Tennessee Documents

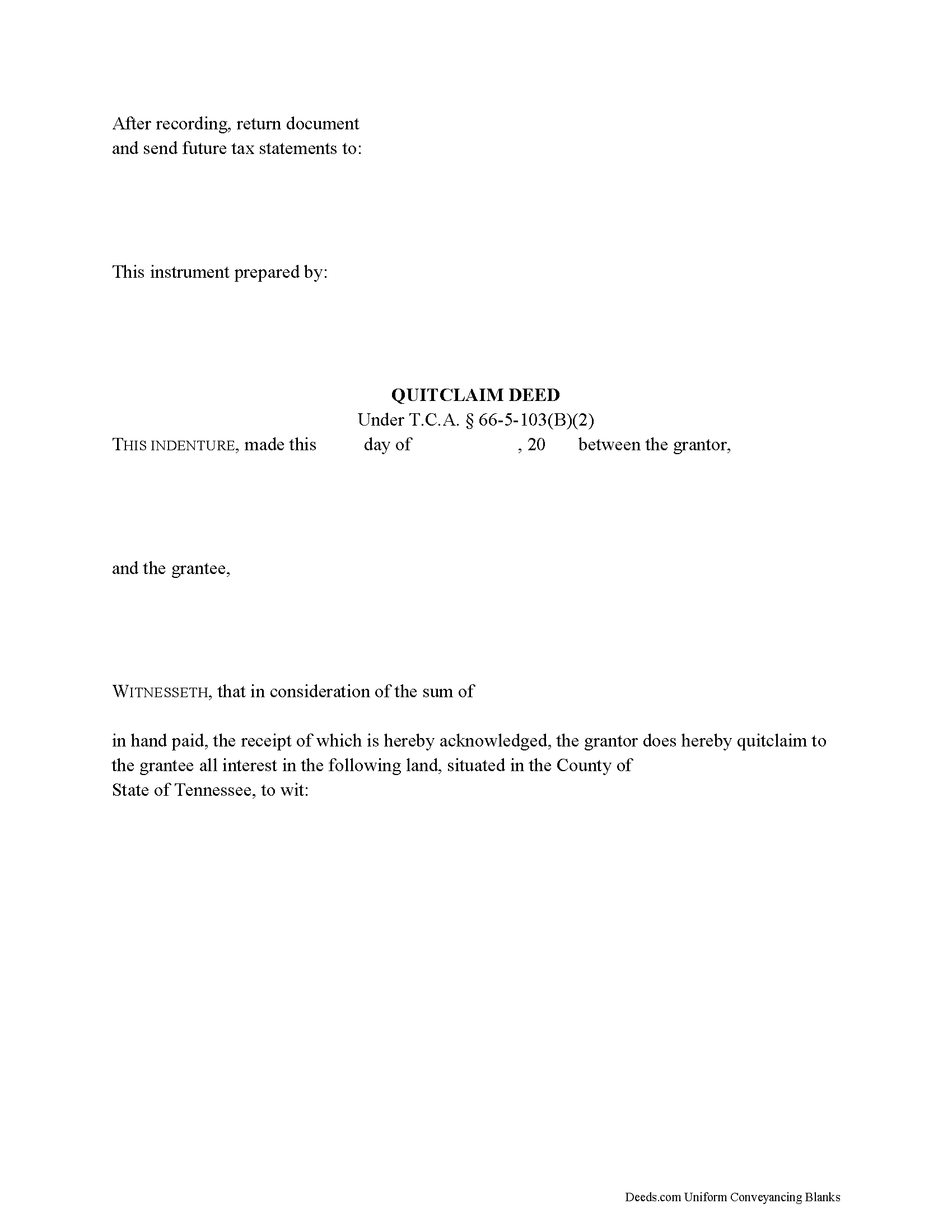

Quitclaim Deed

The grantor to a quitclaim deed executed in Tennessee must sign the document and have his or her signature acknowledged. A legal description of the real property as well as a recital of the grantor's source of title must be included in a quitclaim deed executed in Tennessee. Specific requirements involved in presenting a quitclaim deed to a register of deeds in Tennessee are listed according to county. It is important to abide by these requirements in order to avoid penalty fees or re-recording.

In Tennessee, quitclaim deeds are registered rather than recorded. The recording statute (Tenn. Code Ann. 66.26.101) says that all instruments authorized to be recorded will be valid between parties to the instrument and their heirs and representatives without registration. However, registration is needed in order to provide actual notice to third parties. An unregistered quitclaim deed is not valid as to existing or subsequent creditors without notice or bona fide purchasers without notice (Tenn. Code Ann. 66.26.103). Priority is given to the quitclaim deed that is registered first, unless the party claiming under a subsequent instrument had full notice of the previous instrument (Ten... More Information about the Tennessee Quitclaim Deed

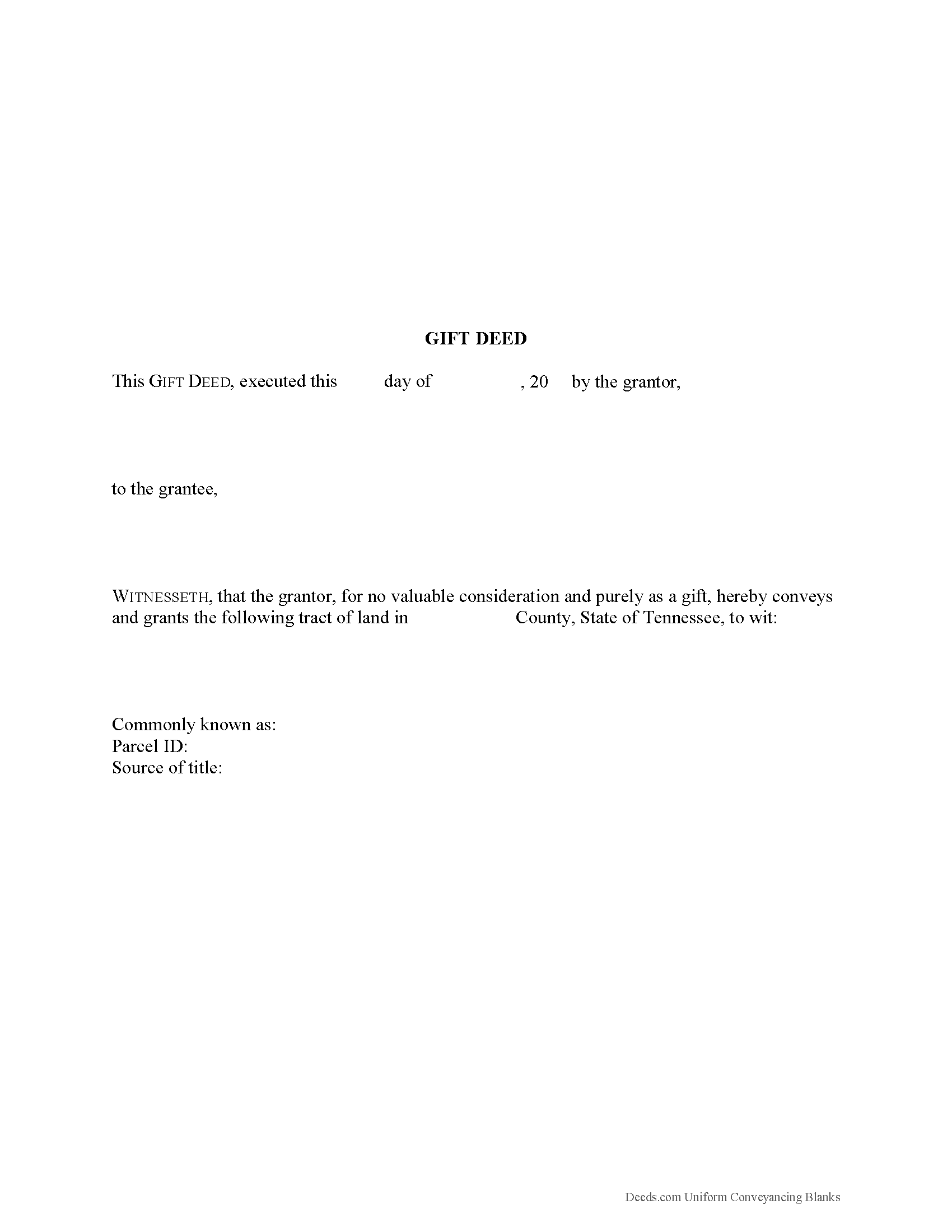

Gift Deed

Gifts of Real Property in Tennessee

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. A gift deed must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's... More Information about the Tennessee Gift Deed

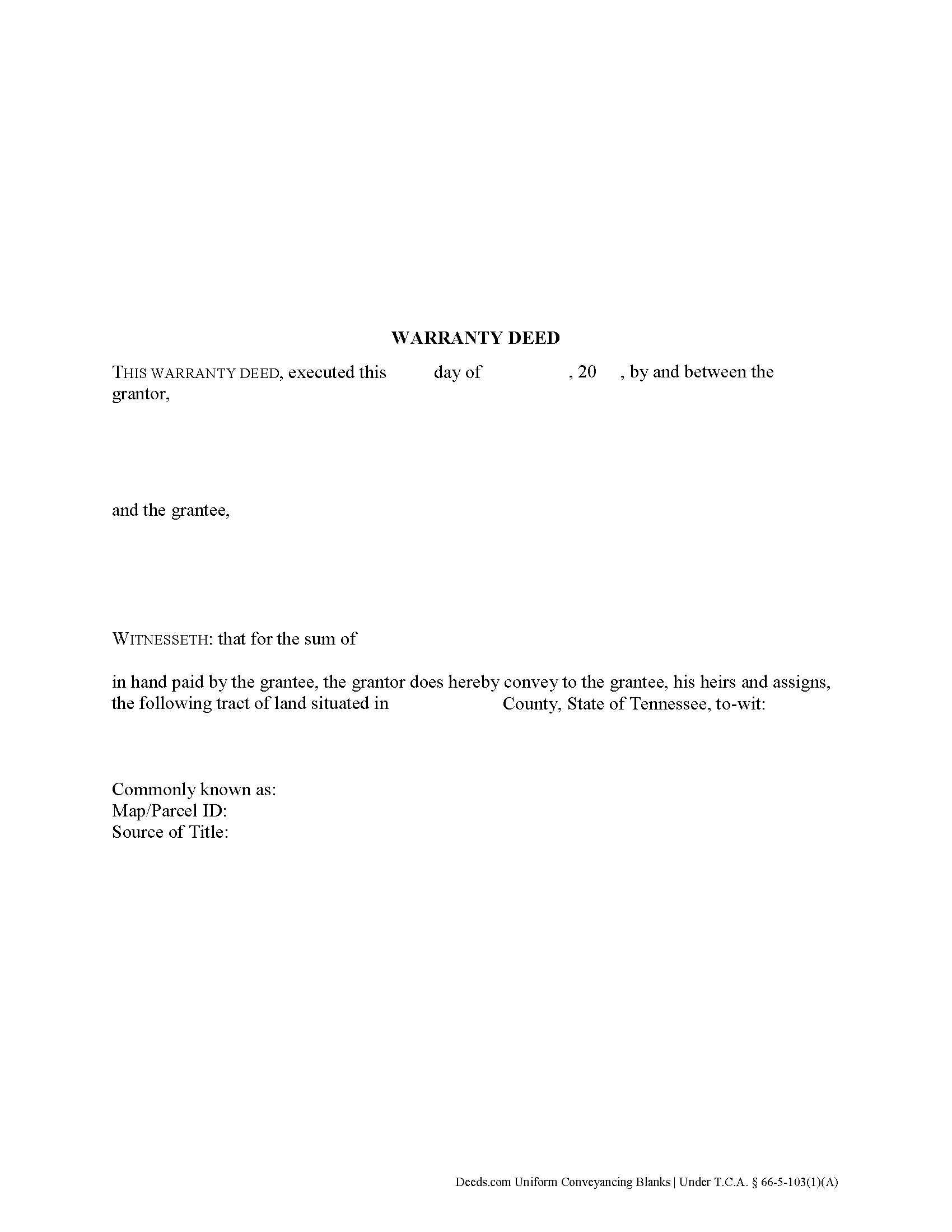

Warranty Deed

In Tennessee, title to real property can be transferred from one party to another using a warranty deed. When recorded, a warranty deed conveys an interest in real property to the named grantee with full warranties of title.

In Tennessee, warranty deeds are statutory. They must use the term "convey," and contains language stating that the grantor will defend the title against "all persons whomsoever" (66-5-103(1)(A)). A warranty deed offers the highest level of protection for the grantee (buyer). It conveys real property in fee simple and contains implied covenants that the grantor holds title to the property and has good right to convey it; and that the property is free from encumbrances (with the exception of any noted in the deed). The guarantee is greater than that of a limited or special warranty deed, which only protects against claims that arising while the grantor held title to the property, or a quitclaim deed, which offers no warranties of title at all.

