractors or material suppliers and other laborers and amounts due to each.

Under Illinois law governing mechanic's liens, the contractor has a duty to give the owner a statement in writing, under oath or verified by affidavit, of the names and addresses of all parties furnishing labor, services, material, fixtures, apparatus or machinery, forms or form work and of the amounts due or to become due to each. 770 Ill. Comp. Stat. 60/5(a). The property owner also has a duty to request this statement from the contractor before the owner (or his agent, architect, or superintendent) makes a payment to the contractor. Id. Merchants and dealers in materials are not required to make this statement. Id.

In regard to any owner-occupied single-family residence, 770 Ill. Comp. Stat. 60/5(b)(i) states that each contractor must provide the owner or his or her agent, (either as part of the contract or as a separate printed statement) with the following statement ... More Information about the Illinois Contractor 60-Day Residential Notice

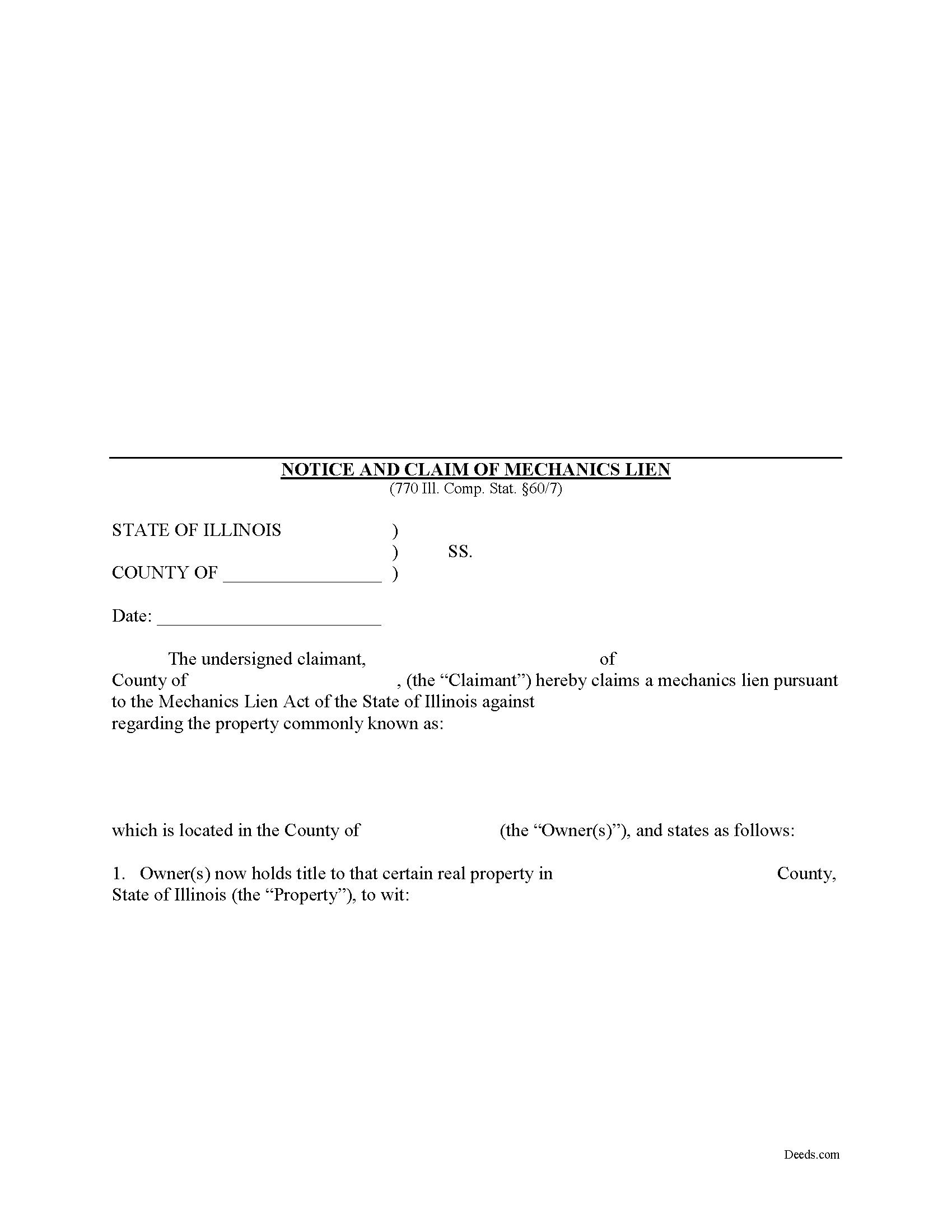

Mechanics Lien

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60 for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals.

A lien is a type of property interest, like a mortgage, in which the lienor retains a claim against the property if it is later sold. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects, not those associated with public (government) entities.

When you provide labor or materials on a contract job and the client never pays the invoice, filing a mechanic's lien is the next step in recovering the amount due. NOTE: Subcontractors must individually file 60-day (owner-occupied residential projects only) and 90-day notices to access their lien rights.

Mechanic's liens demand strict deadlines and missing the filing date by even one day can cost you your right to a lien. In Illinois, the time to file a lien arises within four months from the last date you or any of your employees furnished labor or delivered materials to the jobsite. The four-month period applies to your right against all third parties and... More Information about the Illinois Mechanics Lien