A lawful warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vest... More Information about the Tennessee Warranty Deed

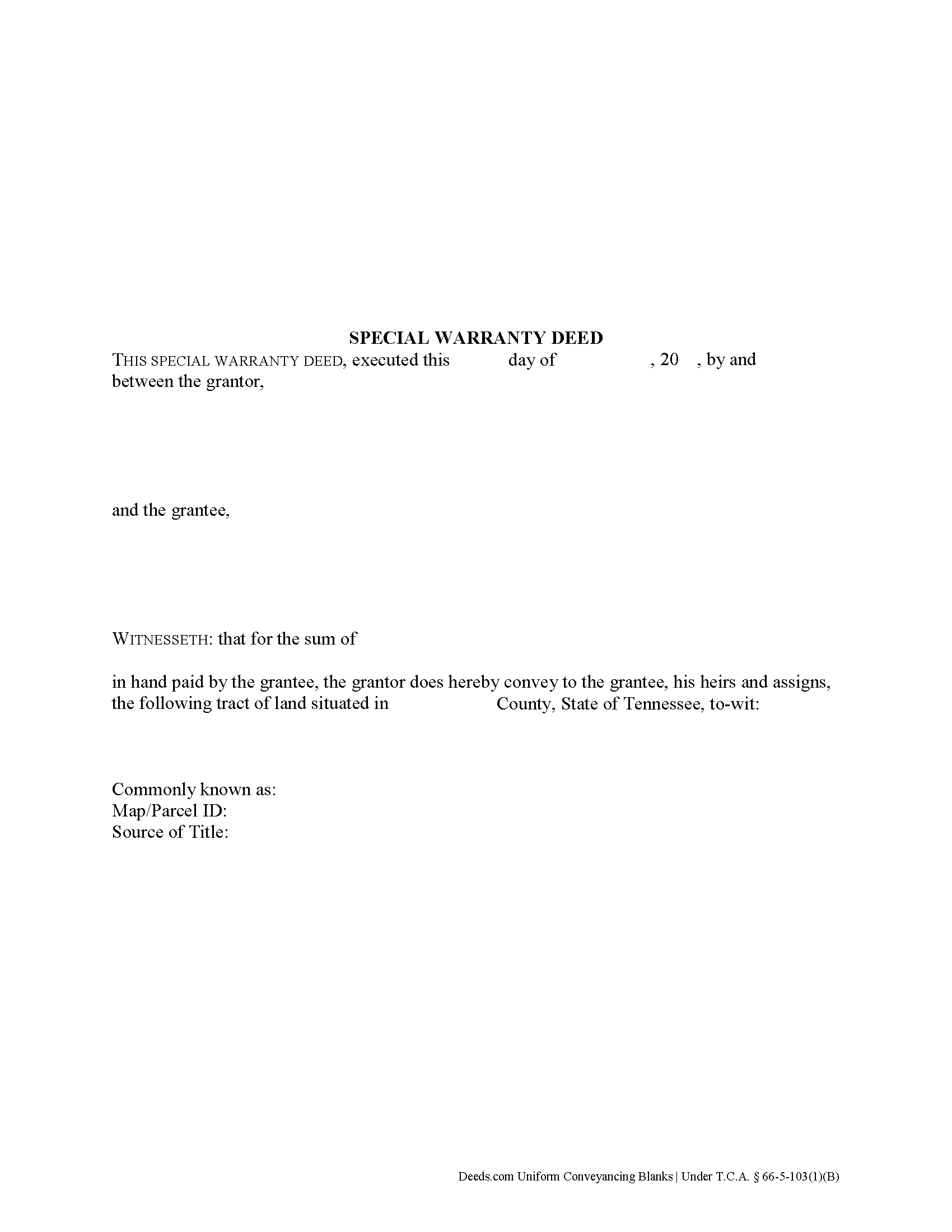

Special Warranty Deed

In Tennessee, title to real property can be transferred from one party to another using a special warranty deed. When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title.

In Tennessee, special warranty deeds are statutory. They must use the term "convey," as well as contain specific covenant language that the grantor is "seized and possessed of this land, and [has] a right to convey it." The deed warrants "the title against all persons claiming under [him or her]" (T.C.A. 66-5-103(1)(B)). This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title.

A lawful special warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Tennessee residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyanc... More Information about the Tennessee Special Warranty Deed

Grant Deed

In Tennessee, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with some covenants of title. The word "grant" in the conveyancing clause typically signifies a grant deed, but it is not a statutory form in Tennessee.

Grant deeds offer the grantee (buyer) more protection than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. Grant deeds contain implied covenants that the grantor holds an interest in the property and is free to convey it. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Tennessee re... More Information about the Tennessee Grant Deed

Easement Deed

An easement is an interest in real property that grants the easement holder a legally enforceable right to use another's property for a specific purpose. This type of interest in land can be created in various ways in Tennessee: by an express grant, by reservation, or by implication. An express easement is a grant of an interest in land and must comply with the Tennessee Code Annotated Statute of Frauds, which states that no charge may be brought against a contract for the sale of lands, tenements, or hereditaments unless the promise or agreement upon which such action shall be brought is in writing and signed by the party to be charged therewith (29-2-101). An express easement by grant is created by a deed in writing that contains plain and direct language evidencing the grantor's intent to create an easement. The scope and duration of the easement is set forth in express terms in the granting document. When the owner of a dominant tenement transfers title in Tennessee, he transfers to the grantee all rights in and to the property, including all appurtenant and necessary easements attached to the property.

A solar energy easement can be created according to the provisions outl... More Information about the Tennessee Easement Deed

Termination of Easement

Use this form to release, terminate, extinguish a previously recorded document that involves access to and from a property.

Documents such as:

1. Easement Deeds or Agreements (An easement is a non-possessory interest in land, granting the right to use someone else's property for a specific purpose, like a driveway or utility line)

2. Access Roads

3. Right of Ways

4. Utility Easements (Power, Gas, Water, Sewer, Etc.)

5. Drainage Easements

This document allows the owner of the land, burdened by the access and the party that benefits from the access, to sign an agreement releasing the property from such access, ... More Information about the Tennessee Termination of Easement

Correction Deed

Use the correction deed to correct errors in a warranty, special warranty, or quitclaim deed in Tennessee.

The best option for correcting a deed in Tennessee is to record a correction deed. Other options, such as a scrivener's affidavit and re-recording the original deed, both have some drawbacks. The scrivener's affidavit can serve as a valid alternative when the original grantor is not available. Tennessee law provides that a corrected copy of the original document may be attached to the affidavit as an exhibit (T.C.A. 66-24-101(a)(27)). Such a copy, however, only carries the weight of an exhibit to an affidavit and not that of a recorded document.

Re-recording the original deed with corrections requires a new execution/signing and notary acknowledgement. The reason for correcting, the actual correction and cross-reference to the prior recording must be made on the existing copy or, depending on county requirements, on a title page. This will not only require fees for the additional page(s) when re-recording, but also creates potential problems during the recording if the added information does not stay within the required document margins.

The easiest and cleanest optio... More Information about the Tennessee Correction Deed

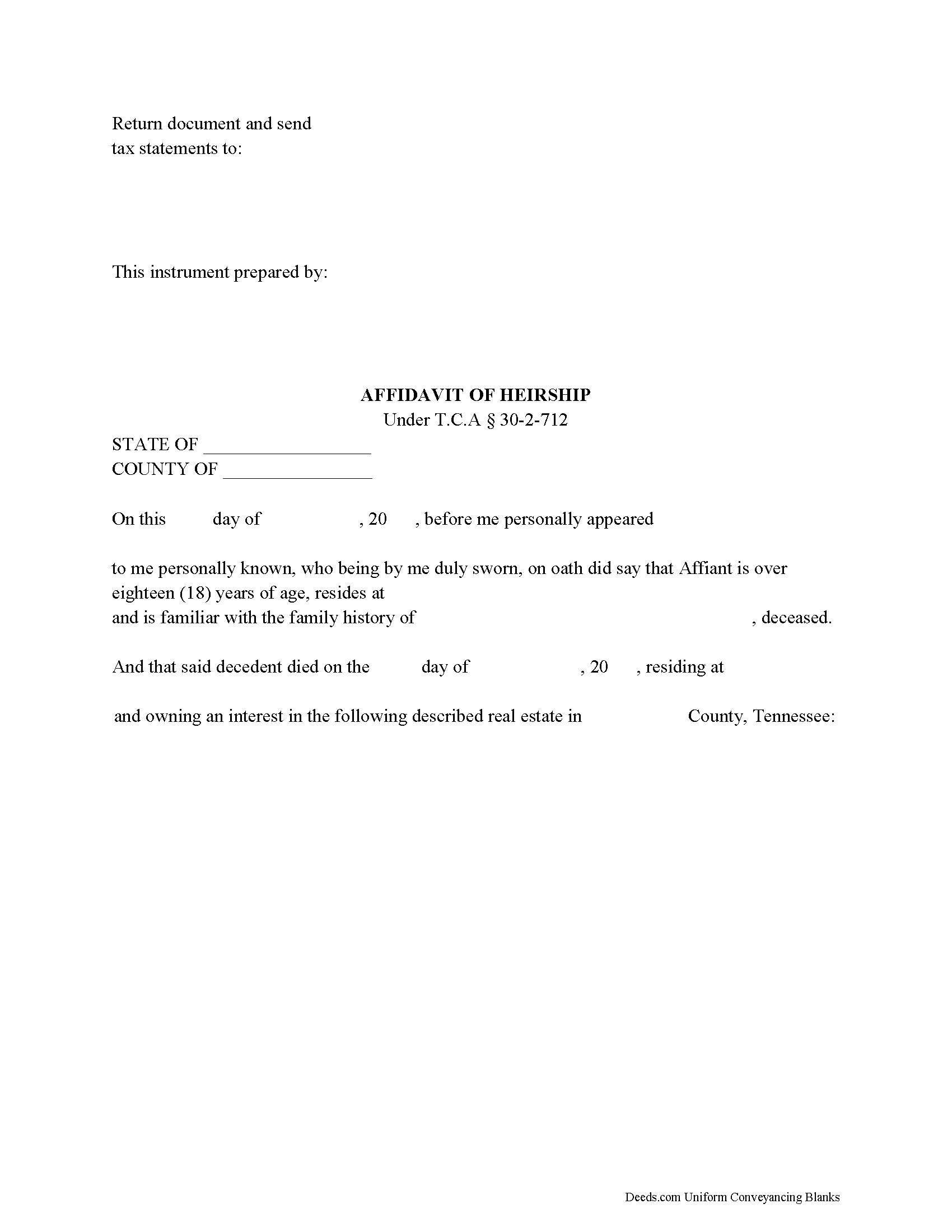

Affidavit of Heirship

The affidavit of heirship, sometimes called an affidavit of inheritance, is a statutory form under T.C.A. 30-2-712.

An affidavit of heirship, when recorded, gives notice of a change in title following the death of a real property owner. It is typically recorded when the decedent has died intestate, or without a last will and testament. The affidavit names the decedent and the heirs who, by operation of law, are the current owners of the property.

The affiant, or person making the sworn statements contained in the affidavit, is anyone having knowledge of the facts contained within. A standard affidavit of heirship contains the legal description and map parcel number of the realty and lists the heirs by name, address, and relation to the decedent.

In addition, if not followed by a recorded deed from one or all heirs, the affidavit requires the tax bill address for tax statements on the property and a prior title reference stating the type of document and book, page, and recording date of the instrument granting title to the decedent.

This is a general affidavit of heirship. Your situation may require more specific information. Consult a lawyer when preparing the affidavi... More Information about the Tennessee Affidavit of Heirship

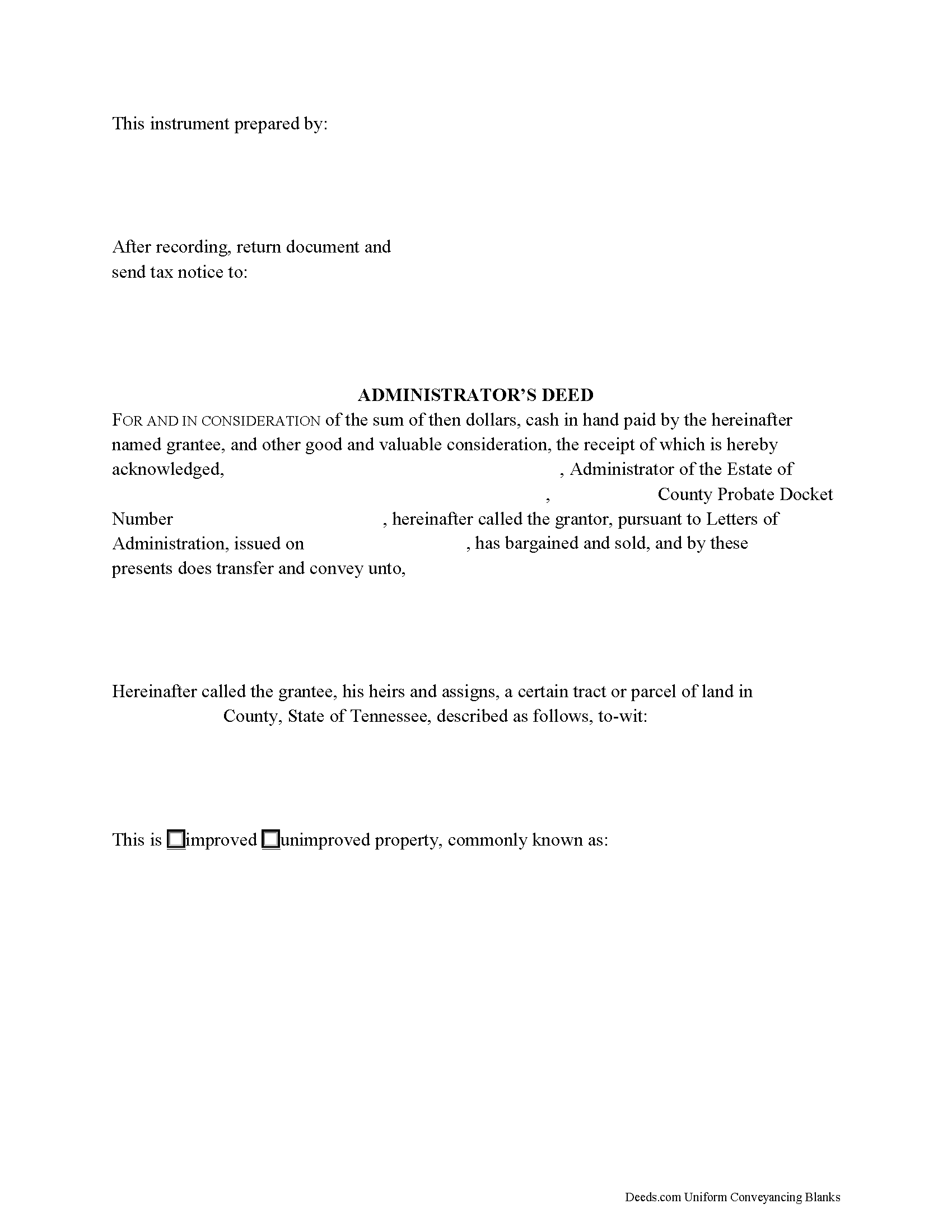

Administrator Deed

Use an administrator's deed to transfer title to a decedent's real property to a purchaser following a sale. An administrator's deed names the duly authorized and acting administrator of the estate of the deceased as the granting party. This is the person to whom the probate court has issued letters of administration.

Typically, administrators' deeds contain fiduciary covenants akin to those found in a special warranty deed, and the deed may even be indexed as a special warranty deed in the county land records. The warranty of title in a special (limited) warranty deed only covers the period that the grantor held title to the property, along with covenants that the grantor is lawfully seized and possessed of the property in fee simple and has a good right to convey it, and that the property is unencumbered, unless noted on the face of the deed.

A sale of realty from the decedent's estate may be required when the decedent's personal property is insufficient to pay the estate's debts. A petition of the court for a decree of sale is required before an administrator can make a sale (T.C.A. 30-2-402). The court may order a sale if there is sufficient evidence, upon hearing, that t... More Information about the Tennessee Administrator Deed

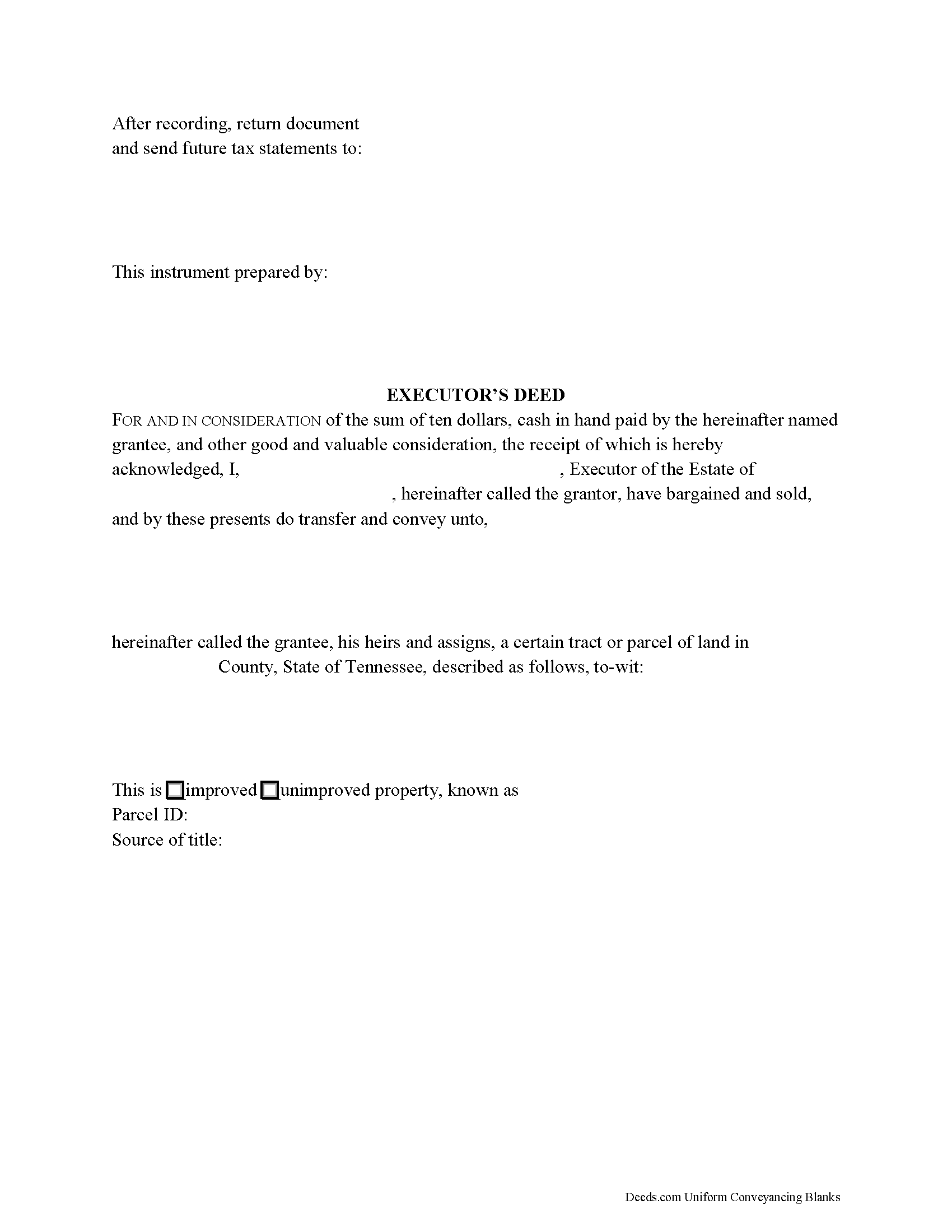

Executor Deed

Use an executor's deed to transfer title to a decedent's real property to a purchaser following a sale. An executor's deed names the duly authorized and acting executor of the estate of the deceased as the granting party. This is the person to whom the probate court has issued letters testamentary.

Typically, executors' deeds contain fiduciary covenants akin to those found in a special warranty deed, and the deed may even be indexed as a special warranty deed in the county land records. The warranty of title in a special (limited) warranty deed only covers the period that the grantor held title to the property, along with covenants that the grantor is lawfully seized and possessed of the property in fee simple and has a good right to convey it, and that the property is unencumbered, unless noted on the face of the deed.

A sale of realty from the decedent's estate may be required when the decedent's personal property is insufficient to pay the estate's debts. A petition of the court for a decree of sale is required before an executor can make a sale (T.C.A. 30-2-402). The court may order a sale if there is sufficient evidence, upon hearing, that the land should be sold.

Fid... More Information about the Tennessee Executor Deed

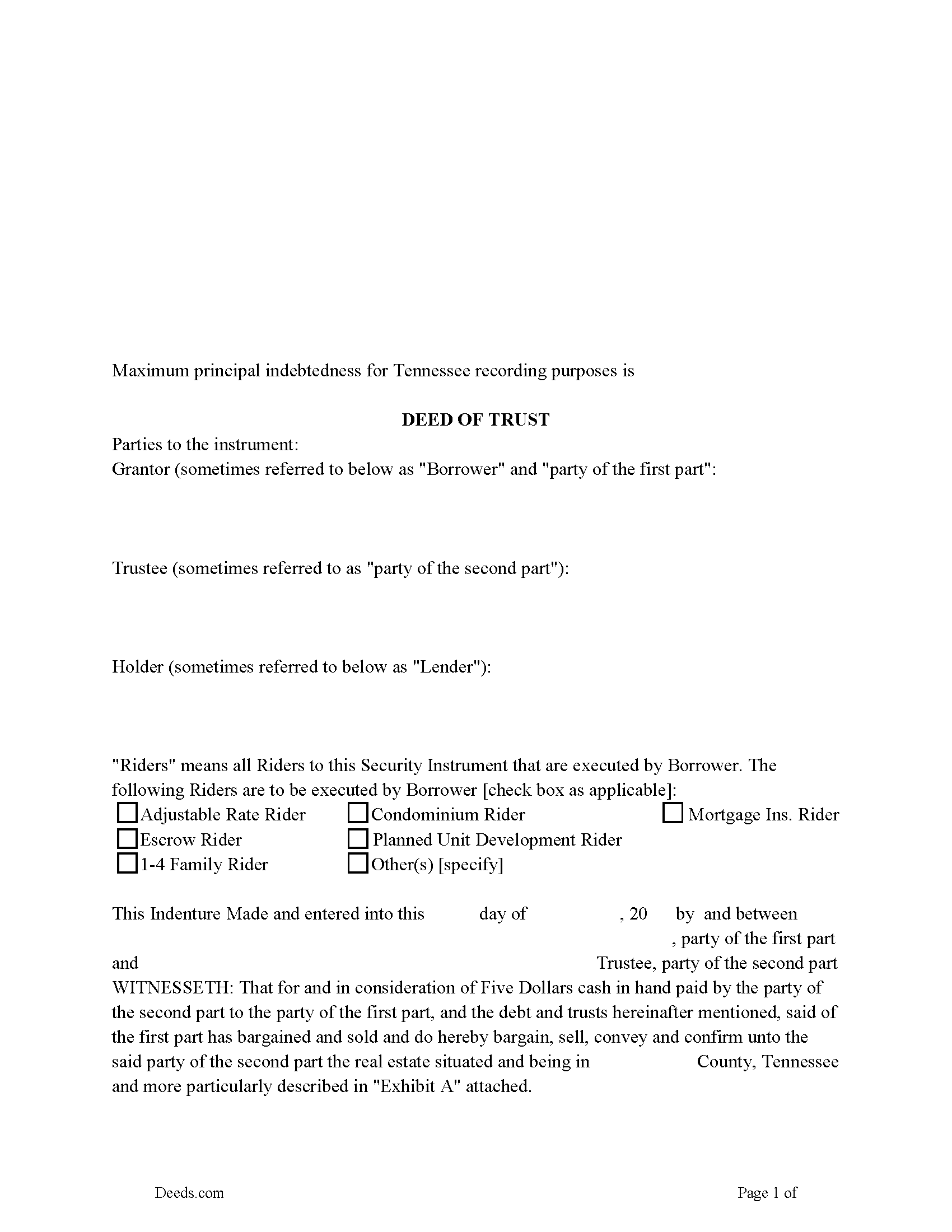

Deed of Trust

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note. It's similar to a mortgage, but differs in that mortgages only include two parties (borrower and lender).

In Tennessee, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale.

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Holder (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take an action against any person for damages.

This form can be used by a party selling/financing their own house, rental, condominium or small office building. A Promissory Note and Deed of Trust combined with stringent default terms, can be advantageous to the Lender.

(Tennessee DOT Package includes form, guidelines, and completed example)

... More Information about the Tennessee Deed of Trust

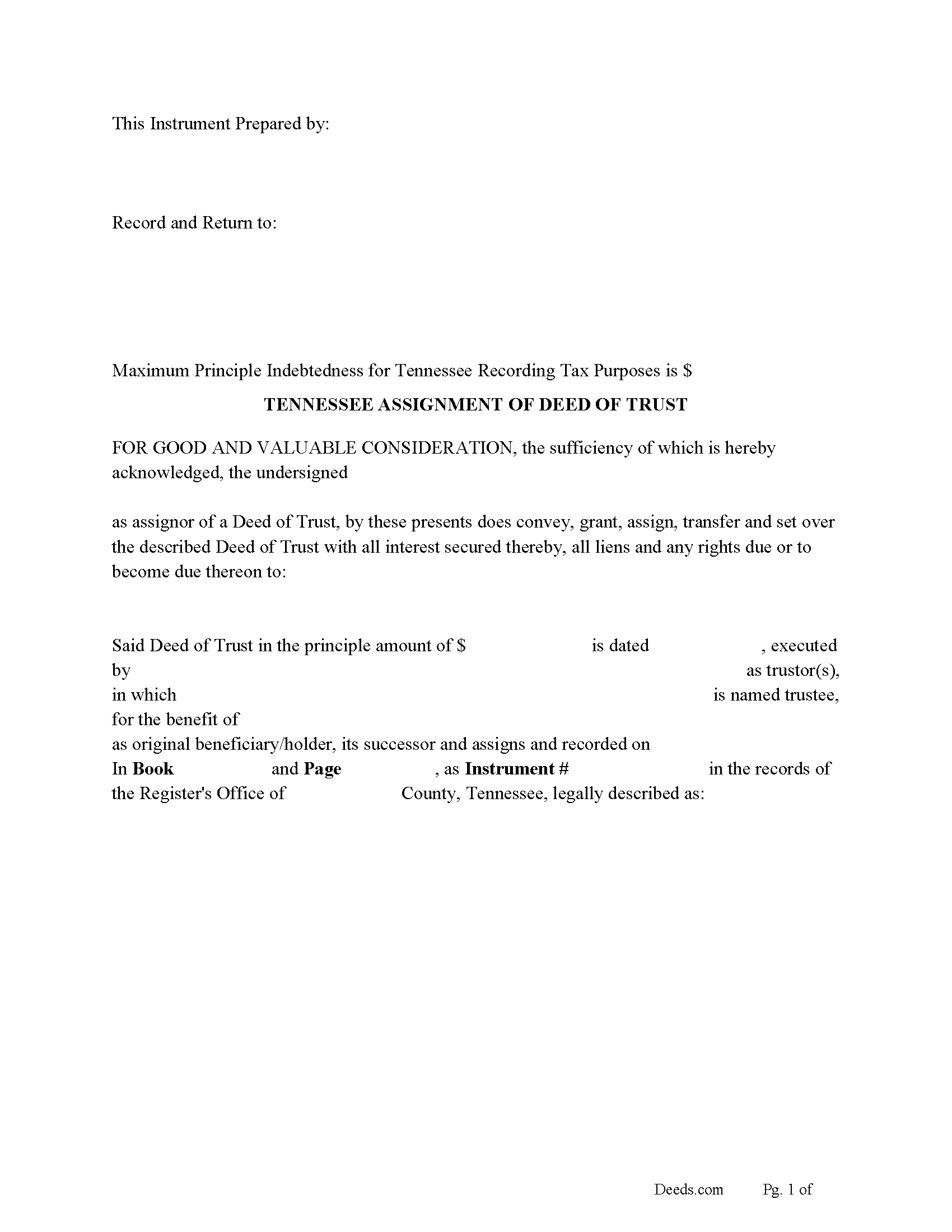

Assignment of Deed of Trust

This form is used by the current lender/beneficiary to Assign/transfer a Deed of Trust and Promissory Note to another party, this is usually done when a note has been sold.