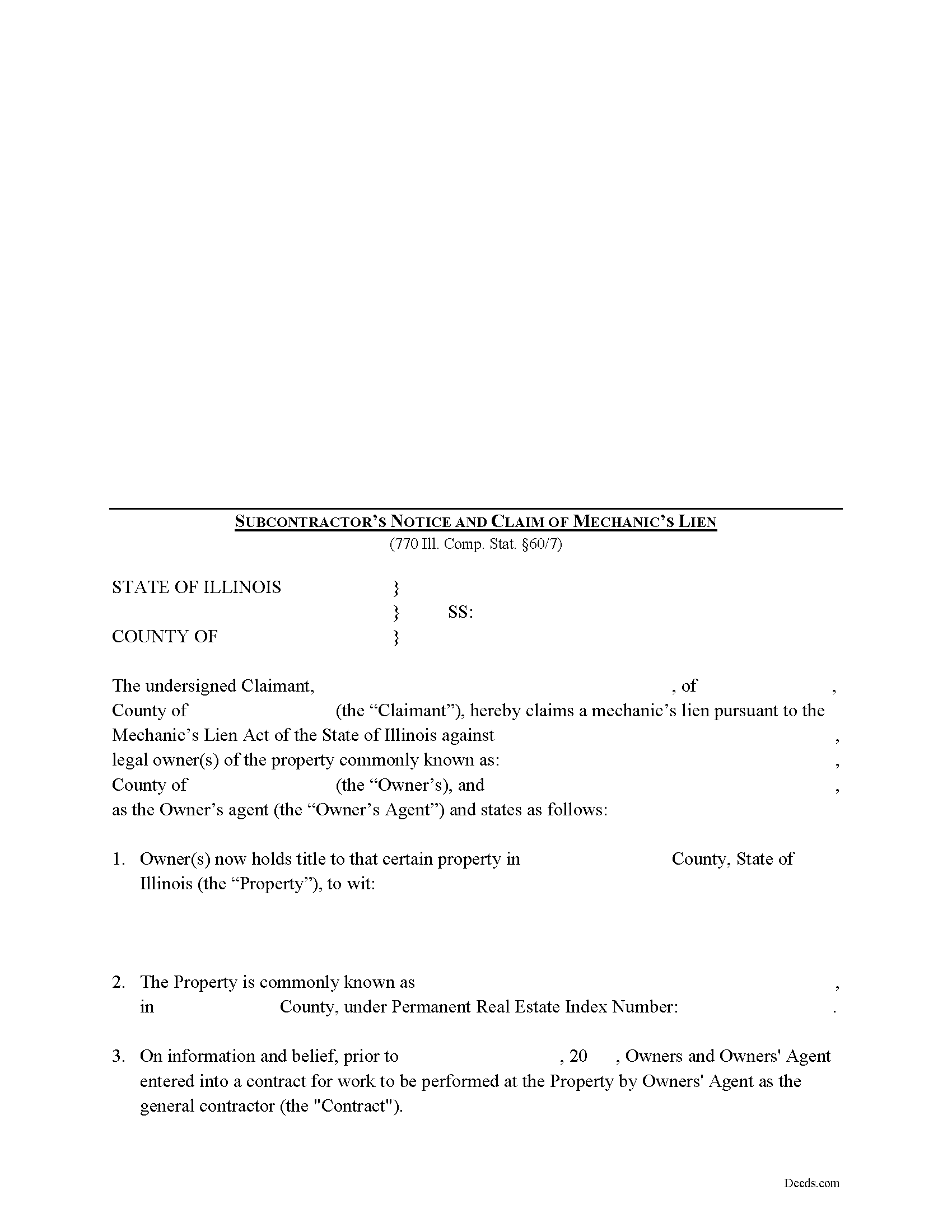

Mechanics Lien Subcontractor

Lien Claims by Subcontractor in Illinois

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60. Liens are generally available for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals. Subcontractors claiming a mechanic's lien should use the specialized form that references the contract between the property owner and the contractor (referred to as his or her agent in the lien claim document).

A lien is a type of property interest, like a mortgage. There are many types of liens such as tax liens, attorneys' liens, and judgment liens. A lien operates by allowing the lienor to make a claim against the property if it is later sold. Therefore, for a sale to occur, the property owner is required to disclose the existence of the lien to any potential purchaser and the sales proceeds must be used to pay off that lien. If the lien exceeds the value of the property this creates something known as a "deficiency," which must be recovered through a lawsuit. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects and not those as... More Information about the Illinois Mechanics Lien Subcontractor