Recording requirements include:

- Assignor & assignee

- Debtor's name

- Reference original Volume & Page of assigned document

- Maximum Principal Indebtedness for Tennessee Recording Tax Purposes is $0 (If amount is listed taxes must be paid)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Tennessee Assignment of DOT Package includes form, guidelines, and completed example) For use in Tennessee only.

... More Information about the Tennessee Assignment of Deed of Trust

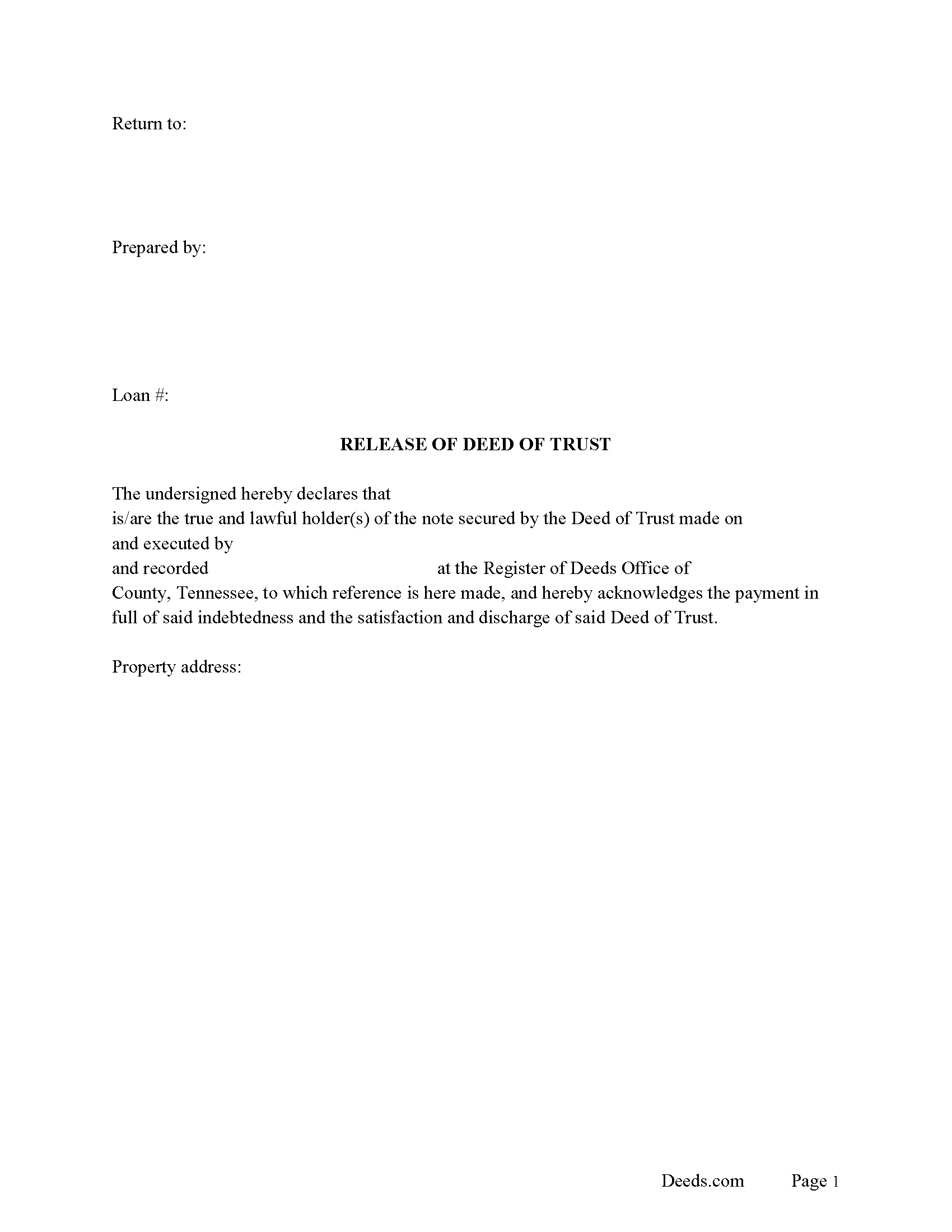

Full Release of Deed of Trust

(When a debt secured) by a Deed of Trust has been satisfied, paid in full the lender or legal holder of the note, (who has received payment or satisfaction of the debt, must satisfy the record by a formal deed of release). Tennessee Statute 66-25-101

This form is executed by the Lender/holder of the note for a full release of a Deed of Trust.

(Tennessee Release of DOT Package includes form, guidelines, and completed example)

... More Information about the Tennessee Full Release of Deed of Trust

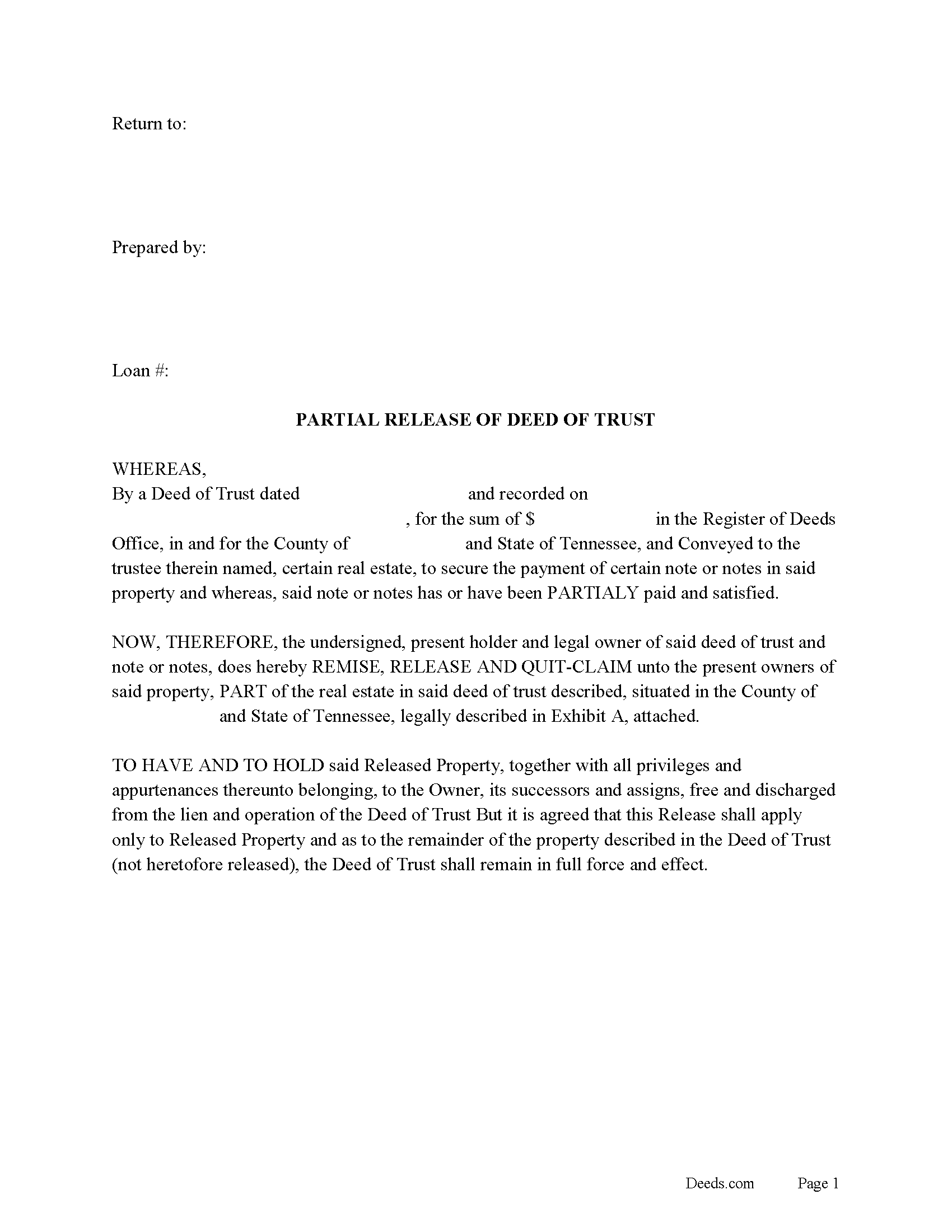

Partial Release of Deed of Trust

This form is executed by the lender to release only a portion of the real property from a Deed of Trust. This form states: That this Release shall apply only to Released Property and as to the remainder of the property described in the Deed of Trust (not heretofore released), the Deed of Trust shall remain in full force and effect.

(Tennessee Partial Release of DOT Package includes form, guidelines, and completed example)... More Information about the Tennessee Partial Release of Deed of Trust

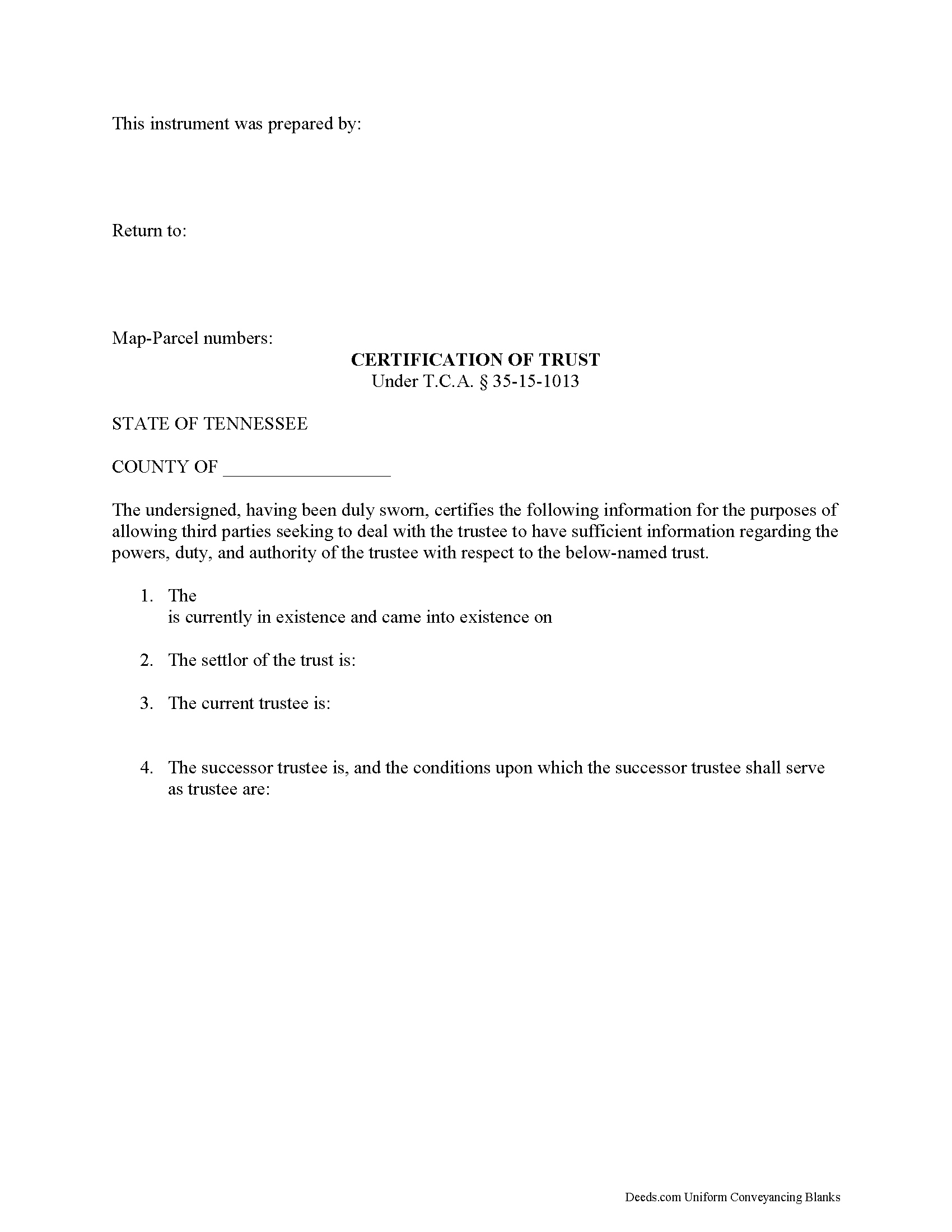

Certificate of Trust

The certificate of trust is codified at T.C.A. 35-15-1013 as part of the Tennessee Uniform Trust Code. The purpose of the certificate is "to evidence the existence and validity of the trust" (35-15-1013(a)). The document contains sworn statements made "by the trustee or trustees having signatory authority as identified" within the document (35-15-1013(a)). The recipient of a certificate of trust may rely on the statements made within as factual without additional inquiry (35-15-1013(d)).

Instead of furnishing the trust document, a trustee may present a certificate of trust to third parties when doing business on behalf of the trust. The certificate is a condensed summary of the trust and its provisions, and allows the settlor's estate plans, including the identities of trust beneficiaries, to remain private.

A certificate of trust contains statements that the trust exists and that it "has not been revoked, modified or amended in any manner that would cause" the information in the certificate to be incorrect. The document recites the name and date of trust, the settlor, trustee, and relevant powers of the trustee to conduct the business for which the certificate is presented... More Information about the Tennessee Certificate of Trust

Trustee Deed

A trustee's deed transfers interest in real property held in a living trust. A settlor (sometimes called a grantor) creates and funds the trust by transferring assets to another person, called the trustee (though these roles may be performed by the same person). The trustee administers the trust for the benefit of another party, called the beneficiary.

The requirements for a trust in Tennessee are that the settlor has a capacity to create a trust and indicates the intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not the sole trustee and sole beneficiary (T.C.A. 35-15-402). A trust must have lawful purposes and its terms must be for the benefit of the trust beneficiaries ( 35-15-404).

The settlor of a living trust generally indicates the intention to create a trust by executing a trust instrument. This unrecorded document sets forth the terms of the trust, indicating how the settlor intends his assets to be administered (settlors of testamentary trusts, or testators, establish the trust's terms in their wills). The trust document also designates the trustee and his successors, if any, and identifies the trust... More Information about the Tennessee Trustee Deed

Durable Power of Attorney

A durable power of attorney designates in writing an agent (attorney in fact) and contains the words. (This power of attorney shall not be affected by subsequent disability or incapacity of the principal, or This power of attorney shall become effective upon the disability or incapacity of the principal, or similar words showing the intent of the principal that the authority conferred shall be exercisable, notwithstanding the principal's subsequent disability or incapacity.) (34-6-102.)

This instrument offers three choices for effective dates.

1. Immediately

2. Upon incapacity

3. Immediately when my spouse is acting as my Agent. If my spouse declines, is unable or ceases to serve as Agent, this Power of Attorney becomes effective upon my becoming disabled or incapacitated.

In the event your agent is unable or unwilling to serve a (substitute Agent) is named.

When the principal is (disabled or incapacitated). All acts done by the agent (attorney in fact) (bind the principal and the principal's successor in interest as if the principal were competent and not disabled.) 34-6-103

In general, if the attorney if fact acts unde... More Information about the Tennessee Durable Power of Attorney

Specific Power of Attorney for the Purchase of Property

In this form the Principal(s), appoint a second party, attorney-in-fact to perform every act necessary and requisite to negotiate, agree to and consummate, on whatever terms the Attorney in Fact deems appropriate for the purchase and financing of the real property specifically described. Included is a "Special Instructions" section where the attorney-in-fact's powers can be further limited and/or defined.

This power of attorney shall become effective immediately upon the execution of same and pursuant to Tennessee Code Annotated Section 34-6-101 et seq. and shall be considered a "Durable Power of Attorney."

Shall be governed, as to its validity, terms and enforcement, by those laws of the State of Tennessee that apply to instruments negotiated, executed, delivered and performed solely within the State of Tennessee.

This power of attorney terminates upon a predetermined date.

(Tennessee SPOA-Purchase Package includes form, guidelines, and completed example)

... More Information about the Tennessee Specific Power of Attorney for the Purchase of Property

Specific Power of Attorney for the Sale of Property

The Principal(s), owners of the property appoint a second party, attorney-in-fact to sell a specific property. In this form the principal is empowering the attorney-in-fact to do and perform any act necessary to sell and convey the real estate specified. Included is a "Special Instructions" section where the attorney-in-fact's powers can be further limited and/or defined.

This power of attorney shall become effective immediately upon the execution of same and pursuant to Tennessee Code Annotated Section 34-6-101 et seq. and shall be considered a "Durable Power of Attorney."

This power of attorney is formatted for recording in the Tennessee County, where the subject property is located and terminates upon a date provided by the principal. Therefore 60, 90, 120 days, etc. can be allotted for the sale.

(Tennessee SPOA-Sale Package includes form, guidelines, and completed example)... More Information about the Tennessee Specific Power of Attorney for the Sale of Property

Mineral Deed

The General Mineral Deed in Tennessee transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive and is made subject to any rights existing under any valid and subsisting oil and gas lease or leases of record.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

In this document the Grantor Warrants and will defend said Title to Grantee. Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Tennessee MD Package includes form, guidelines, and com... More Information about the Tennessee Mineral Deed

Mineral Deed with Quitclaim Covenants

The General Mineral Deed in Tennessee Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer proper... More Information about the Tennessee Mineral Deed with Quitclaim Covenants

Notice of Completion

Protecting Your Property against Lien Claims in Tennessee with a Notice of Completion

Property owners must vigilantly protect against lien claims, especially from a lower-tiered claimant with whom they may not have directly contracted, or even been aware of their participation on the job for which the claim arose.

Tennessee's Property Code 66-11-143(a) offers a tool for this purpose. The owner or purchaser of improved real property, or their agent or attorney may, upon the completion of the improvement, record a Notice of Completion in the office of the register of deeds in the county where the real property is located. The owner or purchaser may also require a person or organization with whom the owner or purchaser has contracted for the improvement to record a notice of completion as well, upon the completion of the improvement. Id.

Along with recording, the owner or purchaser of improved real property or any other authorized party must simultaneously serve a copy of the notice of completion recorded with the register of deeds on the prime contractor and any other entitled parties. Id. Otherwise, the lien rights of the prime contractor who is not served a copy shall no... More Information about the Tennessee Notice of Completion

Notice of Transfer

Transferring Property Subject to Lien Claims in Tennessee

Lots of things can happen with a property that can cause the owner to sell or otherwise transfer ownership while a lien is pending. Luckily, in Tennessee offers a procedure for accelerating the time to enforce a lien when transferring property to a purchaser. Drafting and recording a Notice of Transfer will effectively limit the time that the lien claimant can enforce any lien against a subsequent purchaser.

Under Tenn. Prop. Code 66-11-112(a), any liens claimed only remain effective against subsequent purchasers for ninety (90) days after work on the above-described property is abandoned or completed, unless a sworn statement of lien is filed during that time.

The notice identifies the parties, the location of the work or improvement, intended date of the transfer, and any other information relevant to the specific situation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Transfer or for any ot... More Information about the Tennessee Notice of Transfer

Notice of Spousal Non-Responsibility

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

T... More Information about the Tennessee Notice of Spousal Non-Responsibility

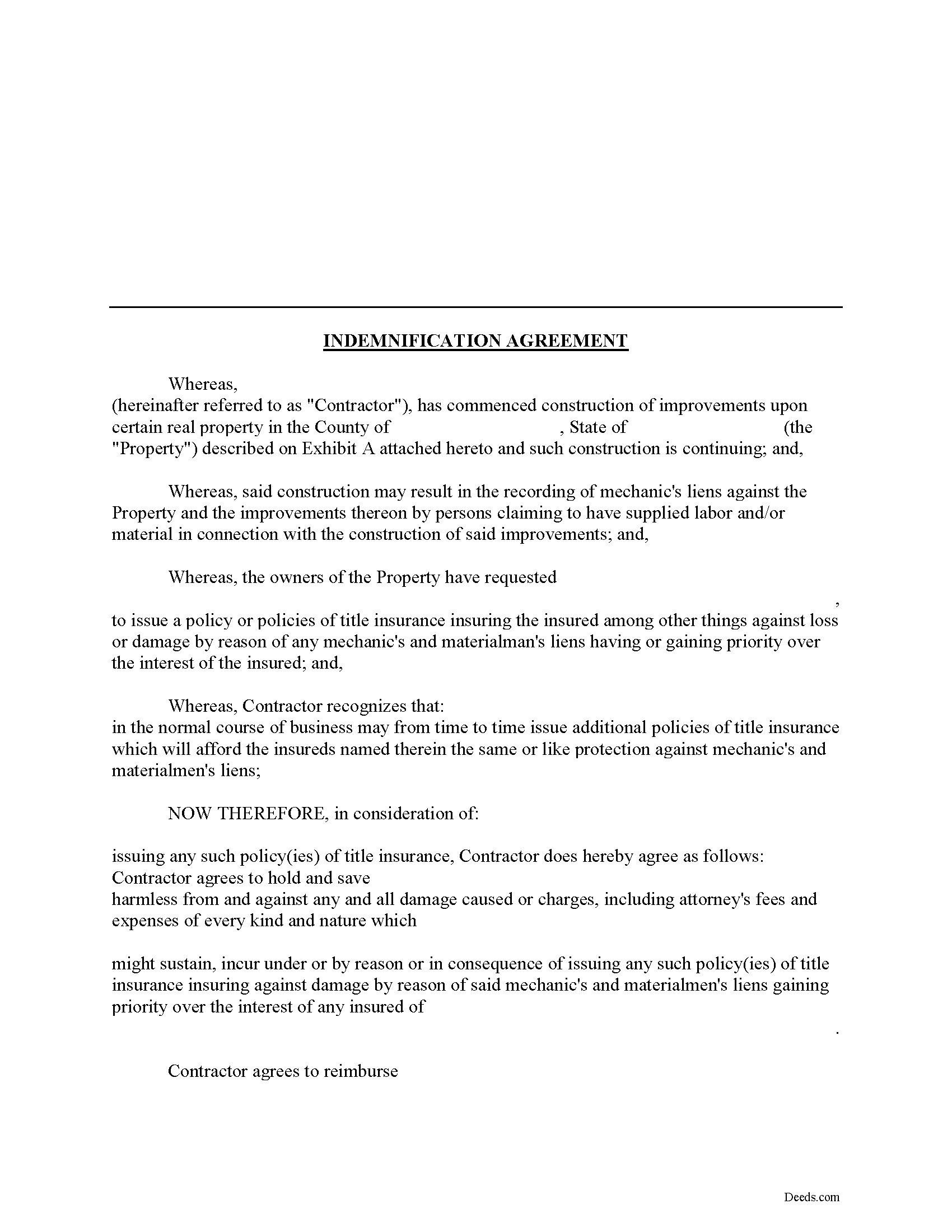

Indemnity Agreement

Using an Indemnity Agreement to Protect from Liens in Tennessee

Property owners can protect themselves from a mechanic's lien on their land by executing an indemnity agreement binding both the contractor and indemnity company. By entering into an agreement, the insurer agrees to pay the contractor any amount that could otherwise be enforced through a lien placed on the property. This way, the contractor will turn to the insurance agency and not the land owner for any deficiency that is owed.

This indemnity agreement is designed to be used by contractors and material providers as well as property owners. Although this form is designed for ease of use, it may not be appropriate in every circumstance. It is always a good idea to consult with an attorney when drafting a contract between two parties.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please speak with an attorney for any questions regarding indemnity agreements.... More Information about the Tennessee Indemnity Agreement

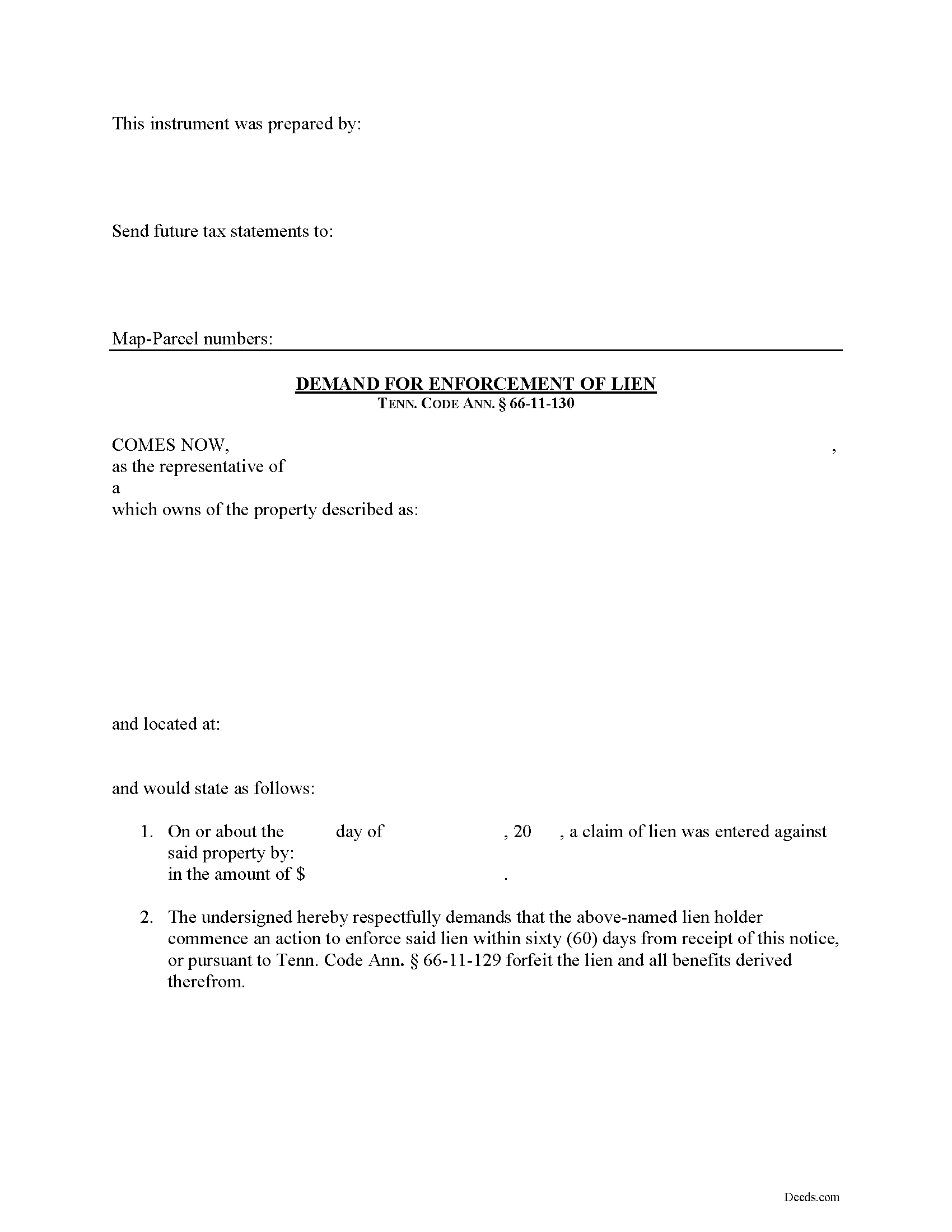

Demand for Enforcement

Demand for Enforcement of a Mechanic's Lien in Tennessee

Liens can be trouble when placed on your property, especially if you're trying to sell or refinance. Regardless of the reason for the lien, there are steps an owner can take to speed up the time that the lien can be effective. In Tennessee, filing a Demand for Enforcement of a filed lien will accelerate the lien action, requiring the lien claimant to enforce the lien or forfeit it.