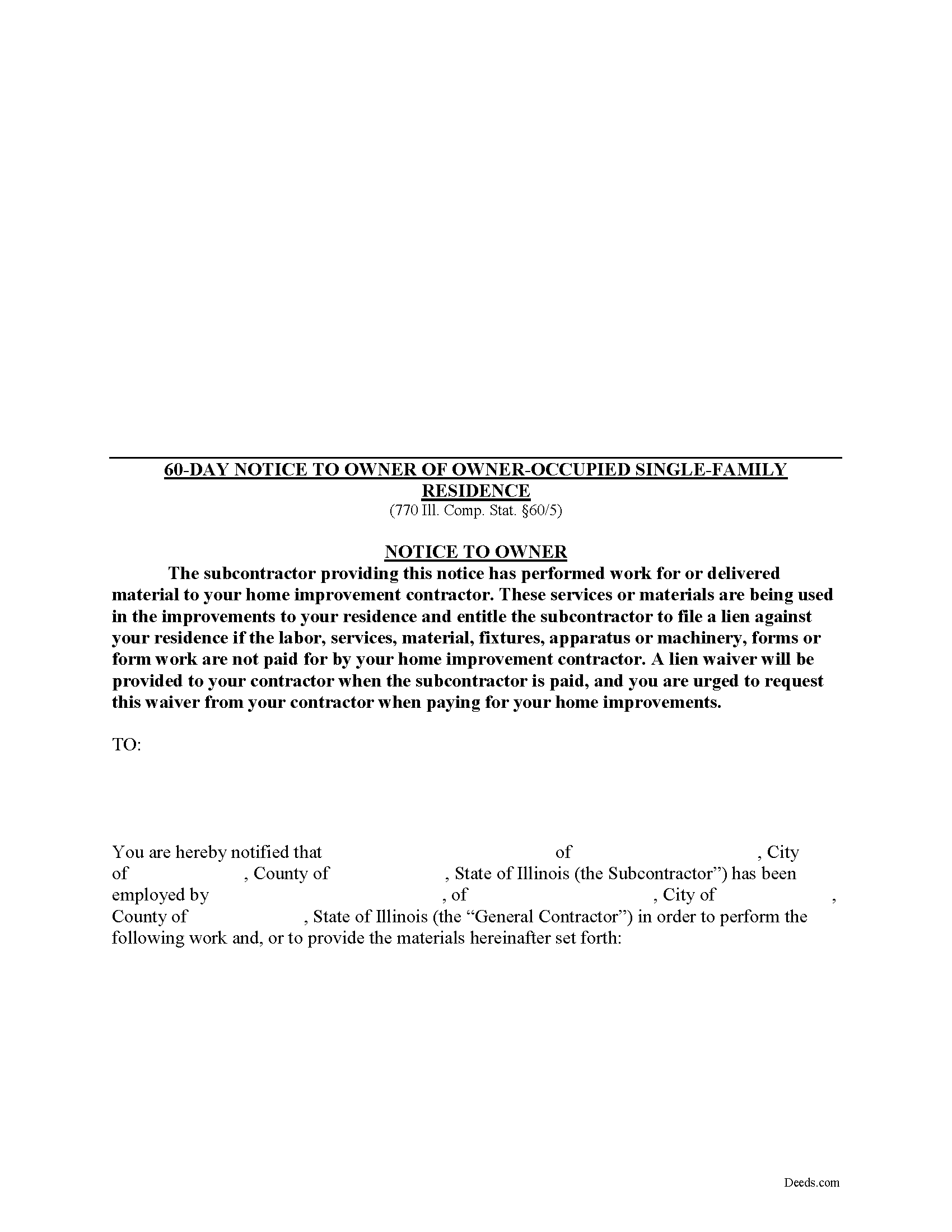

Mechanics Lien Preliminary 60 Day Notice

This statutory form is for a subcontractor's preliminary (60-Day) notice requirement for Illinois Mechanic's Liens

In Illinois, eligible contractors must provide a property owner with the required forms of preliminary notice before leveraging a mechanic's lien. The notice forms include a 60-day and 90-day notice.

Under the state law, the contractor is required to provide the property owner with a statement in writing, made under oath or verified by affidavit, containing the names and addresses of all parties furnishing labor, services, material, fixtures, apparatus or machinery and of the amounts due or to become due to each before payment is made. 770 Ill. Comp. Stat. 60/5(a).

For residential jobs, there are additional requirements. Each subcontractor who has furnished, or is furnishing labor, services, or equipment shall notify the occupant either personally or by certified mail addressed to the occupant or his agent at the residence within 60 days from his first day of work on the job. 770 Ill. Comp. Stat. 60/5(b)(ii). The notice contains the name and address of the subcontractor or material man, the date he started to work or to deliver materials, the type of work req... More Information about the Illinois Mechanics Lien Preliminary 60 Day Notice

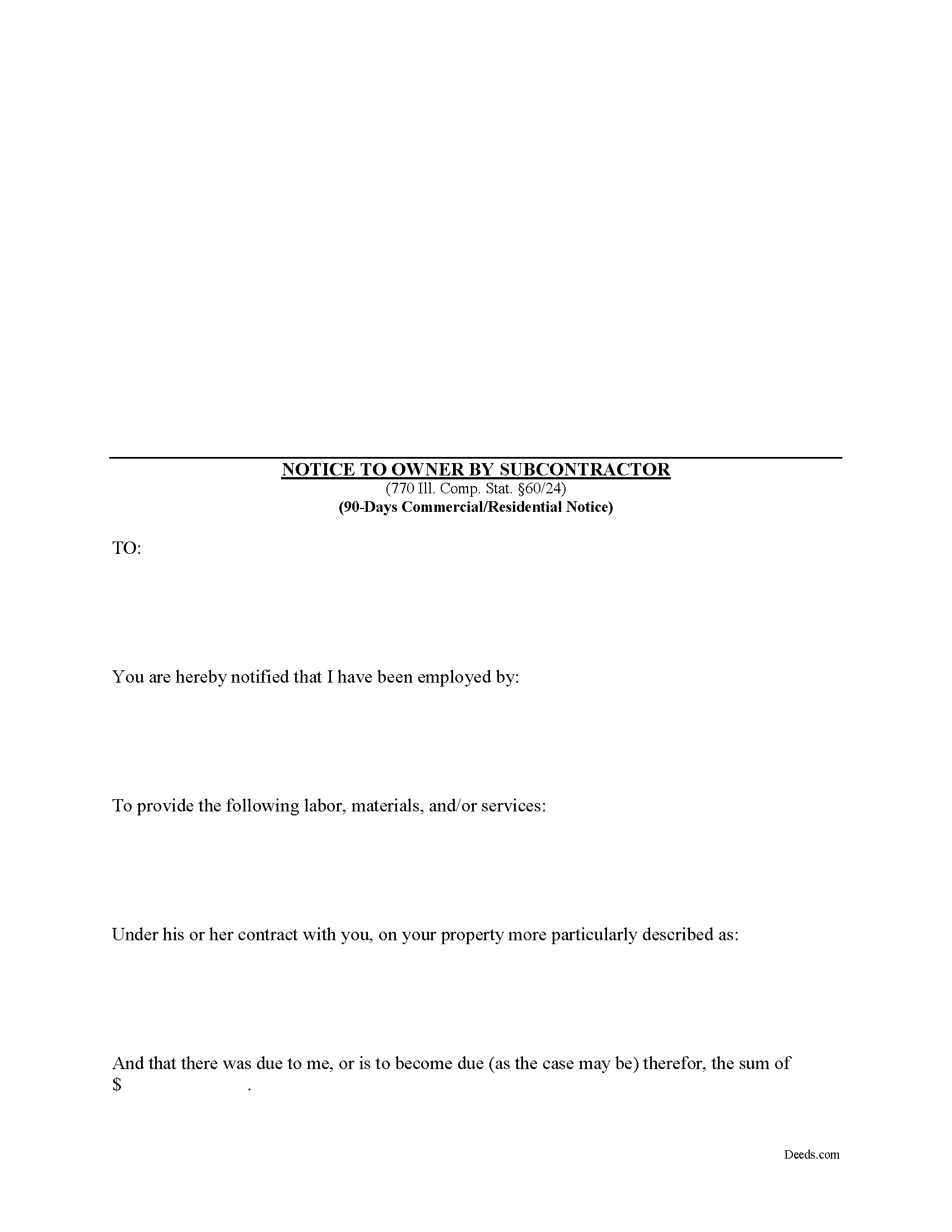

Mechanics Lien Preliminary 90 Day Notice

This statutory form is meant for use by subcontractors or others who are not directly contracted for work with the property owner.

For residential, owner-occupied projects, the 90-day notice form is the second preliminary notice sent in anticipation of filing a lien (the 60-day notice must be served beforehand sent via certified mail within 60 days from the first furnishing). For a commercial project, the 90-day form is the first notice sent to the owner. Either way, both commercial and residential jobs require the 90-day notice prior to filing a lien. 770 Ill. Comp. Stat. 60/24(a).