Upon written demand of the owner, the owner's agent, or prime contractor, served on the lienor, requiring the lienor to commence action to enforce the lienor's lien, and describing the real property in the demand, the action shall be commenced, or the claim filed in a creditors' or foreclosure proceeding, within sixty (60) days after service, or the lien shall be forfeited. Tenn. Prop. Code 66-11-130.

The Demand for Enforcement contains the following: 1) the lien claimant's name (including business name and entity type), 2) a description of the property bound under the lien, 3) date of the lien claim, and 4) amount of the claim. The person sending the document must complete a certificate of delivery that specifies the method of service and... More Information about the Tennessee Demand for Enforcement

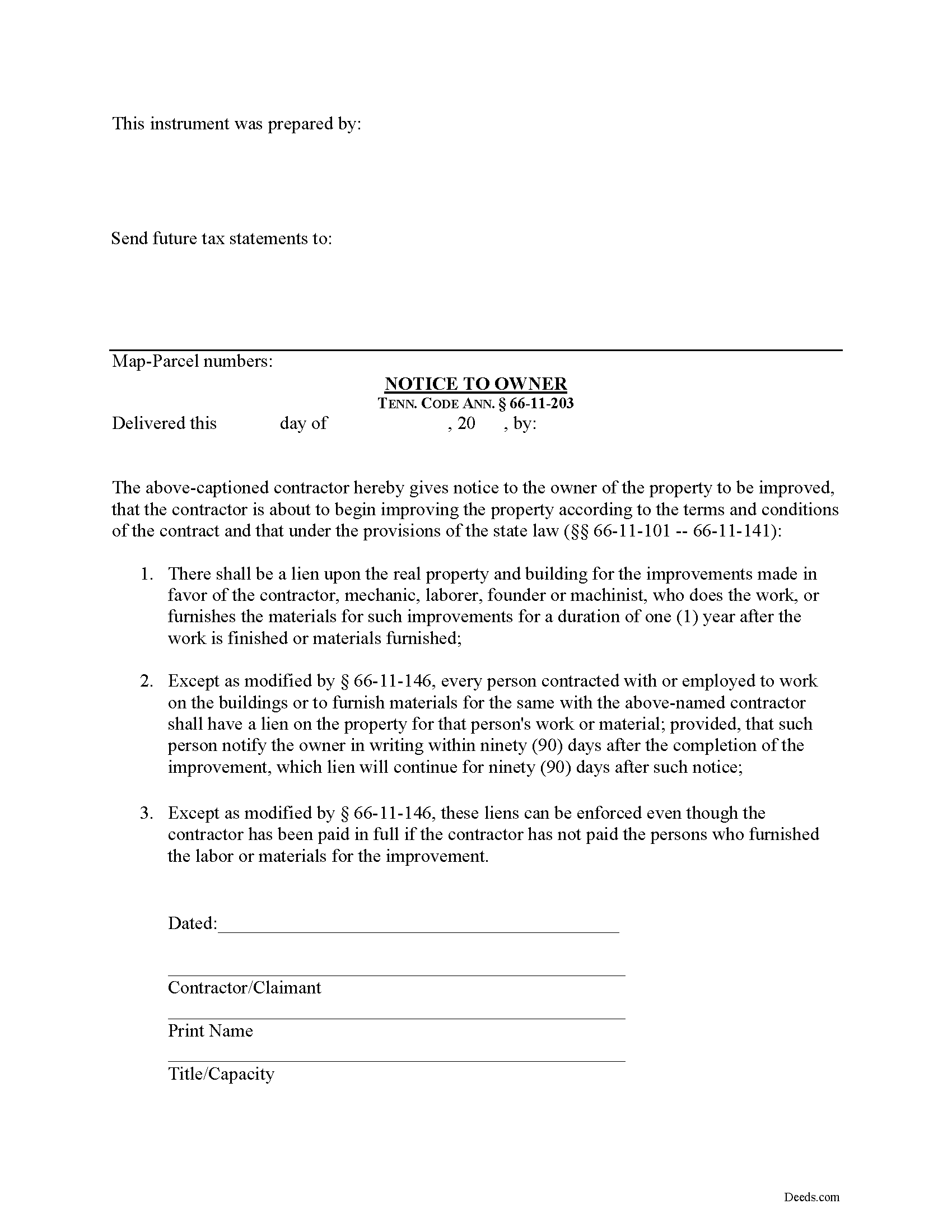

Notice to Owner

Most states require contractors and other workers to provide a written notice to a property owner that lets he or she know that a project is about to commence. Sending the notice is necessary to protect any later mechanic's lien rights. In Tennessee, the form of notice is called a "Notice to Owner."

Any contractor who is about to enter into a contract, either written or oral, for improving real property with the owner or owners thereof shall, prior to commencing the improvement of the real property or making of the contract, deliver, by registered mail or otherwise, to the owner or owners of the real property to be improved a written notice. Tenn. Prop. Code 66-11-203.

The purpose of the Notice is to identify who the contractor is and inform the owner that the contractor is about to commence work and will have a right to claim a lien under State law. Id.

The notice identifies the parties, the delivery date, and the intended location and start date for the work or improvement. It must be sent before the work begins or else the person sending the notice may only be able to claim a lien for work arising after the notice is sent (if sent late). This document does not need t... More Information about the Tennessee Notice to Owner

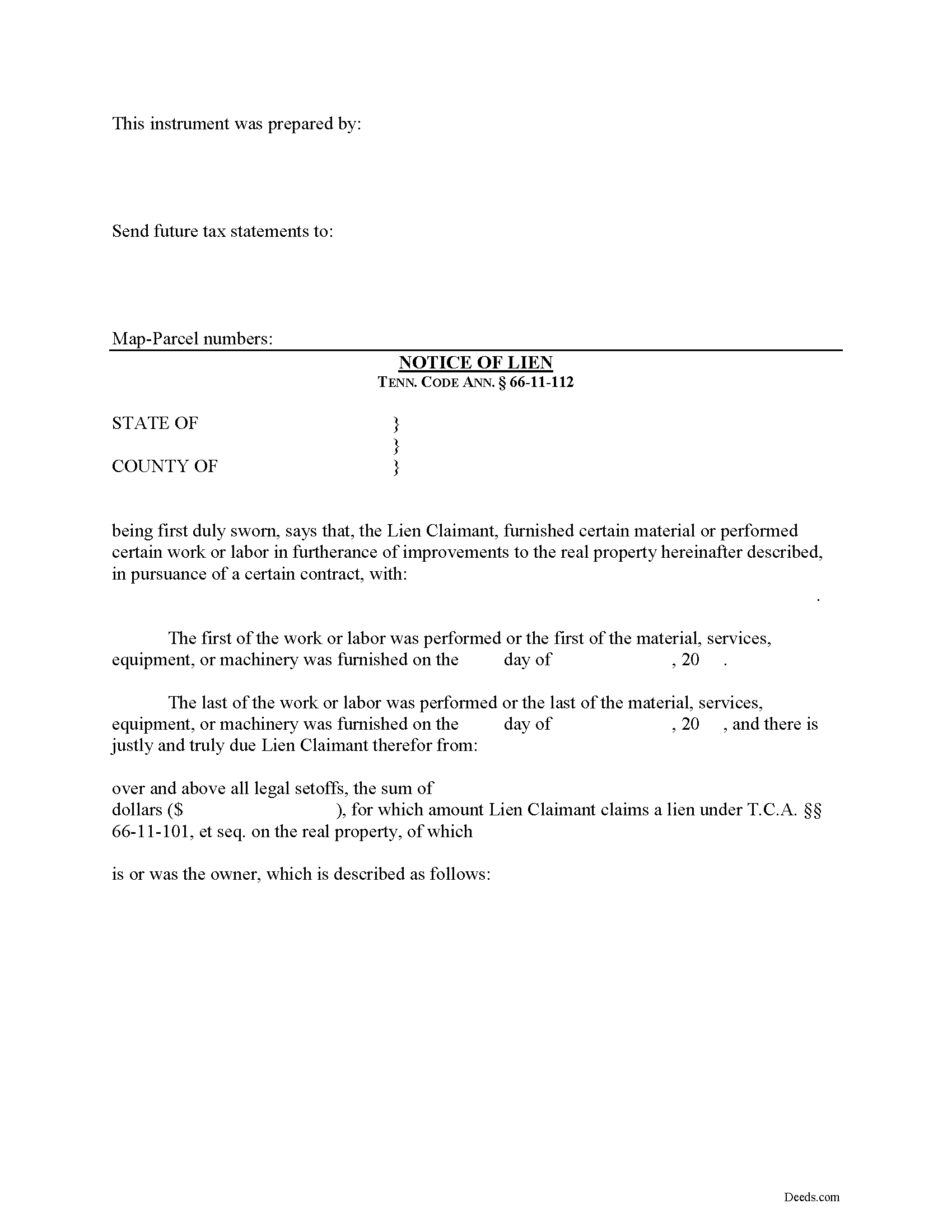

Notice of Mechanics Lien

Filing a Mechanic's Lien Claim in Tennessee

Mechanic's Liens are used to place a block or burden on a property owner's title when a claimant (such as a contractor or materials supplier) has not been paid for labor, materials, or equipment provided. In Tennessee, mechanic's liens are governed under Chapter 11 of the Tennessee Property Code.

In order to preserve the priority of the lien, as it concerns subsequent purchasers or encumbrancers for a valuable consideration without notice of the lien, the lienor, is required to record in the office of the register of deeds of the county where the real property, or any part affected, lies, a sworn statement of the amount for, and a reasonably certain description of the real property on, which the lien is claimed. Tenn. Prop. Code 66-11-112(a).

The recording party shall pay filing fees, and shall be provided a receipt for the filing fees, which amount shall be part of the lien amount. Id. The recordation must be done no later than ninety (90) days after the date the improvement is complete or is abandoned, prior to which time the lien shall be effective as against the purchasers or encumbrancers without the recordation. Id.