The 90-day notice is a demand for payment that must be sent by all contractors, subcontractors, laborers, and material/equipment suppliers who have not directly contracted with the owner or the owner's agent. Note that all eligible workers must send the notice within 90 days after the final furnishing of work or delivery of materials to the jobsite. Id. Any substantial additional or extra work can enlarge the time, but mere corrections of previously completed work will not affect the end date. Be aware the time is 90 days, not three months, so count 90 days from the date labor or materials were la... More Information about the Illinois Mechanics Lien Preliminary 90 Day Notice

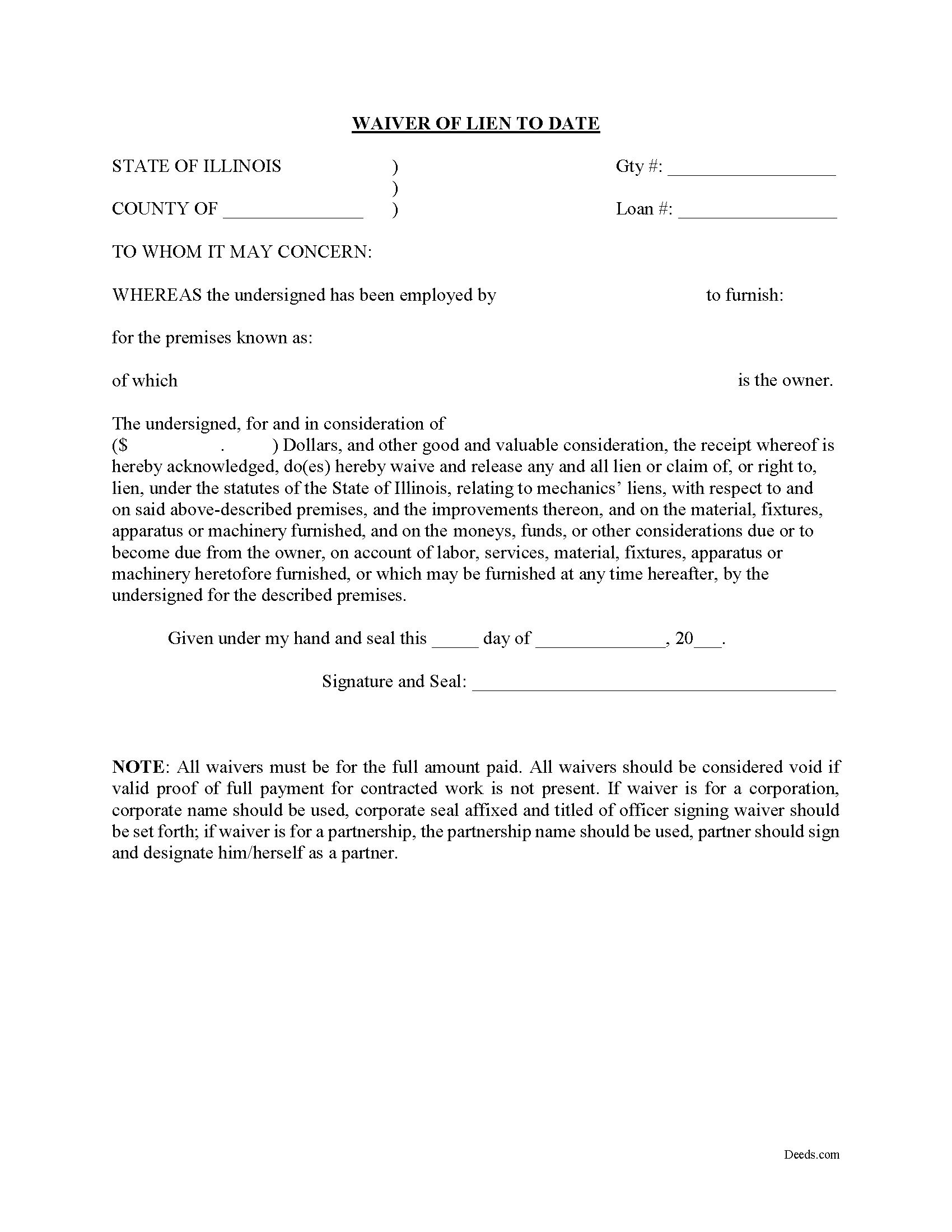

Waiver of Lien to Date

Under 770 ILCS 60, Illinois' Mechanic's Lien Act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

A lien waiver is useful for property owners because it assures them that a lien will not be placed on their property, and for contractors because presenting the waiver can encourage the owner to pay. Therefore, a waiver offers a quid pro quo arrangement with benefits for both sides. Waivers can be conditional, meaning they go into effect based upon actual receipt of payment as a triggering event, or unconditional, meaning the waiver takes effect upon being sent to the owner or prime contractor.

The Waiver of Lien to Date is for a subcontractor and contractor to sign upon receipt of a partial payment from the customer. The parties should ensure the payment has been made (meaning any check has been deposited and cleared) before signing the waiver. The Waiver of Lien to Date includes an affidavit to be completed by the contractor listing all parties contracted with, the contract amounts, payment amount... More Information about the Illinois Waiver of Lien to Date

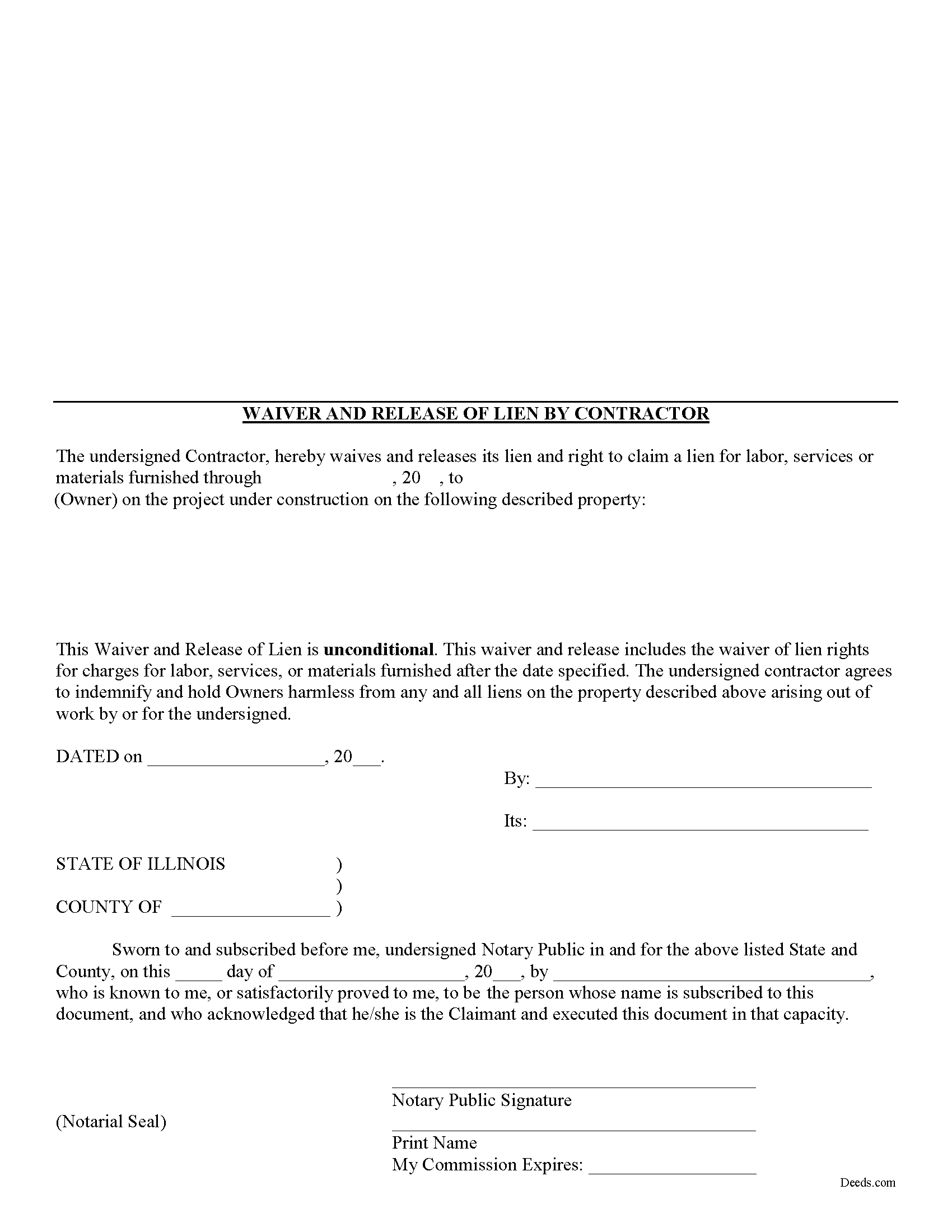

Unconditional Waiver and Release of Mechanic Lien

Illinois Unconditional Waiver and Release of Mechanic's Lien

Under 770 ILCS 60, Illinois' Mechanic's Lien act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

Contractors may use this form to waive and release a right to a mechanic's lien. A contractor waives and releases its lien and right to claim a lien for labor, services, or materials on a construction project described in the document.

Contact an attorney with questions about an unconditional waiver and release, or any other issues related to mechanic's liens in Illinois.... More Information about the Illinois Unconditional Waiver and Release of Mechanic Lien

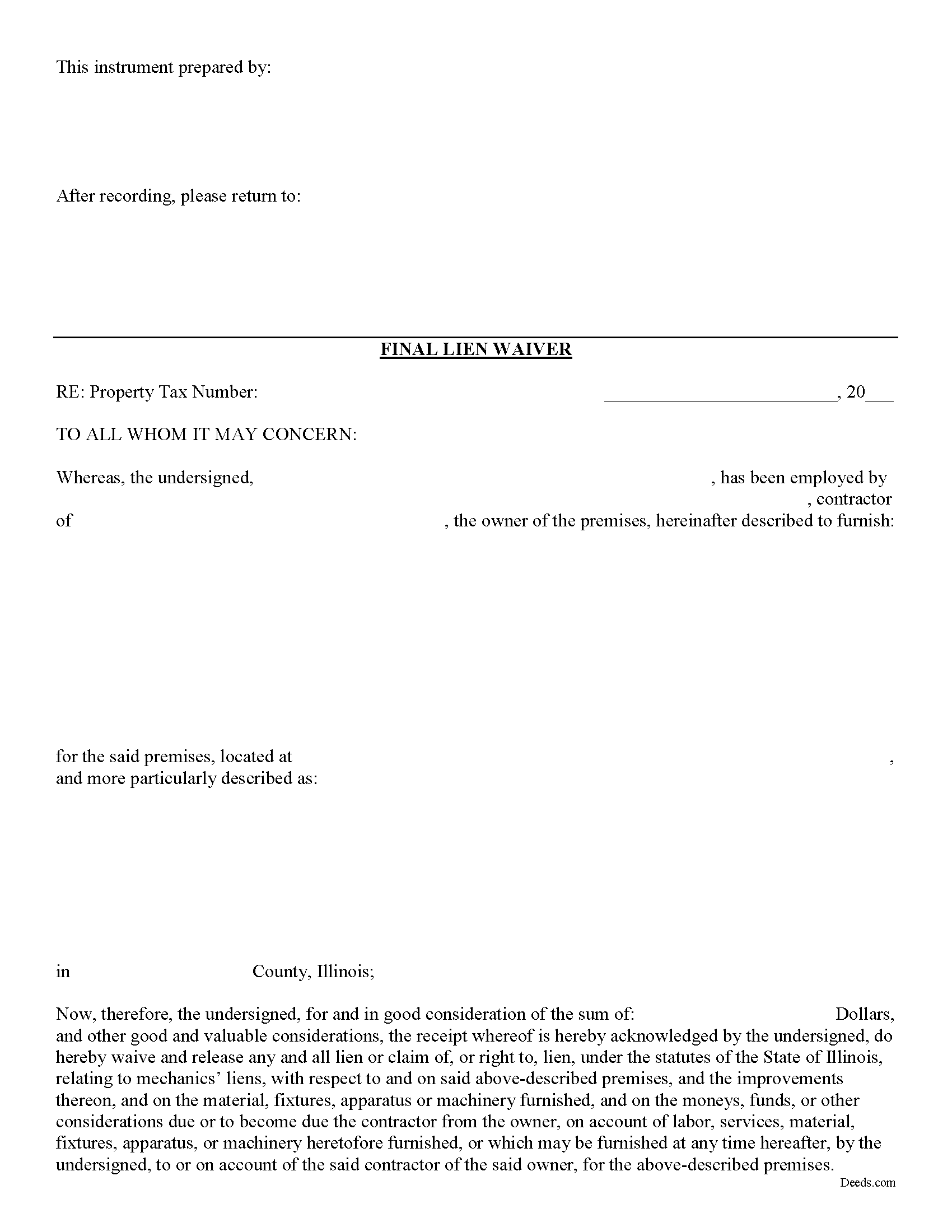

Subcontractor Final Waiver and Release of Lien

Illinois Subcontractor's Final Waiver and Release of Mechanic's Lien

Under 770 ILCS 60, Illinois' Mechanic's Lien act, lien waivers are used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

Use the Final Lien Waiver after the confirmed final payment on an outstanding mechanic's lien. A subcontractor signs this form and provides to the owner and/or prime contractor in exchange for final payment on the job.