The... More Information about the Tennessee Notice of Mechanics Lien

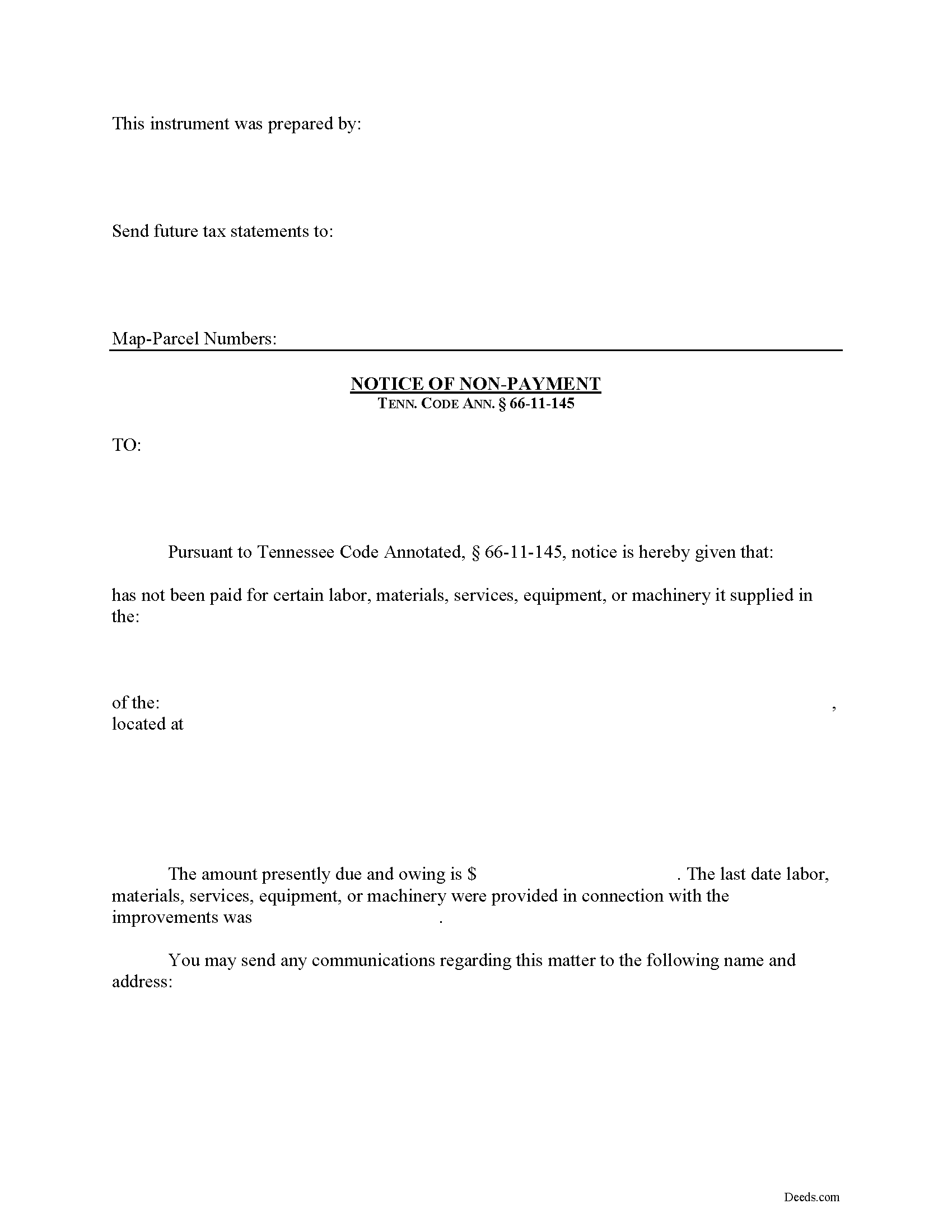

Notice of Non-Payment

Remote Contractor Claims in Tennessee

Remote contractors who have not contracted directly with the owner, must send a special type of notice when they are not paid at time. In Tennessee, that notice is called the "Notice of Non-Payment."

Every remote contractor with respect to an improvement, except one-to-four-family residential units, shall serve, within ninety (90) days of the last day of each month within which work, material, or labor was provided, or machinery furnished and for which the remote contractor intends to claim a lien, a notice of nonpayment to the owner and prime contractor in contractual privity with the remote contractor if its account is, in fact, unpaid. Tenn. Prop. Code 66-11-145(a). Serve the notice via registered or certified US Mail, or any other service with official delivery confirmation.

The notice shall contain the following: (1) The name of the remote contractor and the address to which the owner and the prime contractor in contractual relation with the remote contractor may send communications to the remote contractor; (2) A general description of the work, labor, materials, services, equipment, or machinery provided; (3) The amount owed a... More Information about the Tennessee Notice of Non-Payment

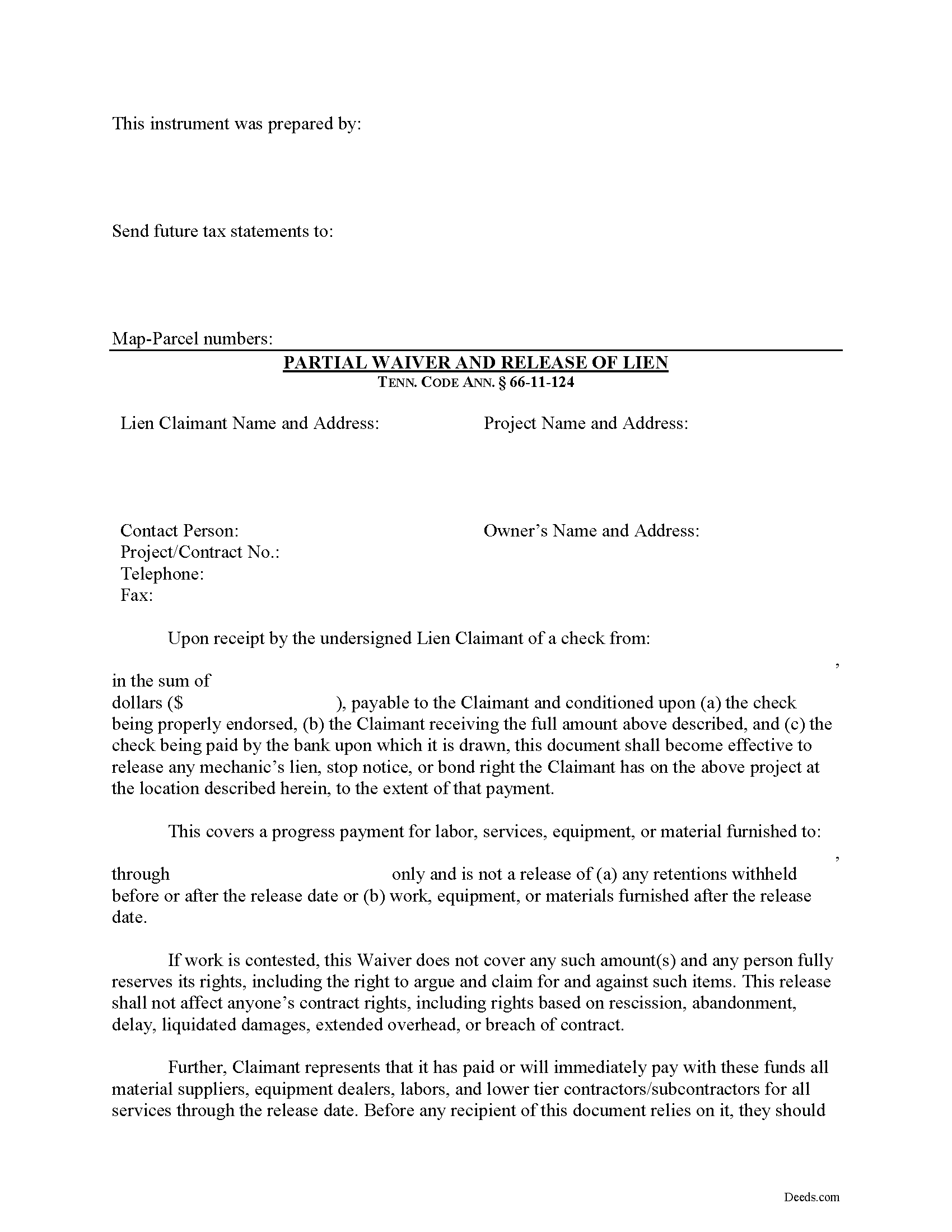

Partial Lien Waivers

"Waiver" is a legal term which means giving up a right. A waiver can be written or oral. It can also be expressed by a formal agreement or implied through conduct of the parties. When discussing mechanic's liens, a waiver refers to a written document granted by a lien claimant to a property owner. This document usually confirms a partial or final payment and states that the lien claimant is waiving a right to claim a lien for the partial or full amount. Waivers help ease feelings of distrust between parties dealing at arms-length and give peace of mind for the laborer that he or she will get paid and for the property owner that his or her property won't be burdened by any mechanic's liens.

In Tennessee, lien waivers are governed under 66-11-124 of the Tennessee Property Code. Lien waivers in Tennessee must be explicit and are never implied. The acceptance by the lienor of a note or notes for all or any part of the amount of the lienor's claim shall not constitute a waiver of the lienor's lien, unless expressly so agreed in writing, nor shall it in any way affect the period for serving or recording the notice of lien under this chapter. Tenn. Prop. Code 66-11-124(a). Further, any... More Information about the Tennessee Partial Lien Waivers

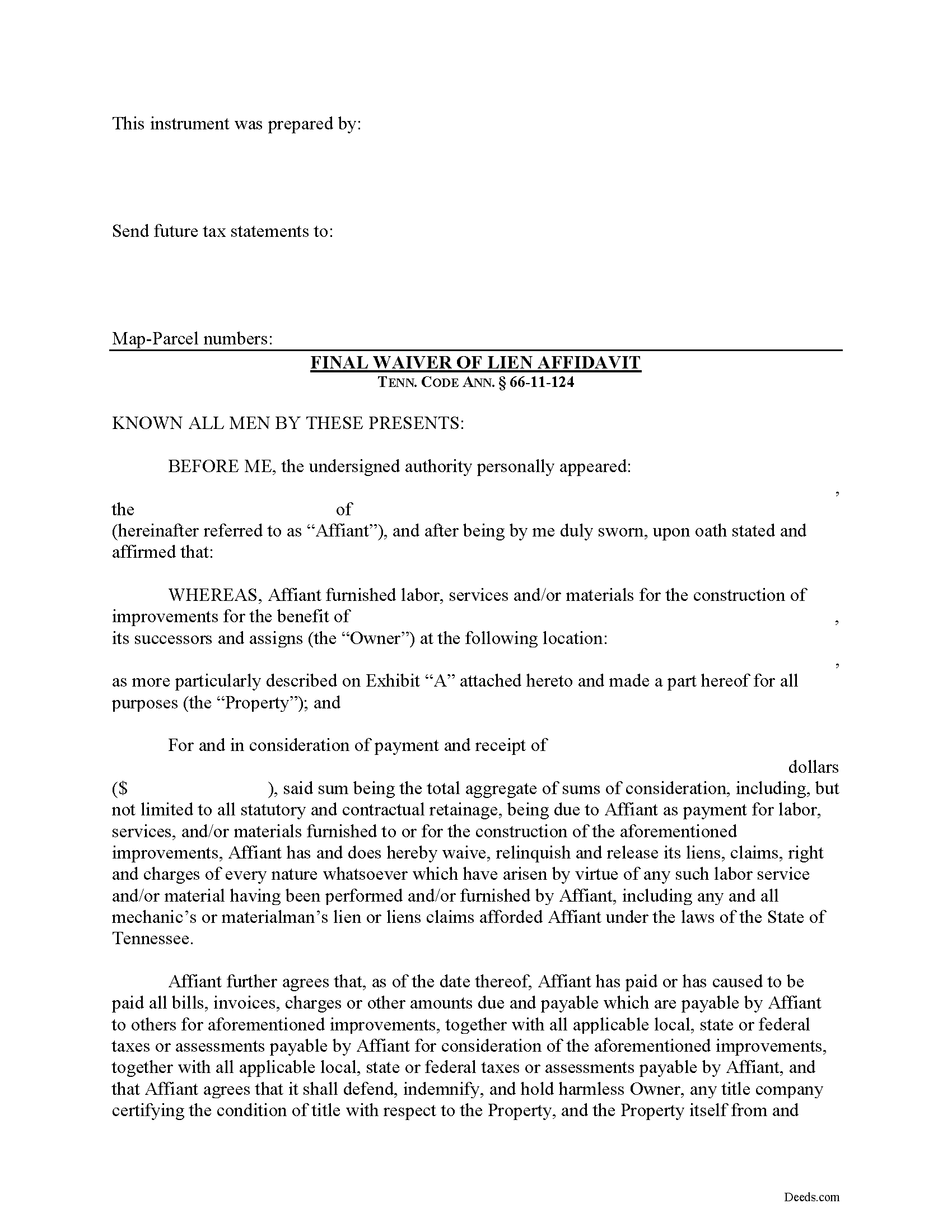

Final Lien Waiver

Executing a Final Lien Waiver in Tennessee

"Waiver" is a legal term which means giving up a right. A waiver can be written or oral. It can also be expressed by a formal agreement or implied through conduct of the parties. When discussing mechanic's liens, a waiver refers to a written document granted by a lien claimant to a property owner. This document usually confirms a partial or final payment and states that the lien claimant is waiving a right to claim a lien for the partial or full amount. Waivers help ease feelings of distrust between parties dealing at arms-length and give peace of mind for the laborer that he or she will get paid and for the property owner that his or her property won't be burdened by any mechanic's liens.