Contact an attorney with questions about the Subcontractor's Final Waiver and Release, or with any other issues related to mechanic's liens in Illinois.... More Information about the Illinois Subcontractor Final Waiver and Release of Lien

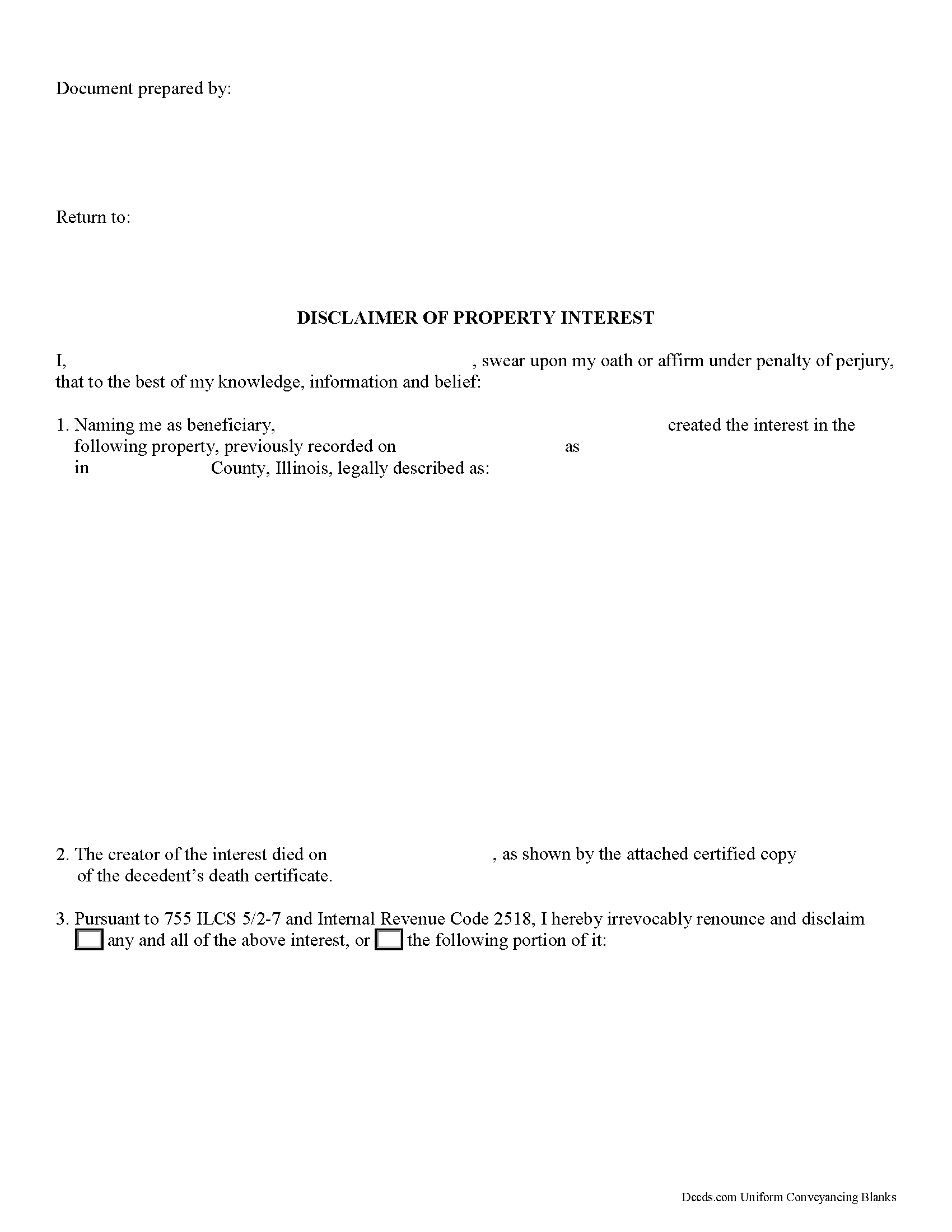

Disclaimer of Interest

A beneficiary of an interest in property in Illinois can disclaim all or part of a bequeathed interest in, or power over, that property according to 755 ILCS 5/2-7(a). This document must be in writing, declared a disclaimer, signed by the disclaimant or a legally authorized representative, and describe the disclaimed property (5/2-7(b)).

The disclaimer must be delivered to the transferor, donor or representative, trustee or person who has legal title. In the case of an interest passing by death, an executed counterpart may be filed with the clerk of the court in the county where the estate is or will be administered. If it pertains to real property, it may also be recorded with office of the recorder in the county where the property is situated (5/2-7 (c)).

Even though the Illinois statutes stipulate no time limit to the delivery, the disclaimer must be received no later than 9 months after the transfer is made (e.g. date of death) in order to comply with IRS regulations. In addition, the disclaimer is invalid if the disclaimant has accepted the property, i.e., performed any affirmative act that is consistent with ownership of property as specified in 5/2-7(e).

Once eff... More Information about the Illinois Disclaimer of Interest

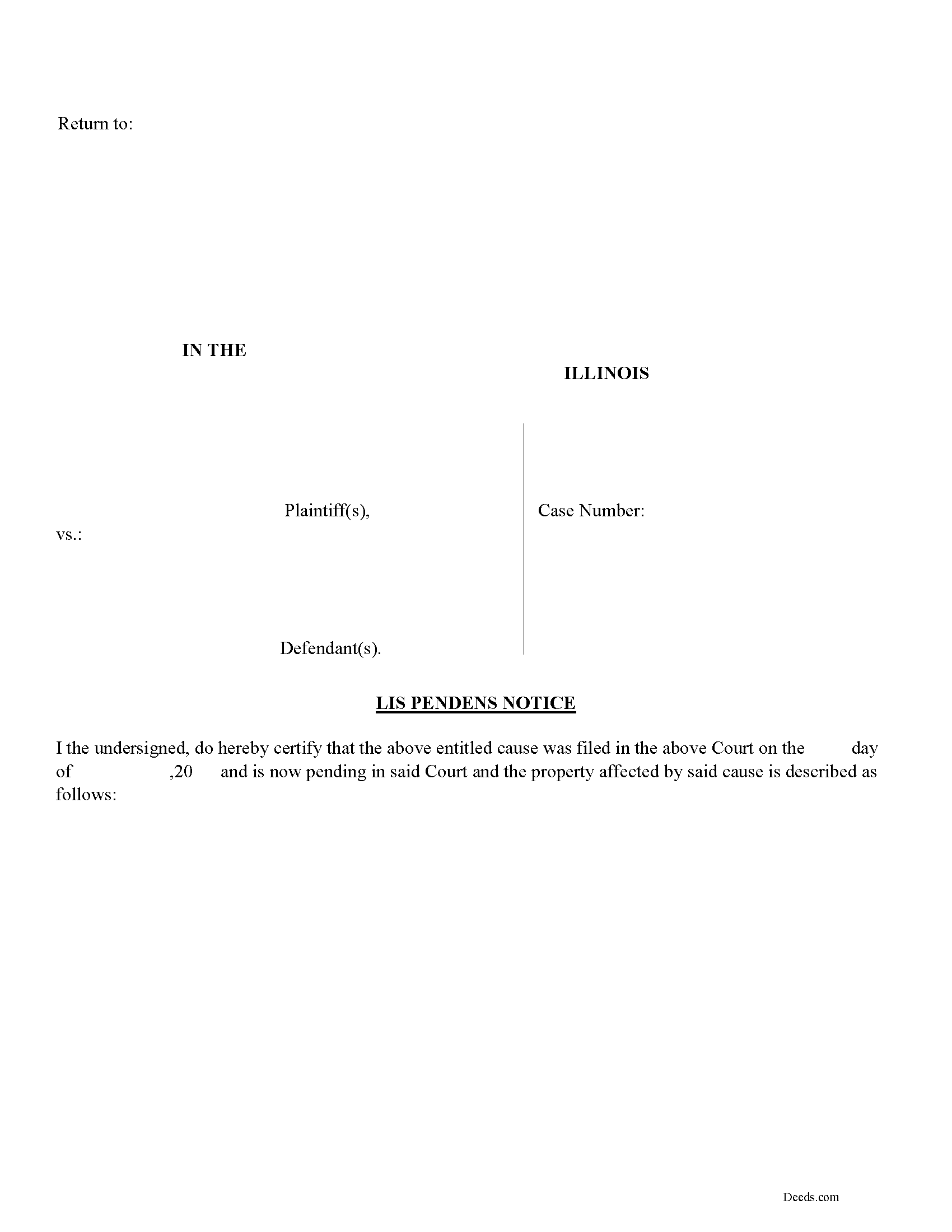

Lis Pendens

Although a plaintiff (person initiation suit) or plaintiff's attorney usually files a Lis Pendens notice, Illinois states any party to the action may file a Lis Pendens (signed by any party to the action or his attorney of record or attorney in fact, on his or her behalf) Sec. 2-1901. Requirements of an Illinois Lis Pendens include; (the title of the action, the parties to it, the court where it was brought and a description of the real estate) Sec. 2-1901. A Lis Pendens is considered constructive notice once recorded in the county where the property is located, subsequent buyers or lien holders would be bound by the outcome of the case, (for the purposes of this Section, be deemed a subsequent purchaser and shall be bound by the proceedings to the same extent and in the same manner as if he or she were a party thereto) Sec.2-1901 Often cases include multiple plaintiff and defendants, this form has adequate space for multiple parties.

(Illinois Lis Pendens Package includes form, guidelines, and completed example)... More Information about the Illinois Lis Pendens