In Tennessee, lien waivers are governed under 66-11-124 of the Tennessee Property Code. Lien waivers in Tennessee must be explicit and are never implied. The acceptance by the lienor of a note or notes for all or any part of the amount of the lienor's claim shall not constitute a waiver of the lienor's lien, unless expressly so agreed in writing, nor shall it in any way affect the period for serving or recording the notice of lien under this chapte... More Information about the Tennessee Final Lien Waiver

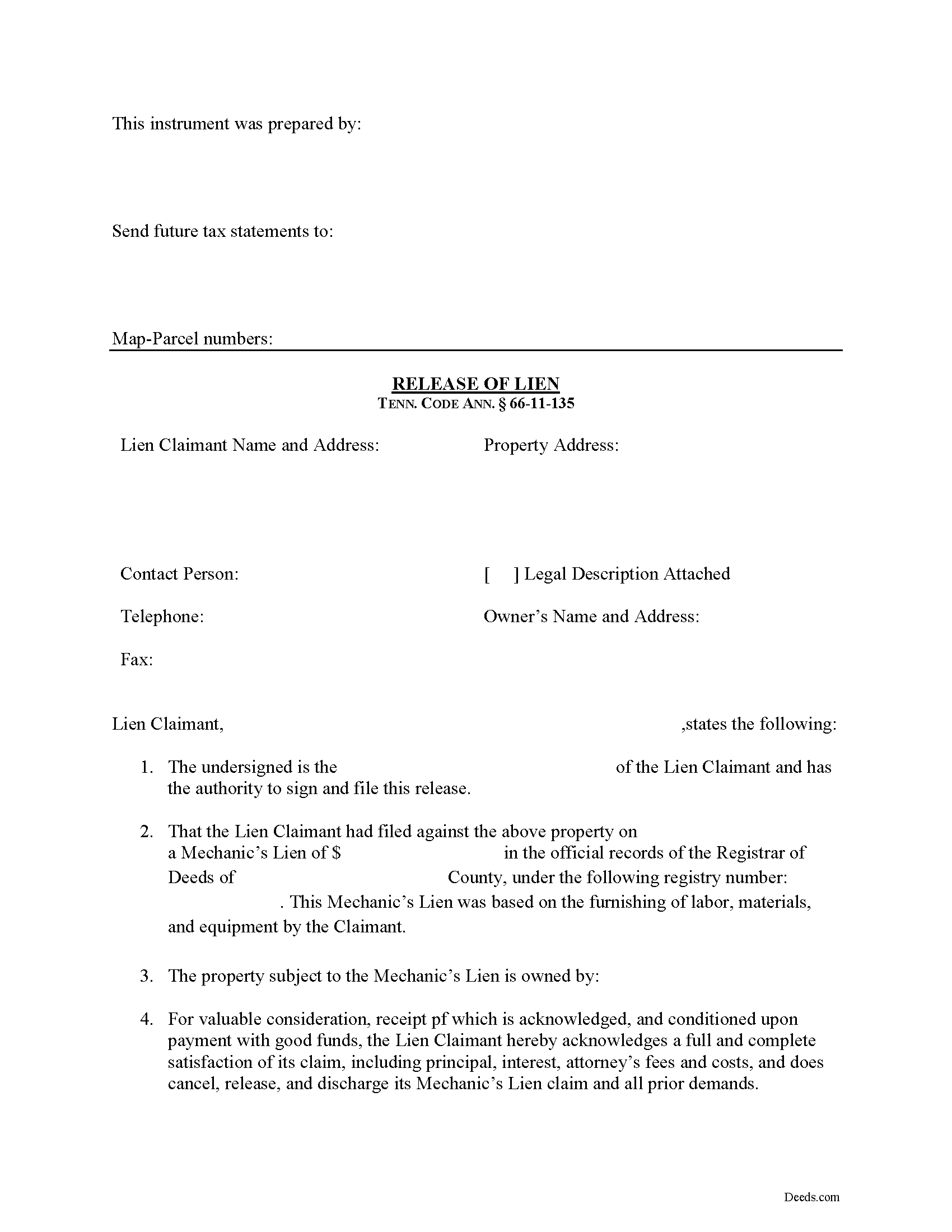

Release of Mechanic Lien

Releasing a Mechanic's Lien in Tennessee

Lien claimants must grant releases when the lien is no longer effective because it has been paid off or for any other reason.

If a lienor whose lien has been forfeited, expired, satisfied or adjudged against the lienor in an action on the lien, fails to cause the lien provided by this chapter to be released within thirty (30) days after service of written notice demanding release, the lienor shall be liable to the owner for all damages arising therefrom, and costs, including reasonable attorneys' fees, incurred by the owner. Tenn. Prop. Code 66-11-135(a).

A valid release form under this section identifies the parties, the location of the work or improvement, a reference to the recorded notice of lien, relevant dates and payments, and any other information necessary for the specific situation.

The lienor must file the release in the office where the notice of lien was recorded. Tenn. Prop. Code 66-11-135(b). The fee for recording shall be the fee required for the recording of a release or satisfaction of a mortgage as provided by law. Id. The lien shall be deemed released on the day on which the release of the lien is recorded in... More Information about the Tennessee Release of Mechanic Lien

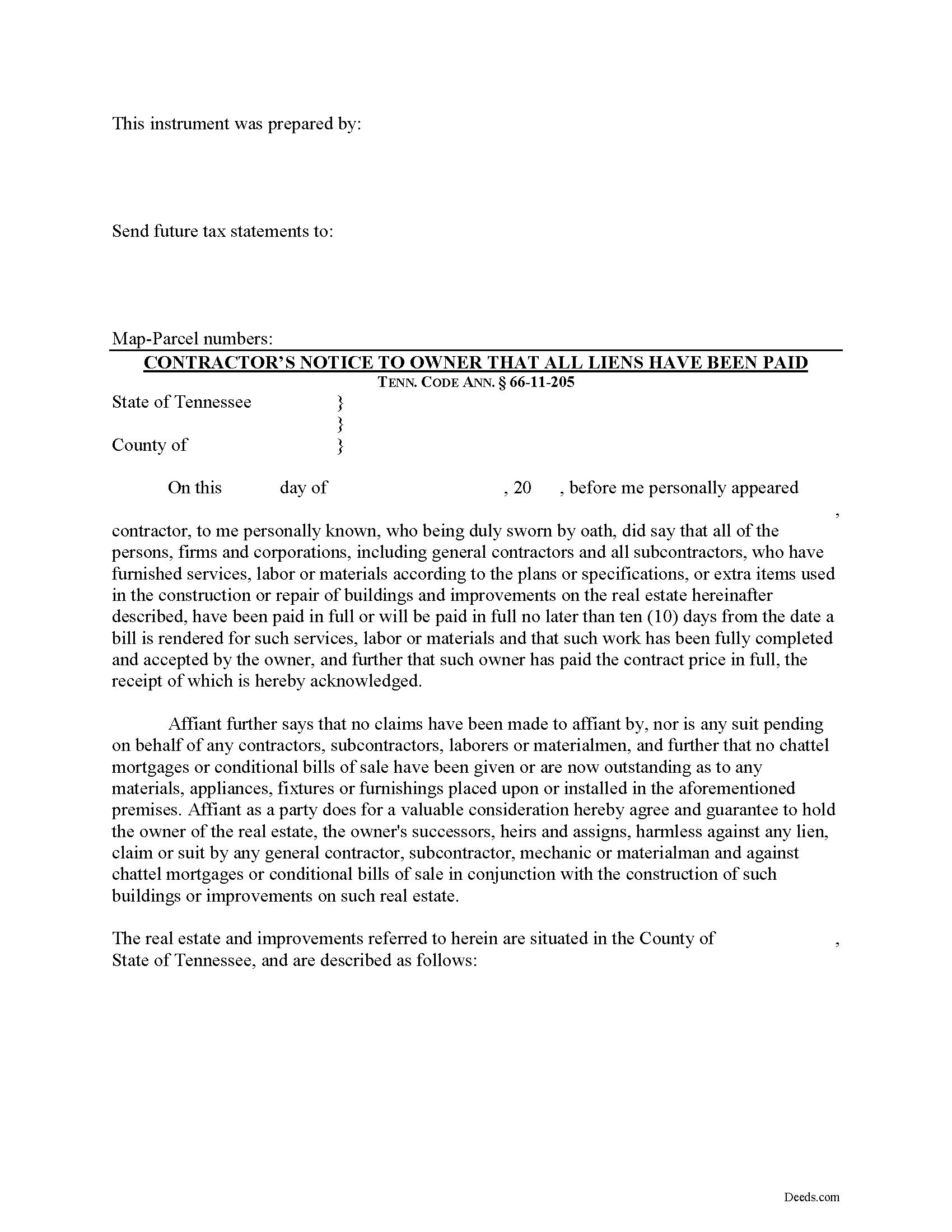

Contractor Notice of All Liens Paid

Upon completion of the contract or improvement and upon receipt of the contract price, the contractor must deliver by registered mail or otherwise to the owner or owners of the real property a sworn affidavit stating that all liens have been paid in full or will be paid in full no later than ten (10) days from the date a bill is rendered for such services. Tenn. Prop. Code 66-11-205. The sworn affidavit must be executed and signed in the presence of a notary public.

The notice identifies the parties, the location and nature of the work or improvements, relevant dates, and anything else necessary for the specific situation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the notice of payment of all liens or for any other issues regarding mechanic's liens.... More Information about the Tennessee Contractor Notice of All Liens Paid

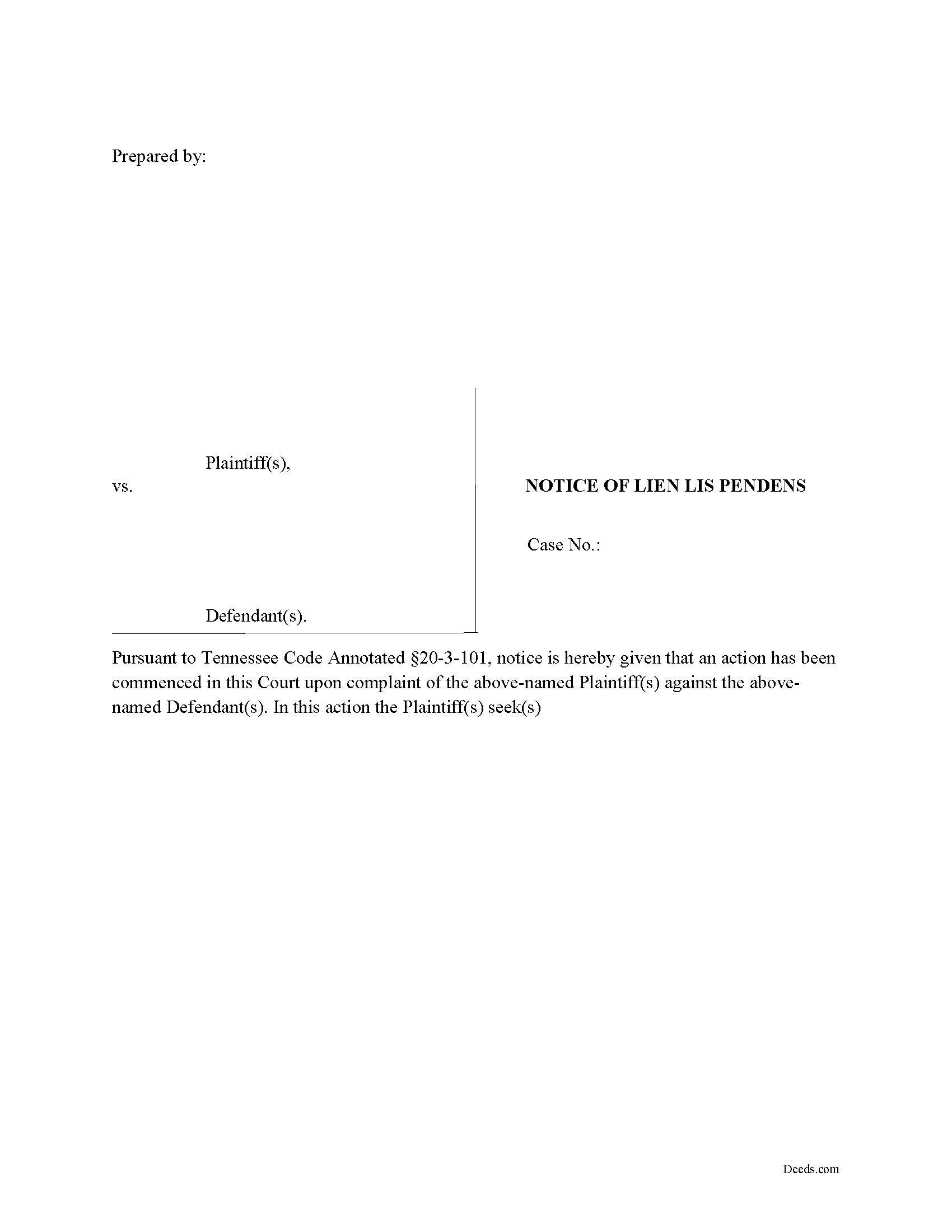

Lien Lis Pendens

When a case that involves any interest in real estate a party to such case may seek to provide constructive notice to would be purchasers or encumbrancers by filing a Lien Lis Pendens. The Lien of Lis Pendens shall contain the (names of the parties to the suit, a description of the real estate affected, its ownership and a brief statement of the nature and amount of the lien sought to be fixed.) Such Lien Lis Pendens shall be certified by the clerk and recorded in the registers office of the county where the property lies. 20-3-101

RULE 69. EXECUTION ON JUDGMENTS Rule 69.07: Execution on Realty.

(1) Lien Lis Pendens. A lien lis pendens applies only to realty that is the subject matter of a lawsuit and described in the complaint. To affect the rights of bona fide purchasers and encumbrancers, an abstract must be registered in the register's office of the county where the realty is located. The abstract must identify the court and contain names of parties to the action and a description of the realty and its ownership.

(Tennessee Lien LP Package includes form, guidelines, and completed example)

... More Information about the Tennessee Lien Lis Pendens

Disclaimer of Interest

Under the Tennessee Annotated Code, the beneficiary of an interest in property may renounce the gift, either in part or in full (T.C.A. 31-1-103(b)(1)(c)). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (T.C.A. 31-1-103(b)(3)).

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (T.C.A. 31-1-103(b)(1)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the court having jurisdiction to appoint such a person. In the case of real property, acknowledge the disclaimer as is required for a deed (T.C.A. 66-22-101) and record it in the county where the property is located (T.C.A. 31-1-103(b)(2)). In addition, deliver a copy of the disclaimer to the person or legal entity with current custody or possession of the property.

A disclaimer is irrevocable and binding for the disclaiming party, so be sure to consult an attorney whe... More Information about the Tennessee Disclaimer of Interest