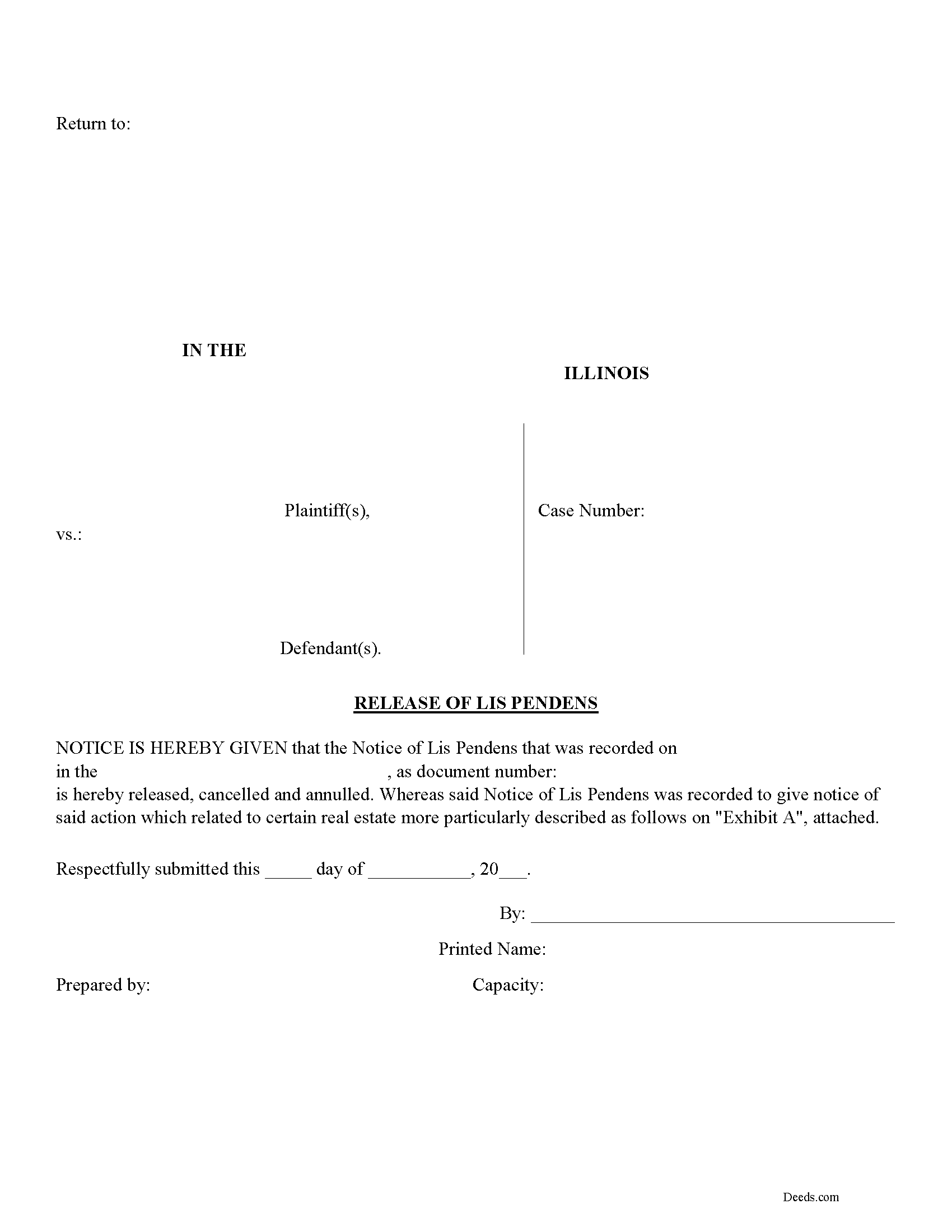

Lis Pendens Release

This document is used to release/cancel a previously recorded Notice of Lis Pendens. File this form in the County Recorder's Office in which the Notice was filed.

(Illinois Release of Lis Pendens Package includes form, guidelines, and completed example)... More Information about the Illinois Lis Pendens Release

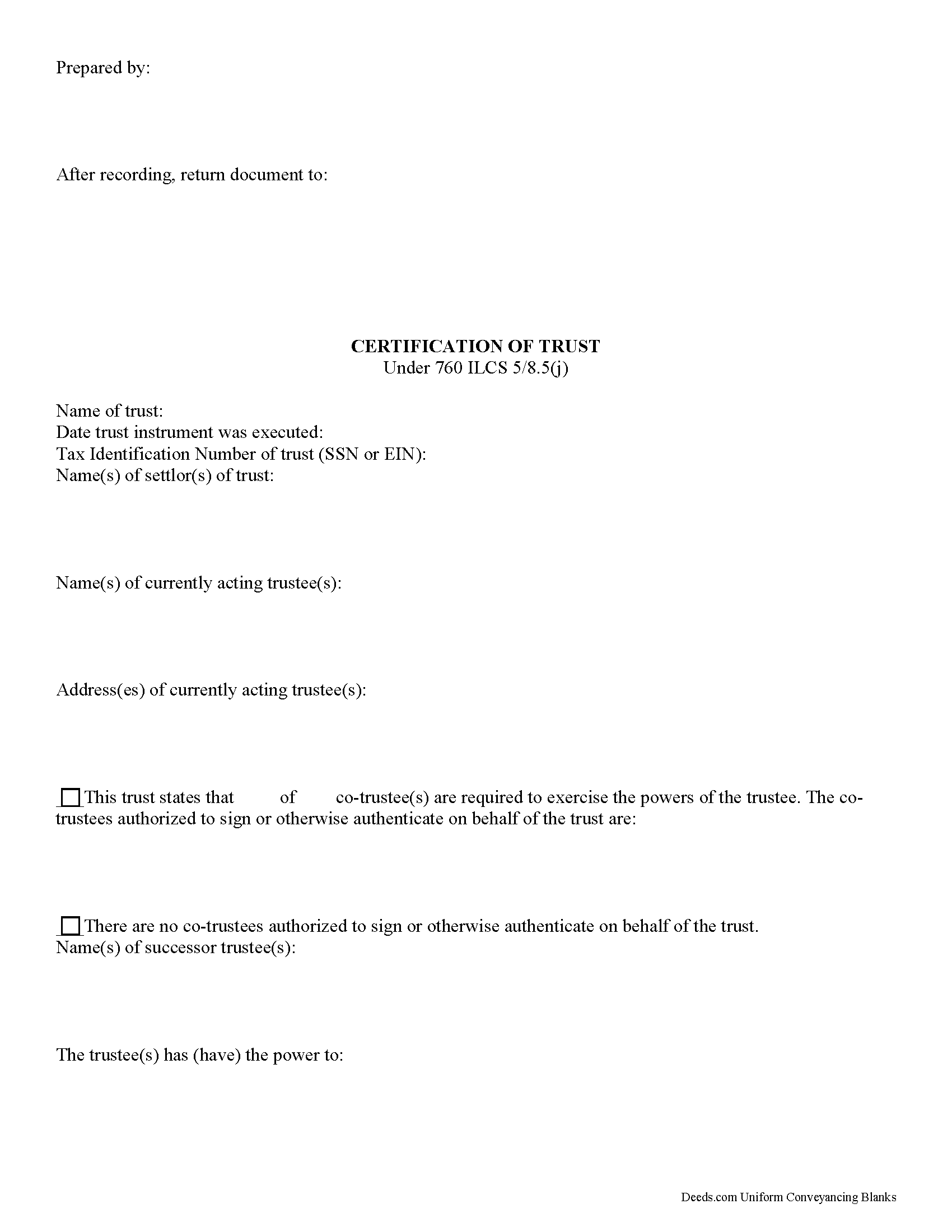

Certificate of Trust

Governed by 760 ILCS 5/8.5, the certificate of trust is the document a trustee provides to a lending institution or other third party that certifies the existence of a trust and his/her authority to act on behalf of the trust.

The document presents only essential information about the trust in lieu of the actual trust document. It names the settlor of the trust and all acting trustees, as well as any successor trustees who may be named under the terms of the trust document. If there are co-trustees, it states the number of trustees required to authorize actions. In addition, the certificate identifies whether or not a trust is revocable and amendable, and who holds authority to revoke and/or make amendments. Certain information, such as the parties having a beneficial interest in the trust, remains confidential.

The recipient of a certificate of trust is not liable for any actions they may take based on false representations within the certificate (760(ILCS 5/8.5(f)). While notarization is not obligatory, a third party may require that the certification of trust be acknowledged.

(Illinois Certificate of Trust Package includes form and completed example)... More Information about the Illinois Certificate of Trust